My Personal Weekly Dynamic Asset Allocations

Suggestions for ETF Allocations to Outperform the 60/40 Portfolio

Latest Posts

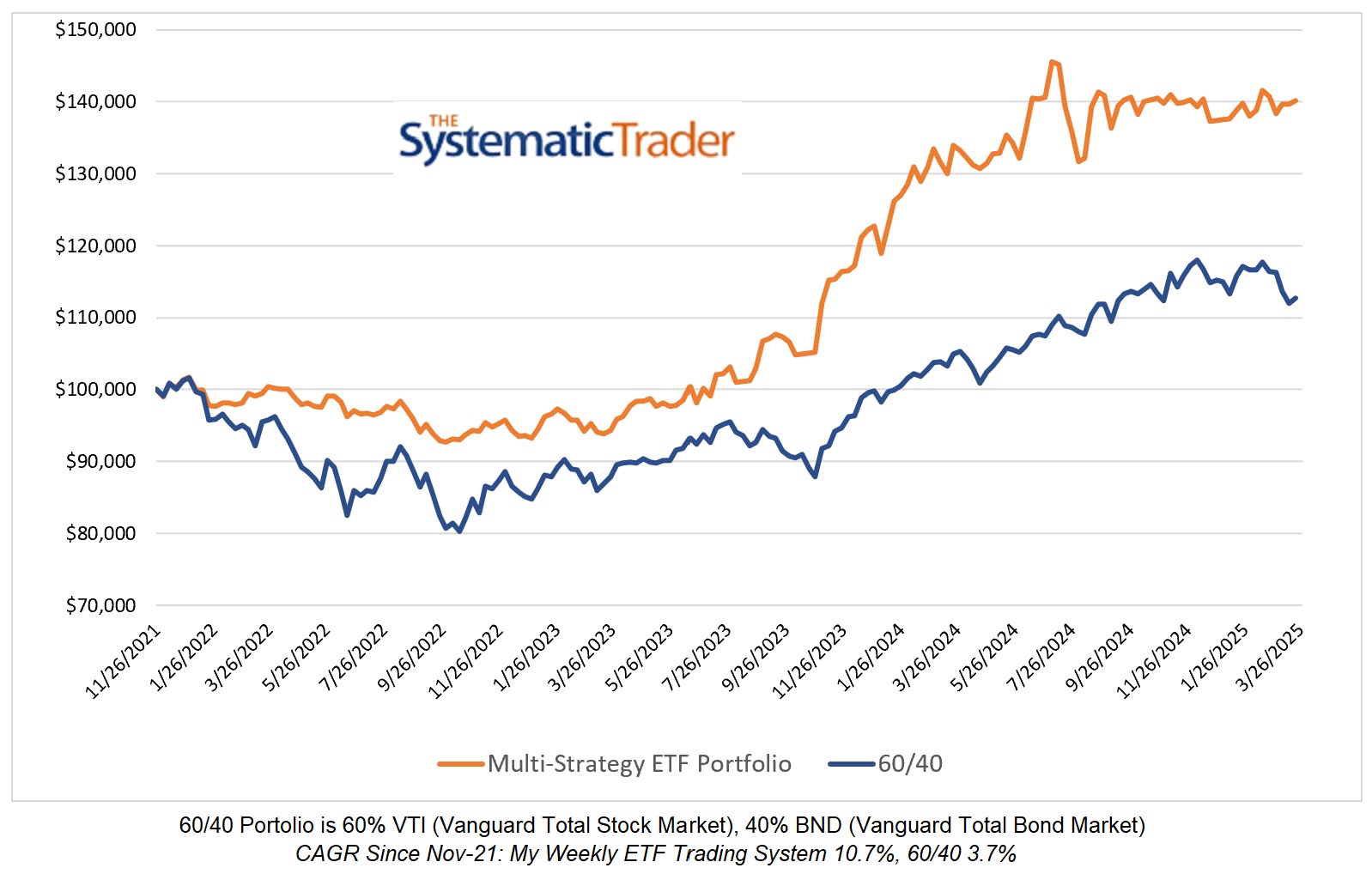

