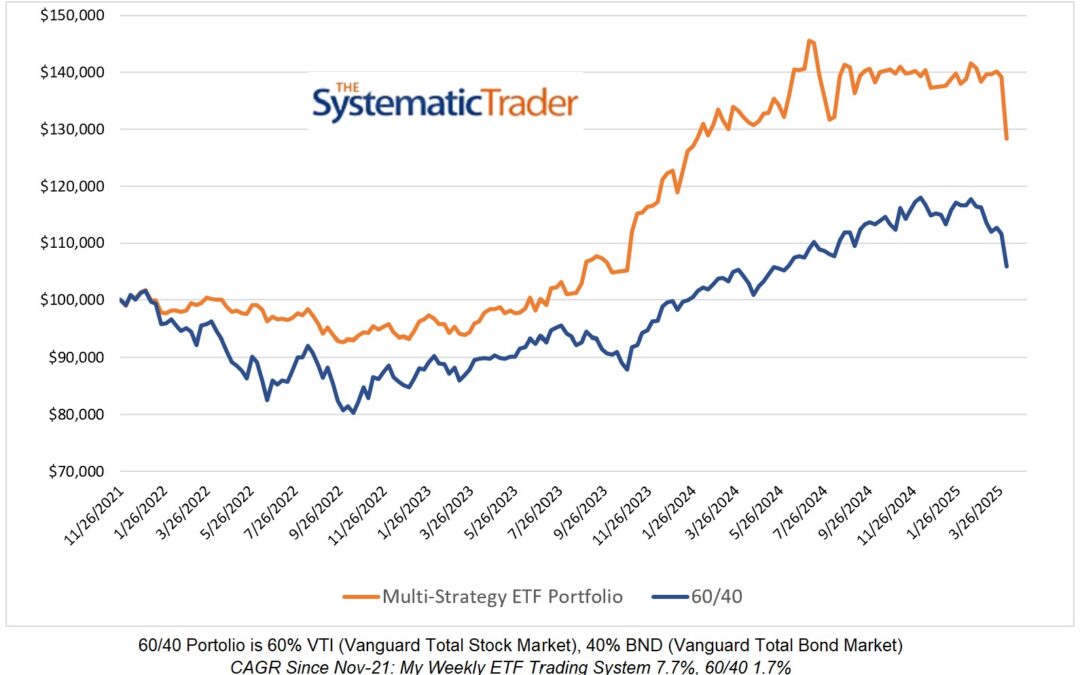

I thought that now was a good time to zoom out and look at the long-term performance of my system. If nothing else, it gives me the confidence to continue placing trades. My ETF system is no longer defensive and is allocated as per the table below.

I thought that now was a good time to zoom out and look at the long-term performance of my system. If nothing else, it gives me the confidence to continue placing trades. My ETF system is no longer defensive and is allocated as per the table below.

It was a flat week for my ETF system but a great week for the 60/40 portfolio which rose 3%. My system remains defensive as it is now evenly allocated to BIL, IEF, and TIP. I have made an allocation to the trend following ETF, CTA. CTA is the only trend following ETF...

The moves in my ETF system and the 60/40 portfolio were very subdued this week. My system remains 100% allocated to BIL (SPDR 1 - 3 Month Treasuries).

What a difficult two weeks! My system suffered losses two weeks ago due to its exposure to equity ETFs. It switched to a strategy that was in defensive mode and had allocated to three US Treasury ETFs. Unfortunately, they all had losses this past week due to a global...

In the backtesting that I have done with my ETF system, it experienced a maximum drawdown (weekly) of around 15% so I expect a drawdown of 15% to occur at any time. The current drawdown is 11.8% and it certainly isn't pleasant to go through. That said, I have been...

My ETF multi-strategy system fell by 0.68% this past week compared to a decline of 0.96% for the 60/40 model. There is one change in the ETFs held as EWJ has been replaced by INDA.

The markets aren't providing much to be upbeat about but my ETF system and the 60/40 model both had modestly positive weeks. There is one change in the ETFs held by my system this week as TIP is out and XLE is in.

