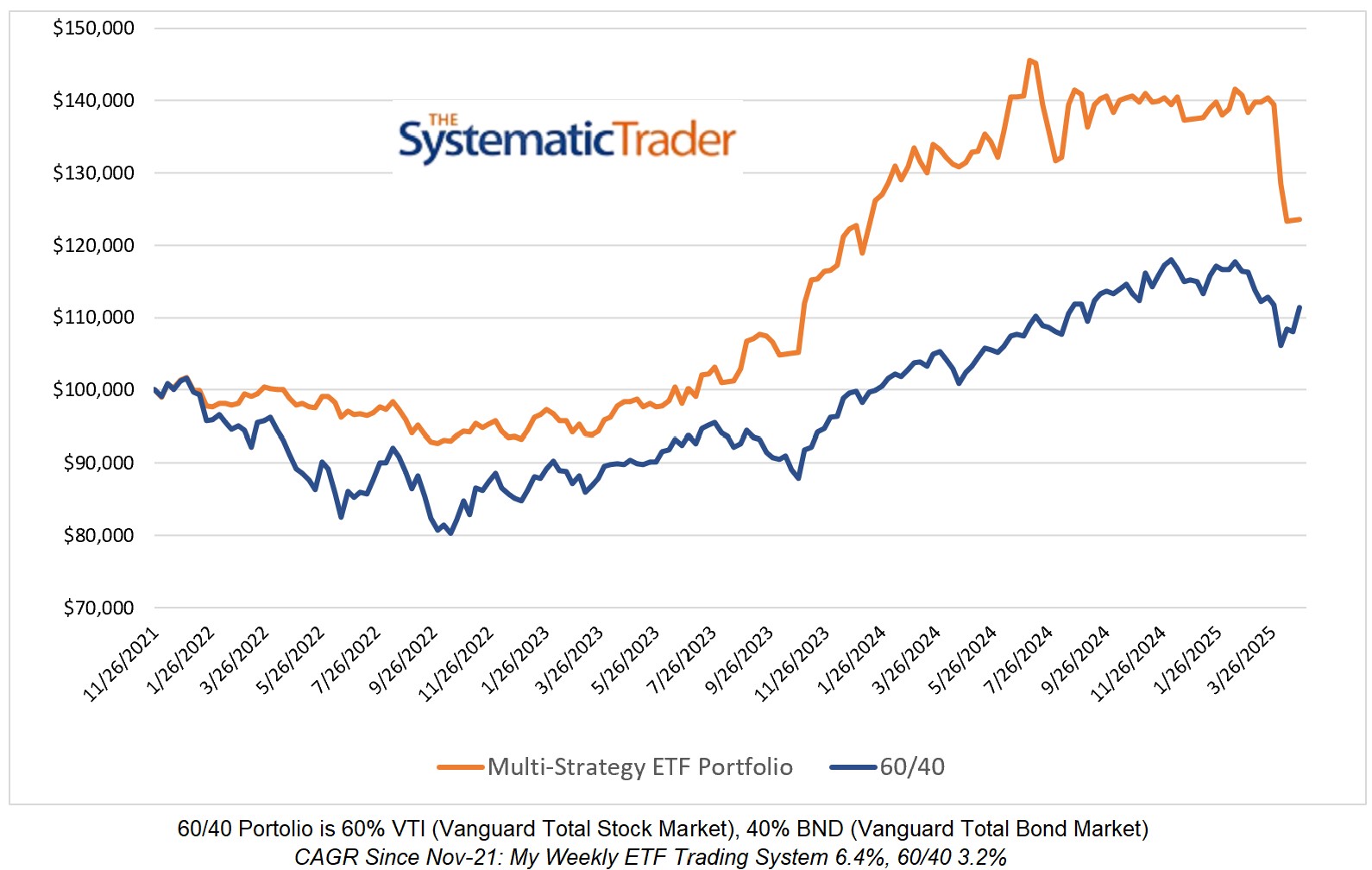

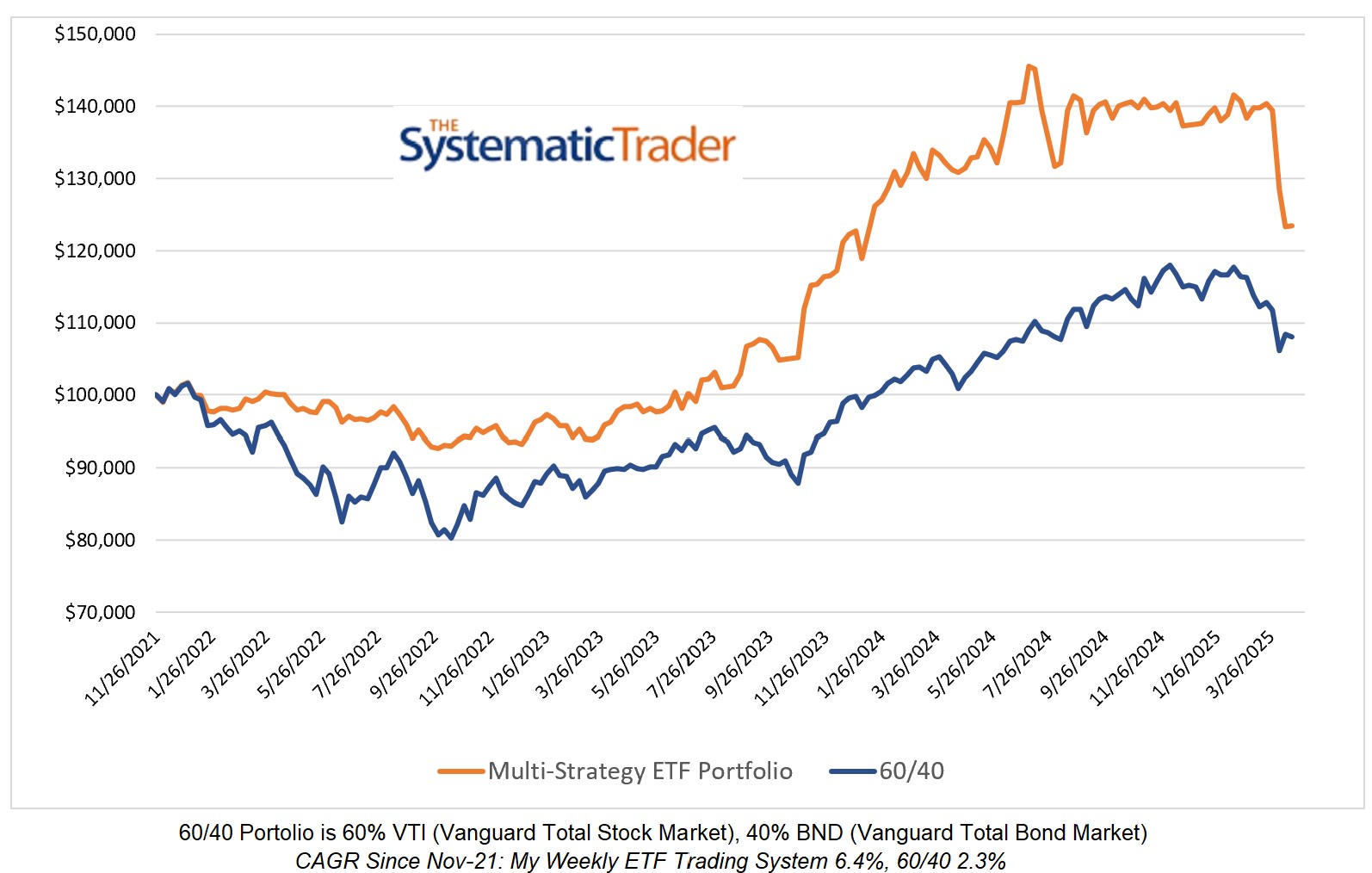

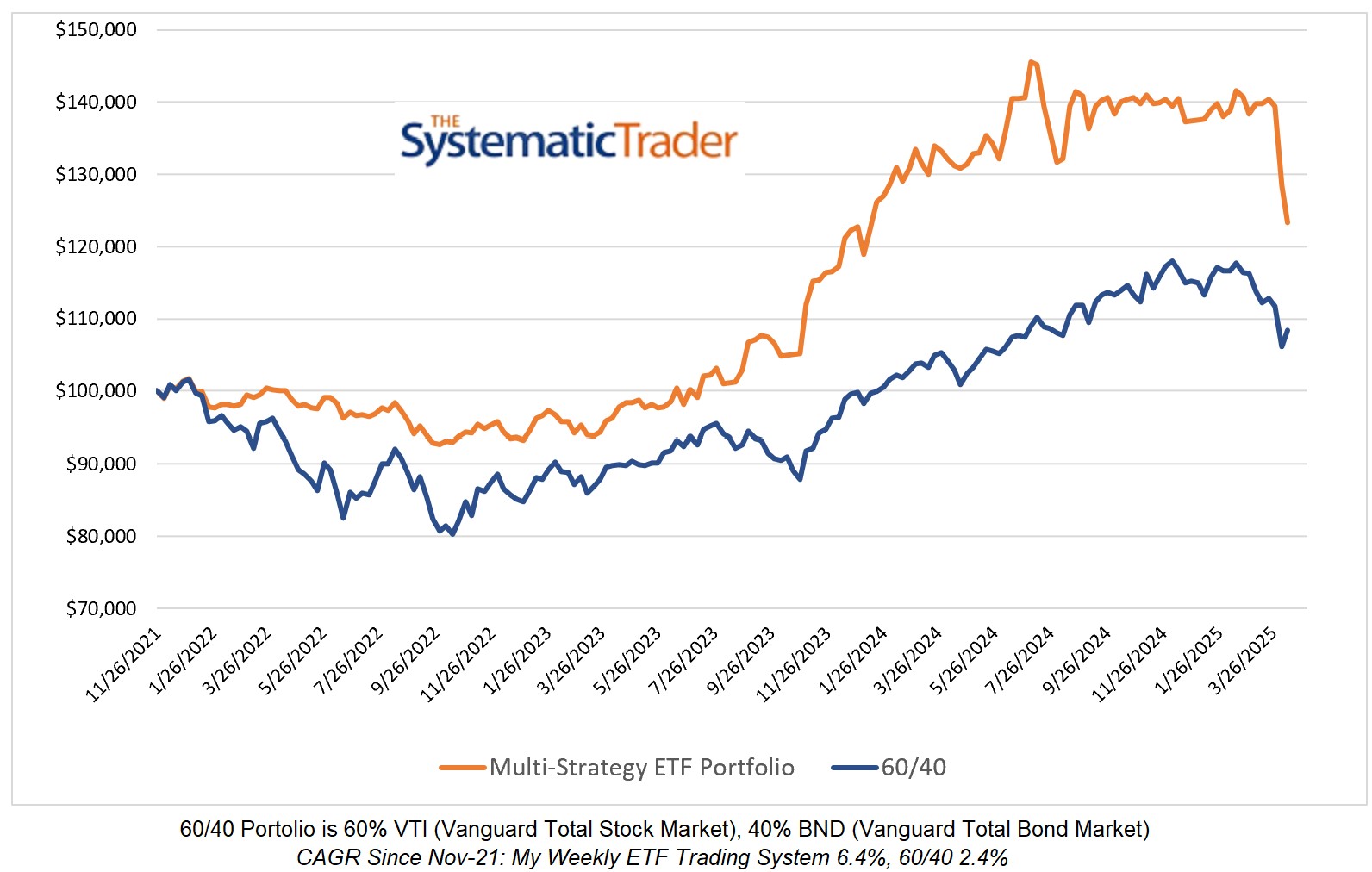

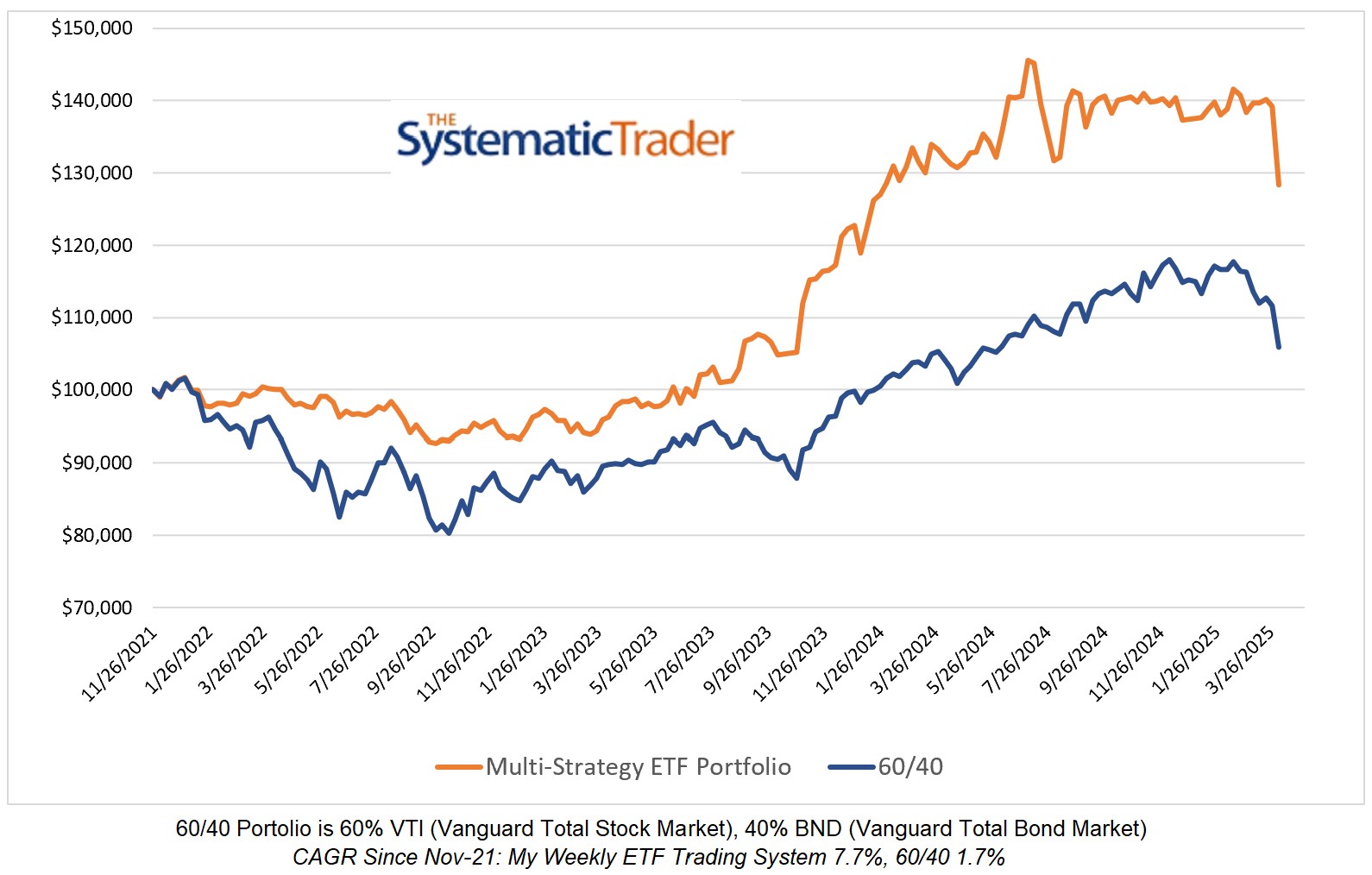

