My Personal Weekly Dynamic Asset Allocations

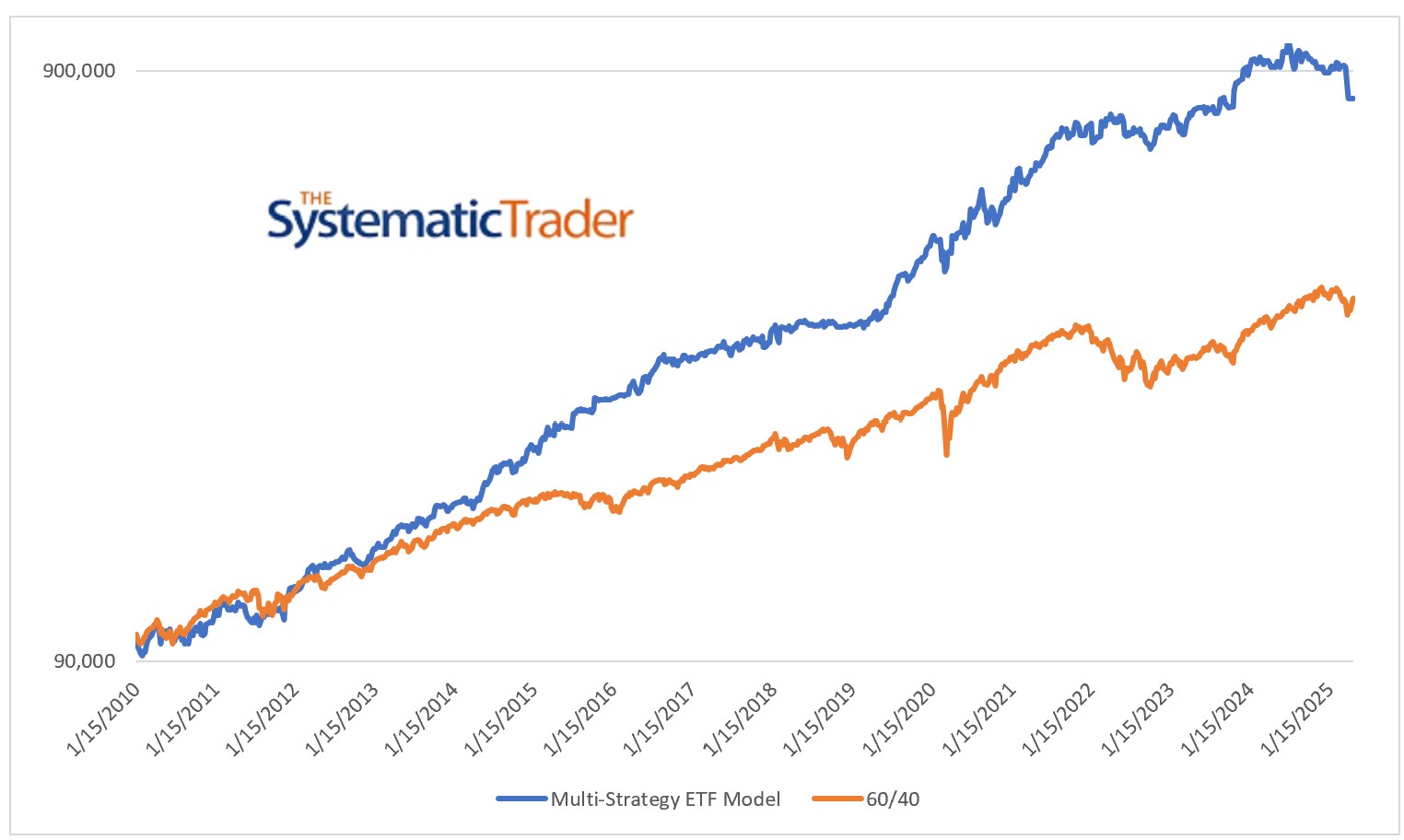

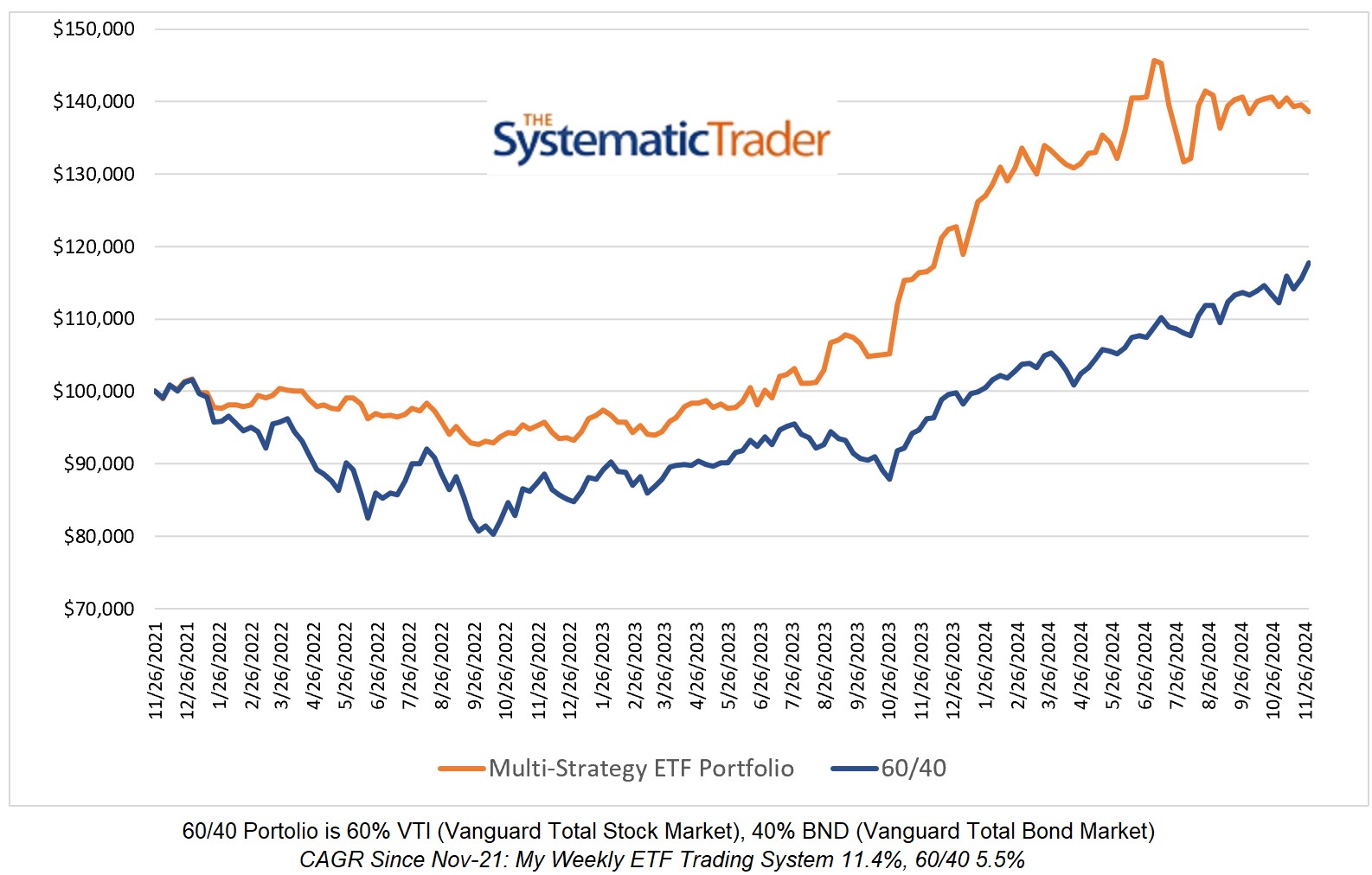

Suggestions for ETF Allocations to Outperform the 60/40 Portfolio

Latest Posts

Investing Update for the Week Ending April 26, 2024