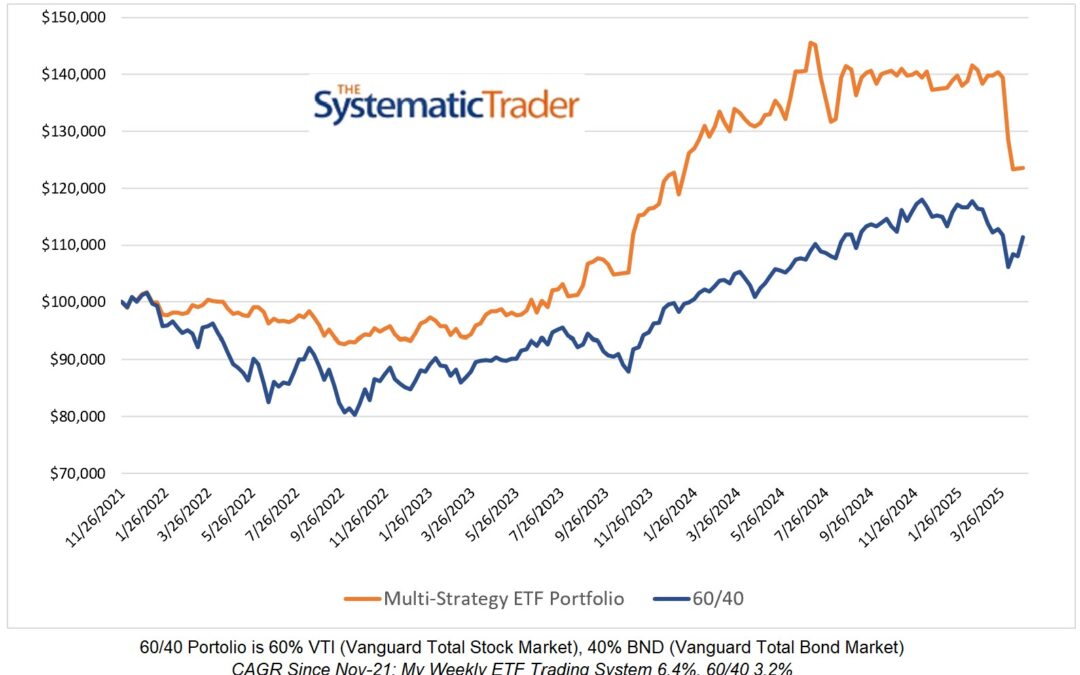

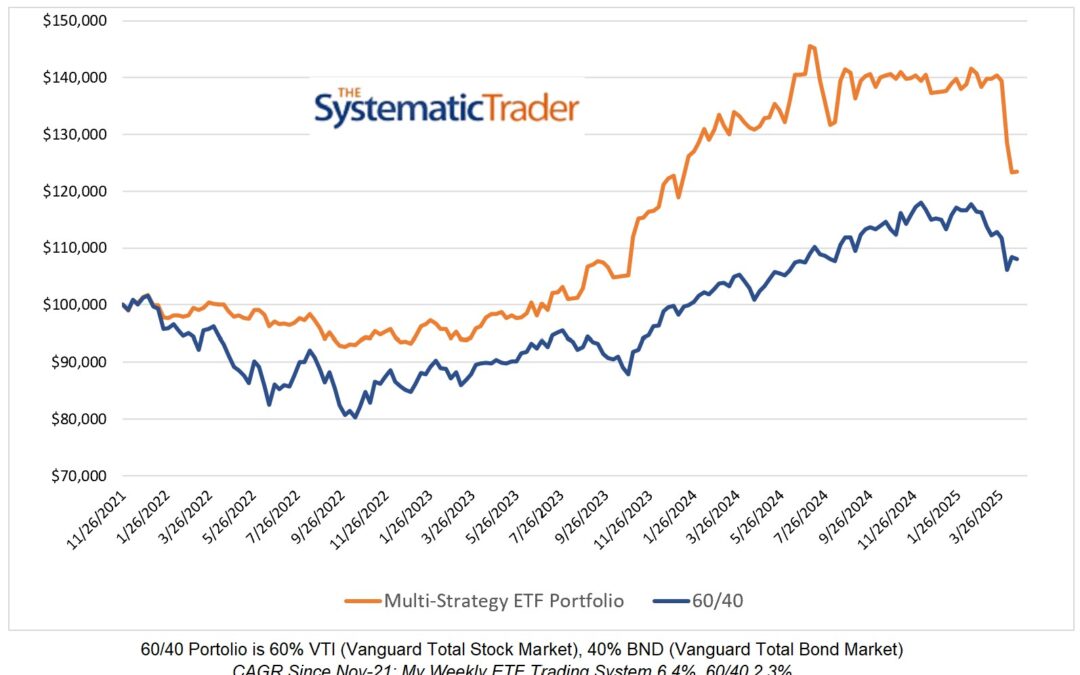

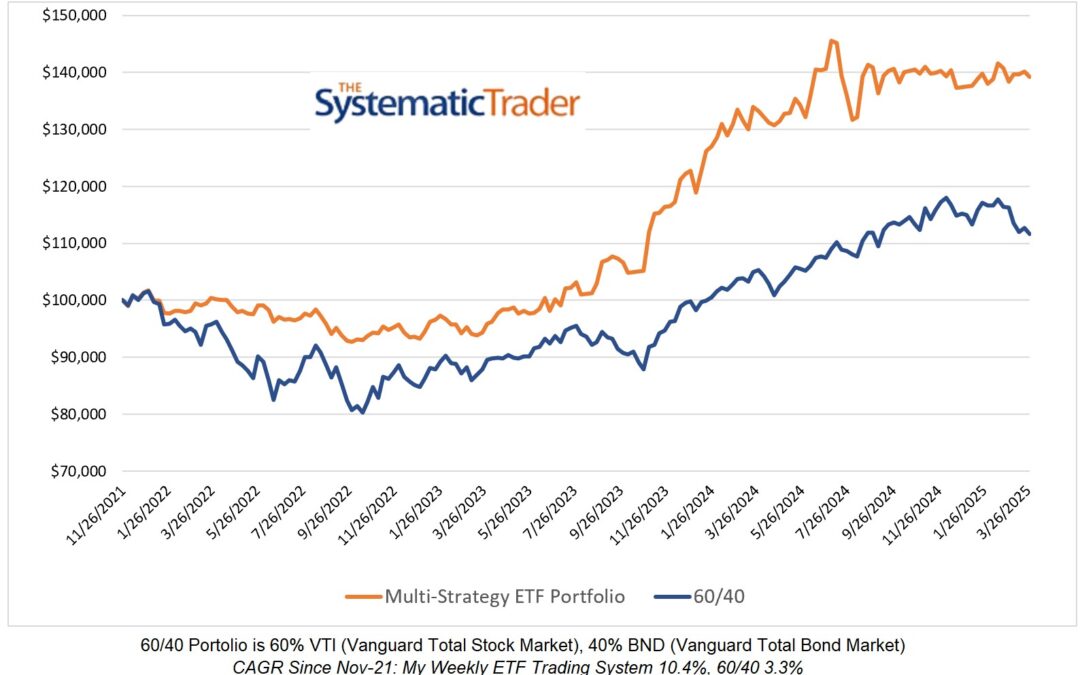

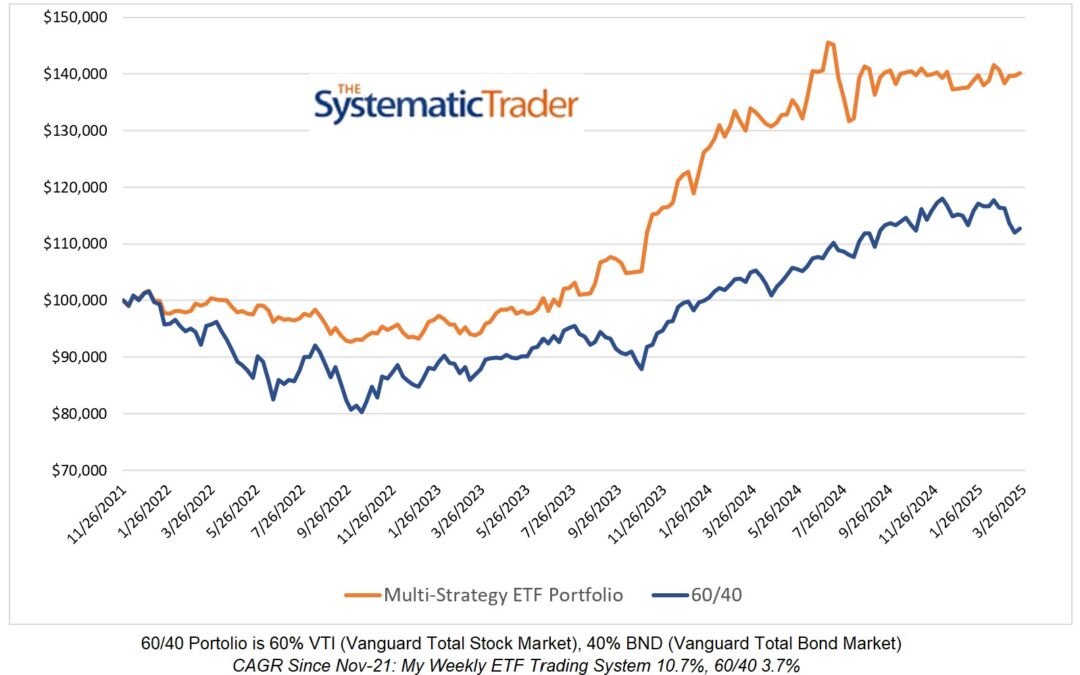

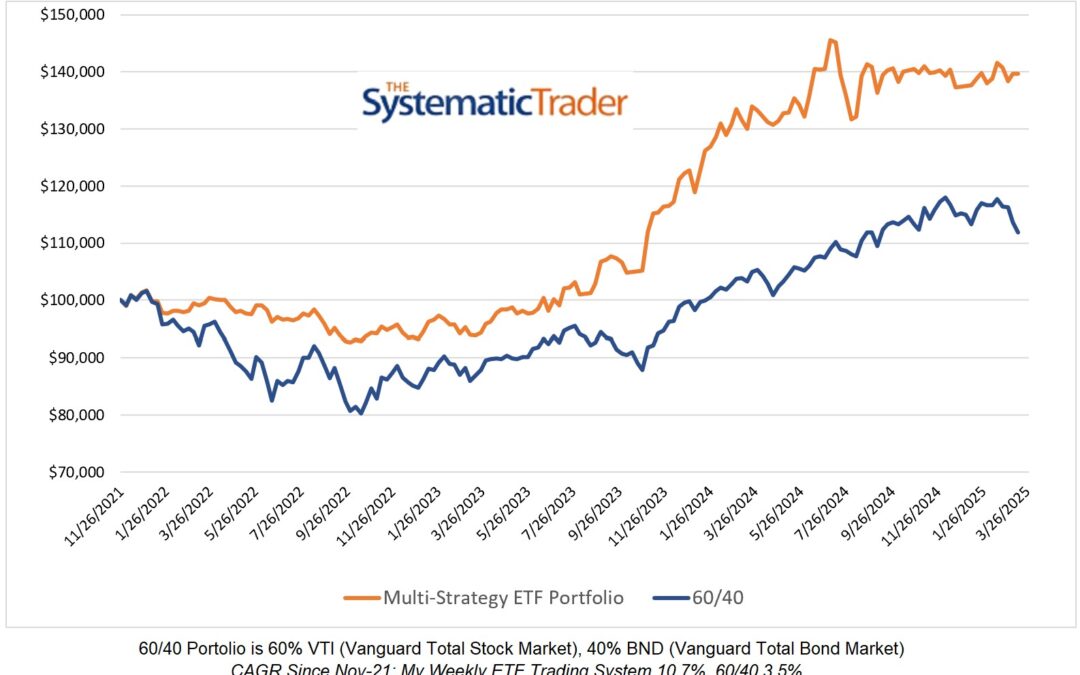

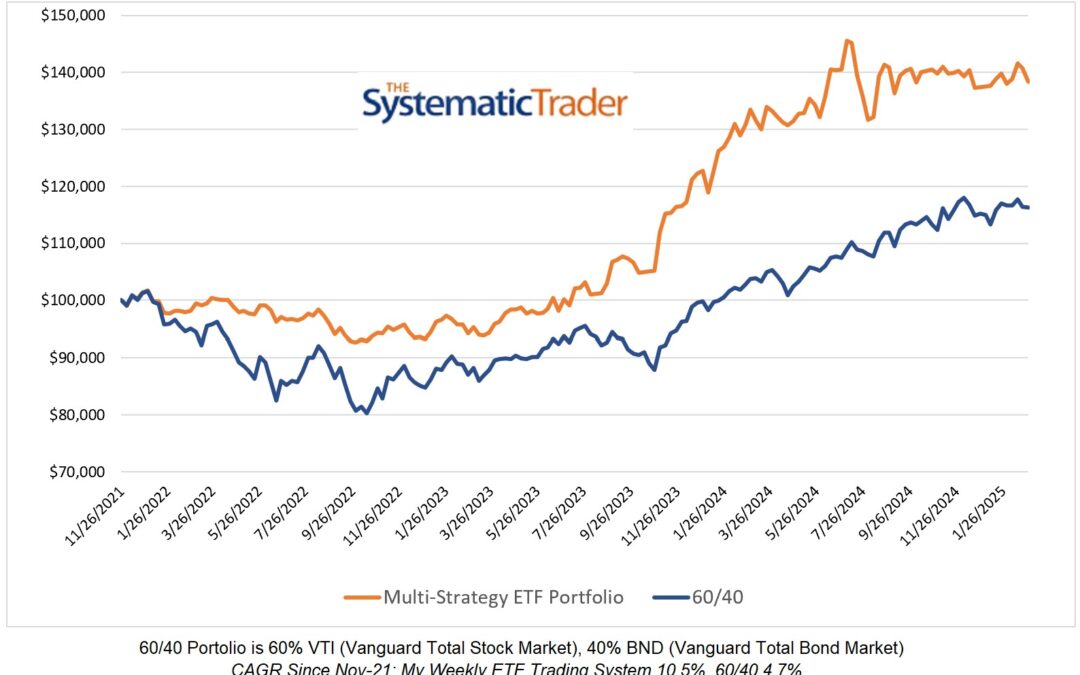