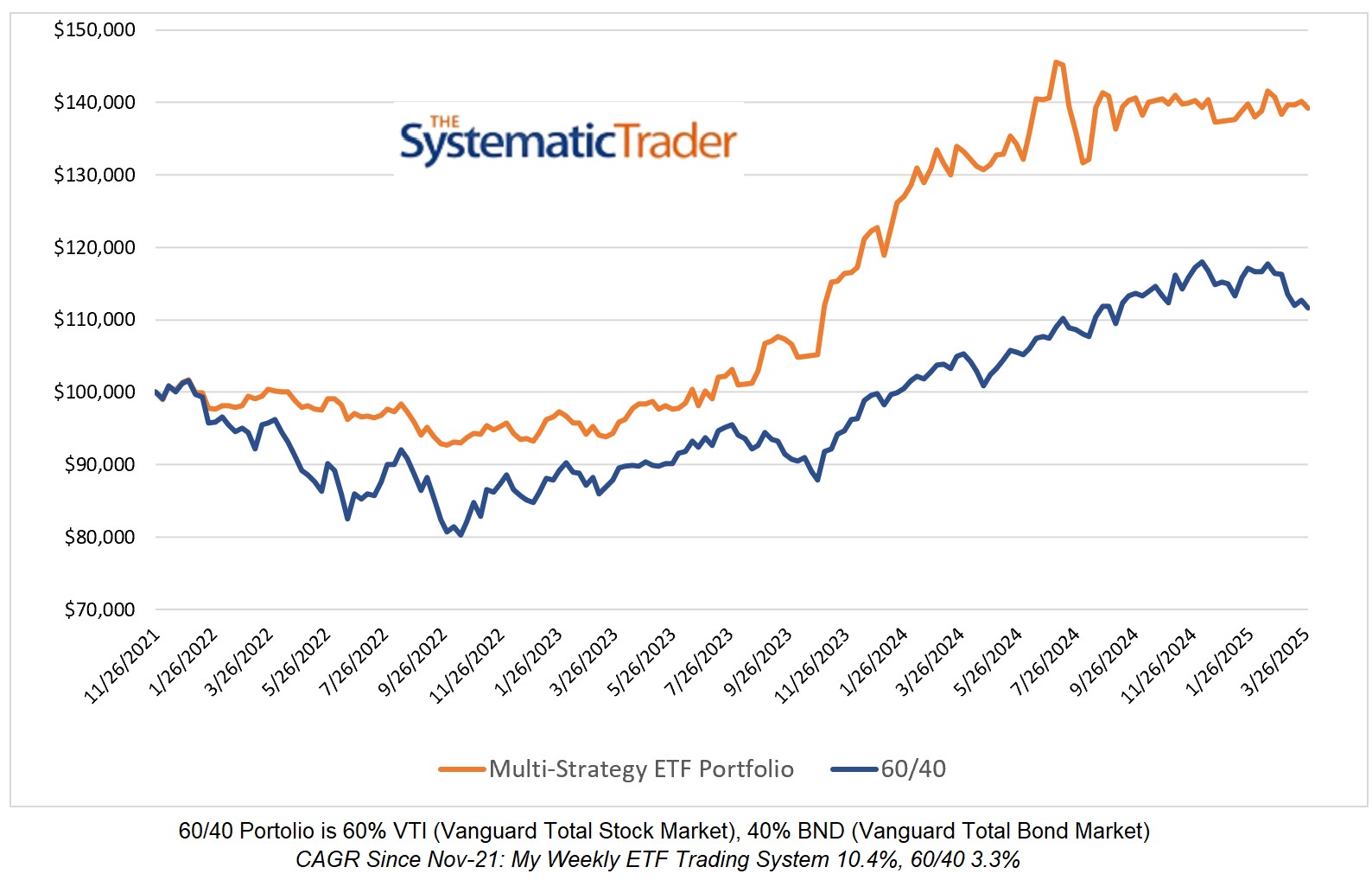

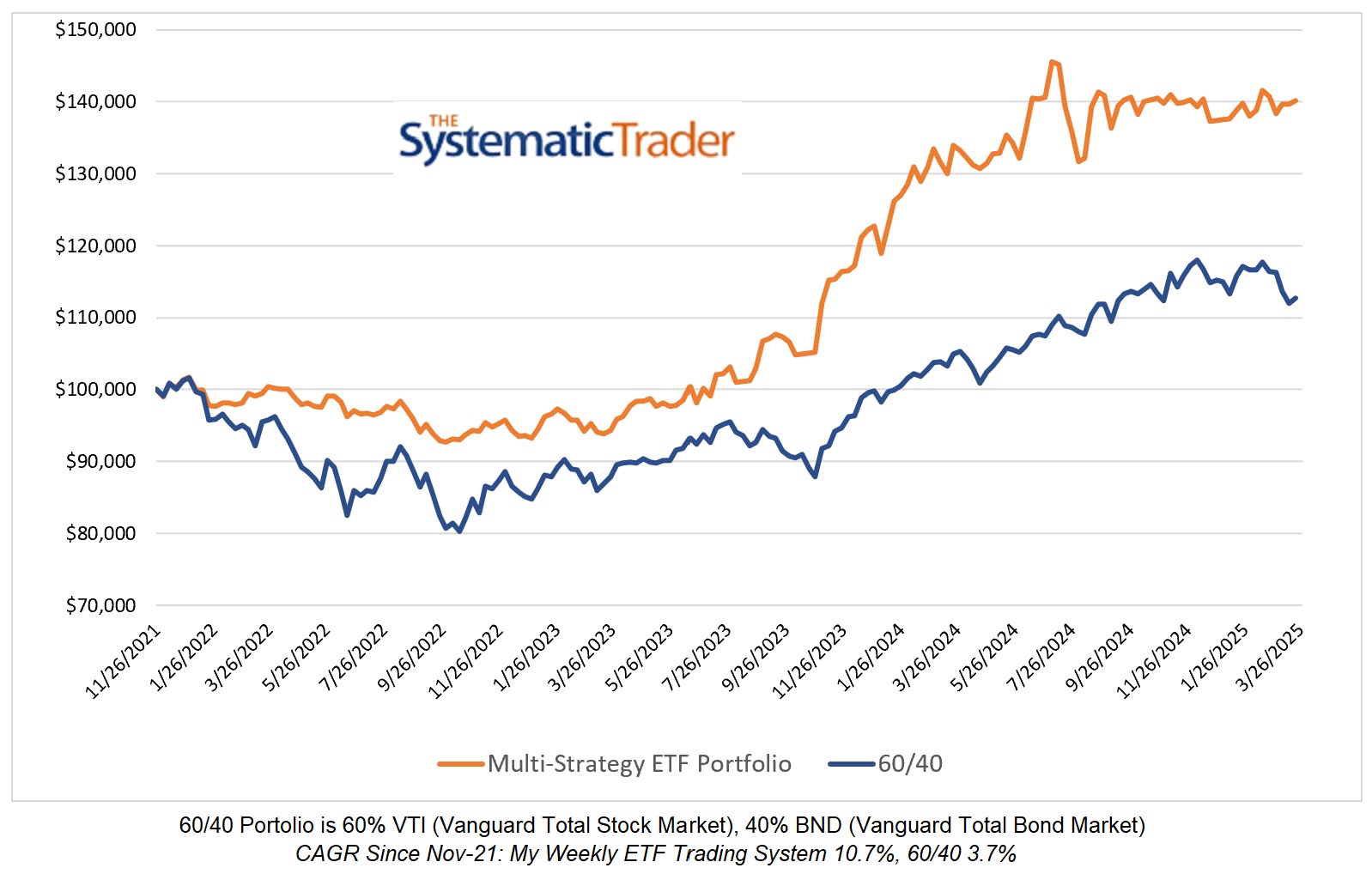

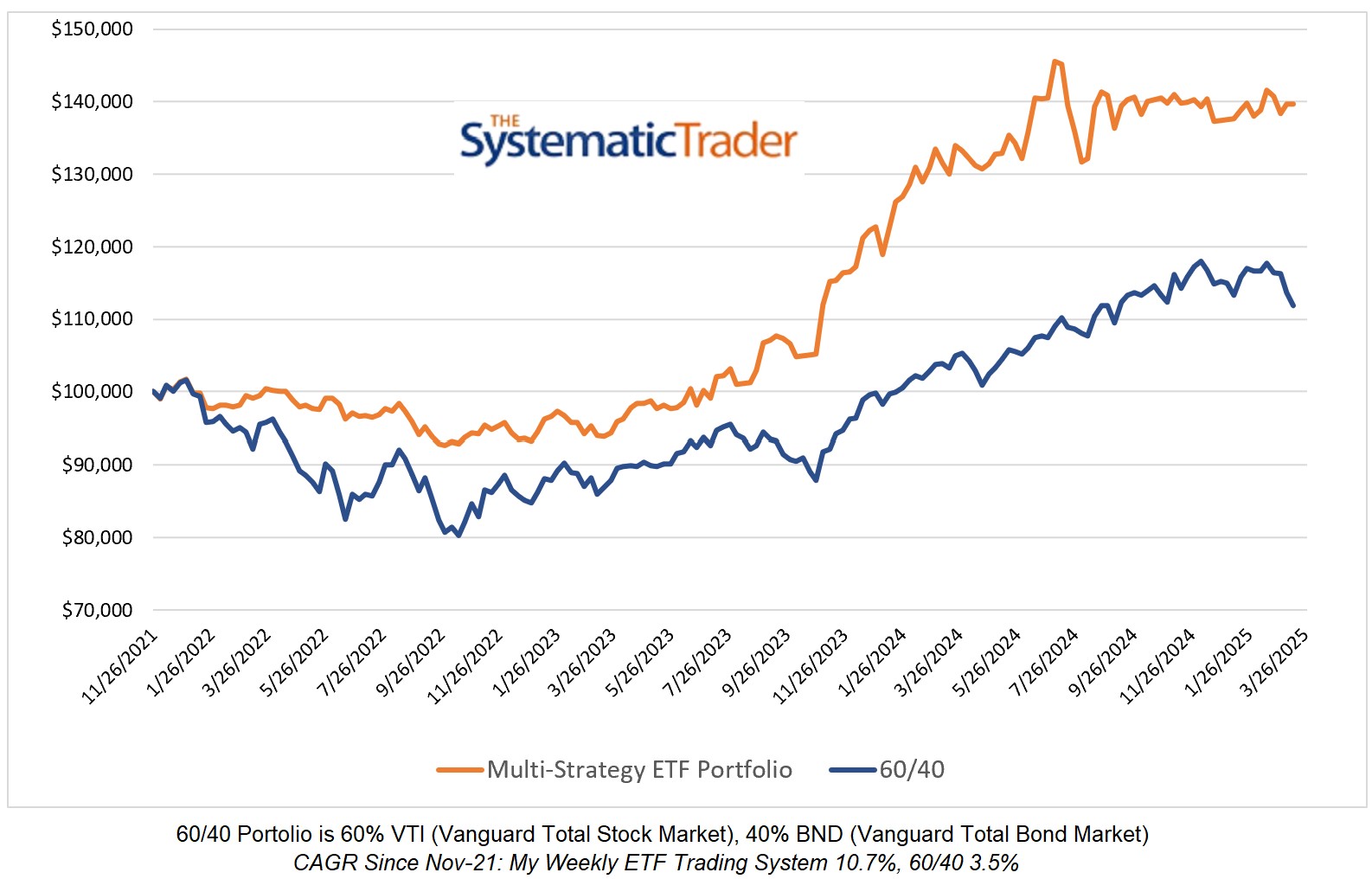

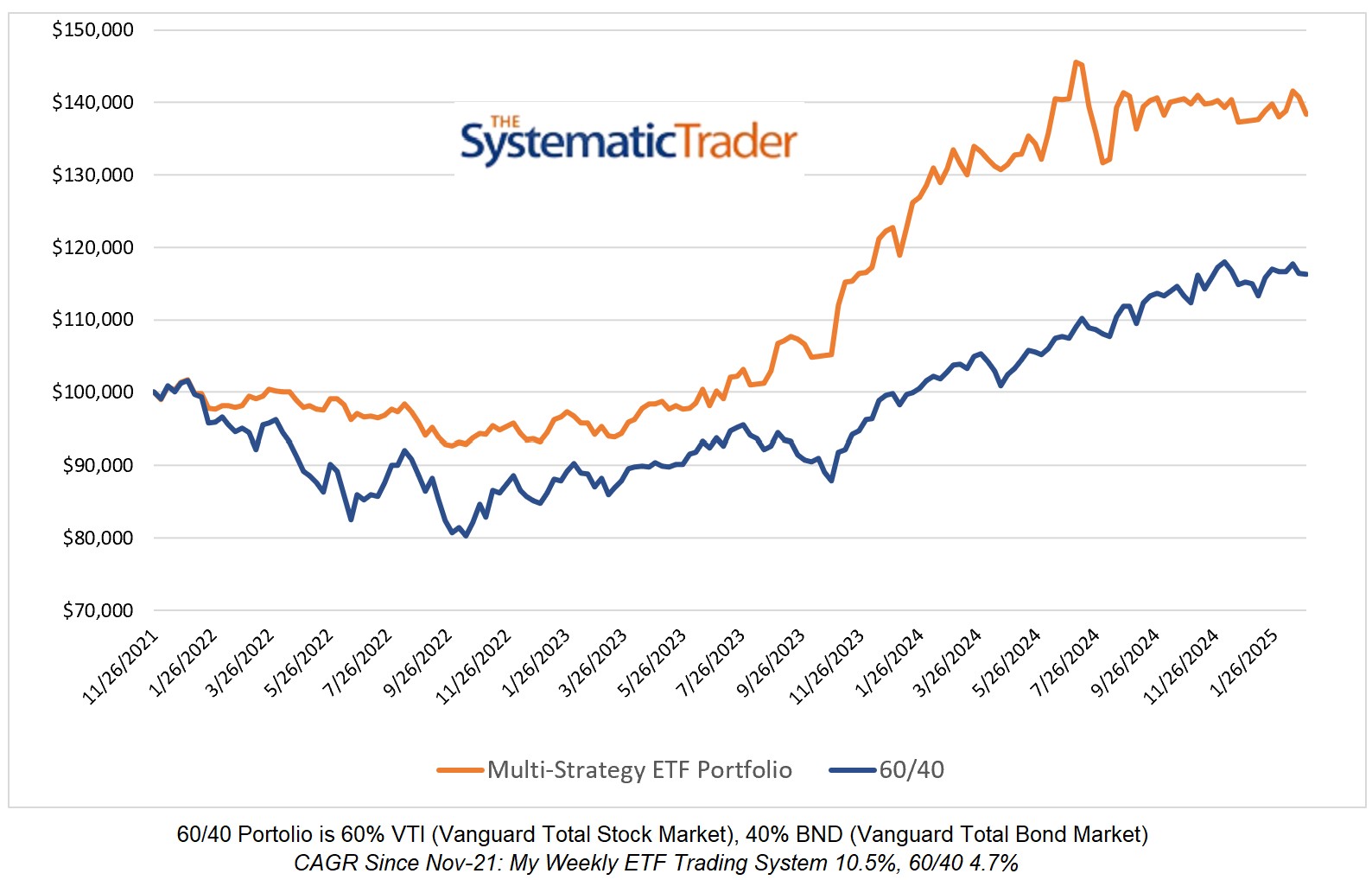