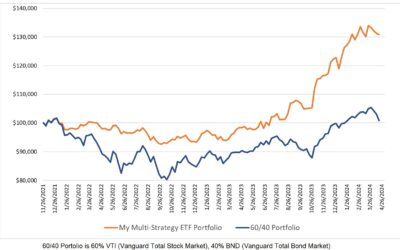

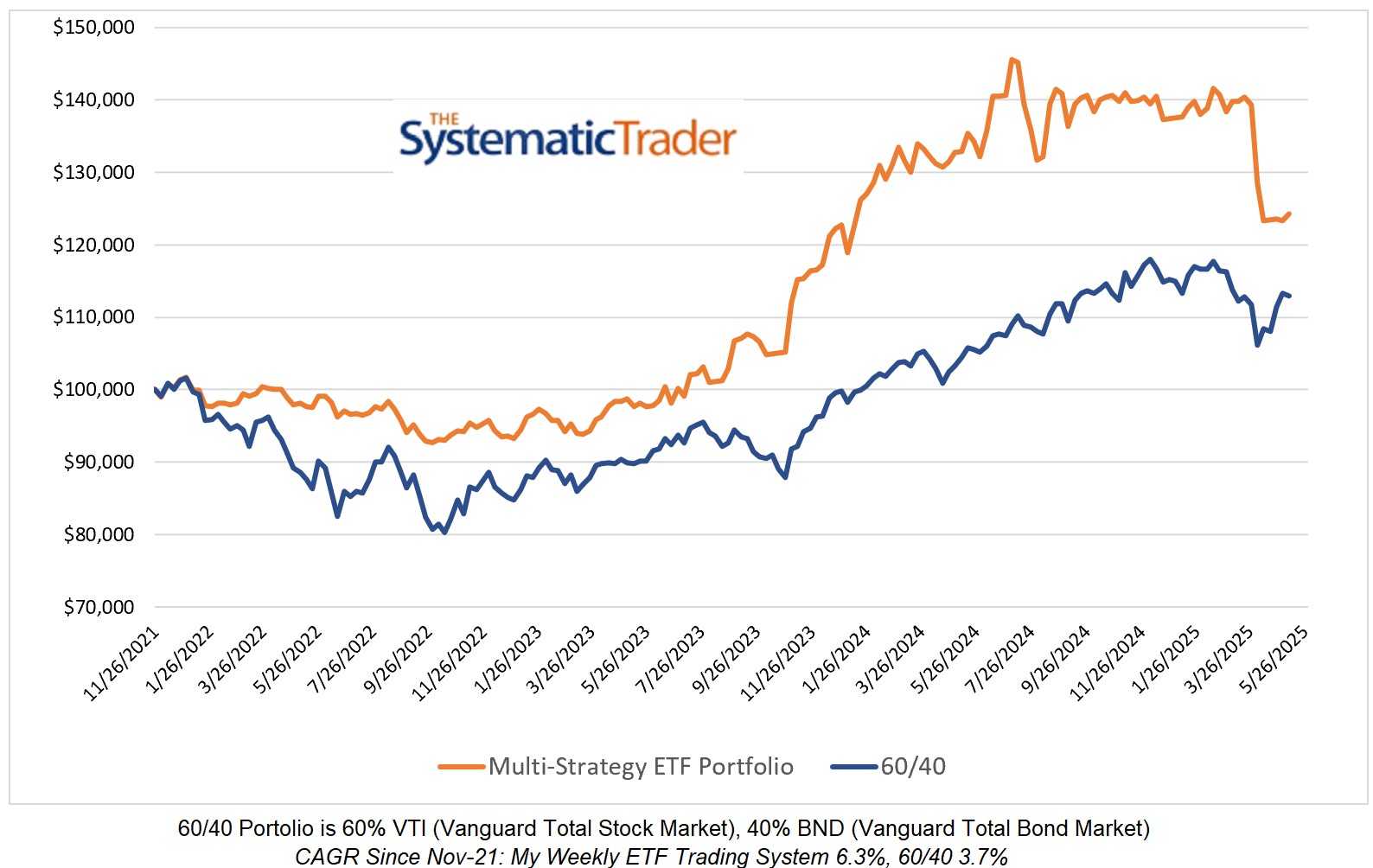

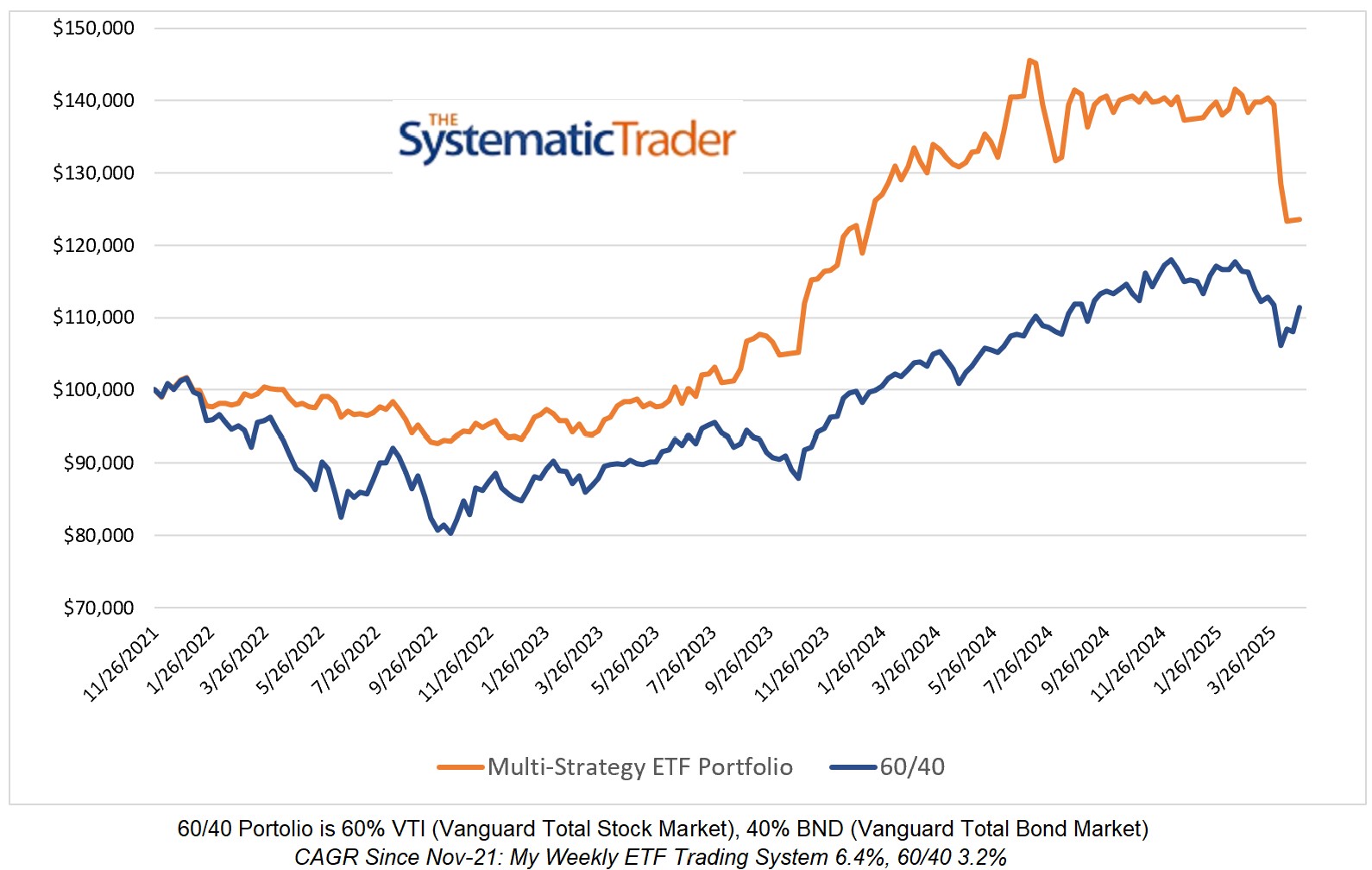

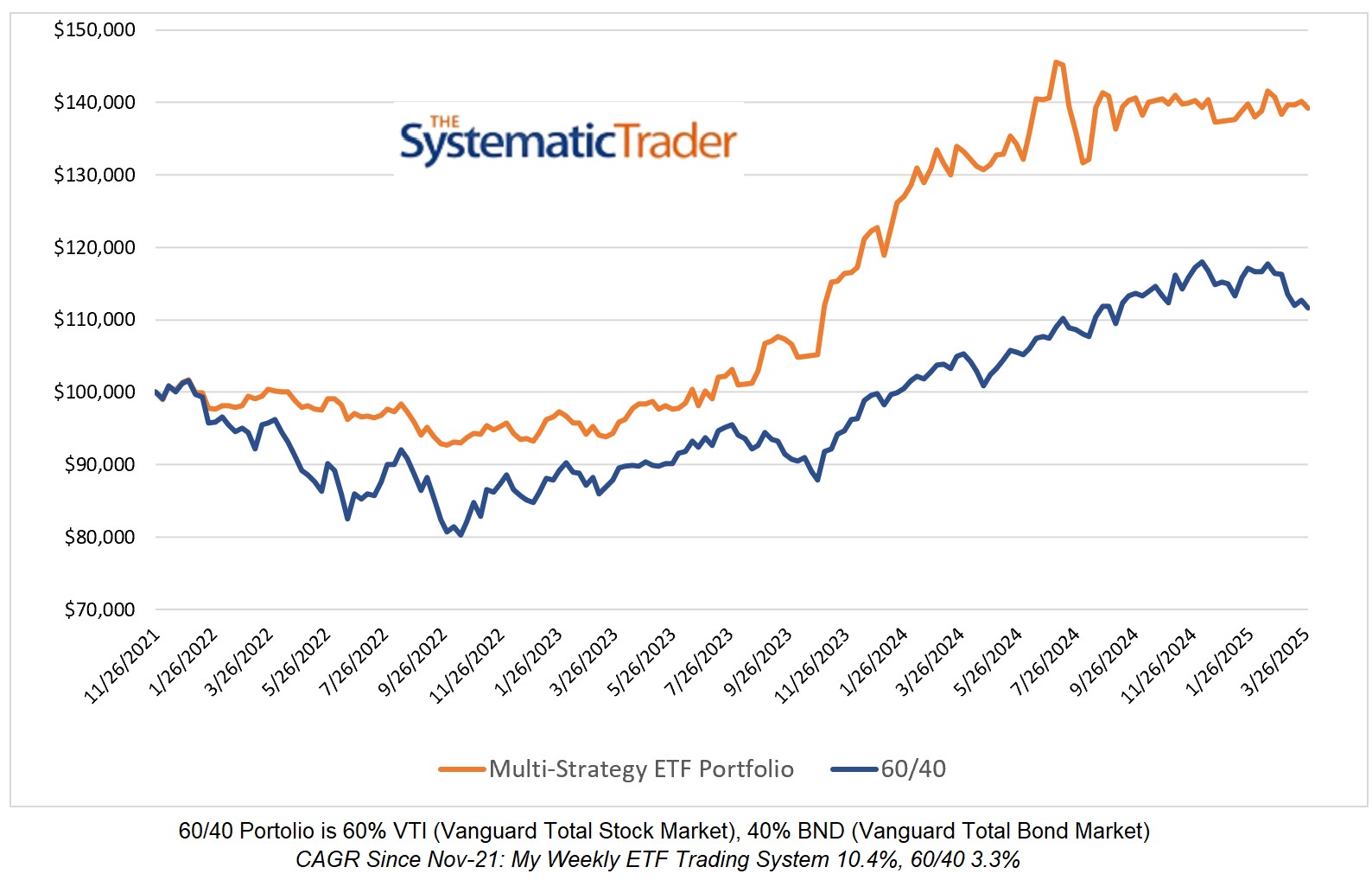

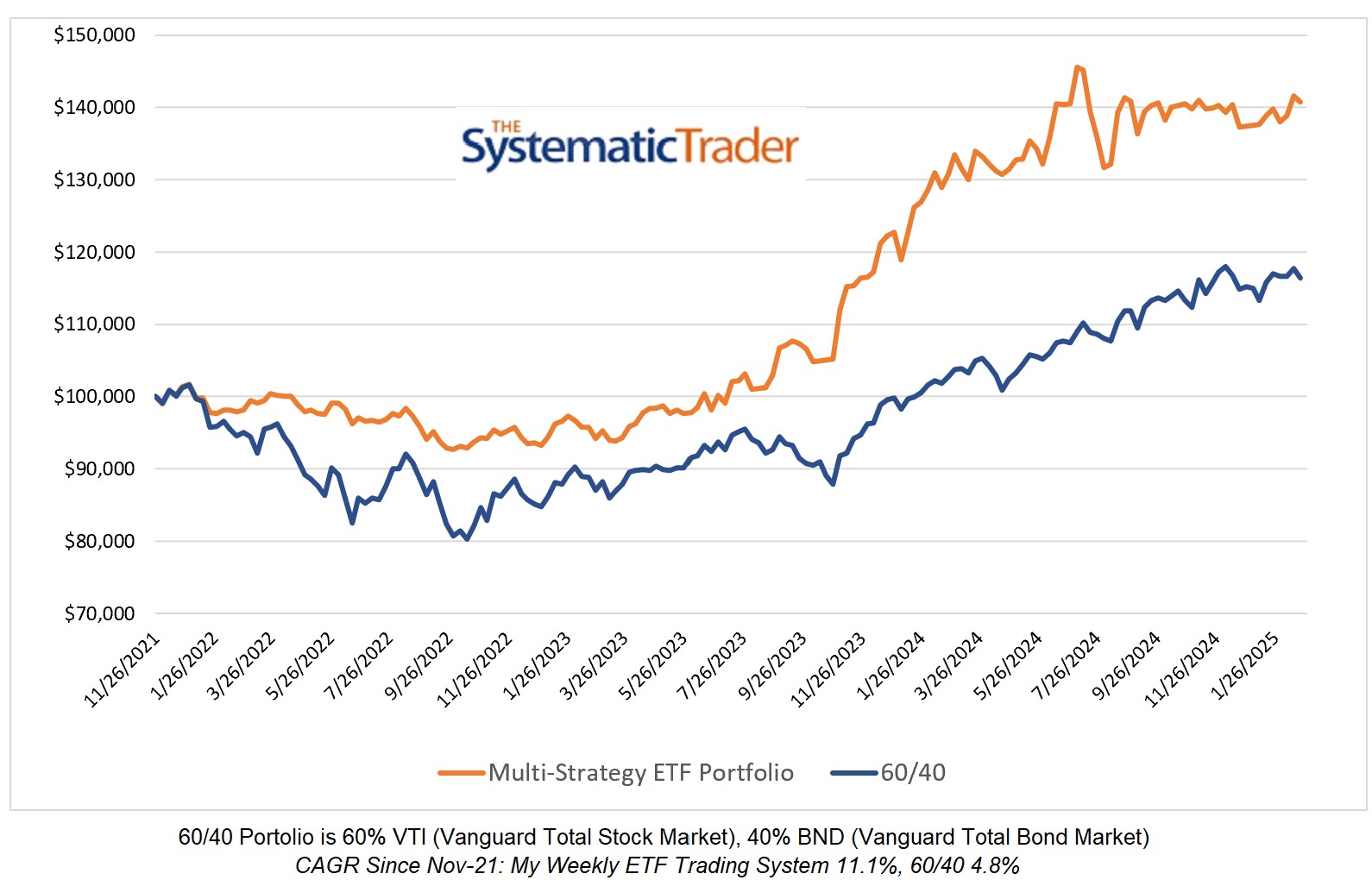

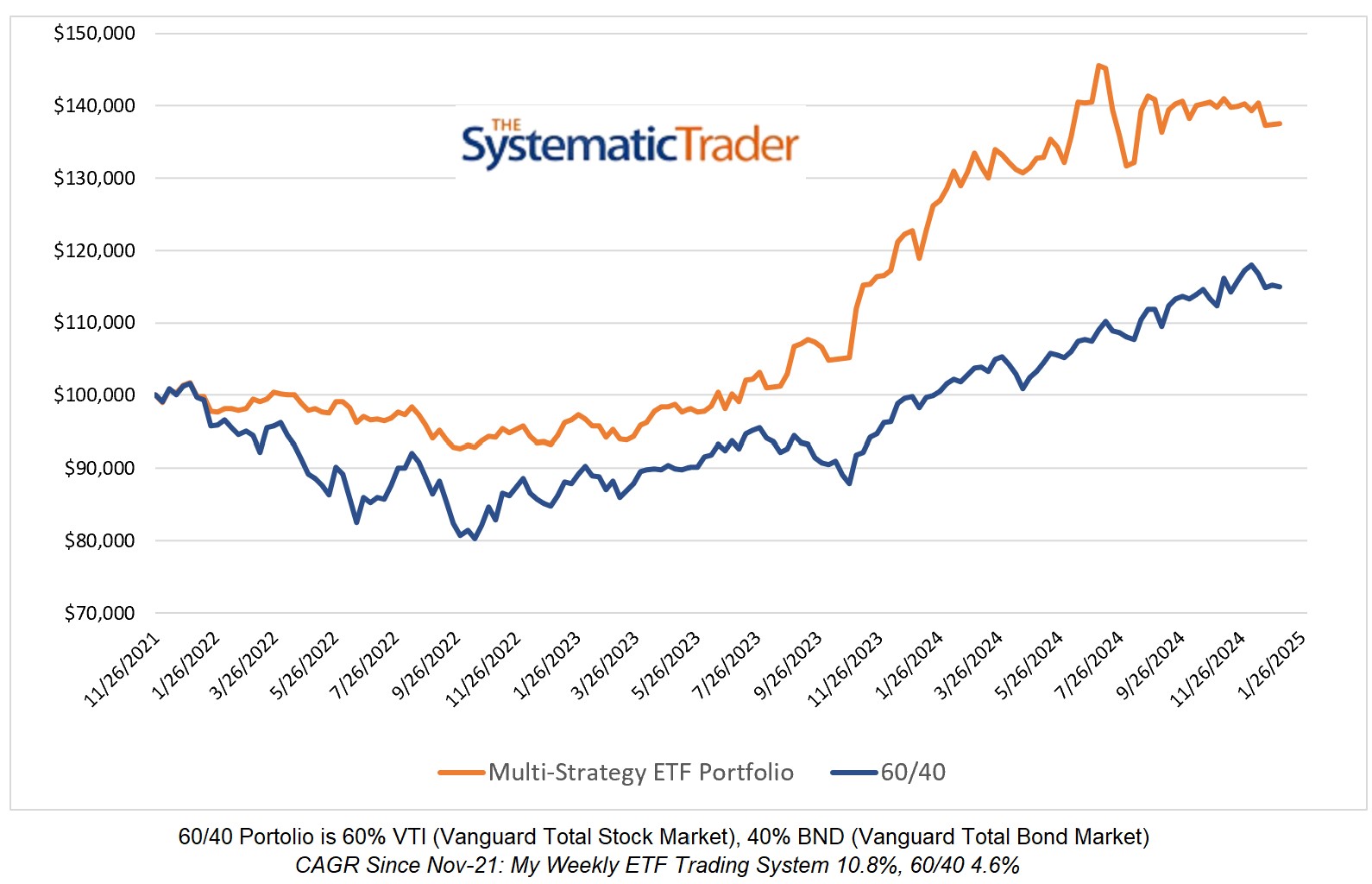

It was a positive week for both my global multi-strategy ETF model and the 60/40 with my model up by 0.50% and the 60/40 up by a healthy 1.57%. Since I began posting weekly ETF allocations in November 2021, my model has produced a CAGR that is 11.0% higher than the...

