My Personal Weekly Dynamic Asset Allocations

Suggestions for ETF Allocations to Outperform the 60/40 Portfolio

Latest Posts

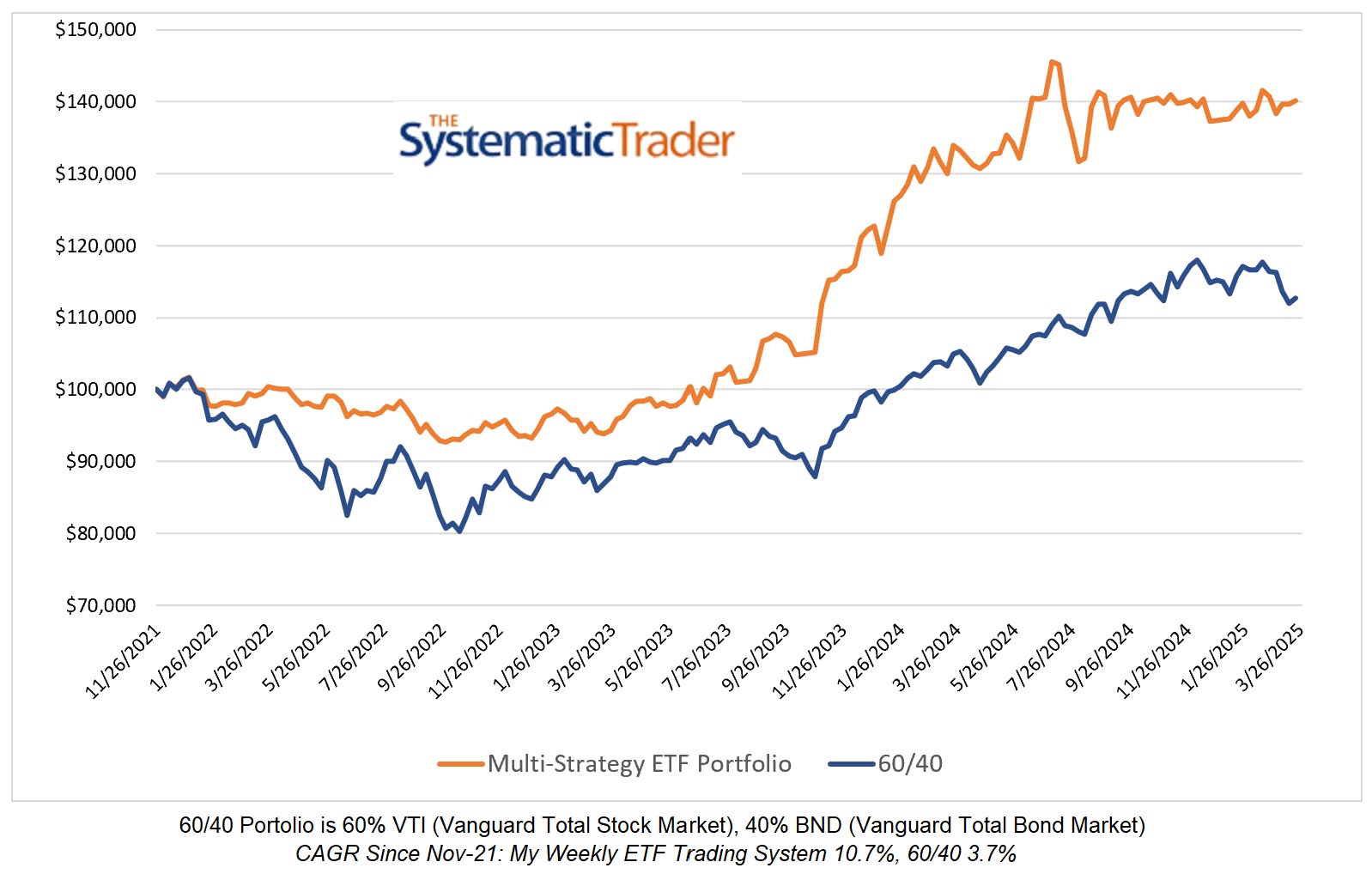