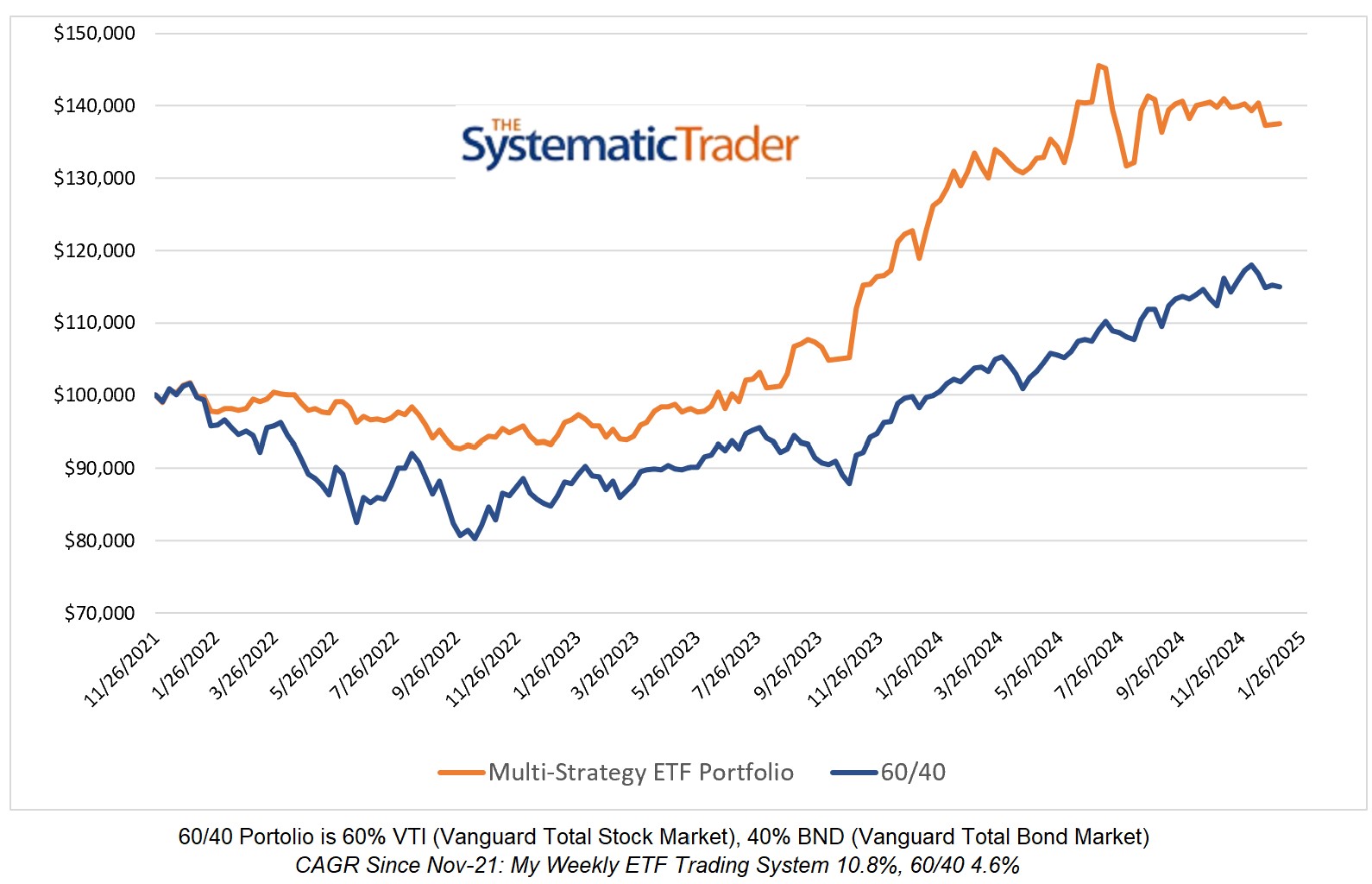

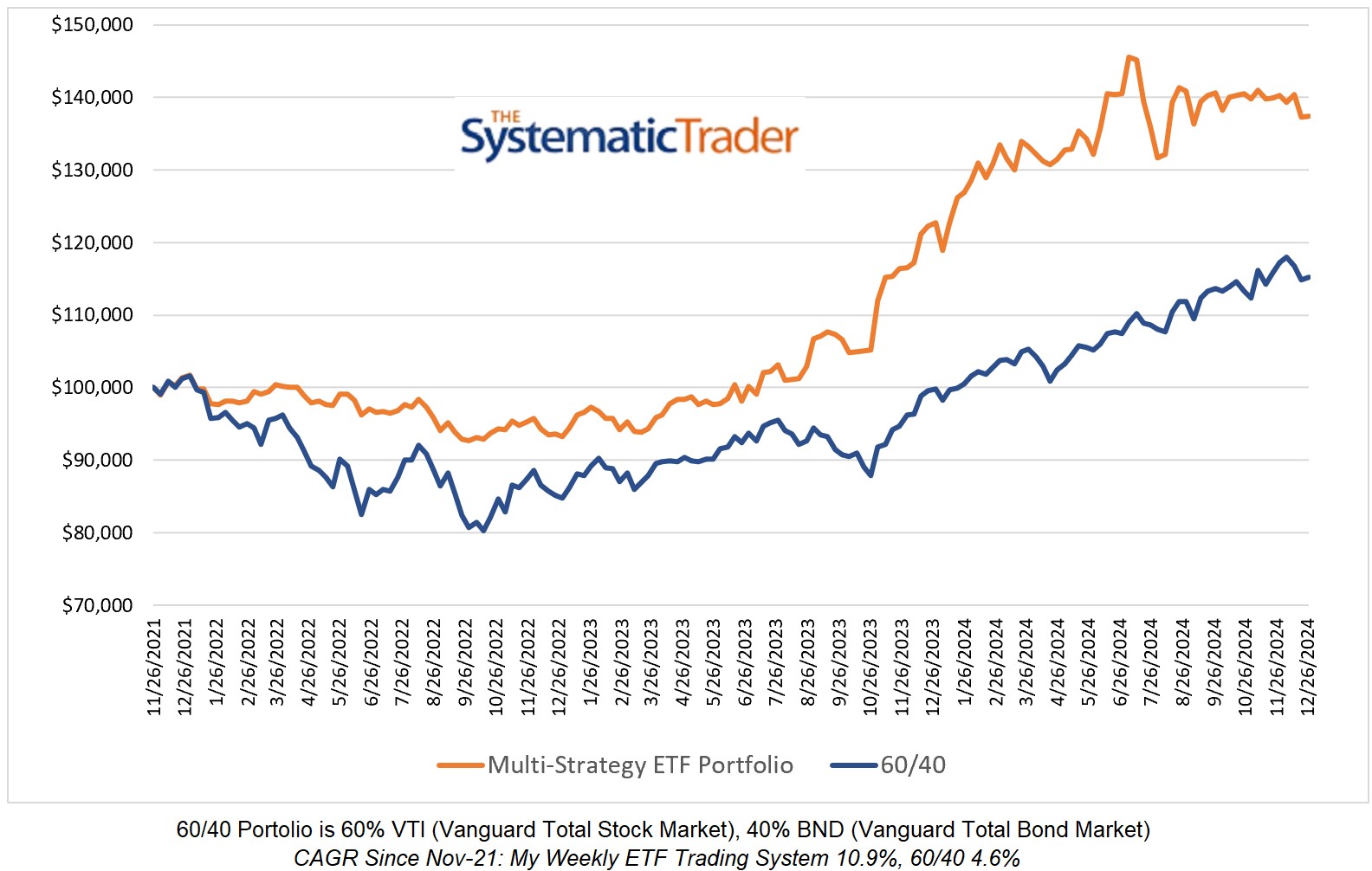

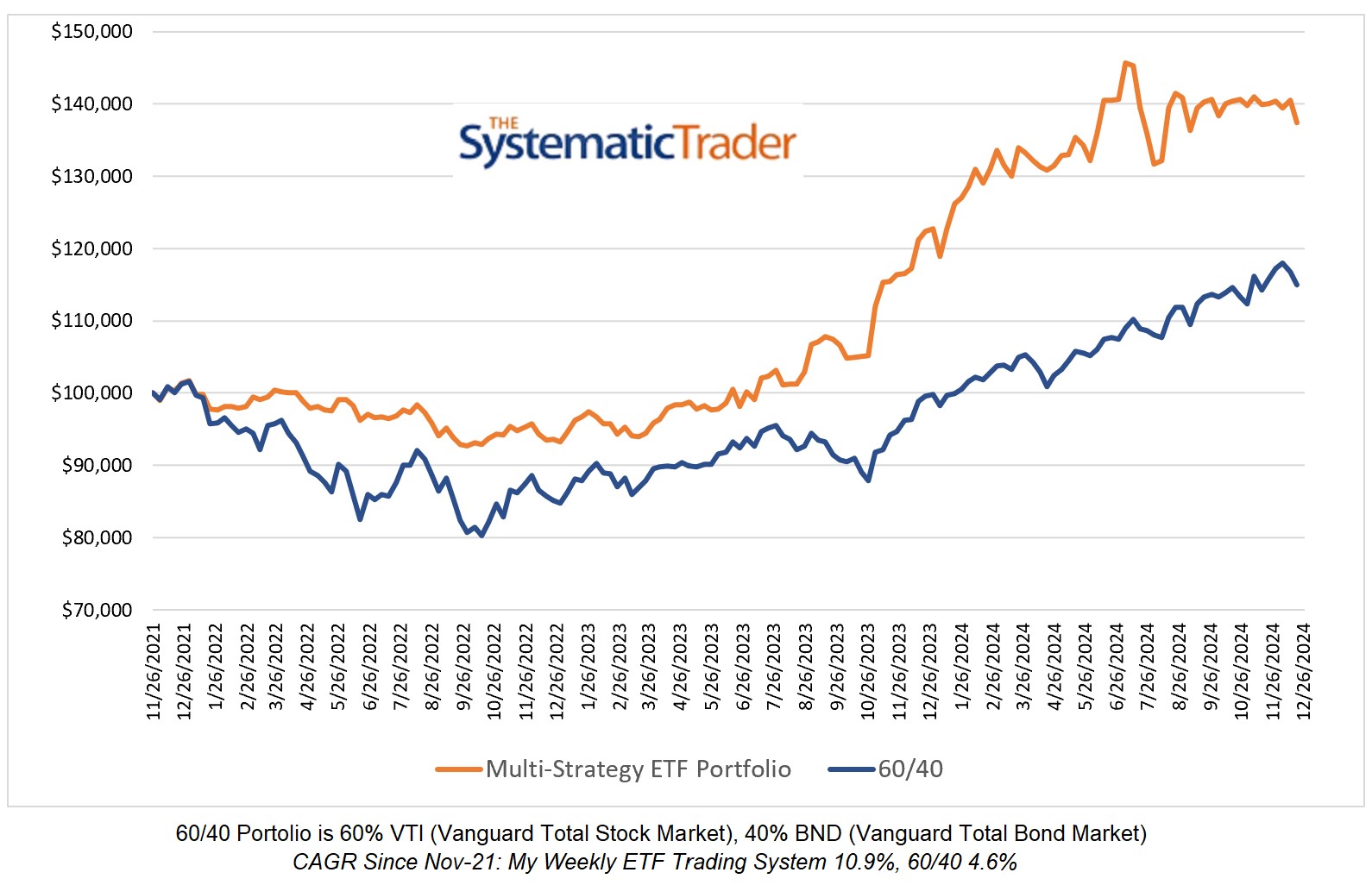