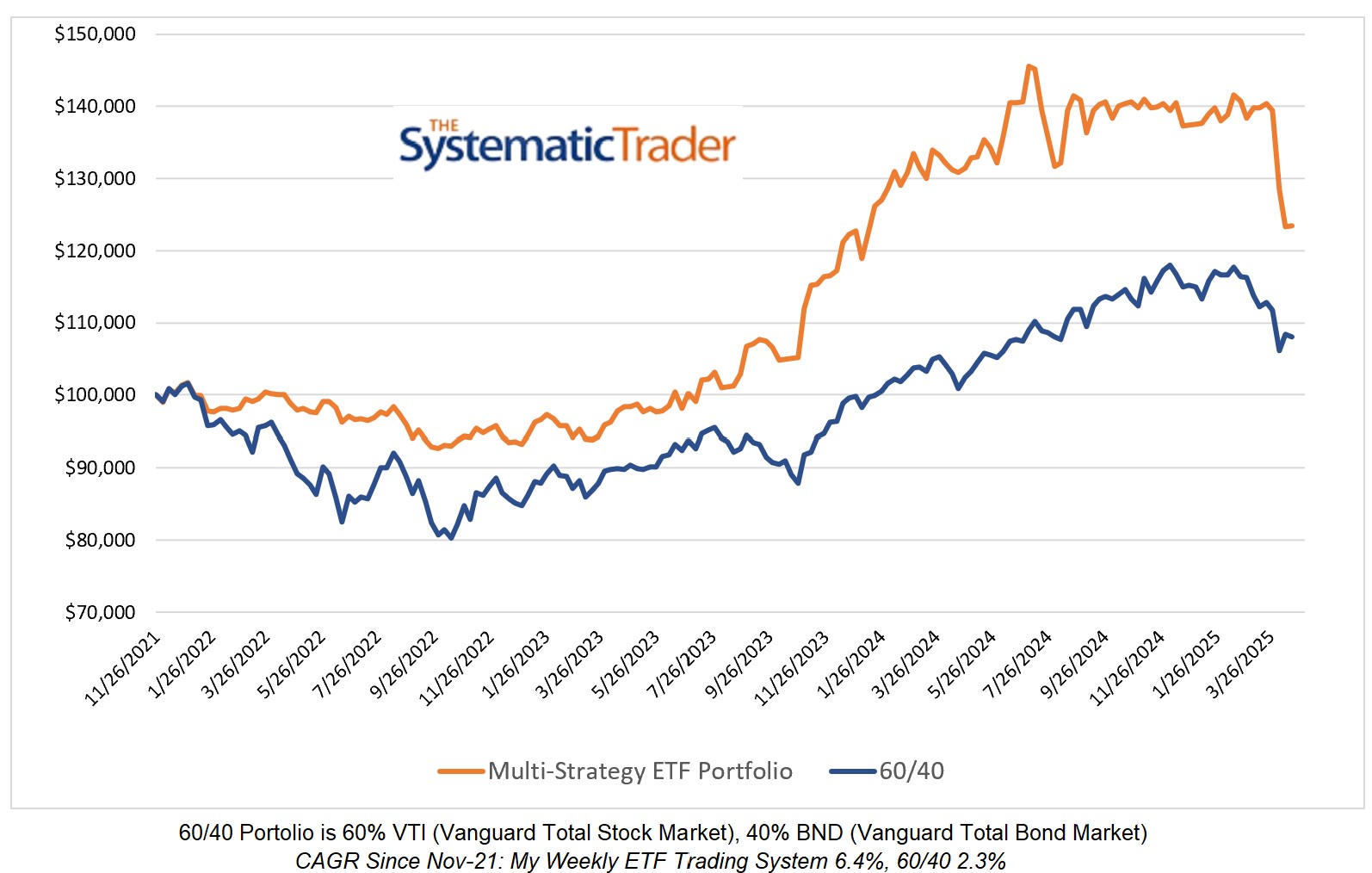

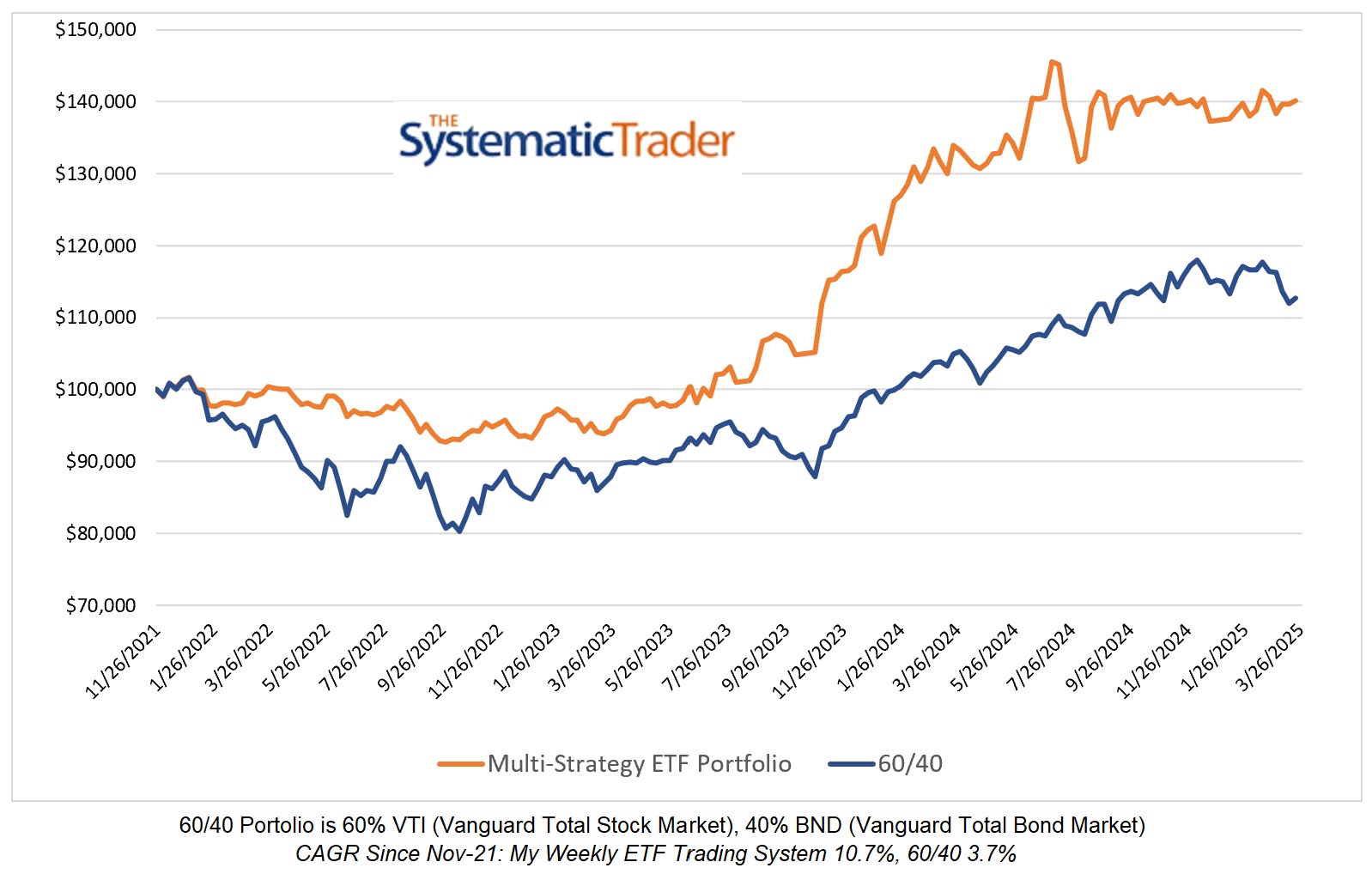

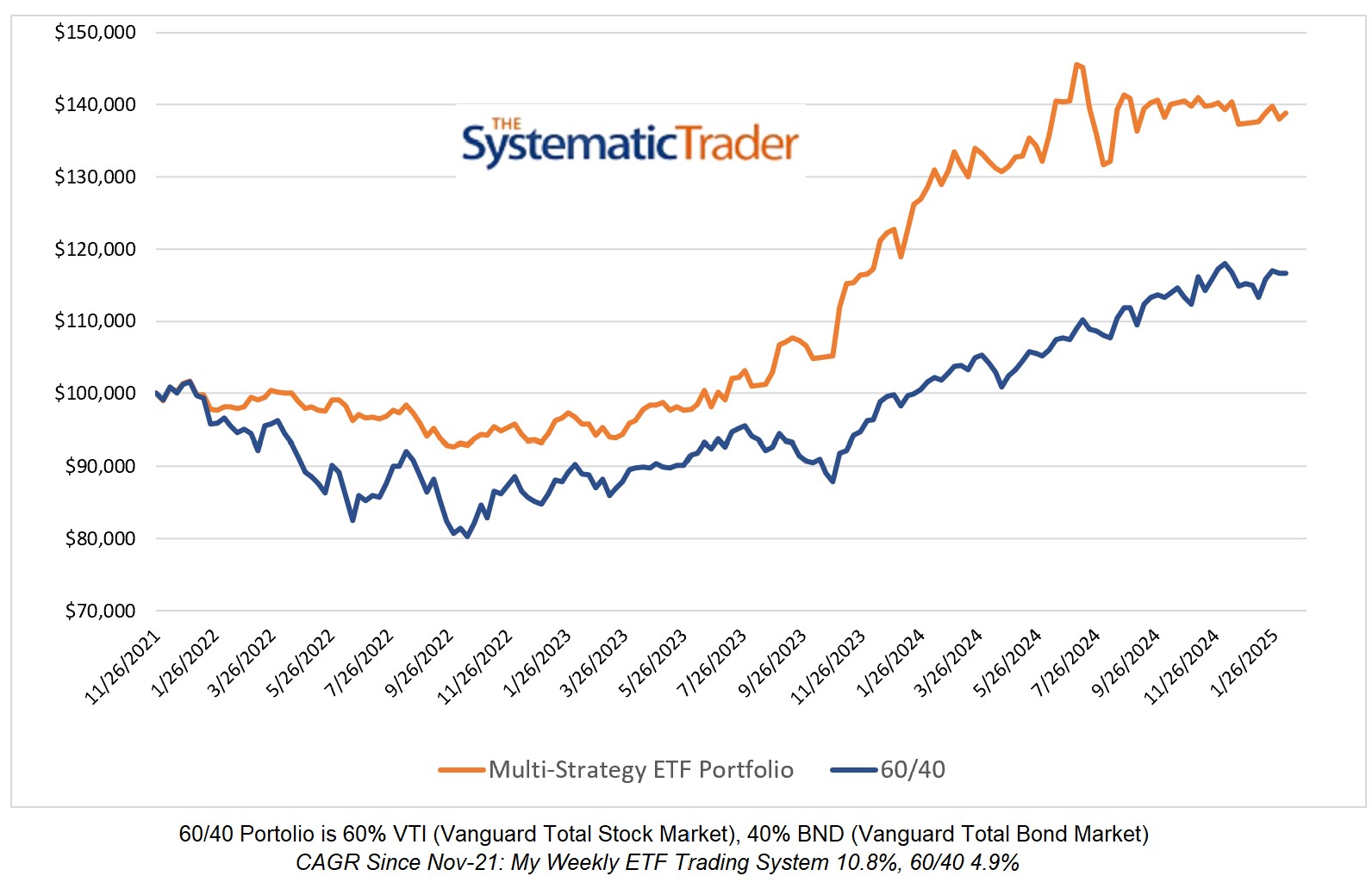

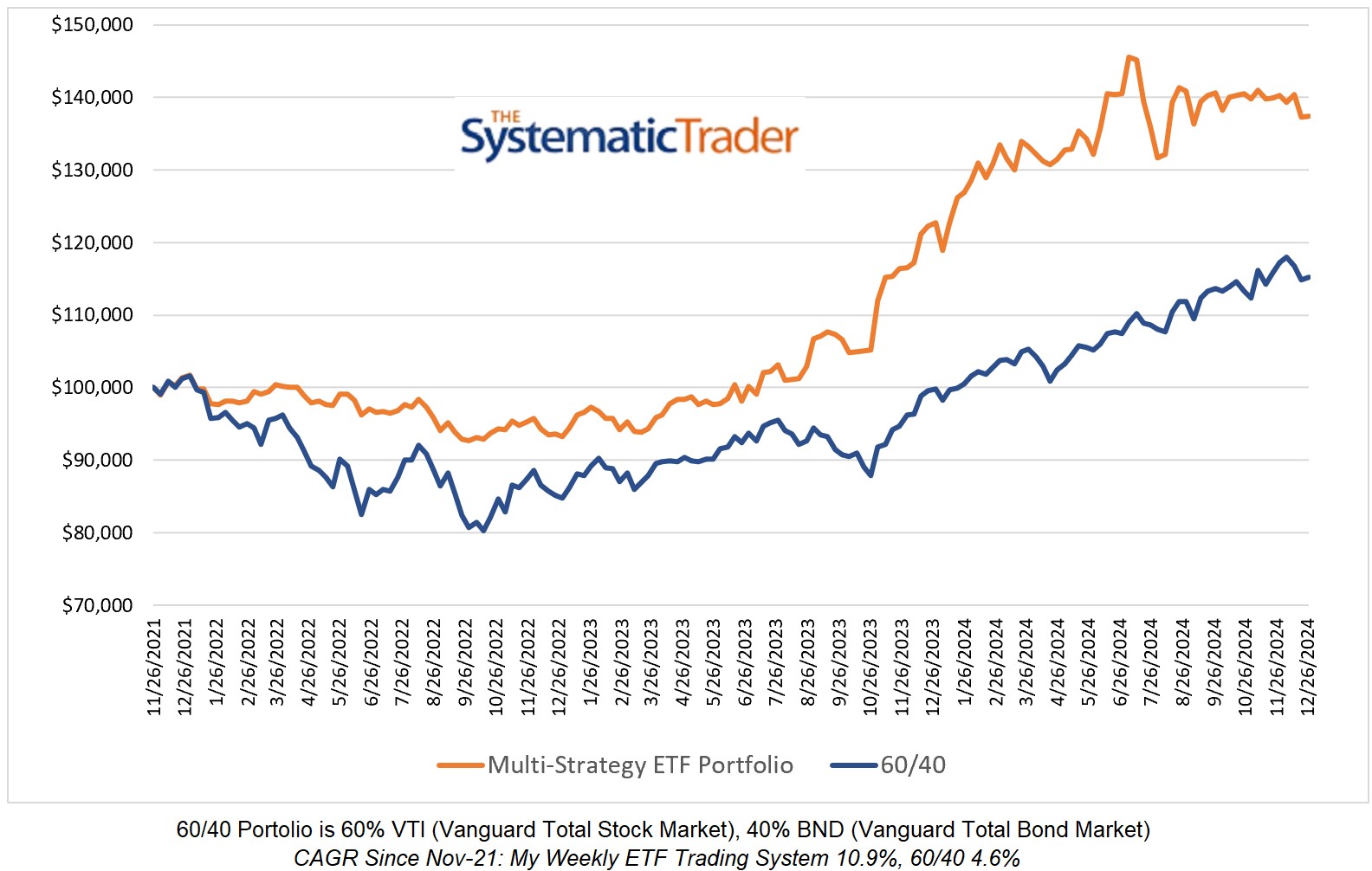

My global multi-strategy ETF model mostly side-stepped an ugly week in the markets as it lost 0.35% compared to a 2.07% loss for the 60/40 model. My model has new allocations as per the table below. This is the first time in months that my model did not have an...