Relatively speaking, it was a good week for my ETF multi-strategy system as it was flat compared to a loss of 1.4% experienced by the 60/40 portfolio. I began posting weekly ETF allocations here in November 2021. Since then my system has produced a compound annual...

It was a rough week for US equities but not for my ETF system was was up 0.94% compared to a loss of 2.31% for the 60/40 portfolio. My system's allocations are presented below and you will notice the tilt towards commodities and non-US equities.

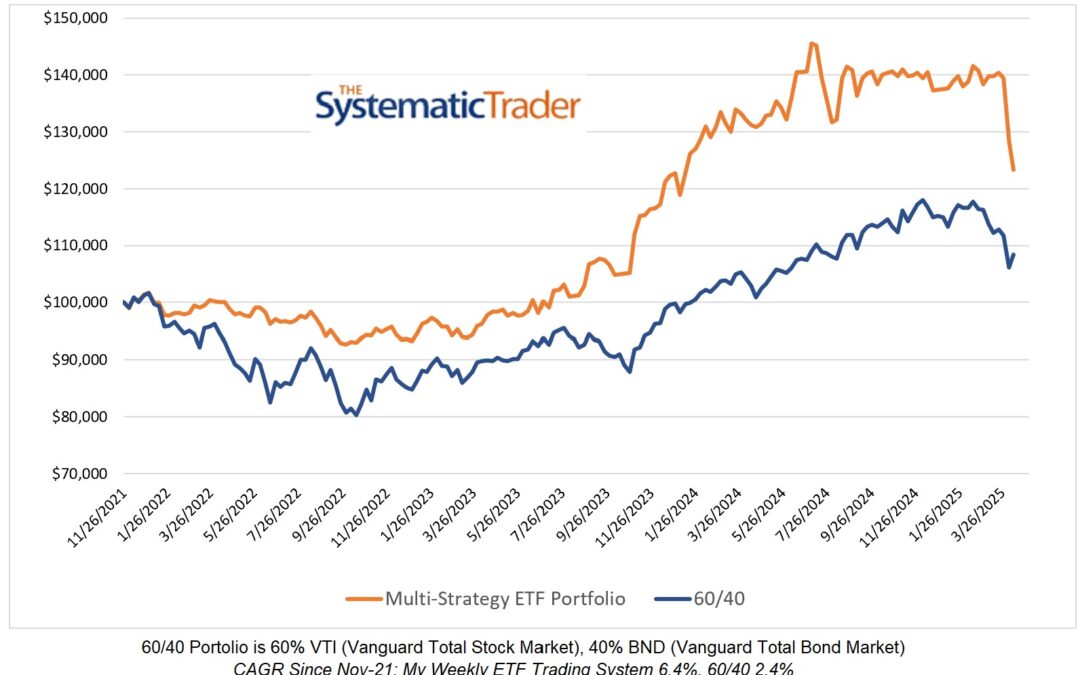

There has been a change in the ETF allocations this week. The table below summarizes the performance of my weekly ETF trading system and the 60/40 model since I began posting here in November 2021.