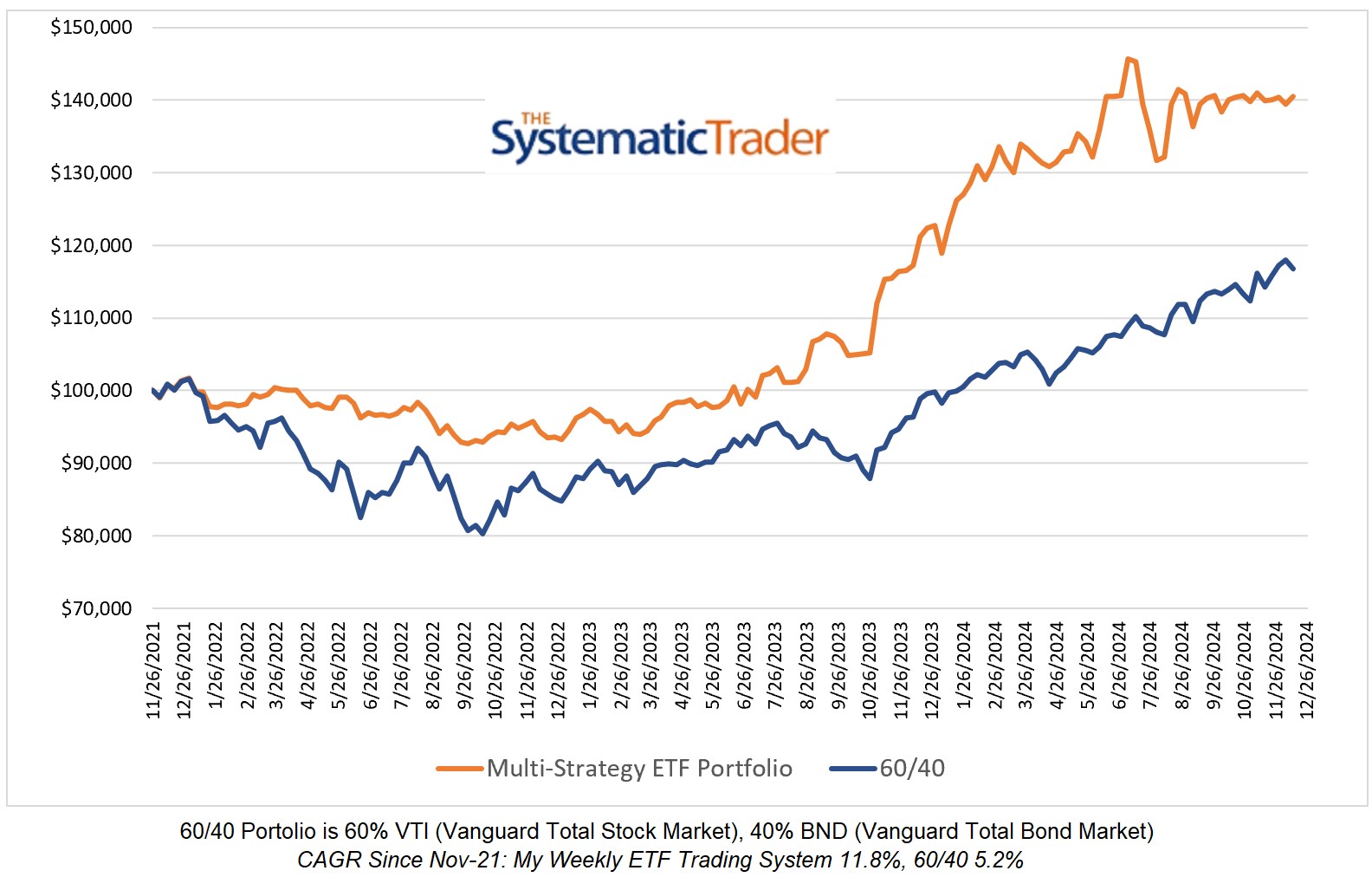

My Personal Weekly Dynamic Asset Allocations

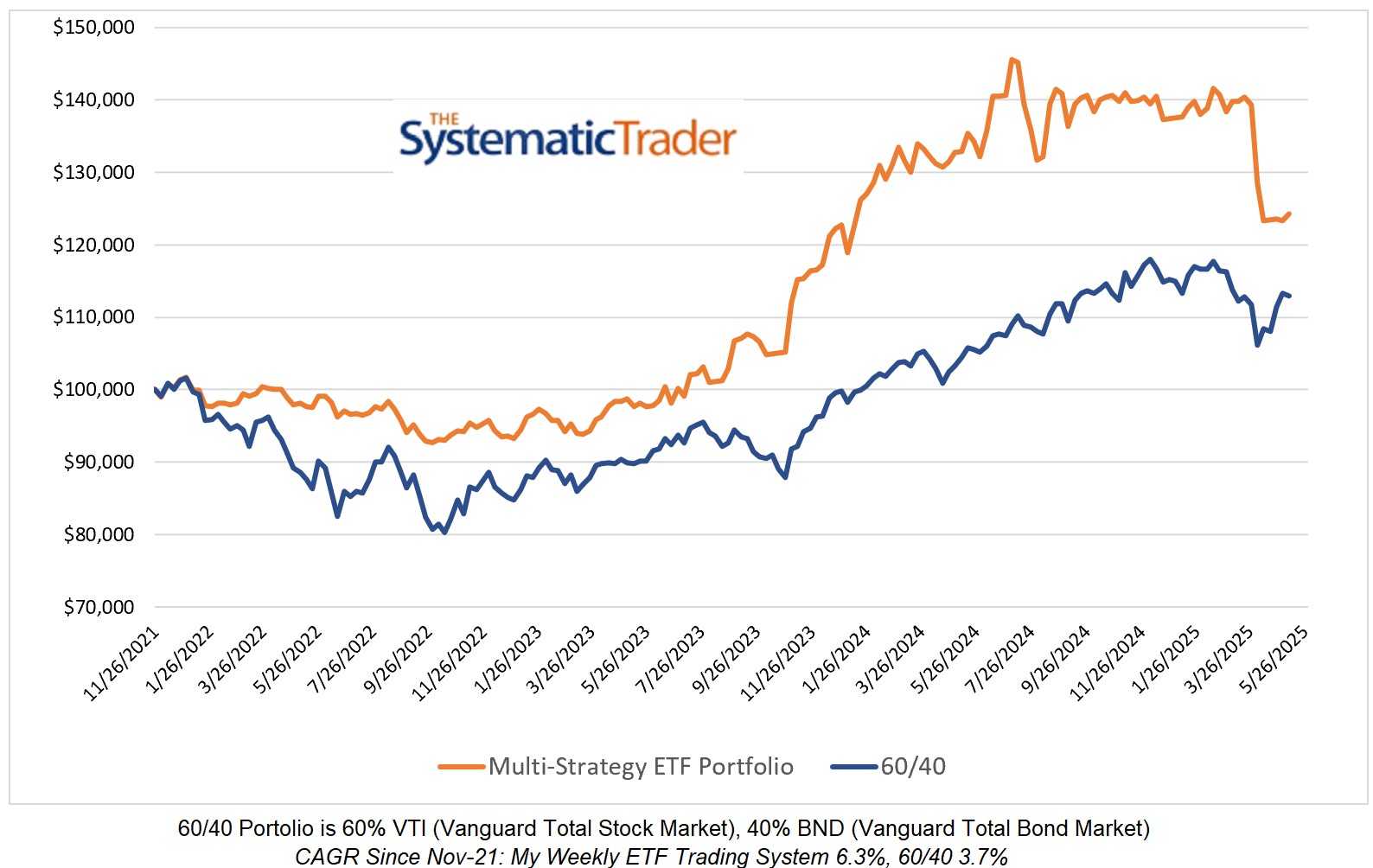

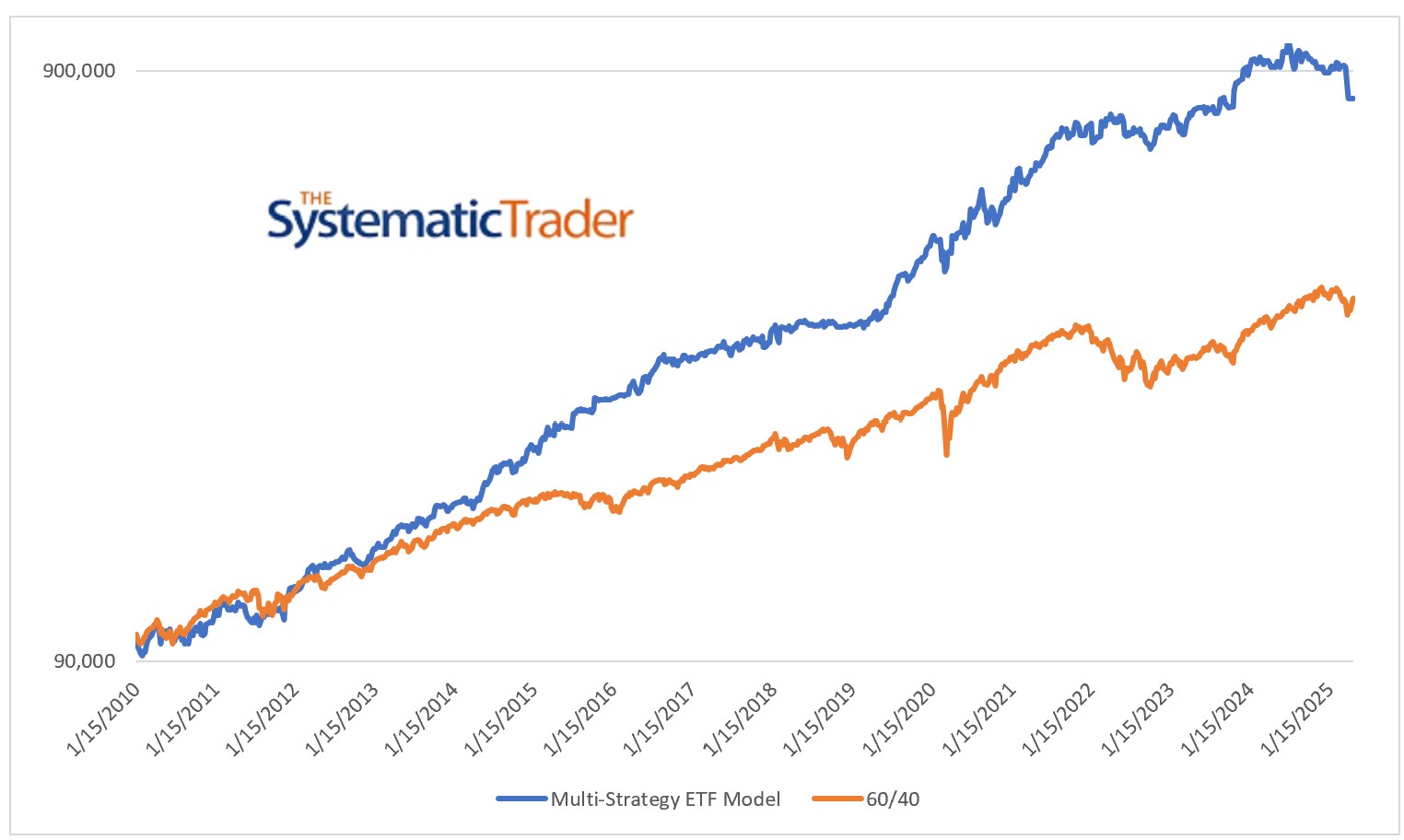