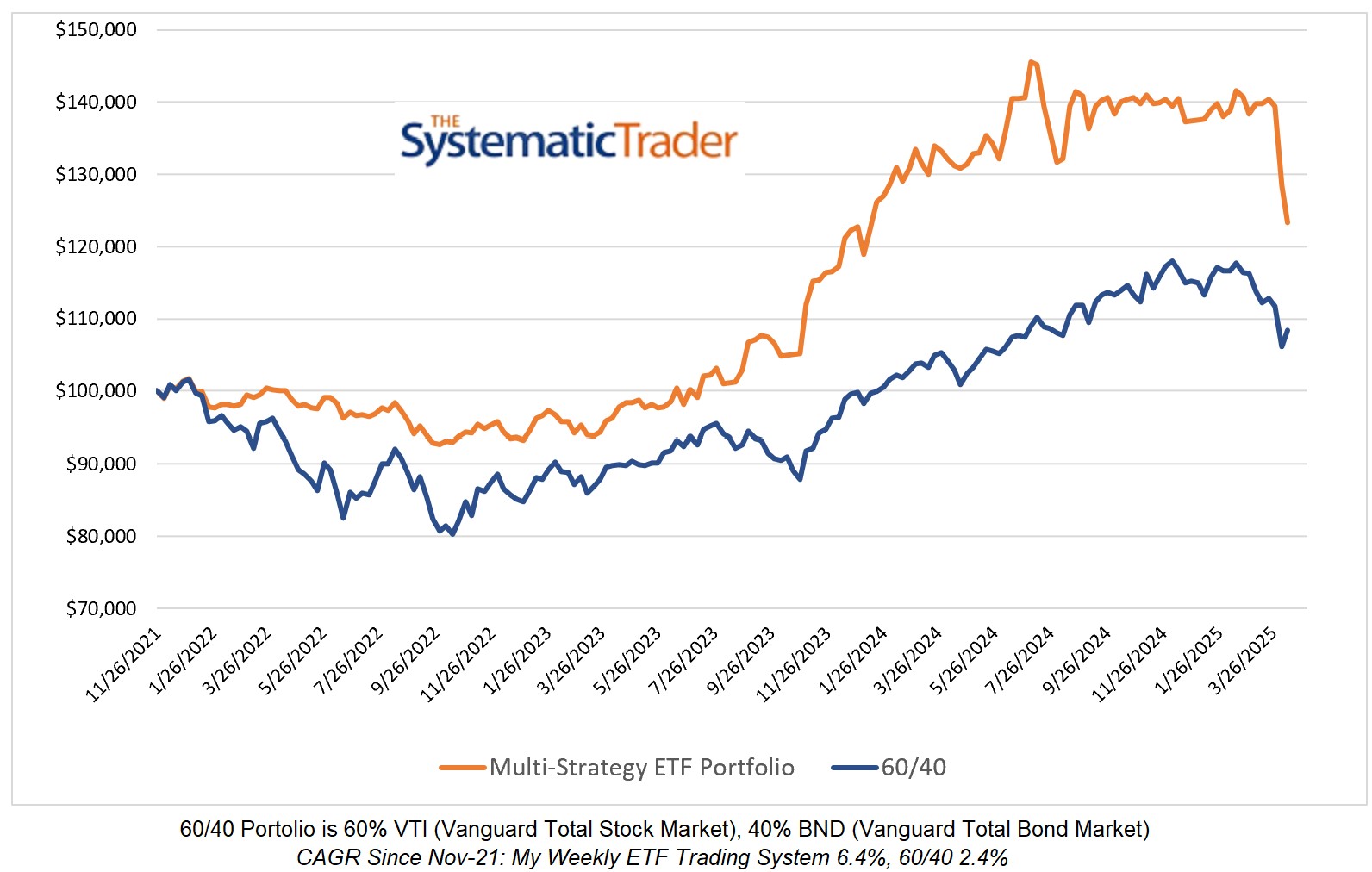

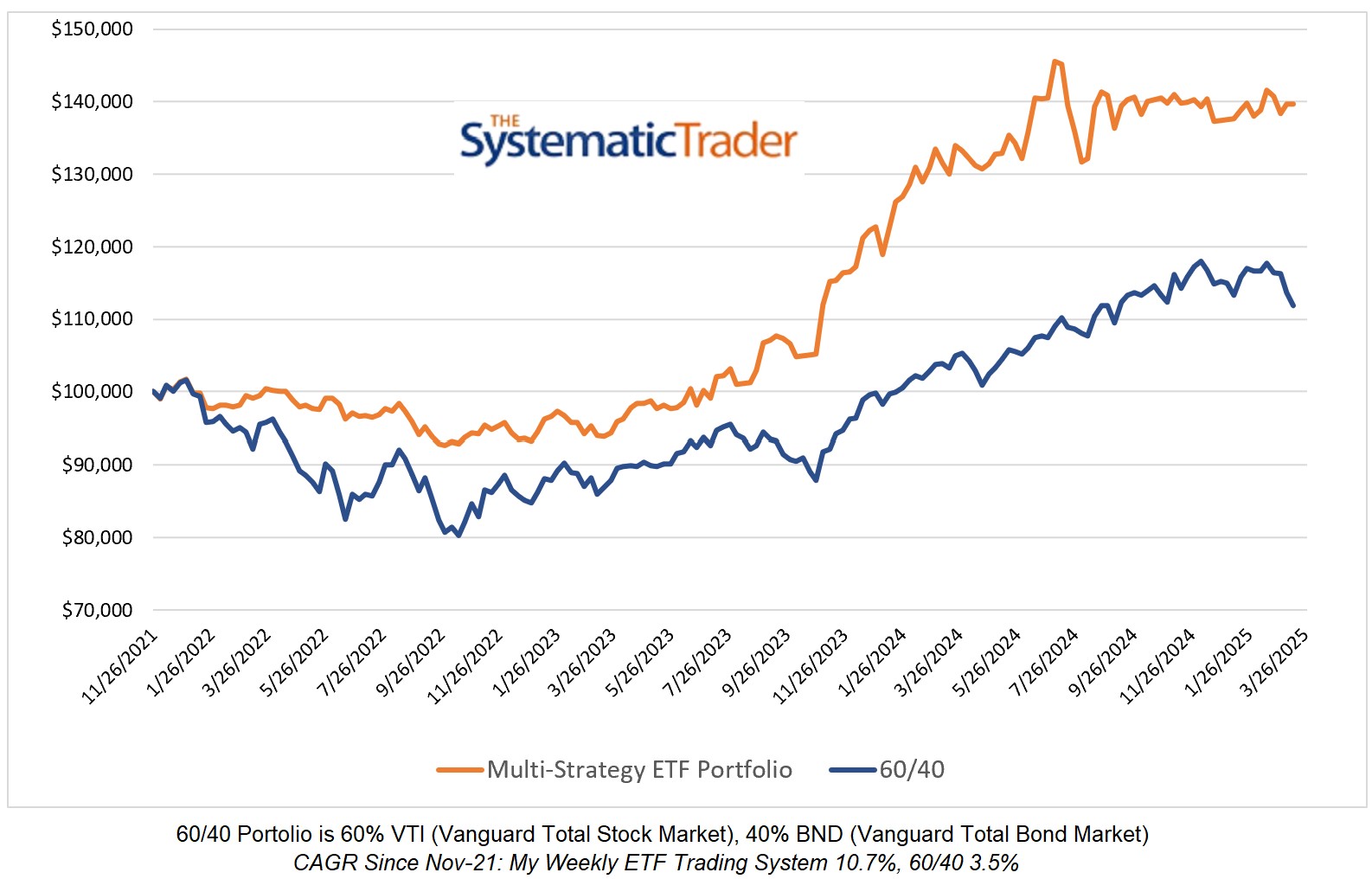

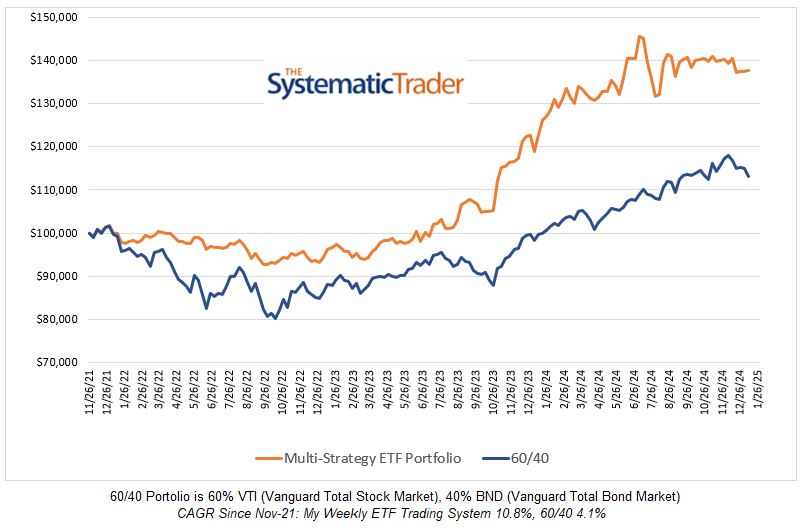

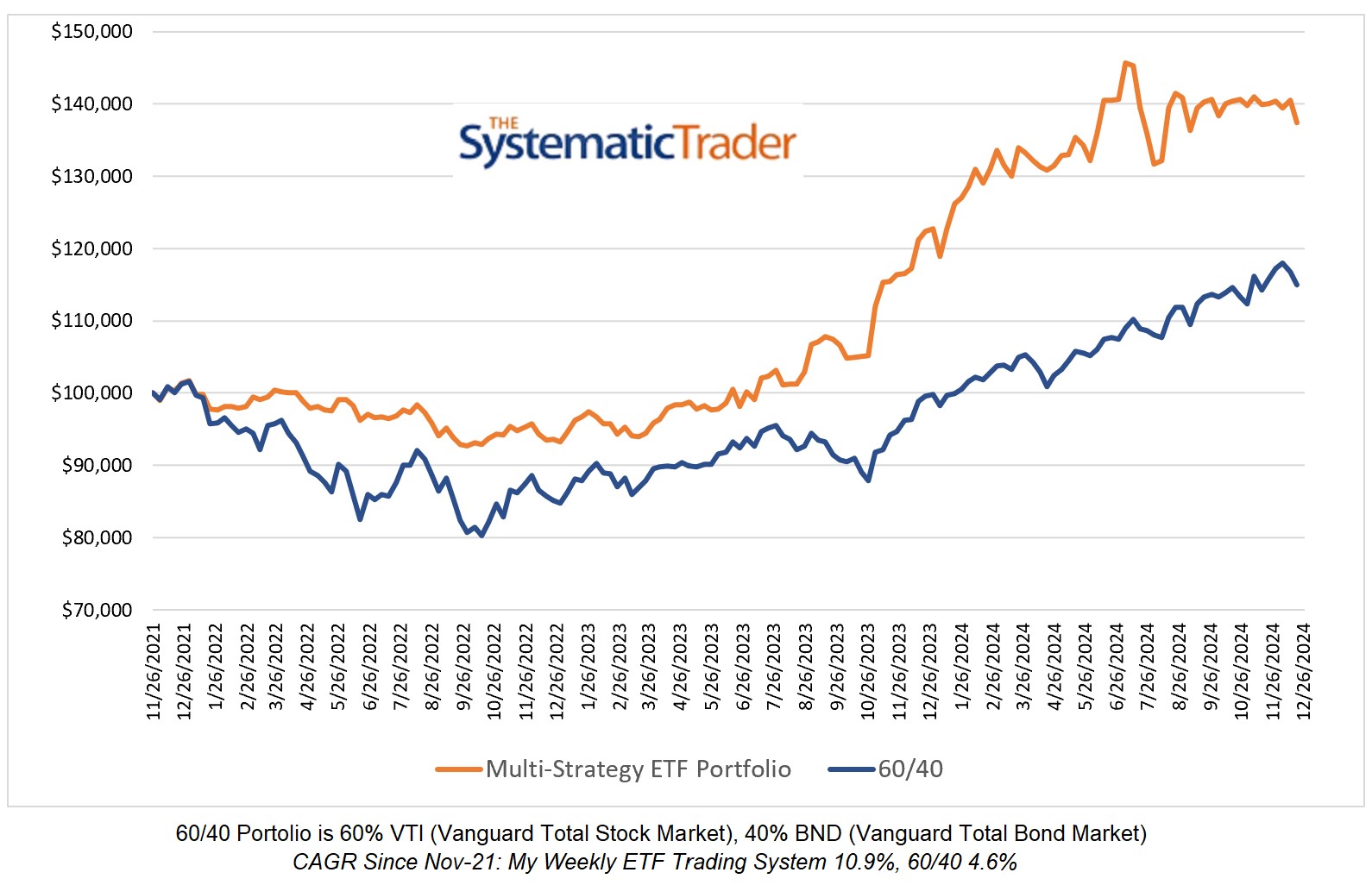

Investing Update for the Week Ending April 12, 2024