Investing Update for the Week Ending April 05, 2024

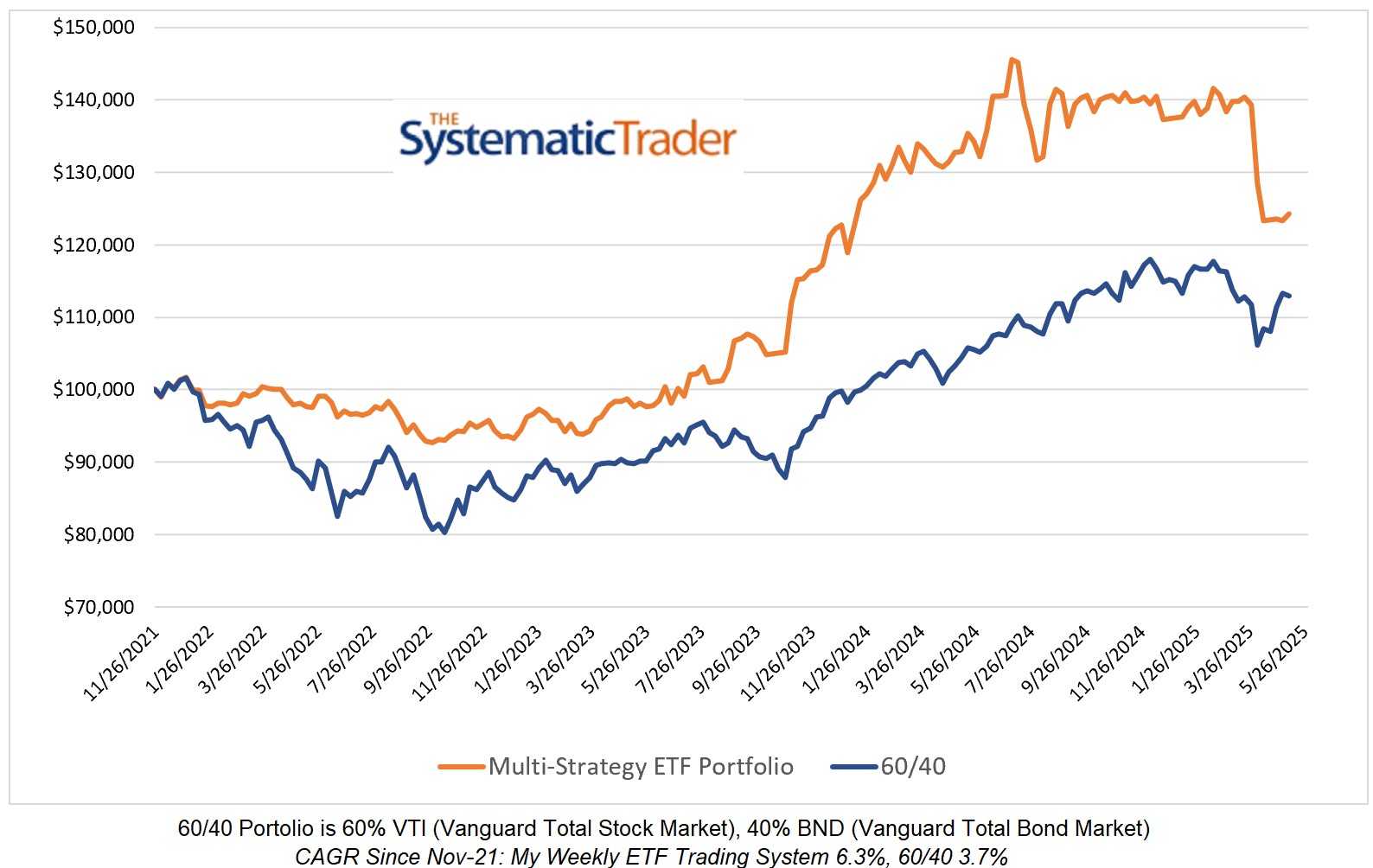

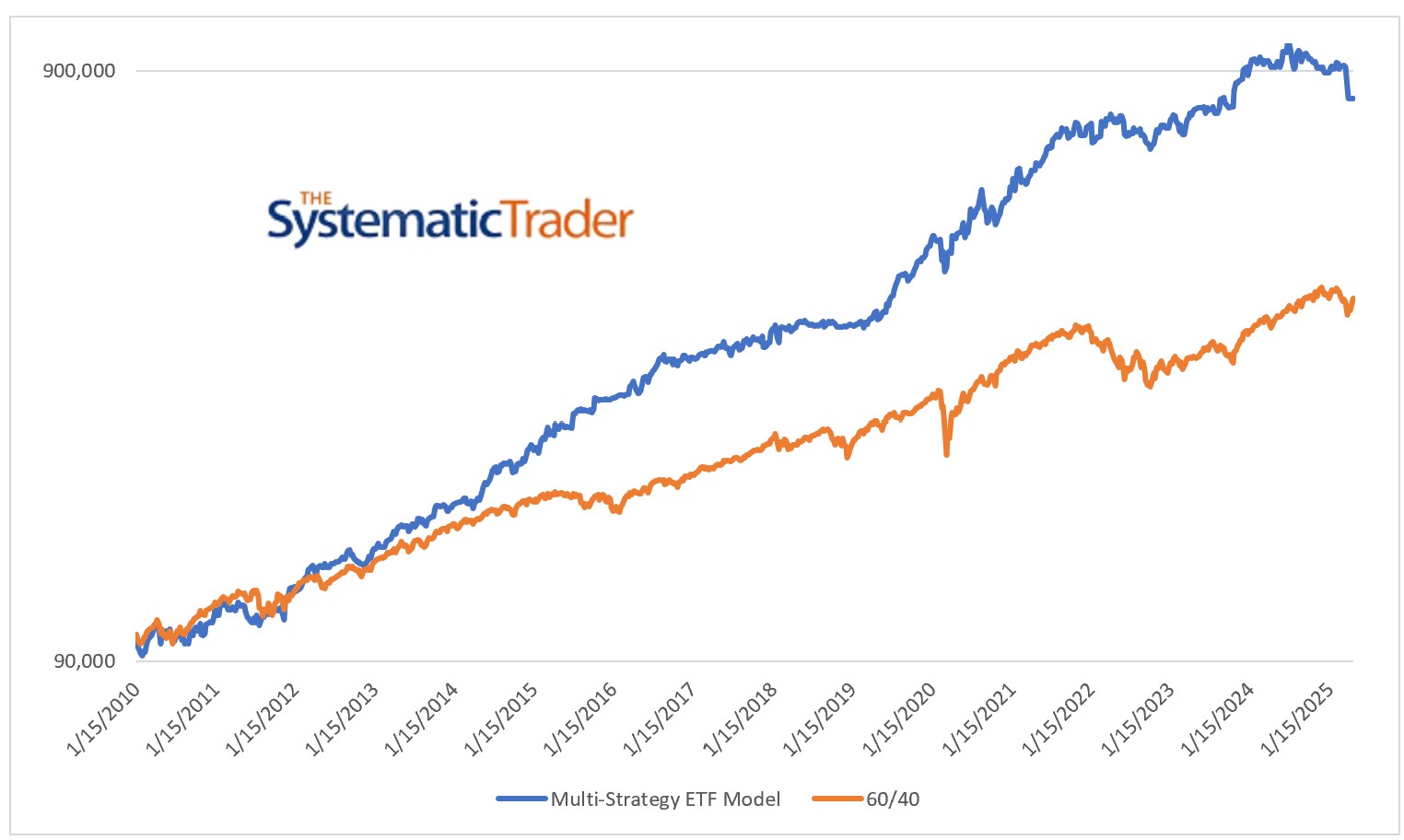

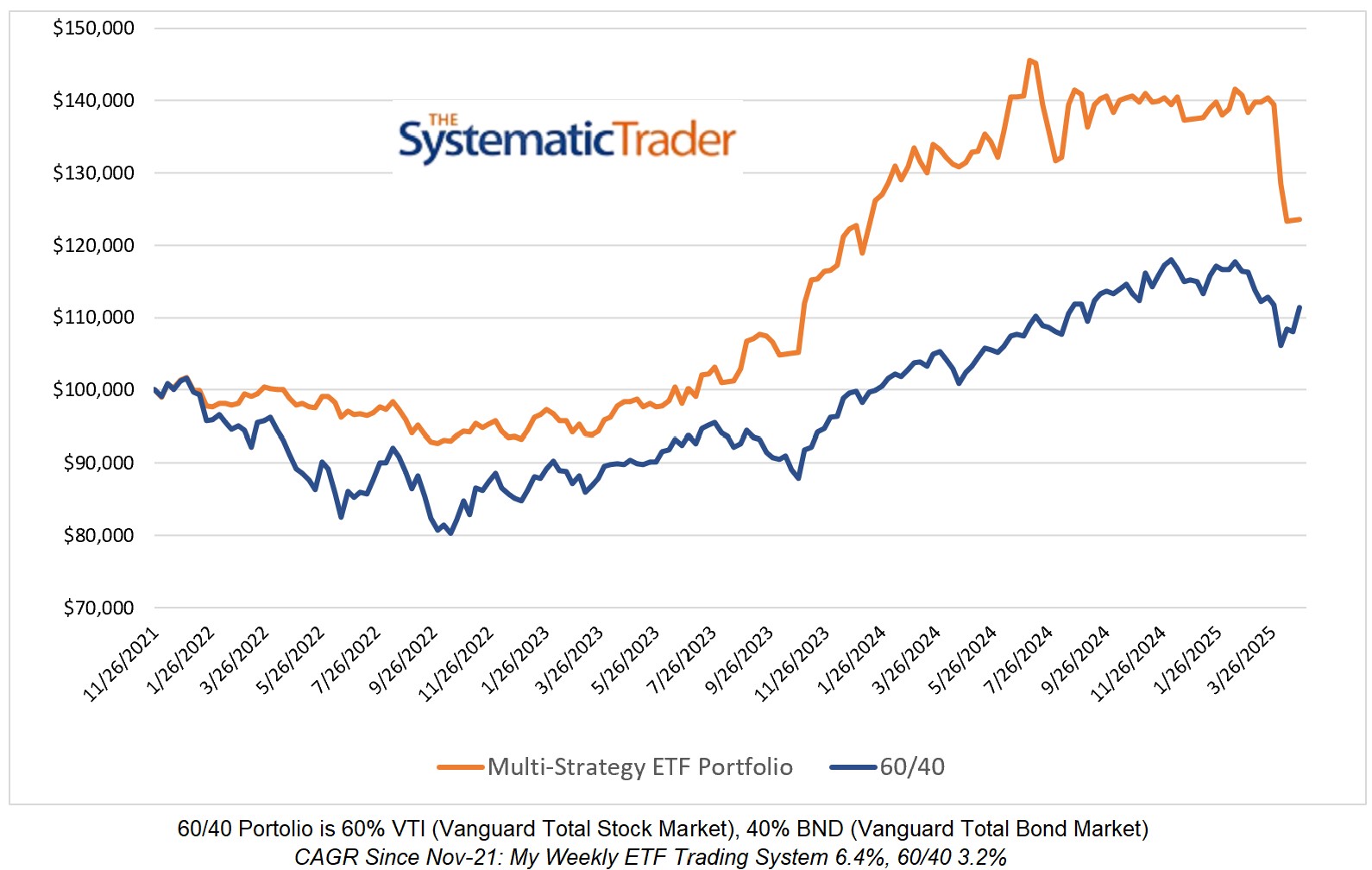