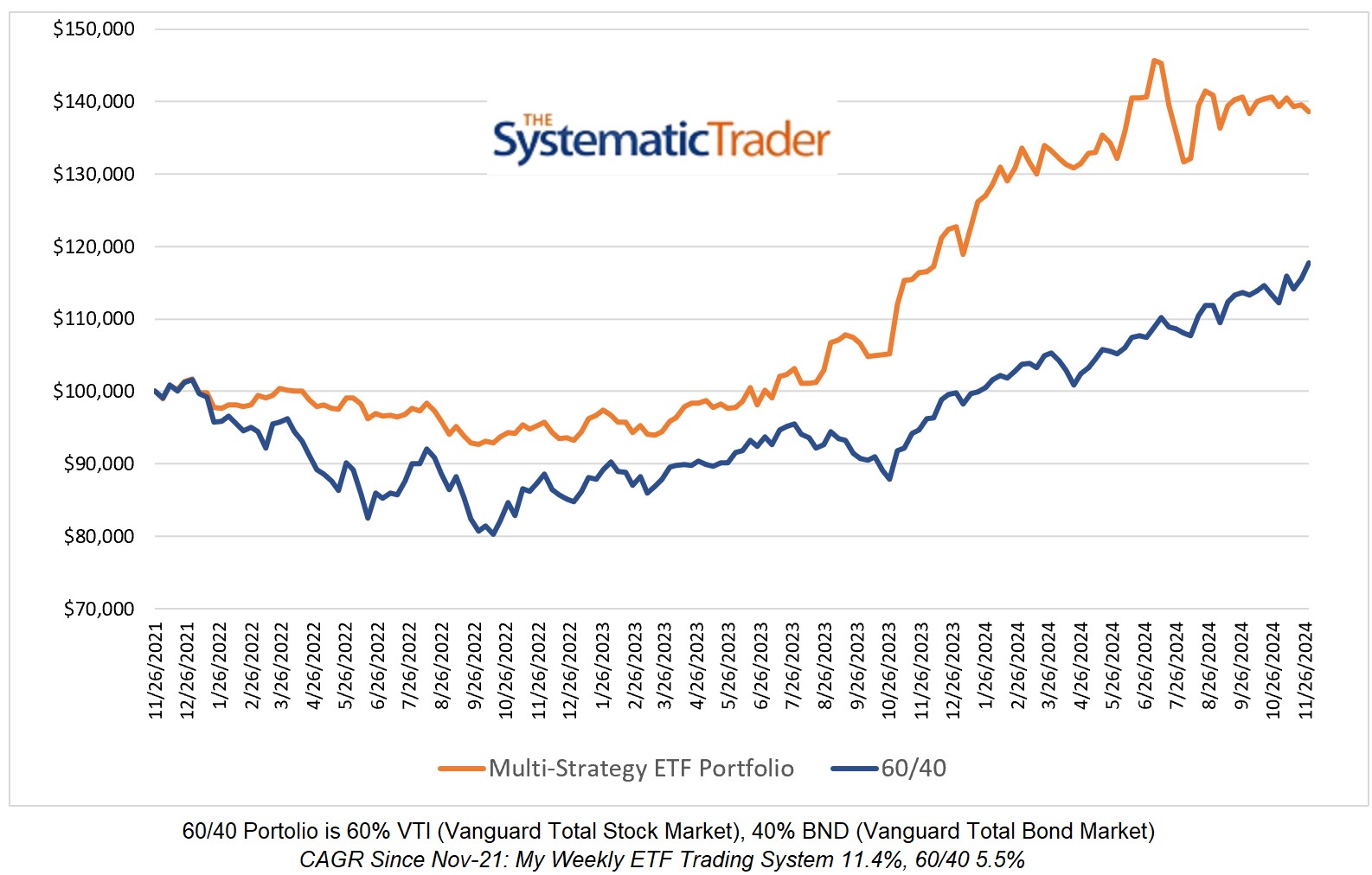

Suggestions for ETF Allocations to Outperform the 60/40 Portfolio

Latest Posts

Investing Update for the Week Ending July 05, 2024