Investing Update for the Week Ending August 16 2024

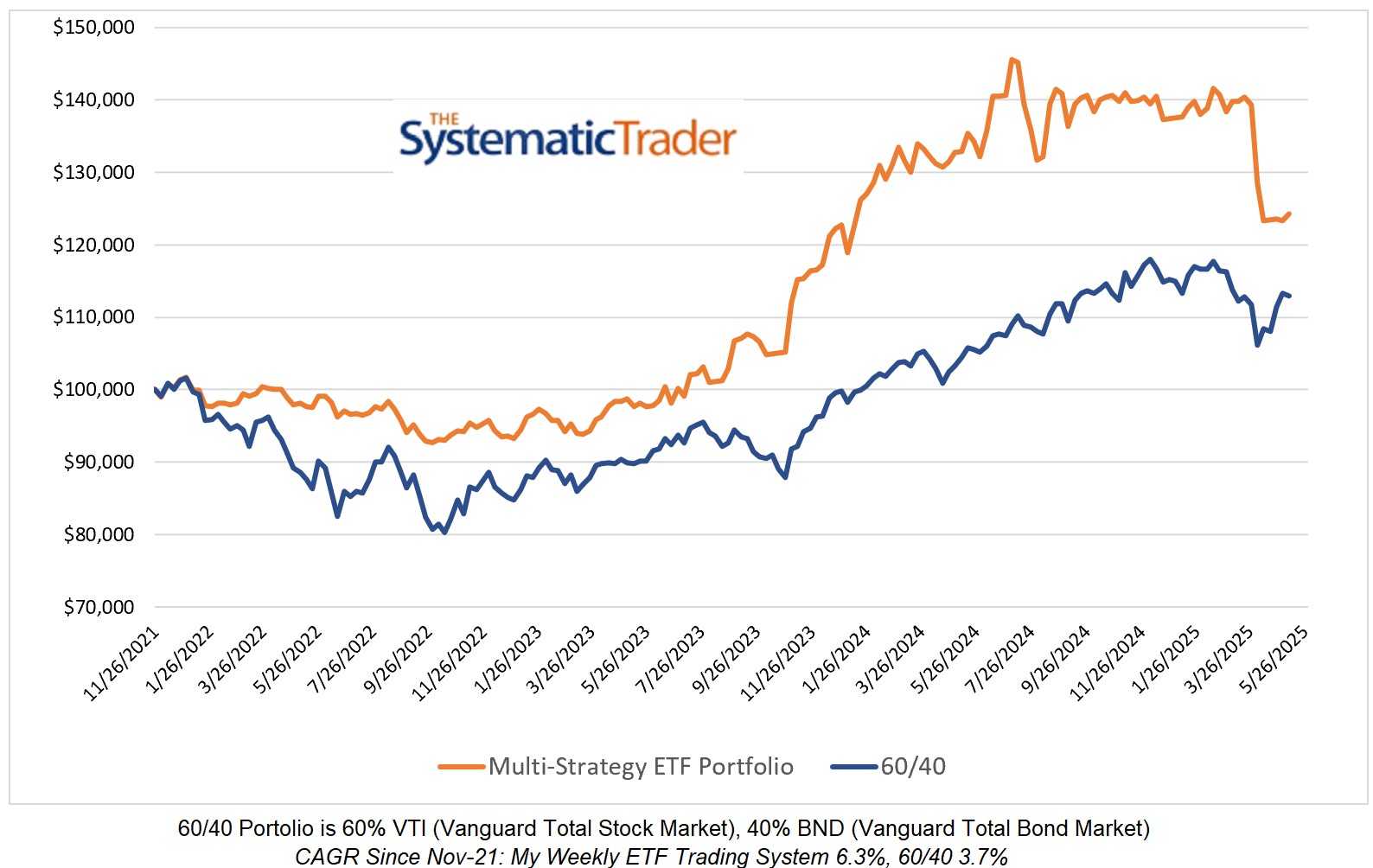

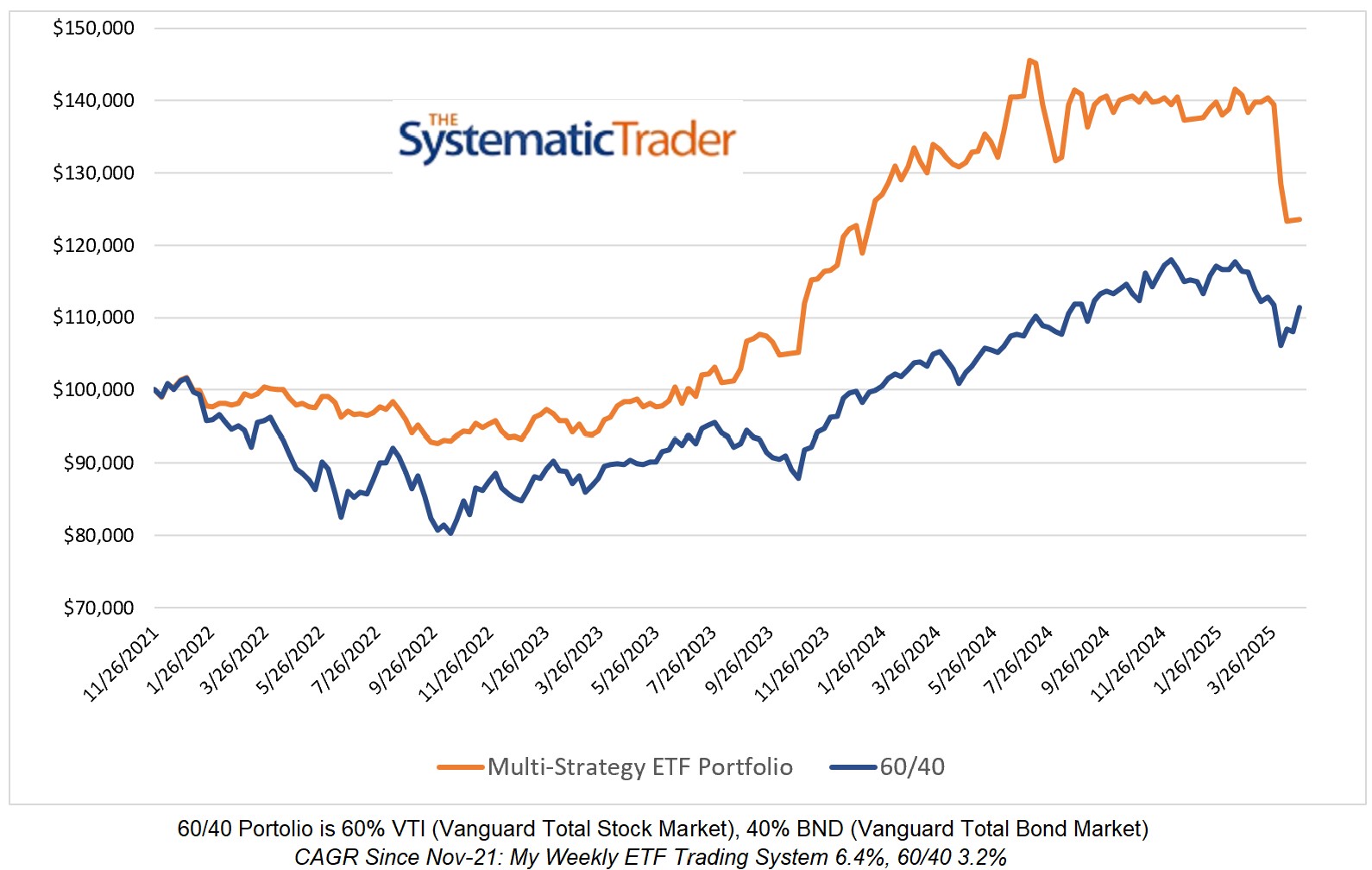

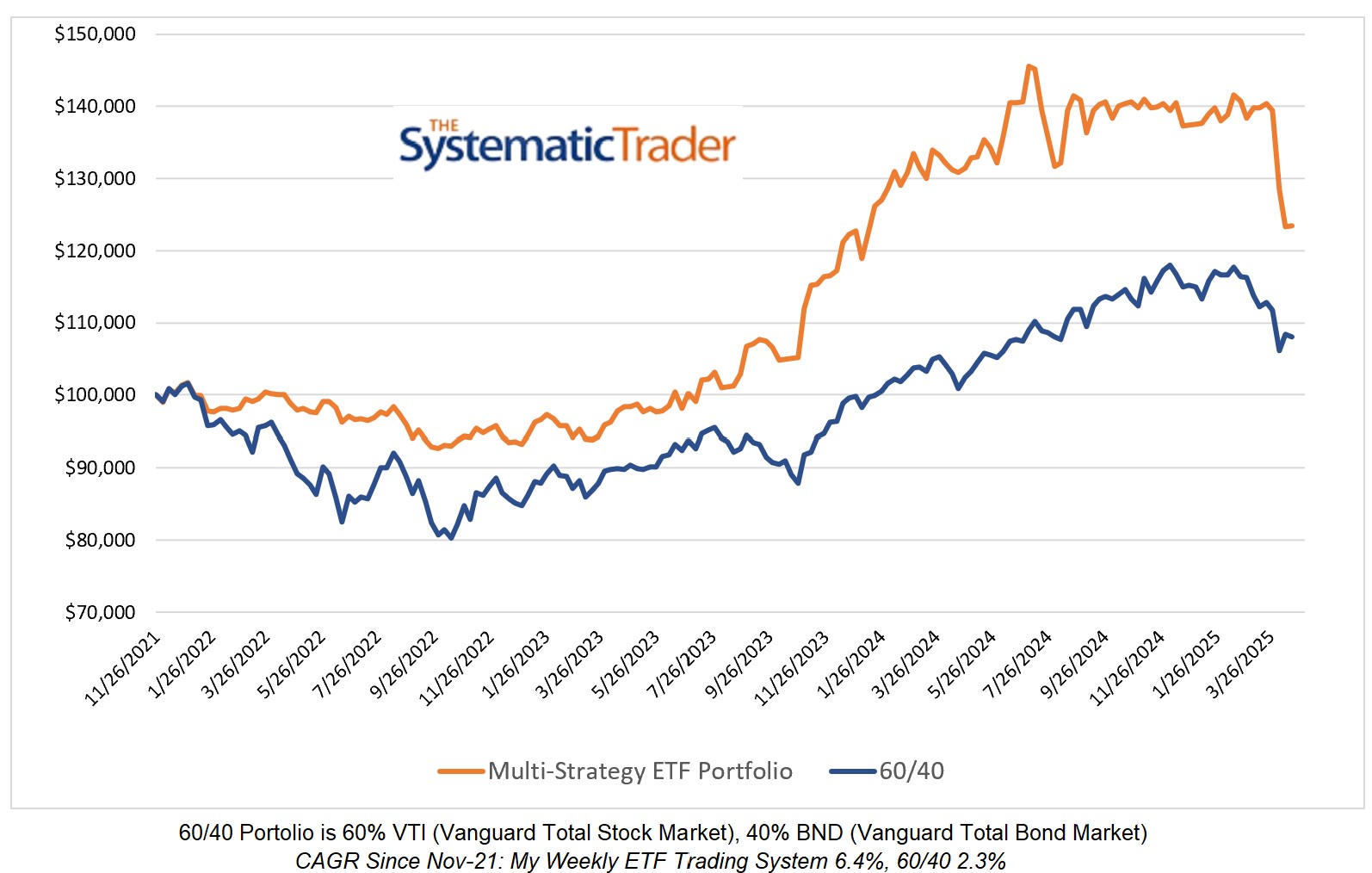