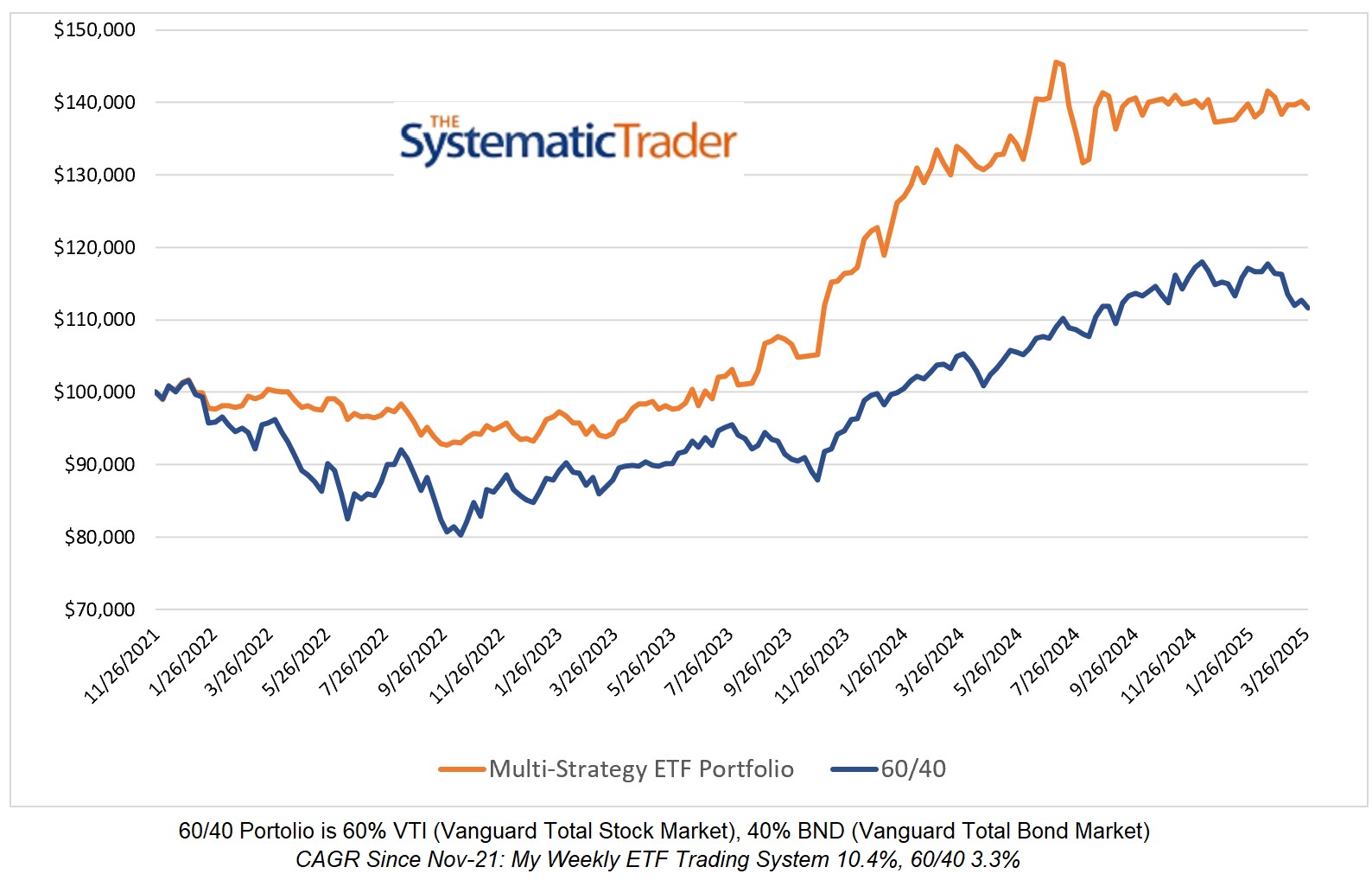

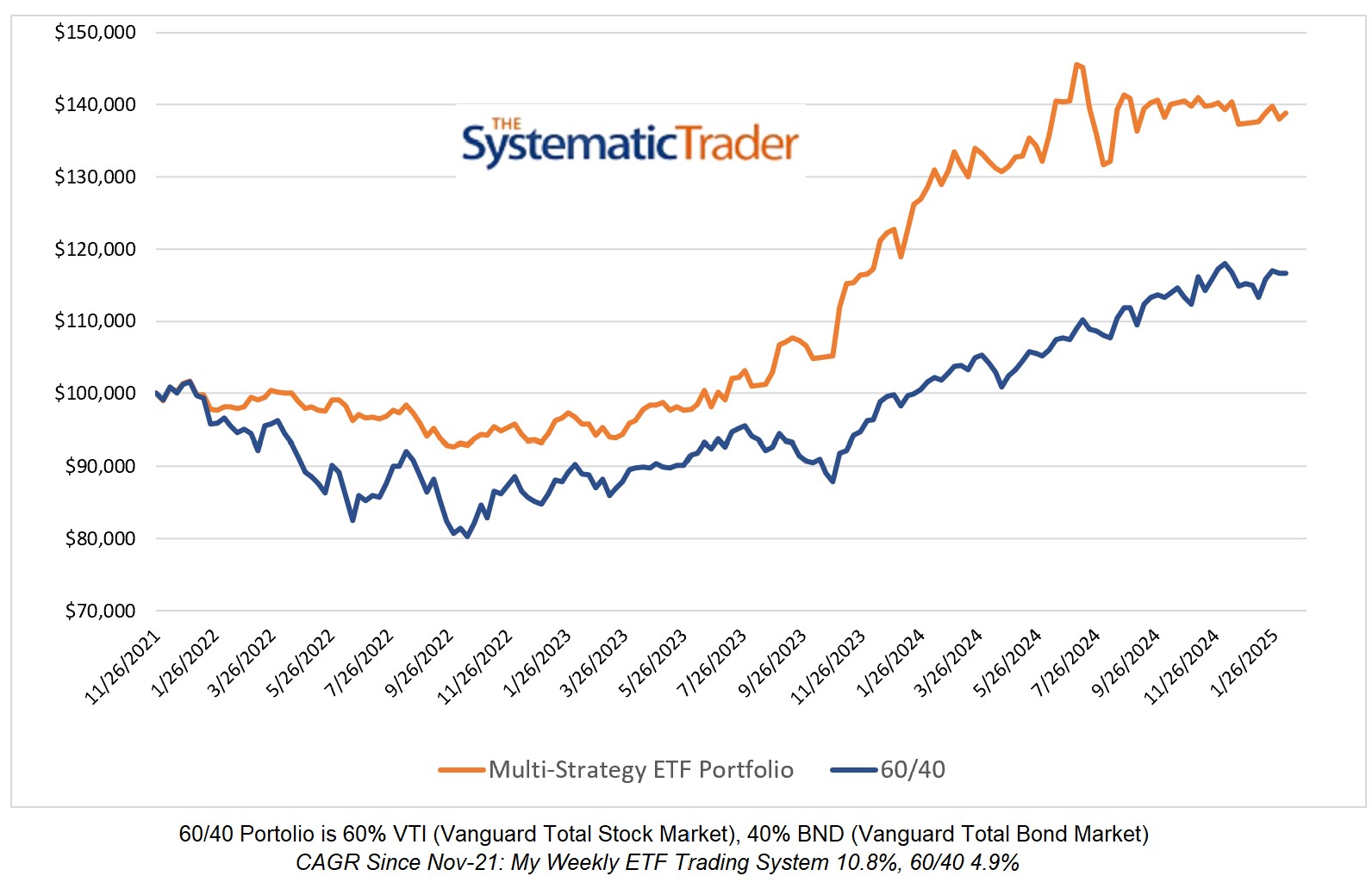

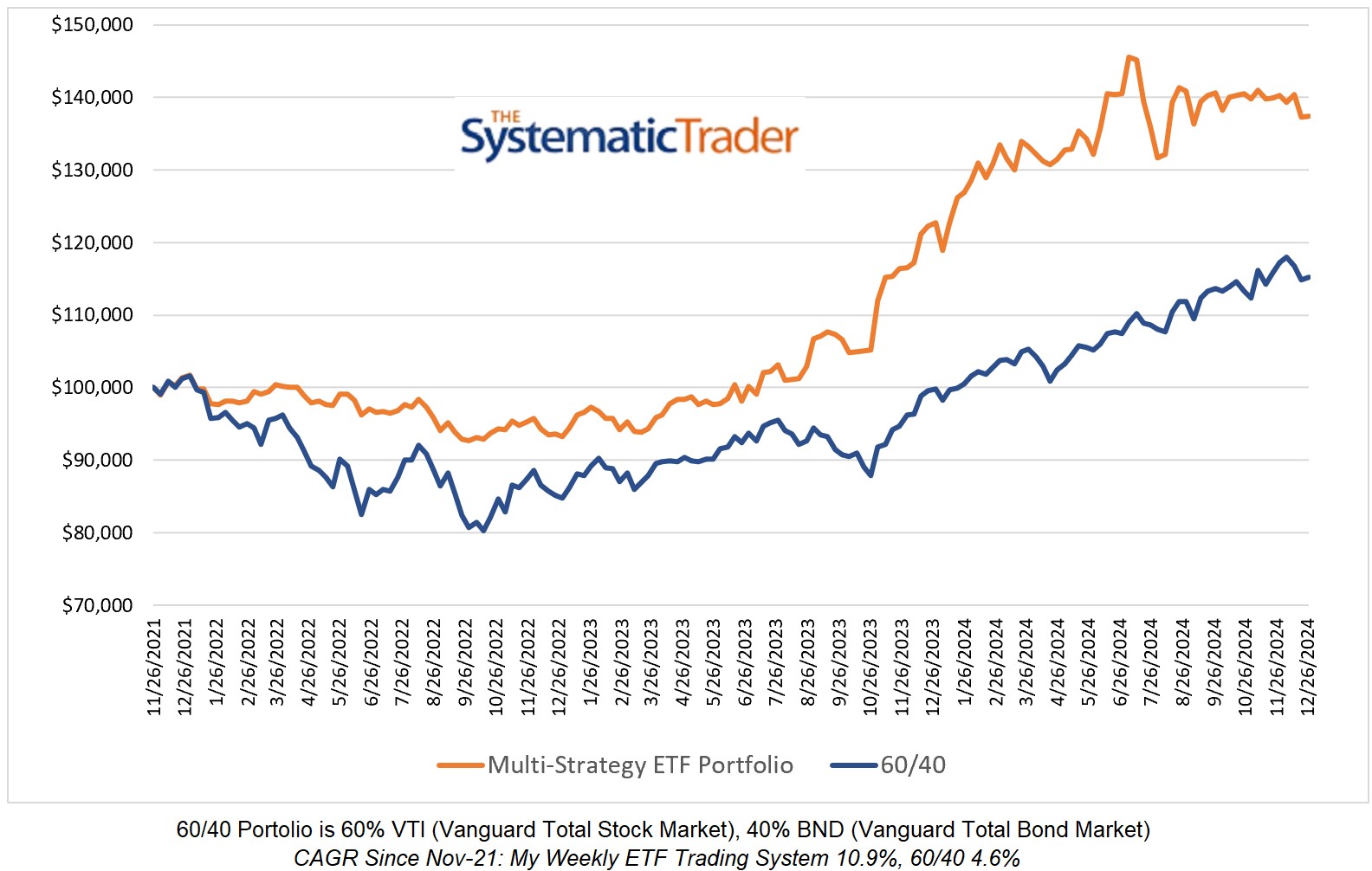

My global multi-strategy ETF model is up 8.2% year-to-date compared to 4.7% for the 60/40 model. The allocation to QQQ only has ended as my model now has allocations to five ETF's as noted in the table below.