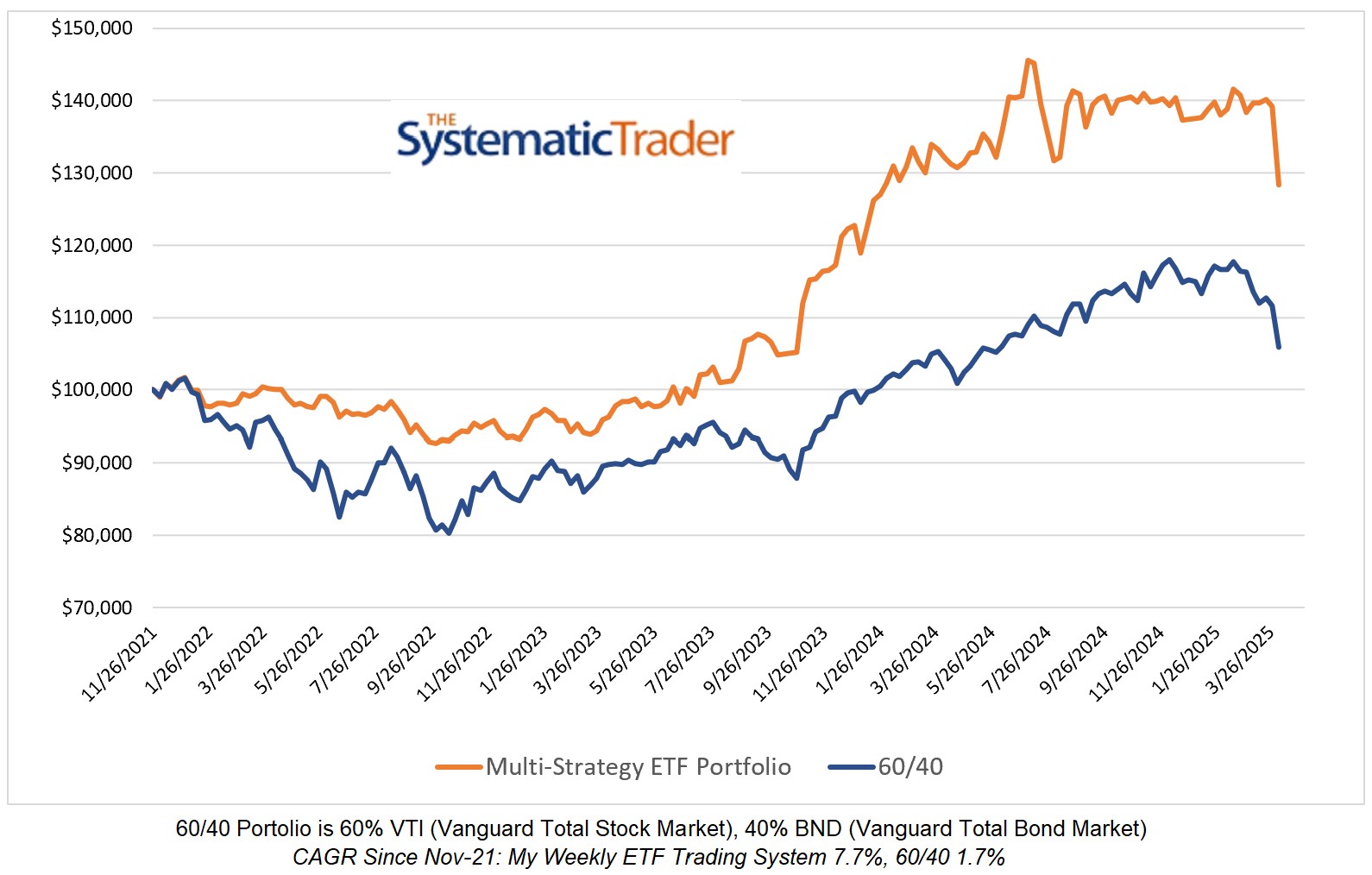

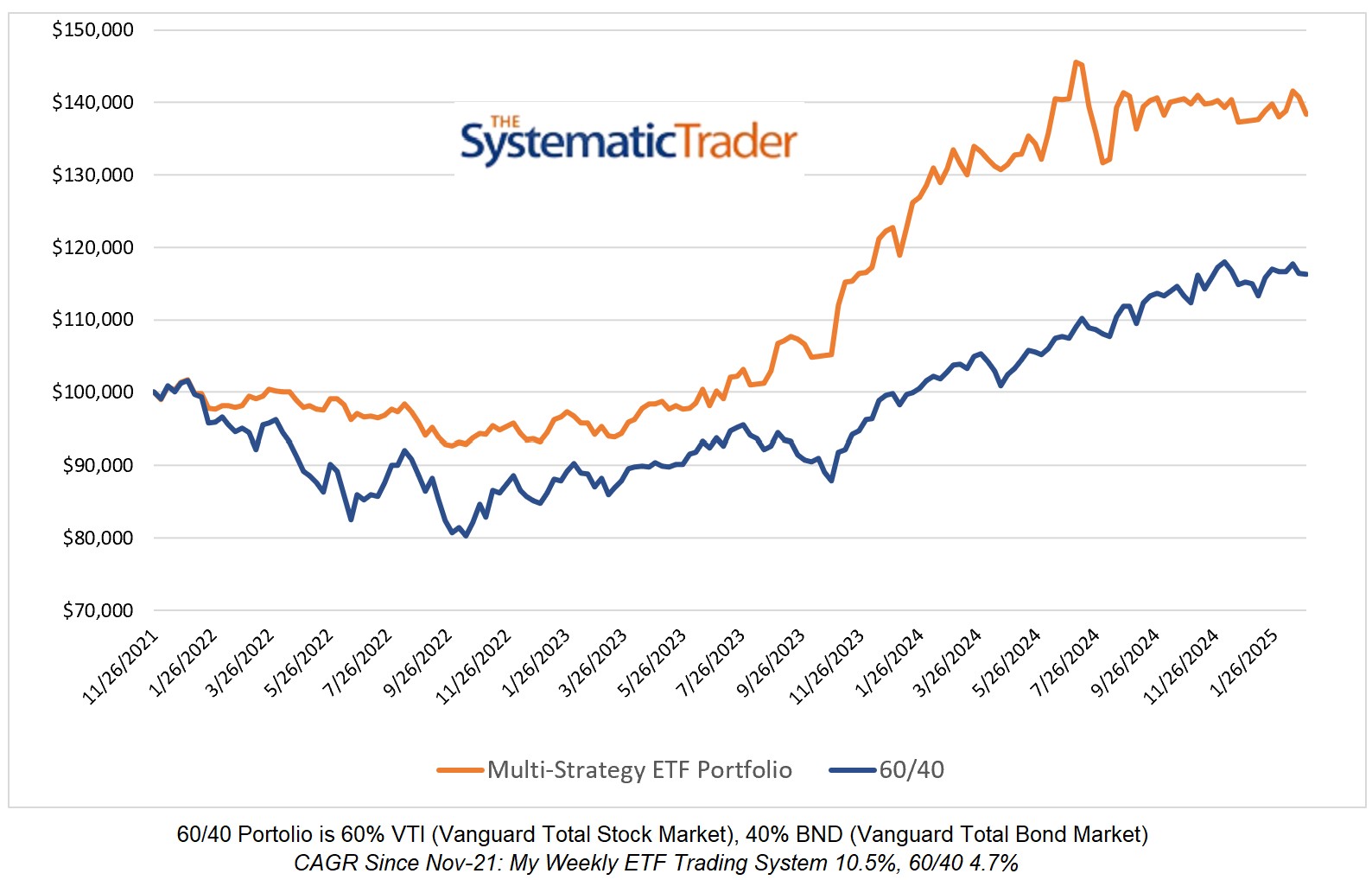

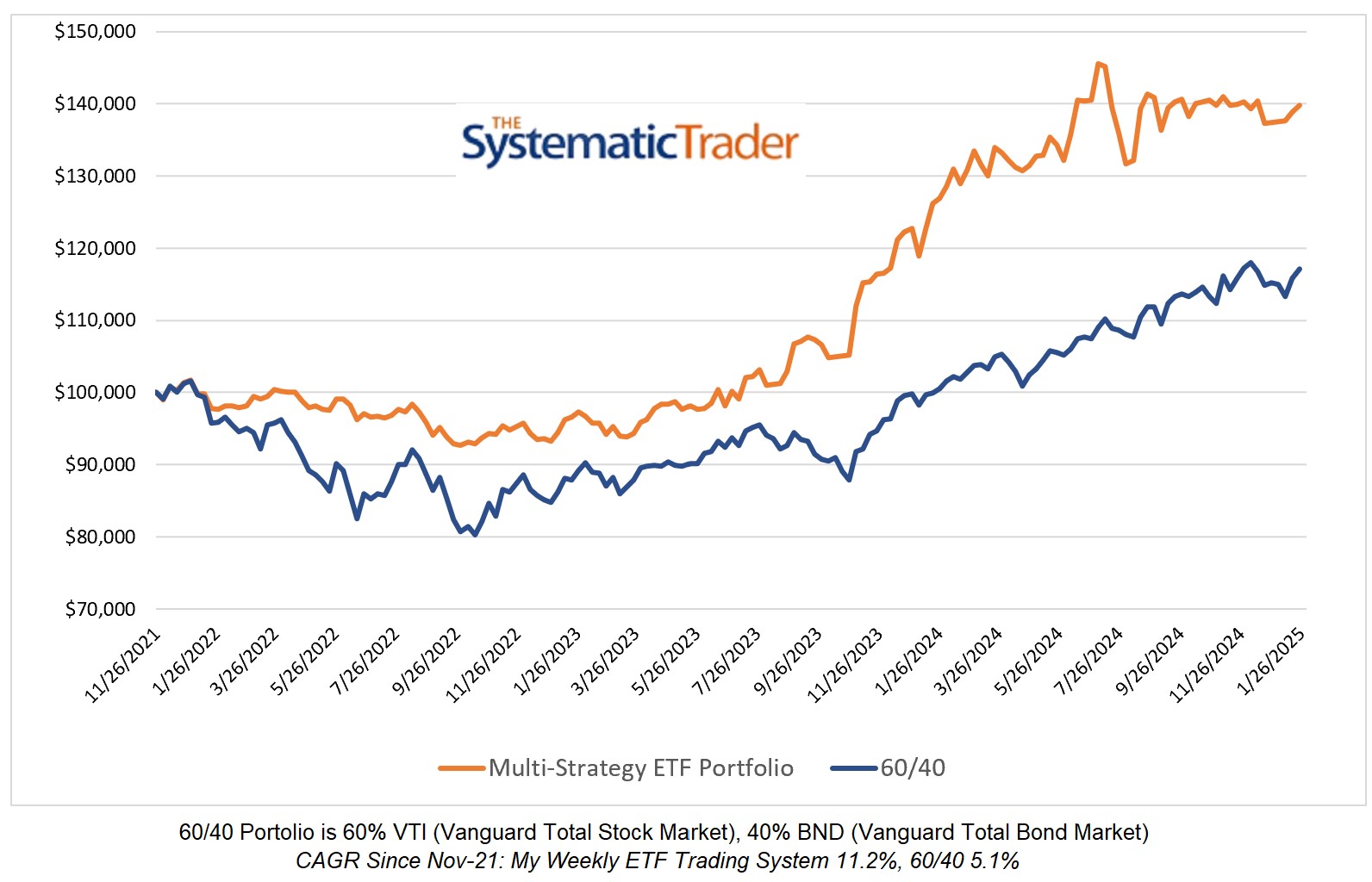

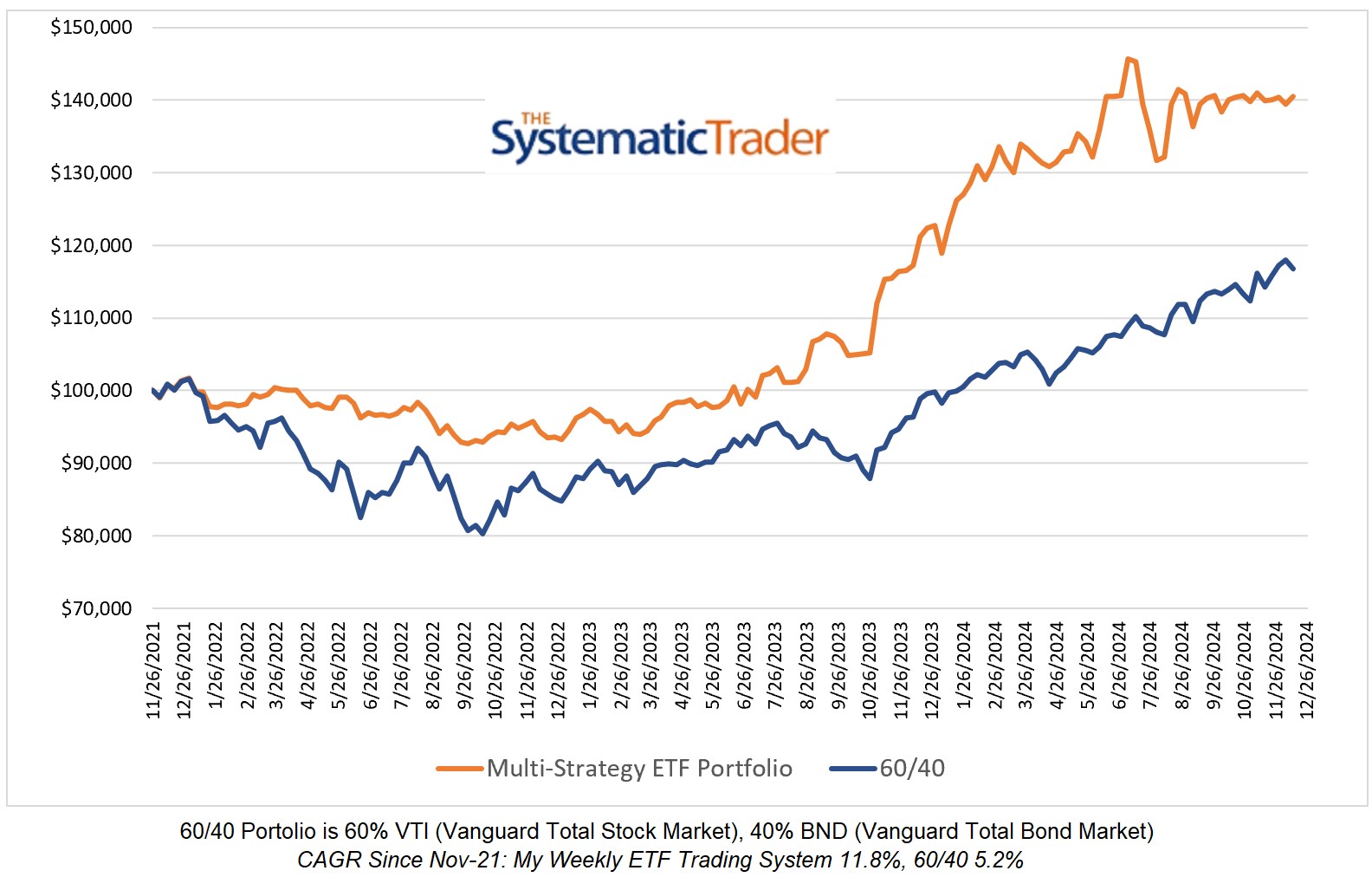

This past week was one in which it was hard to hide from falling prices. Both my Global Multi-Strategy ETF model and the 60/40 fell in price. My model has changed allocations to 66.7% BIL (SPDR 1 - 3 Month Treasuries) and 33.3% PDBC (Optimum Yield Diversified...