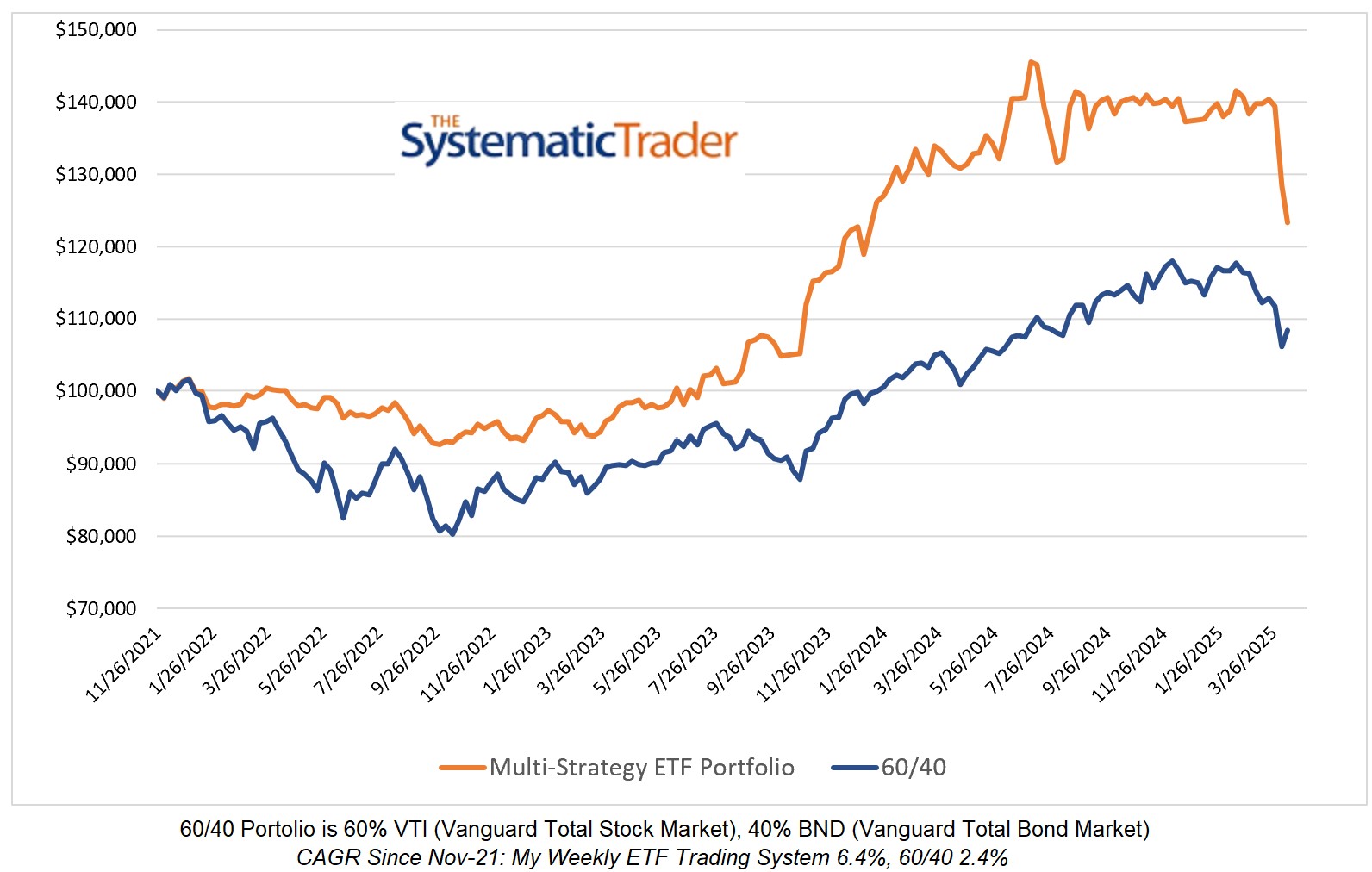

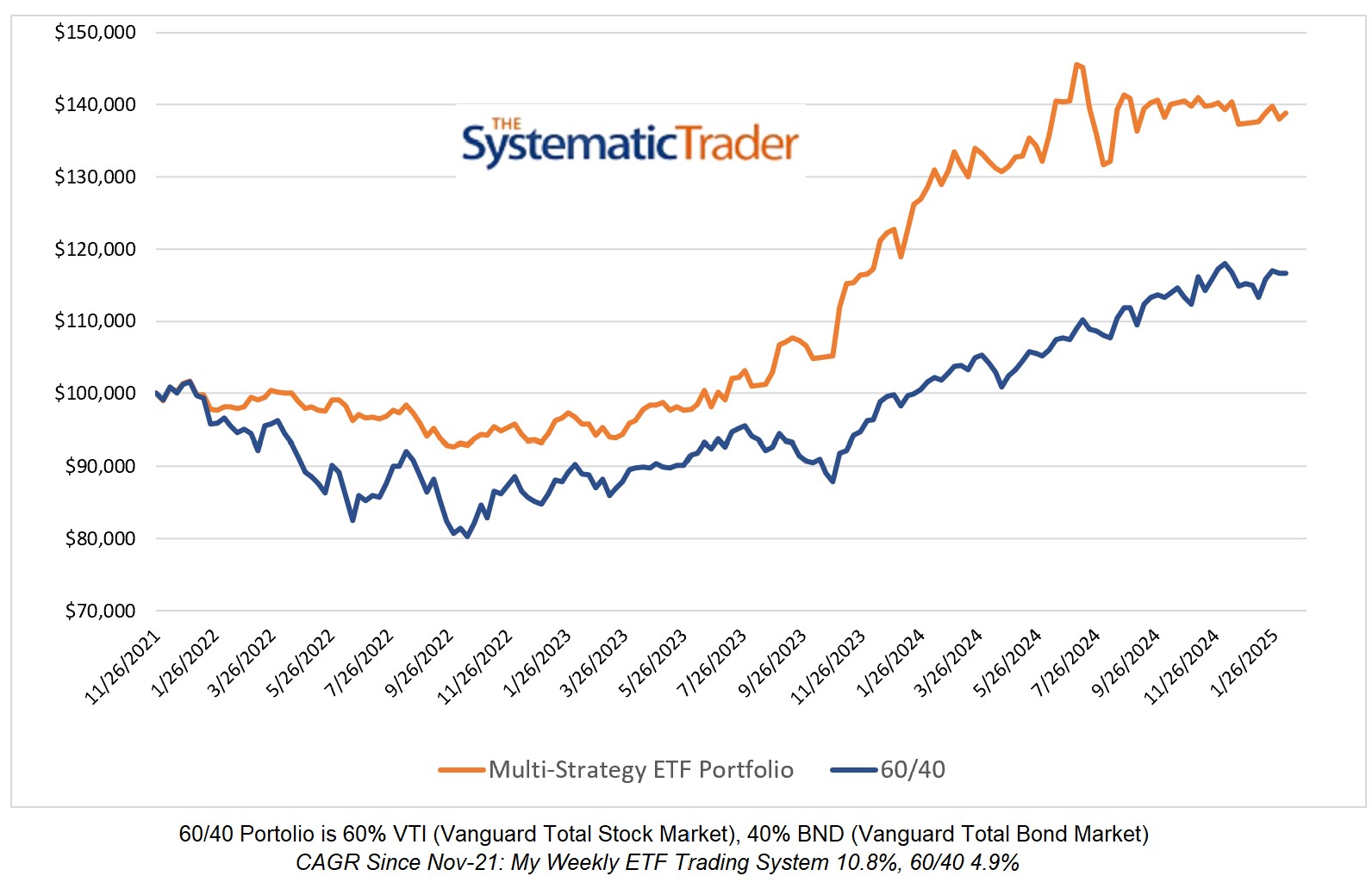

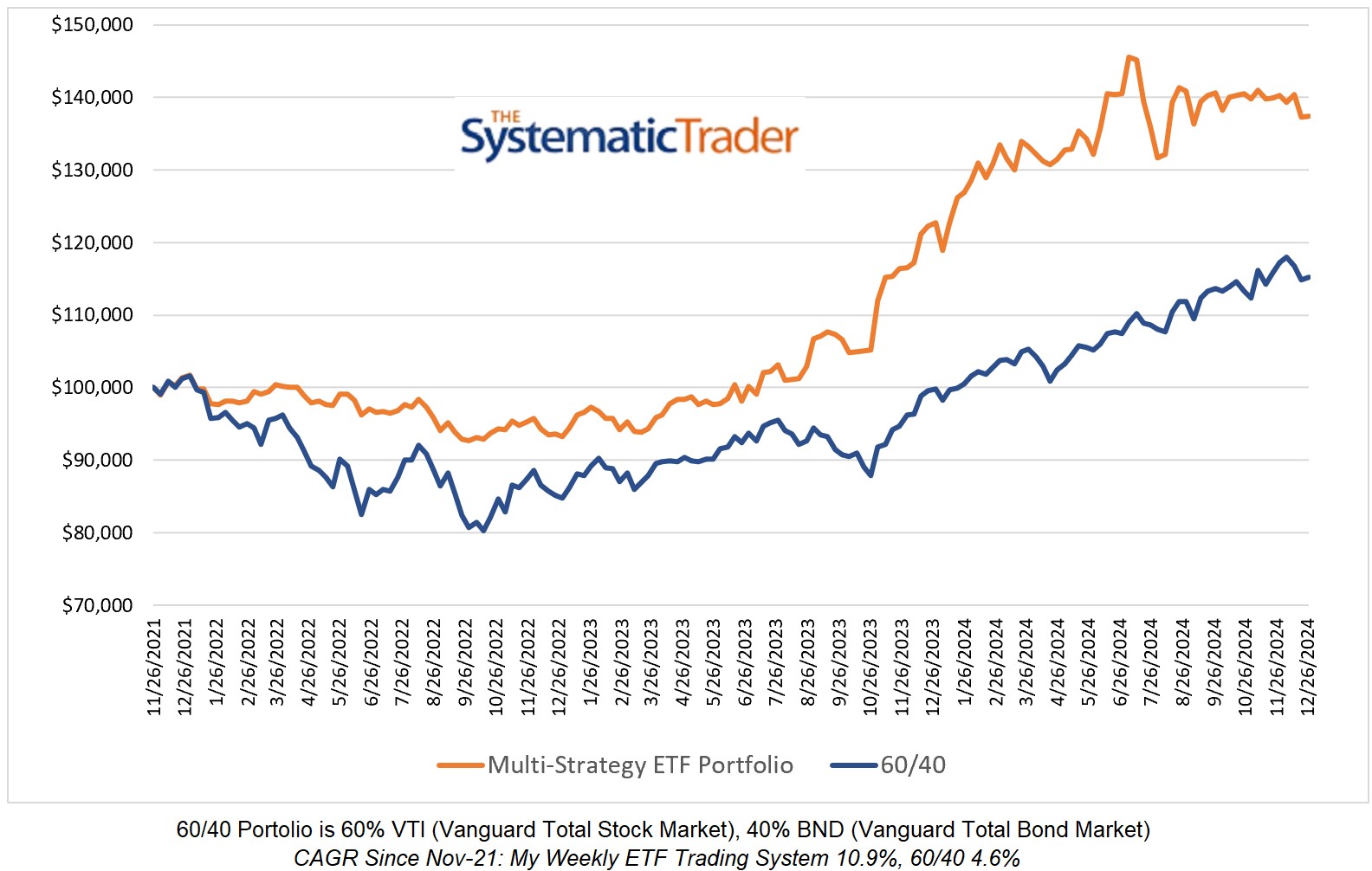

My ETF model had a solid gain this week of 5.40% which erased more than half of the recent 9.6% drawdown. My model is now equally allocated to the six ETFs listed in the table below. So far, my ETF investing strategy has performed fairly well especially...