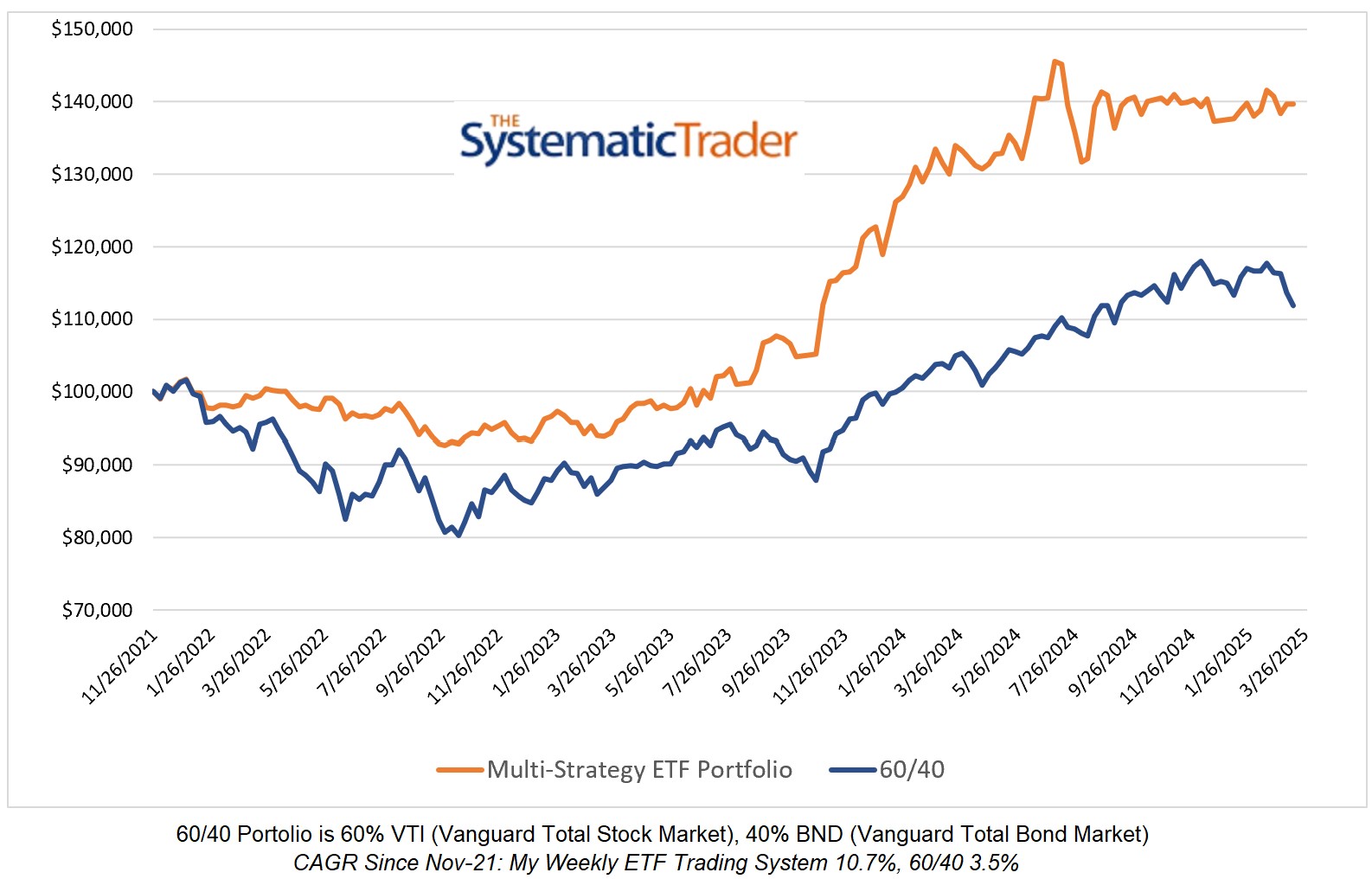

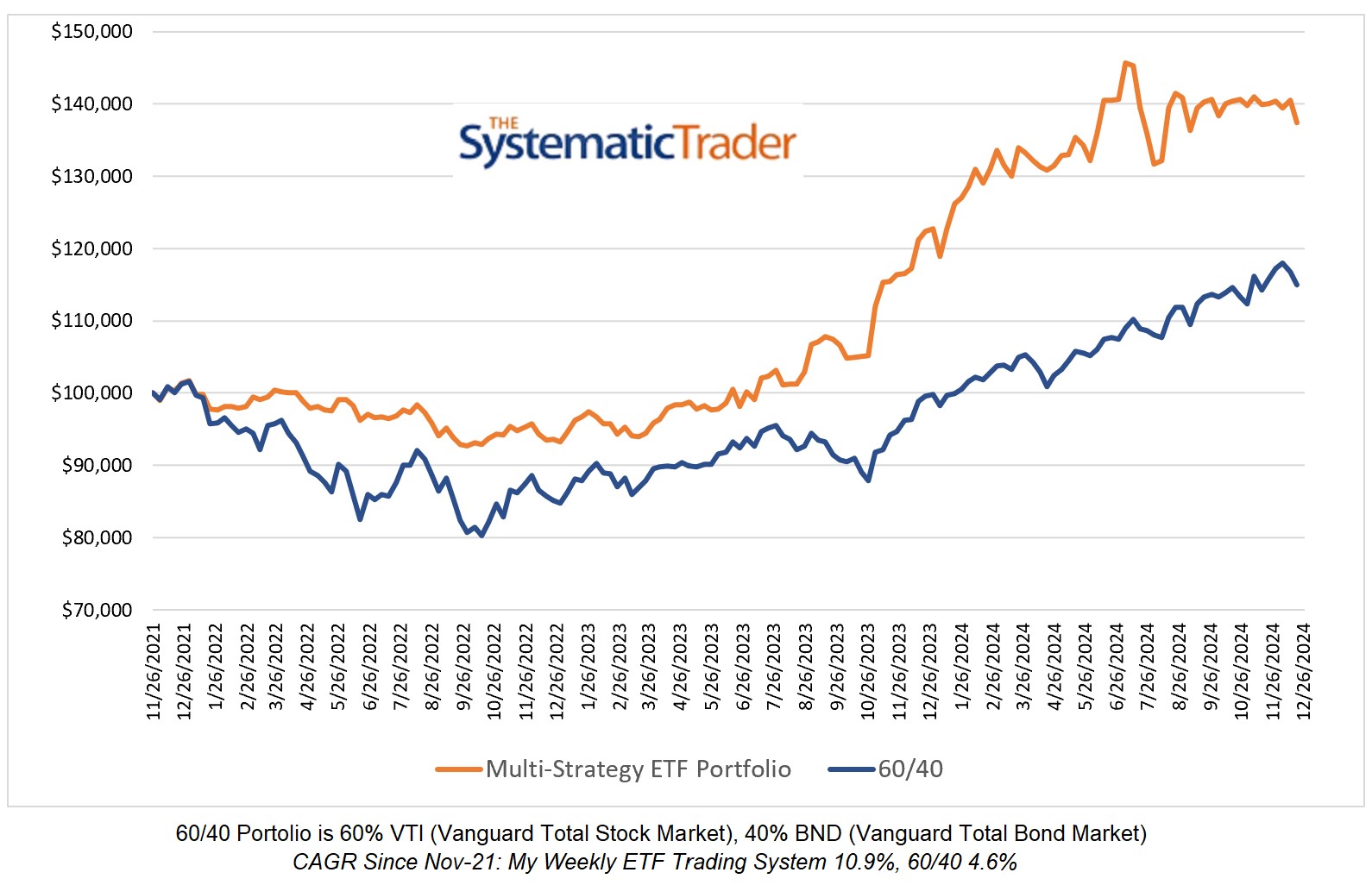

Investing Update for The Week Ending March 29, 2024

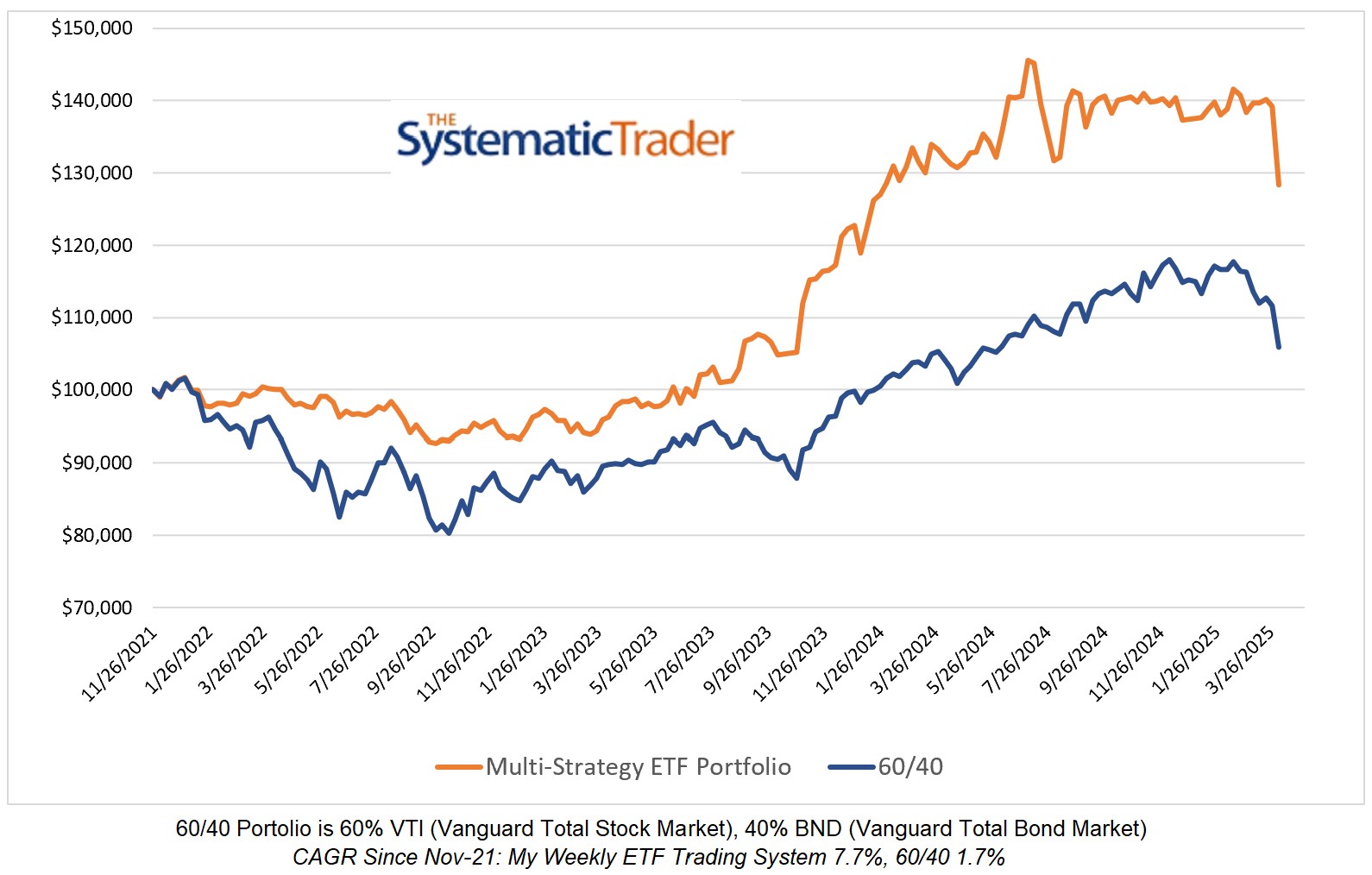

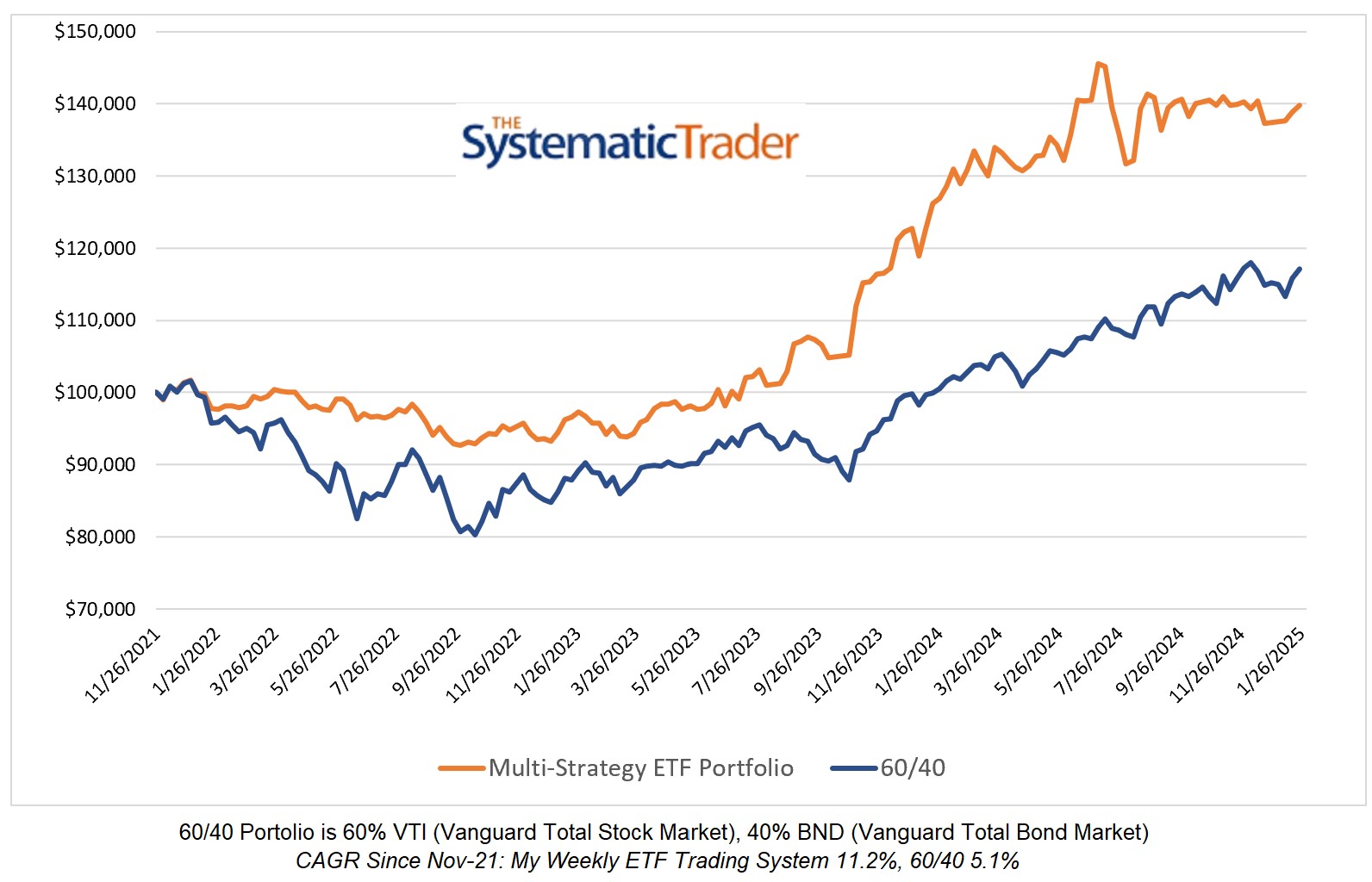

For the twentieth consecutive week, my global multi-strategy ETF model remains 100% allocated to QQQ. My model has increased by 38.8% over the past year compared to a 17.3% increase in the 60/40 model. To be honest, this much outperformance in one year is a lot higher...