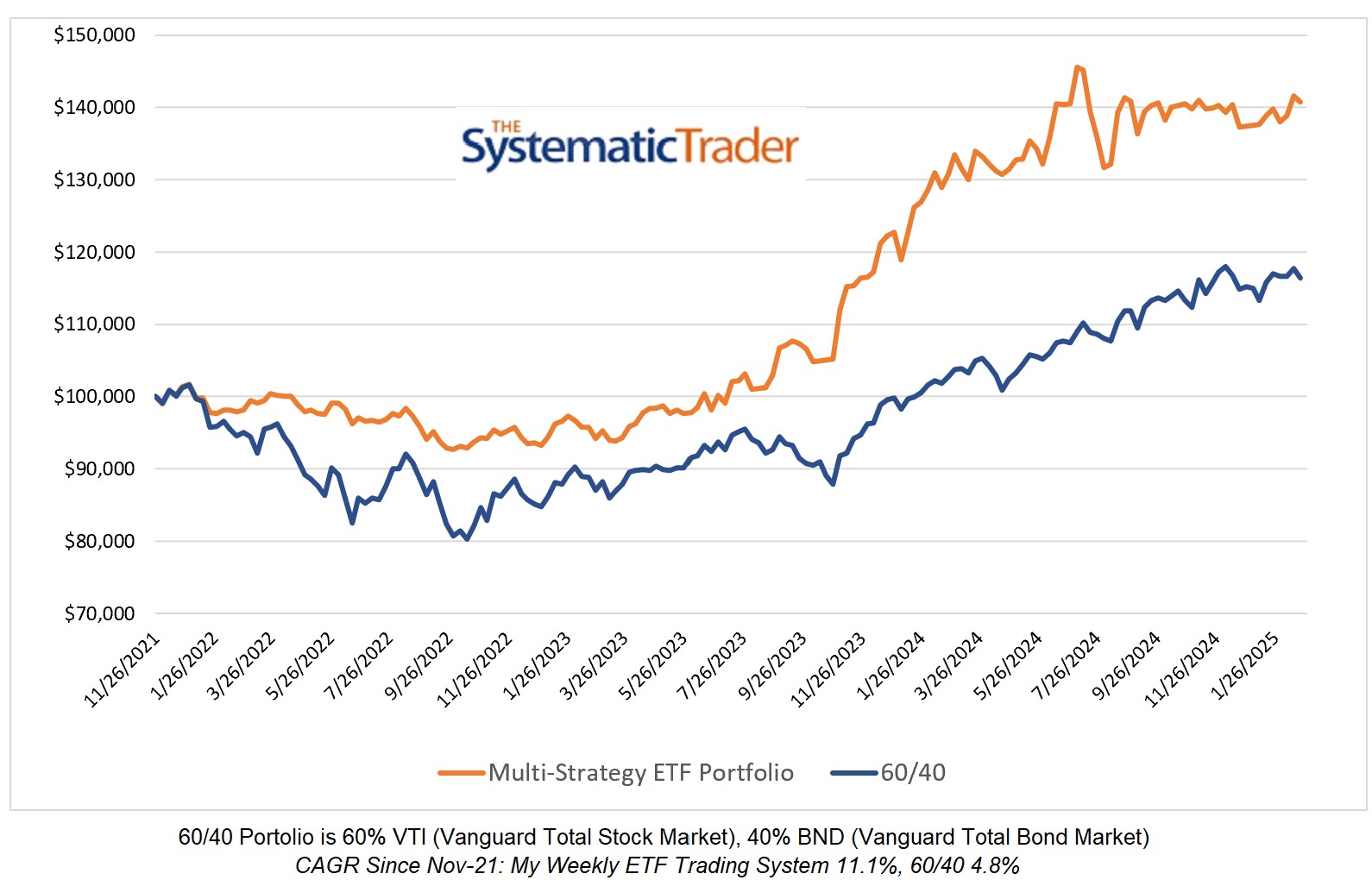

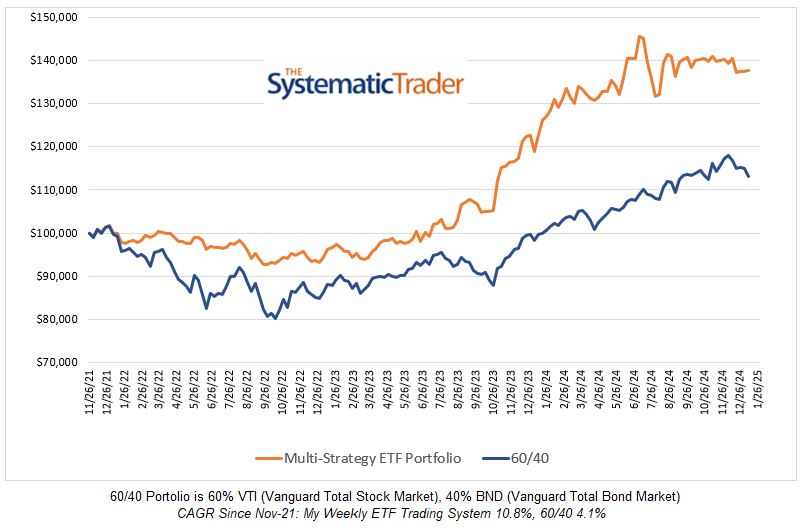

My Global Multi-Strategy ETF Model rose 3.56% this week to hit another all-time high. Since Nov-21, my model has achieved a 15.51% CAGR with a mild 9.0% maximum drawdown. My model remains 100% allocated to QQQ.