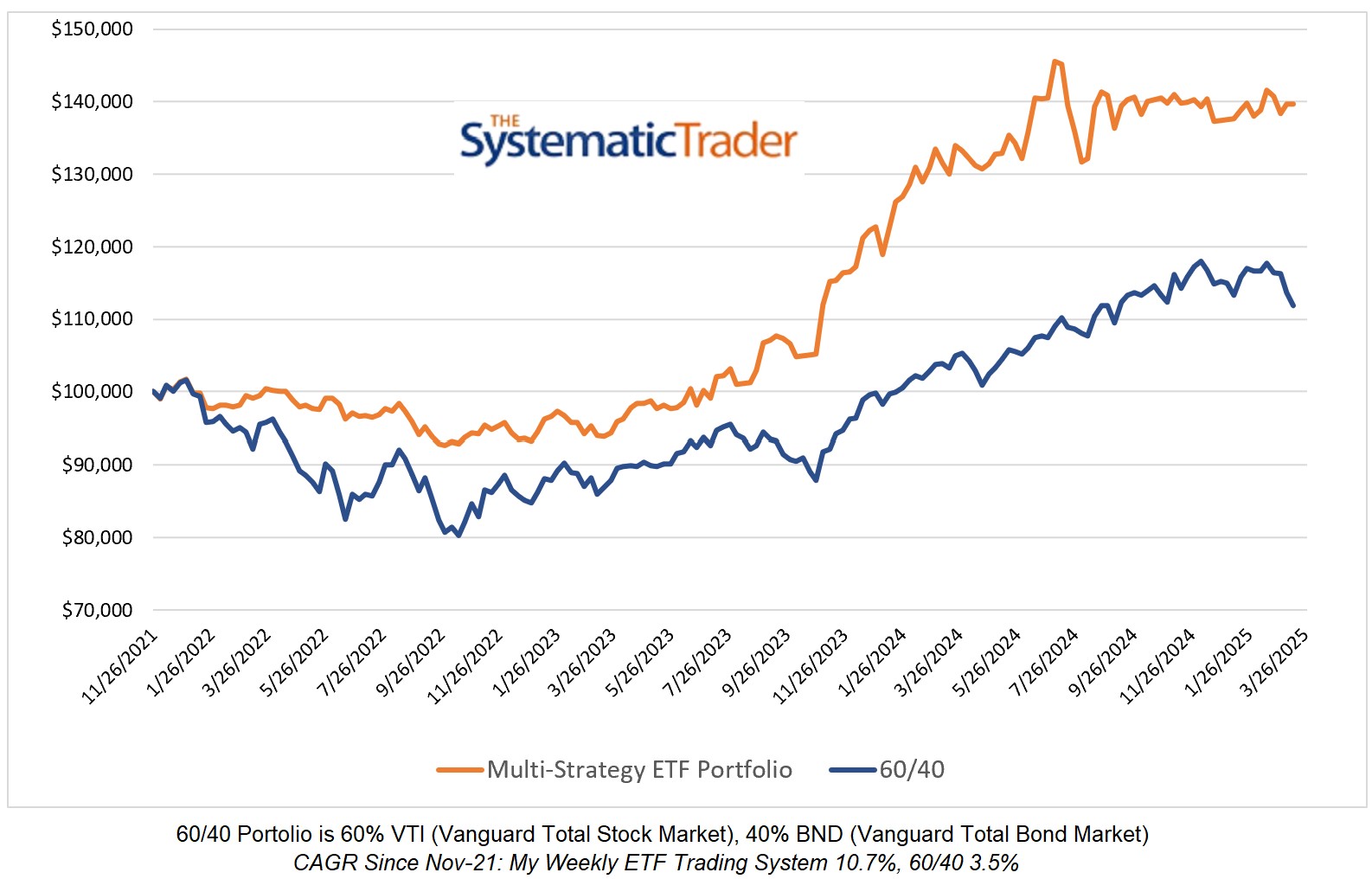

Investing Update for the Week Ending August 09, 2024

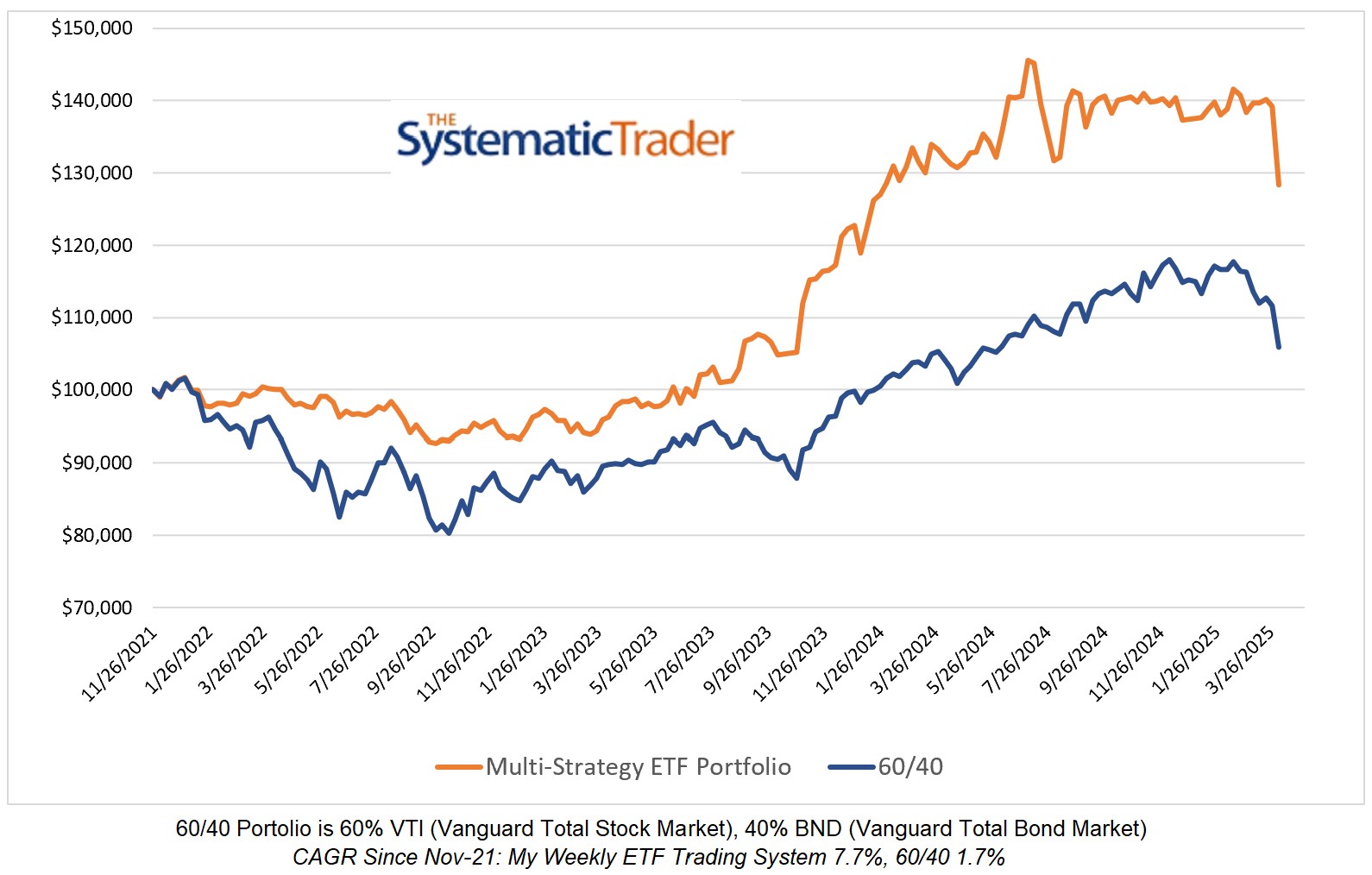

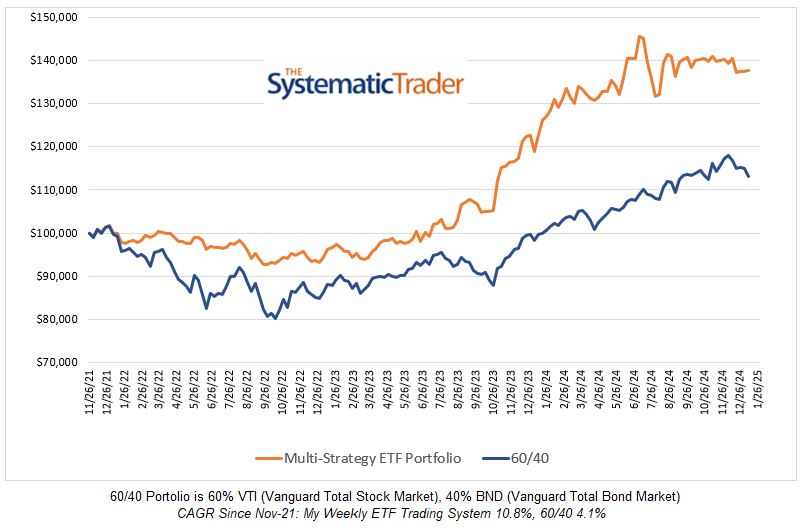

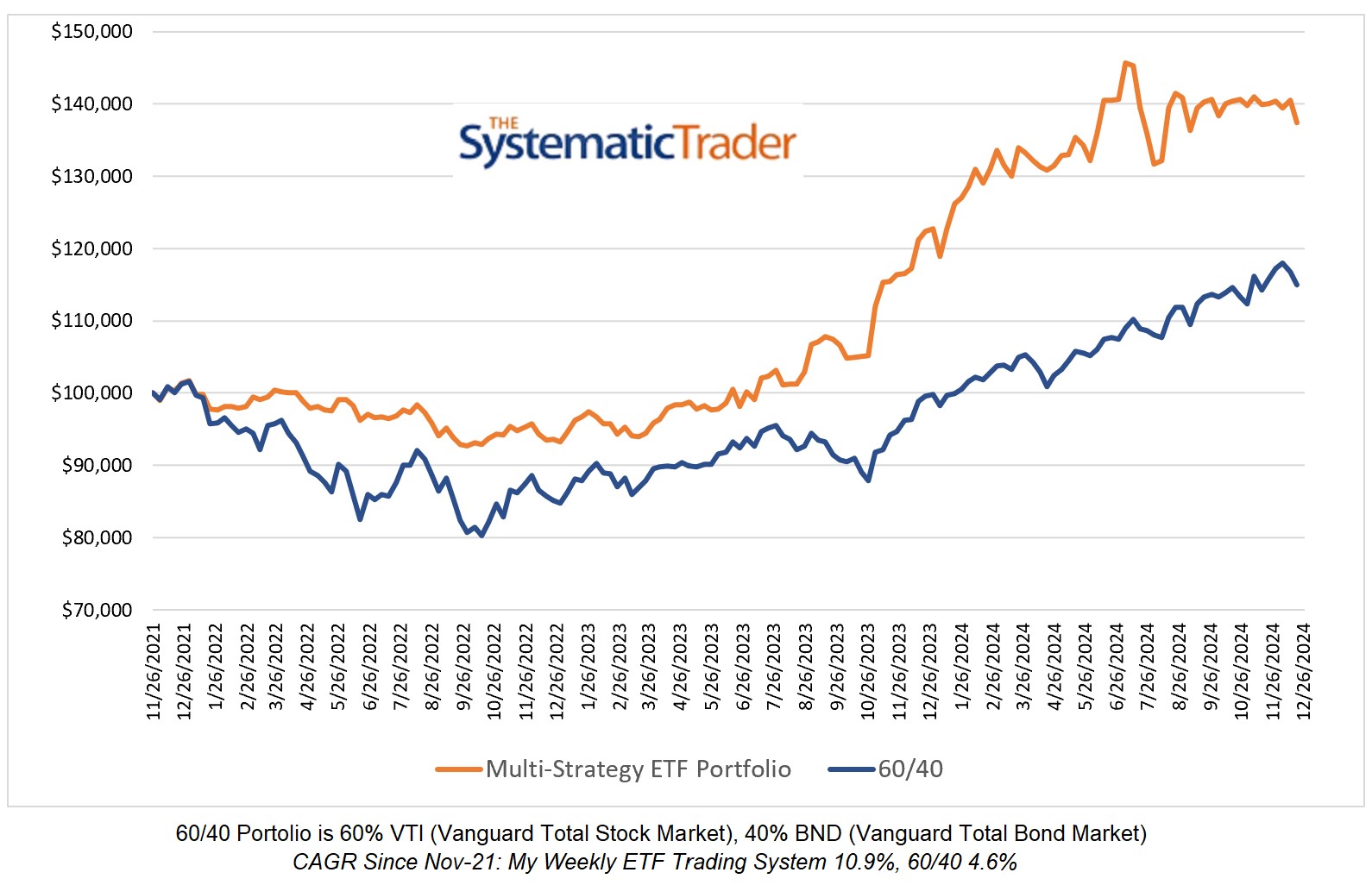

If you follow the markets closely, you know that this past week was a wild one with violent daily swings down and back up. I can hardly believe that after Monday's steep declines in equities, my model, which was 100% allocated to QQQ all week, ended the week with a...