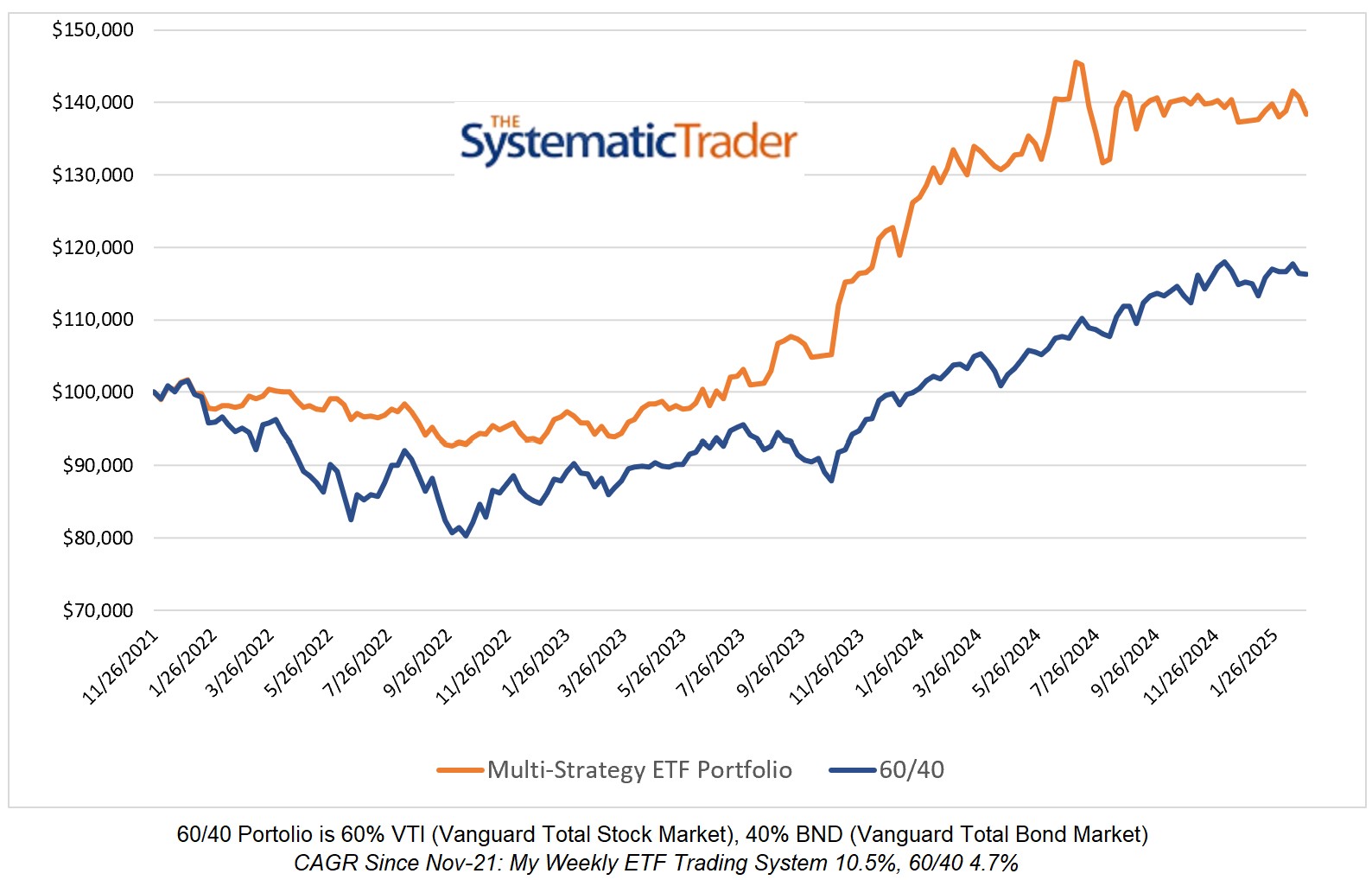

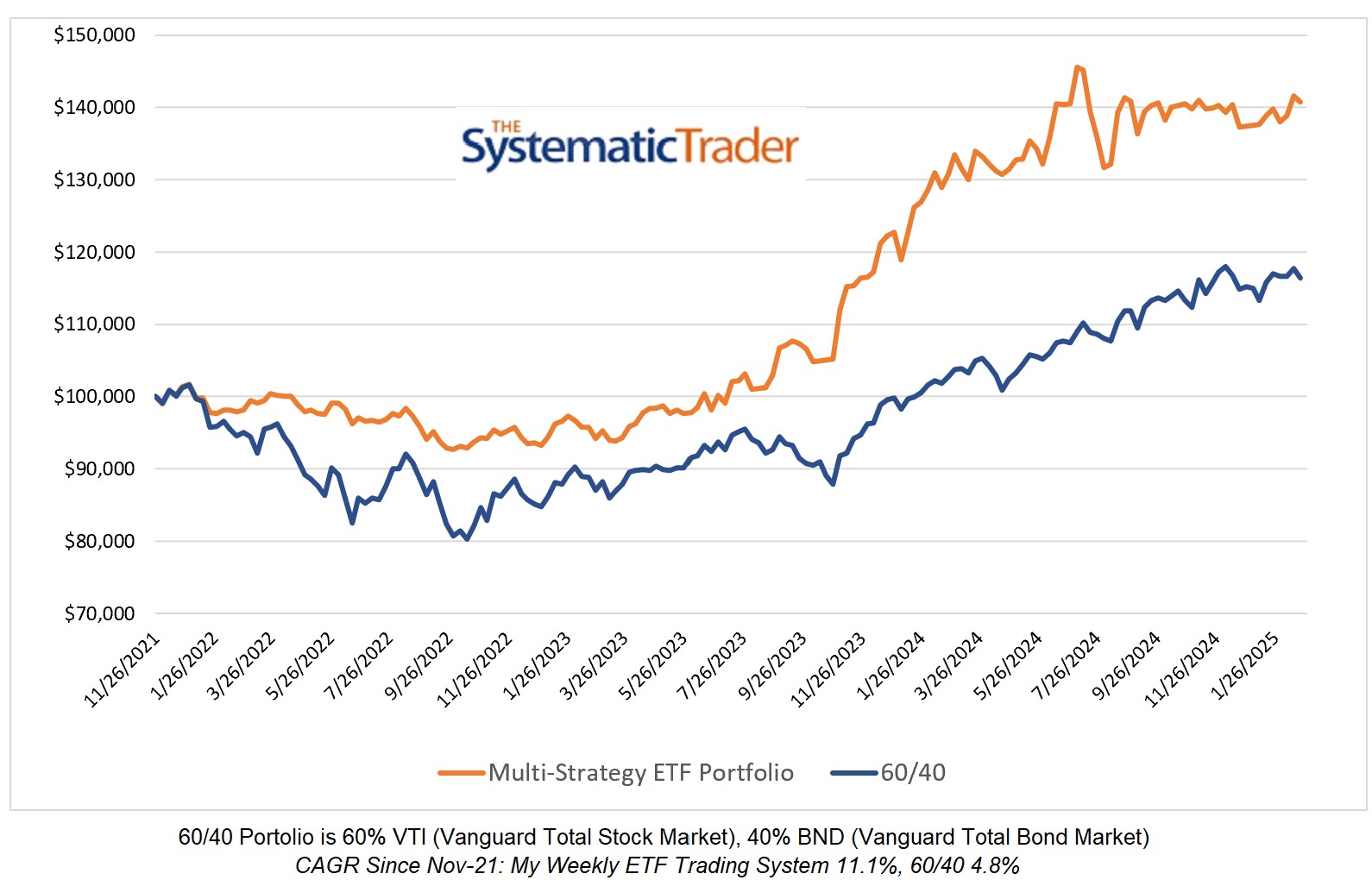

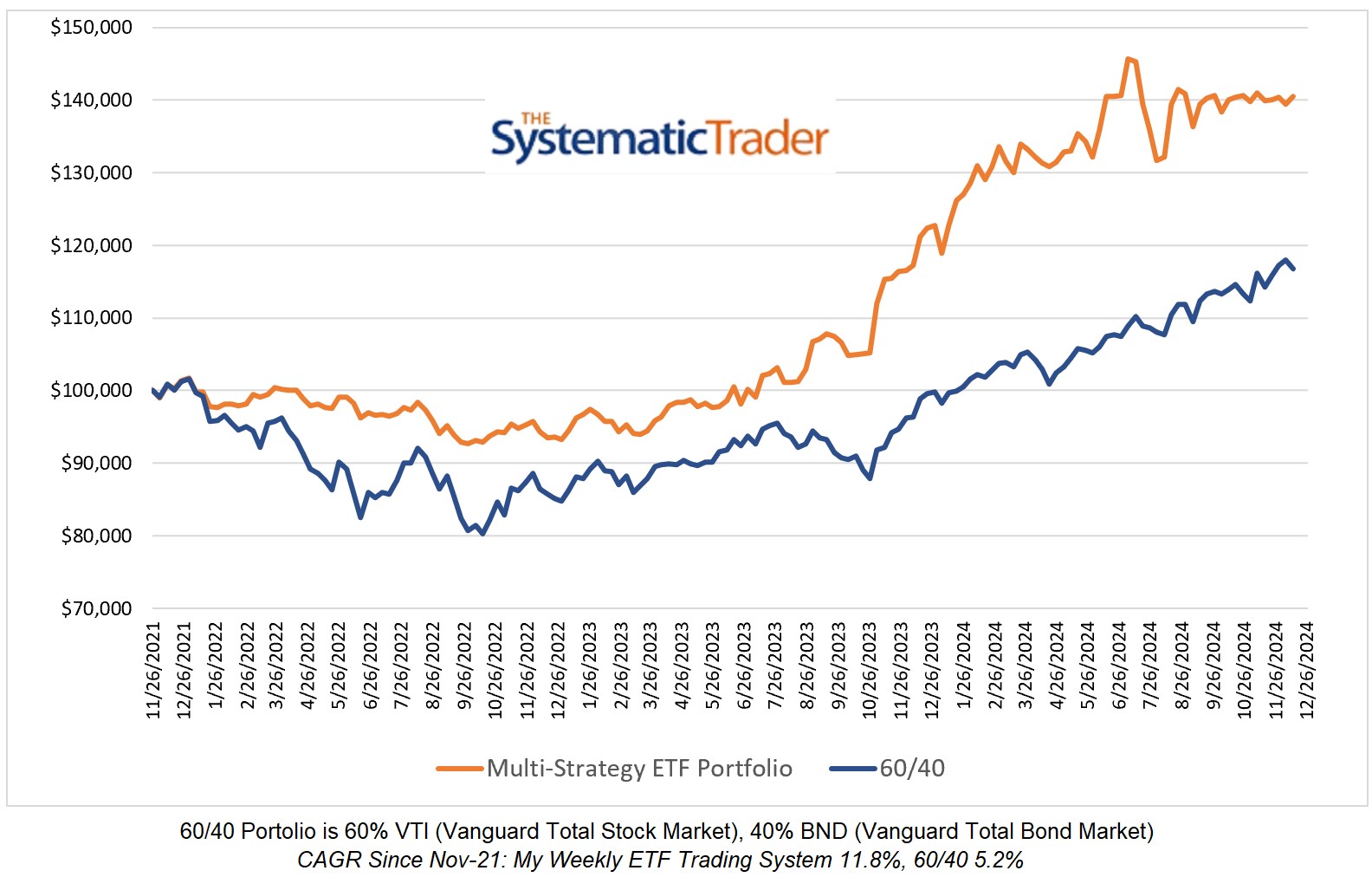