Investing Update for the Week Ending June 28, 2024

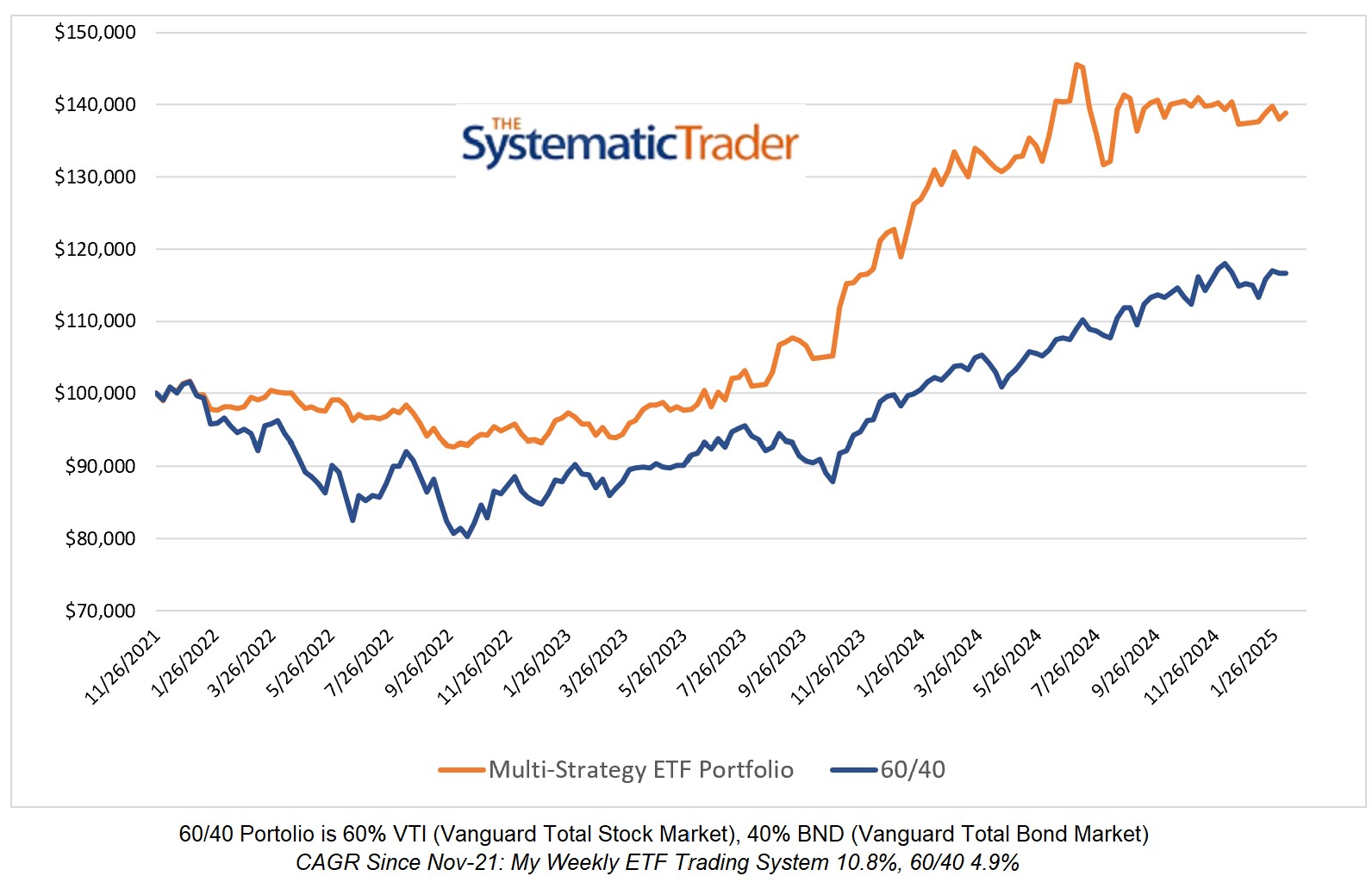

My global ETF multi-strategy model was essentially flat this past week and the 60/40 model (VTI/BND) declined by 0.23% At the close on Friday, my model had switched to an aggressive stance and is now 100% allocated to QQQ. To my fellow Canadians, I hope you enjoy the...

Investing Update for the Week Ending June 21, 2024

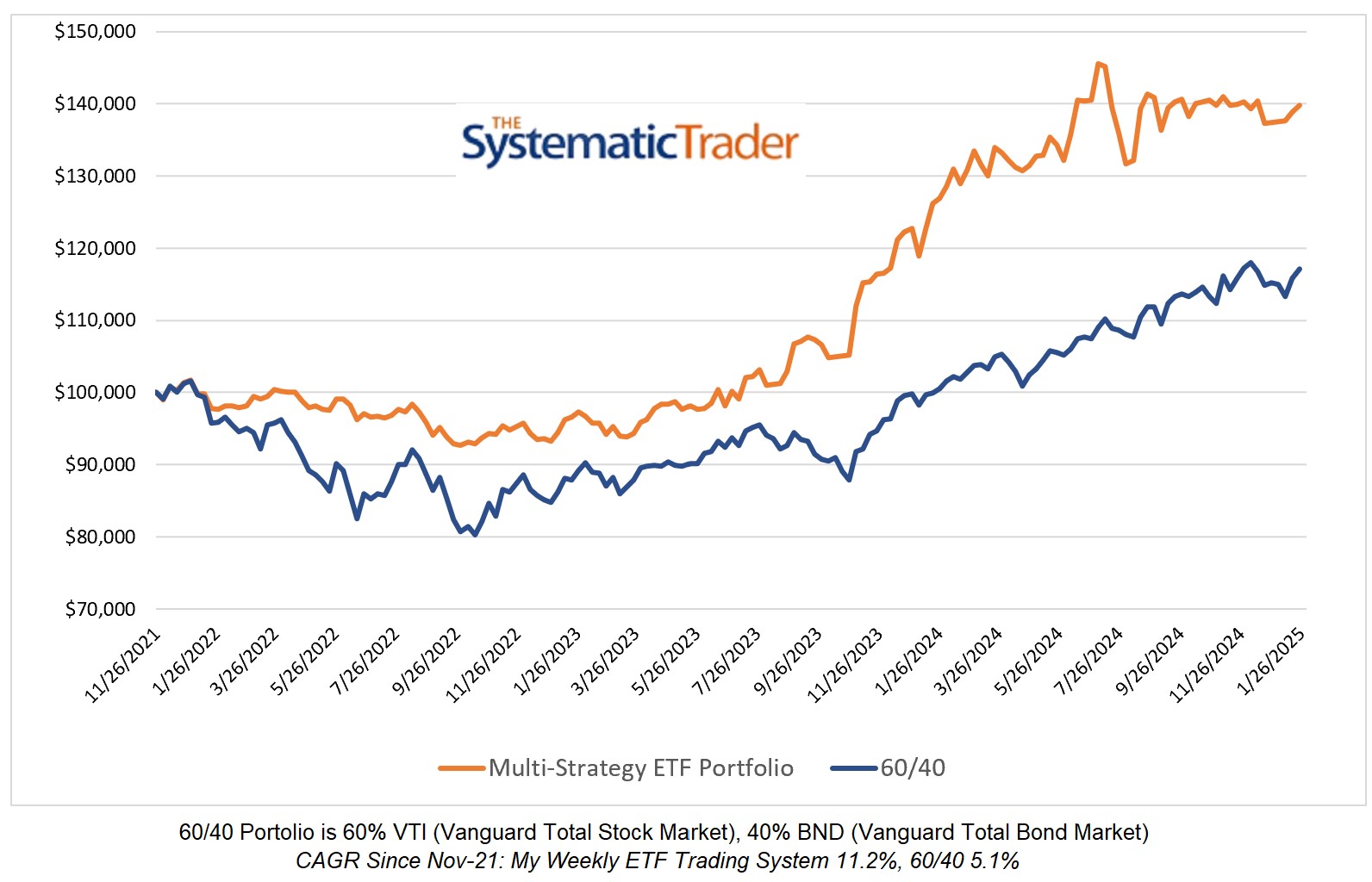

As expected, my model was flat this past week. The 60/40 model rose very modestly (0.30%). My model is as defensively positioned as it gets now with a 100% allocation to BIL (SPDR 1 - 3 Month Treasuries).