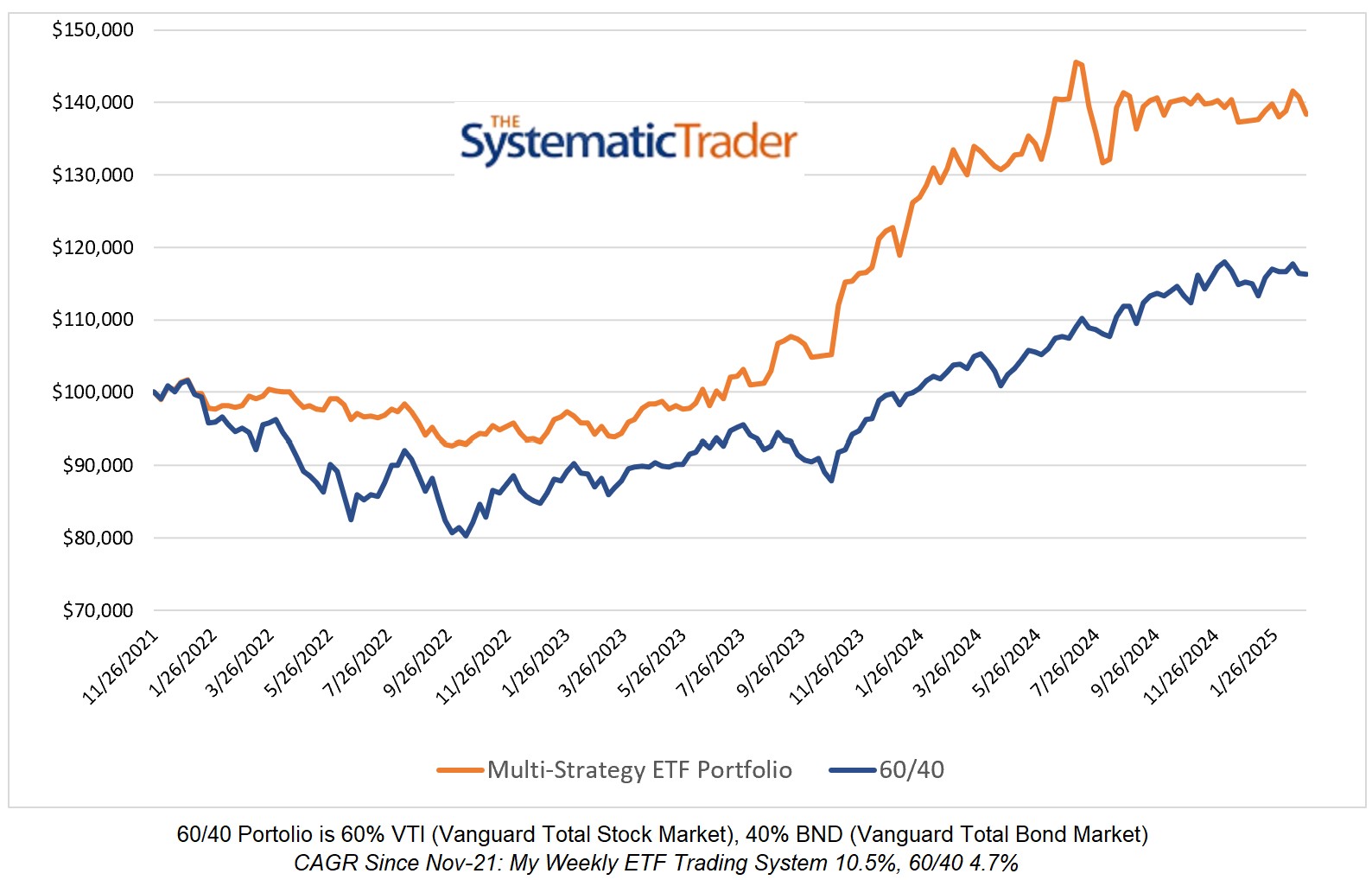

Investing Update for the Week Ending August 02, 2024

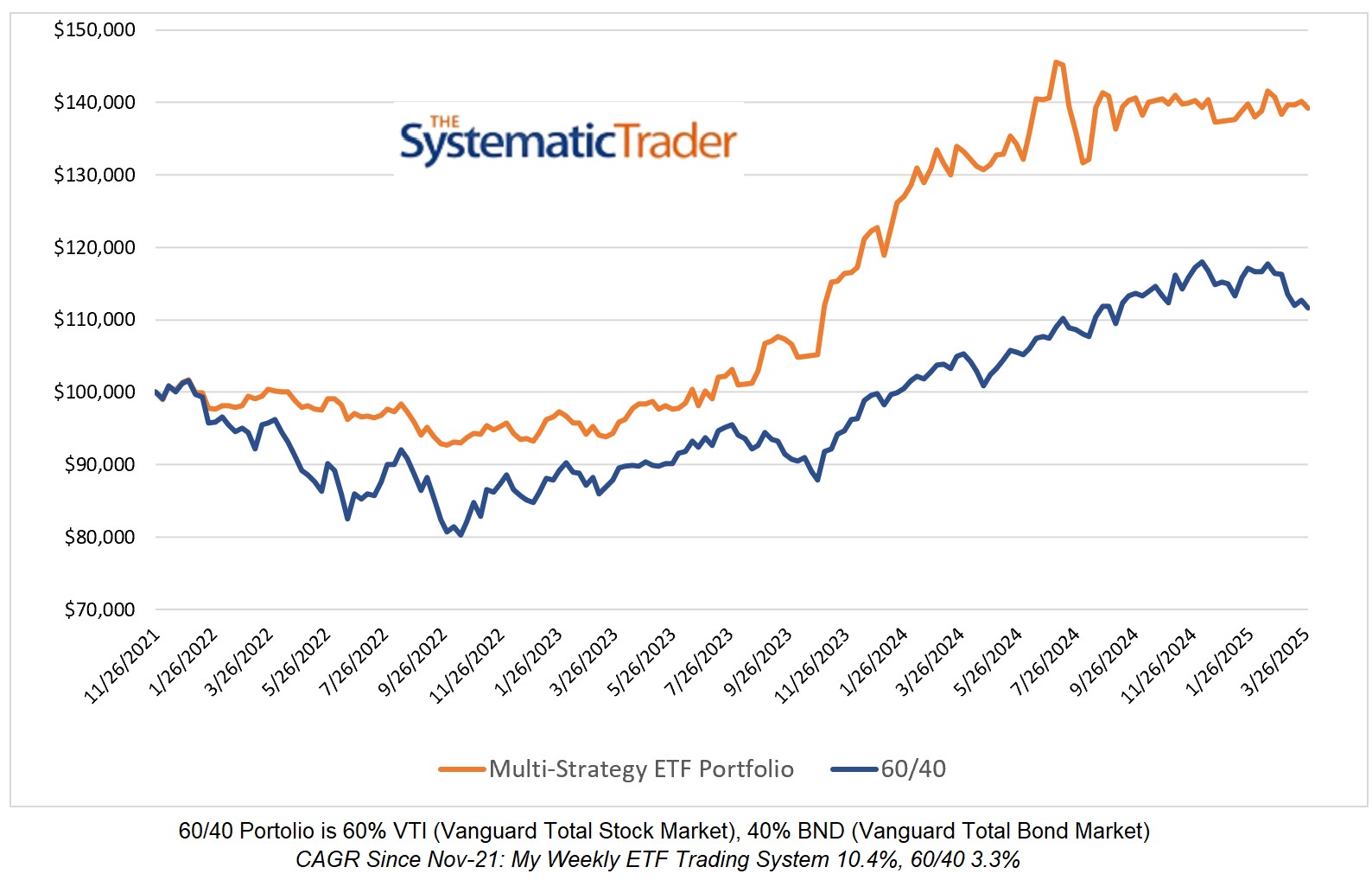

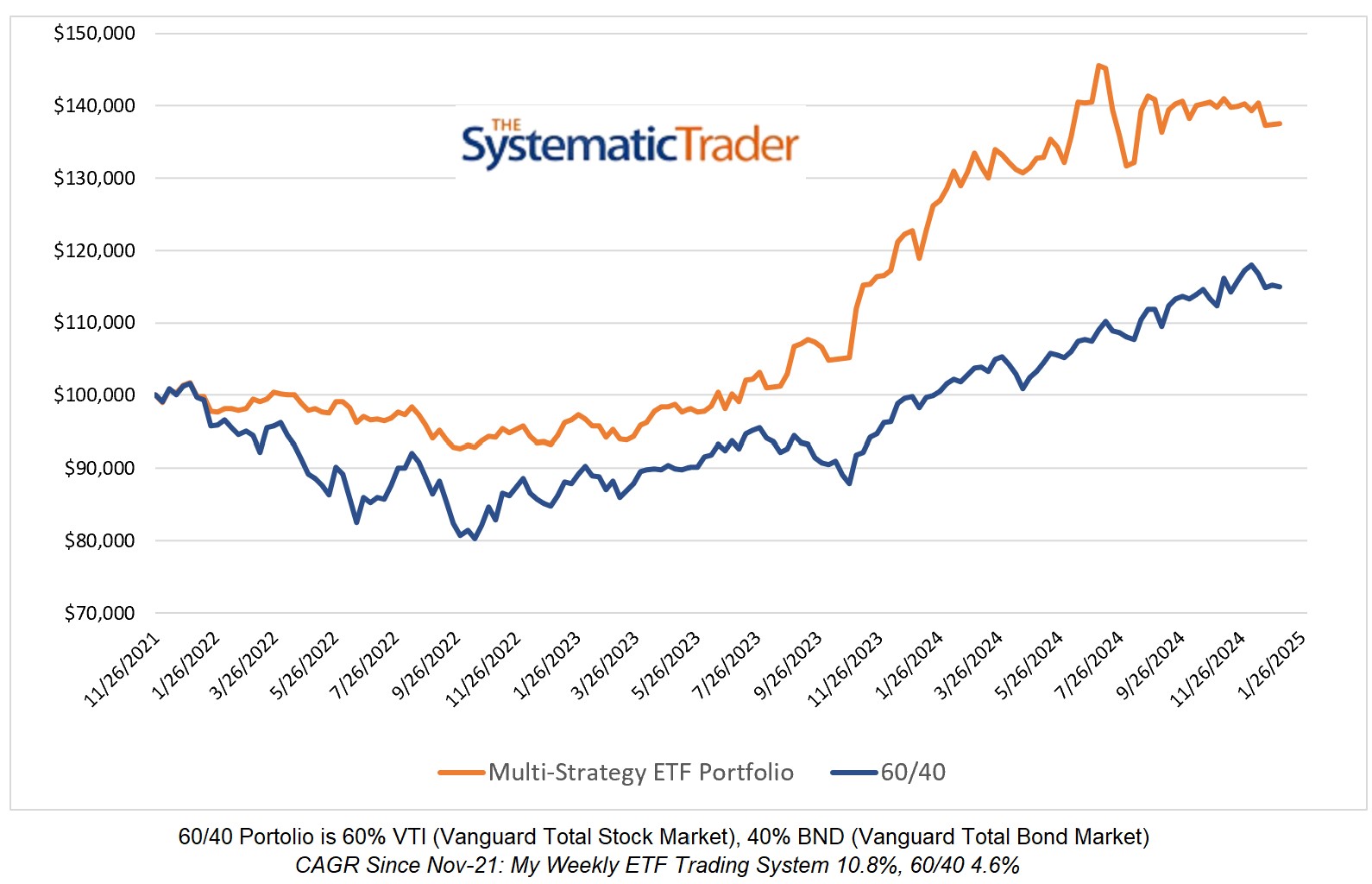

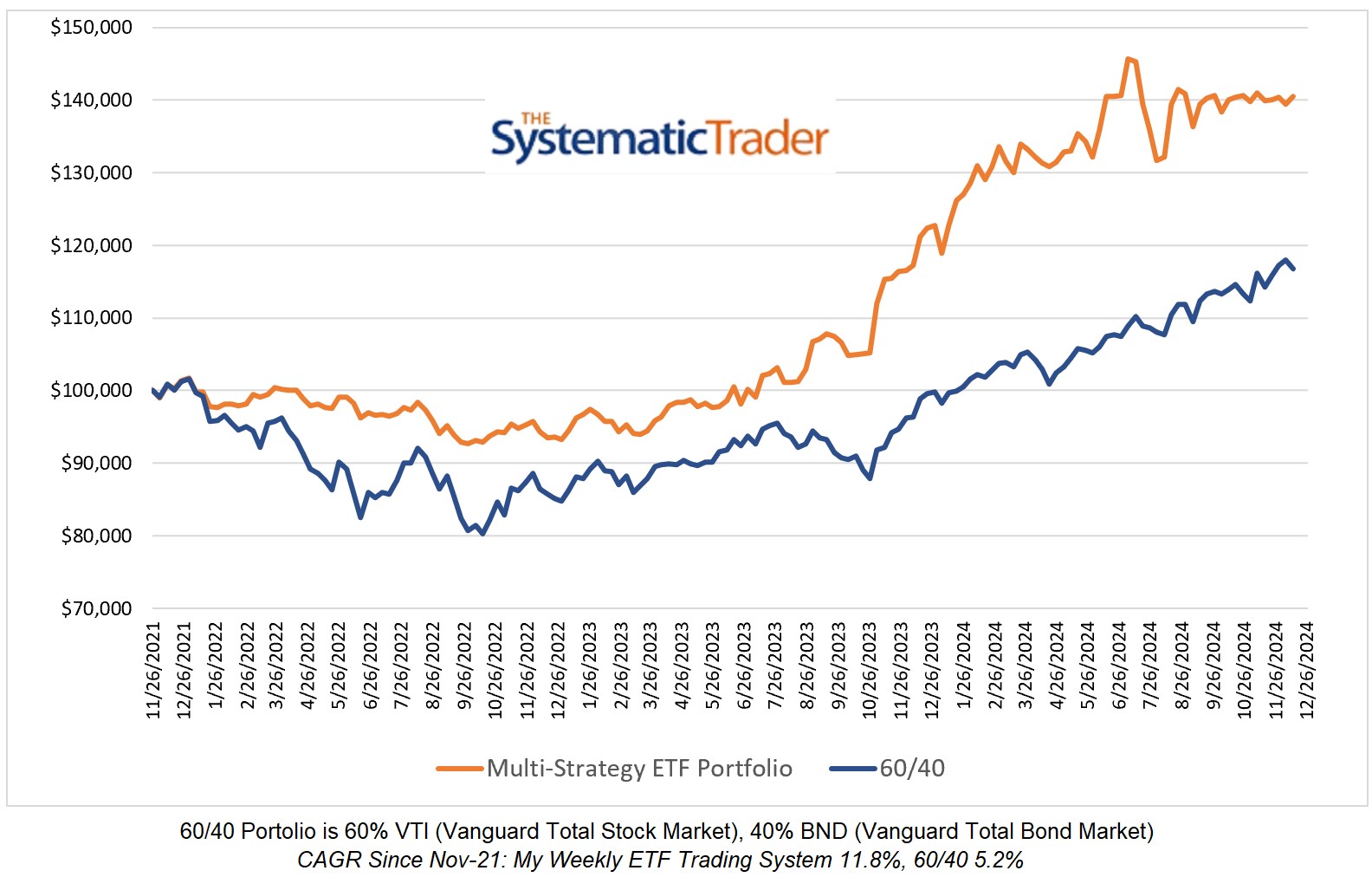

My ETF model is now in its worst drawdown since I began posting weekly allocations in November 2021. My model remains 100% allocated to QQQ and, although an earlier version of me would be tempted to override my model and take a defensive stance, I know that the model...