Investing Update for the Week Ending March 22, 2024

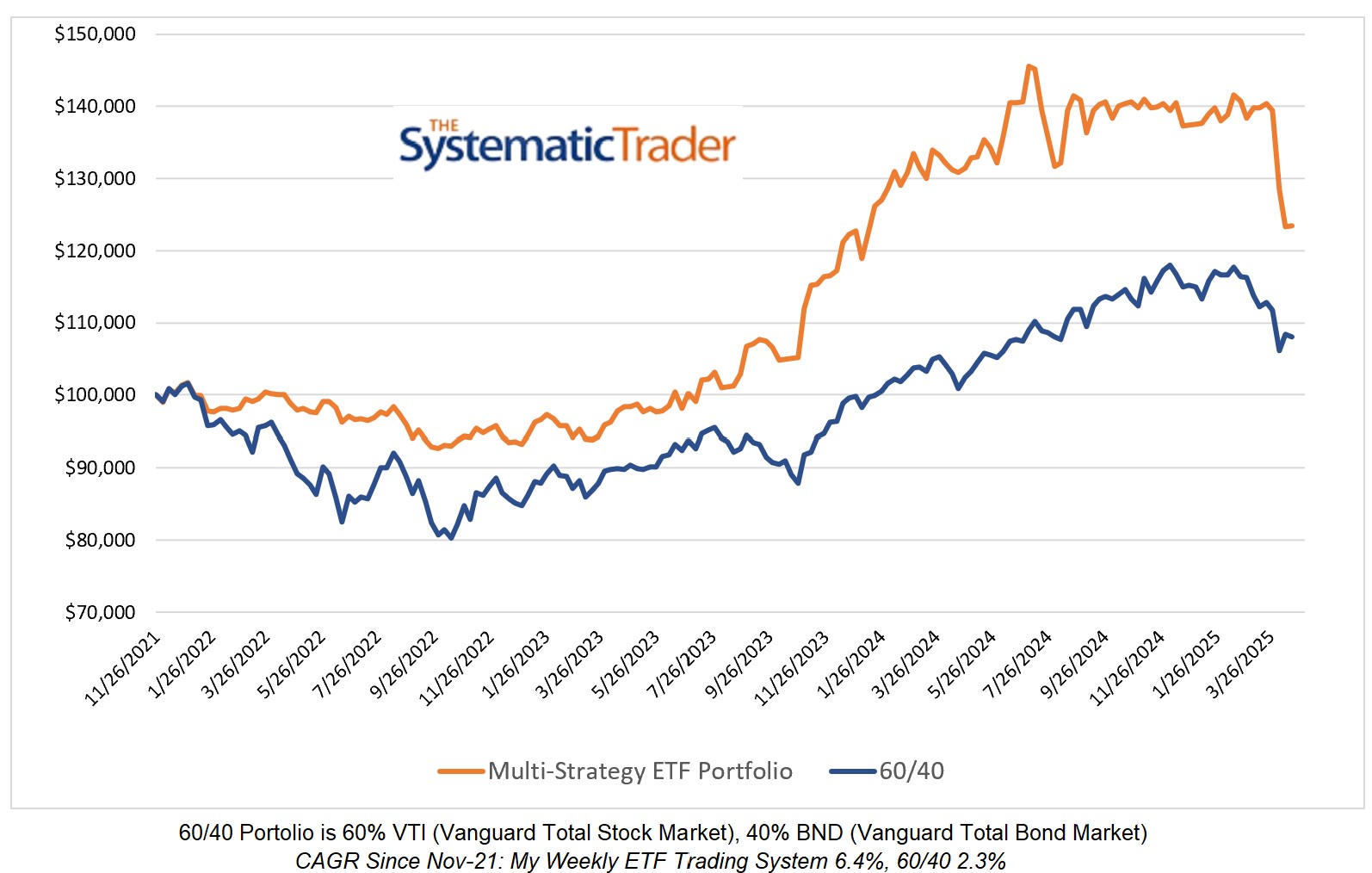

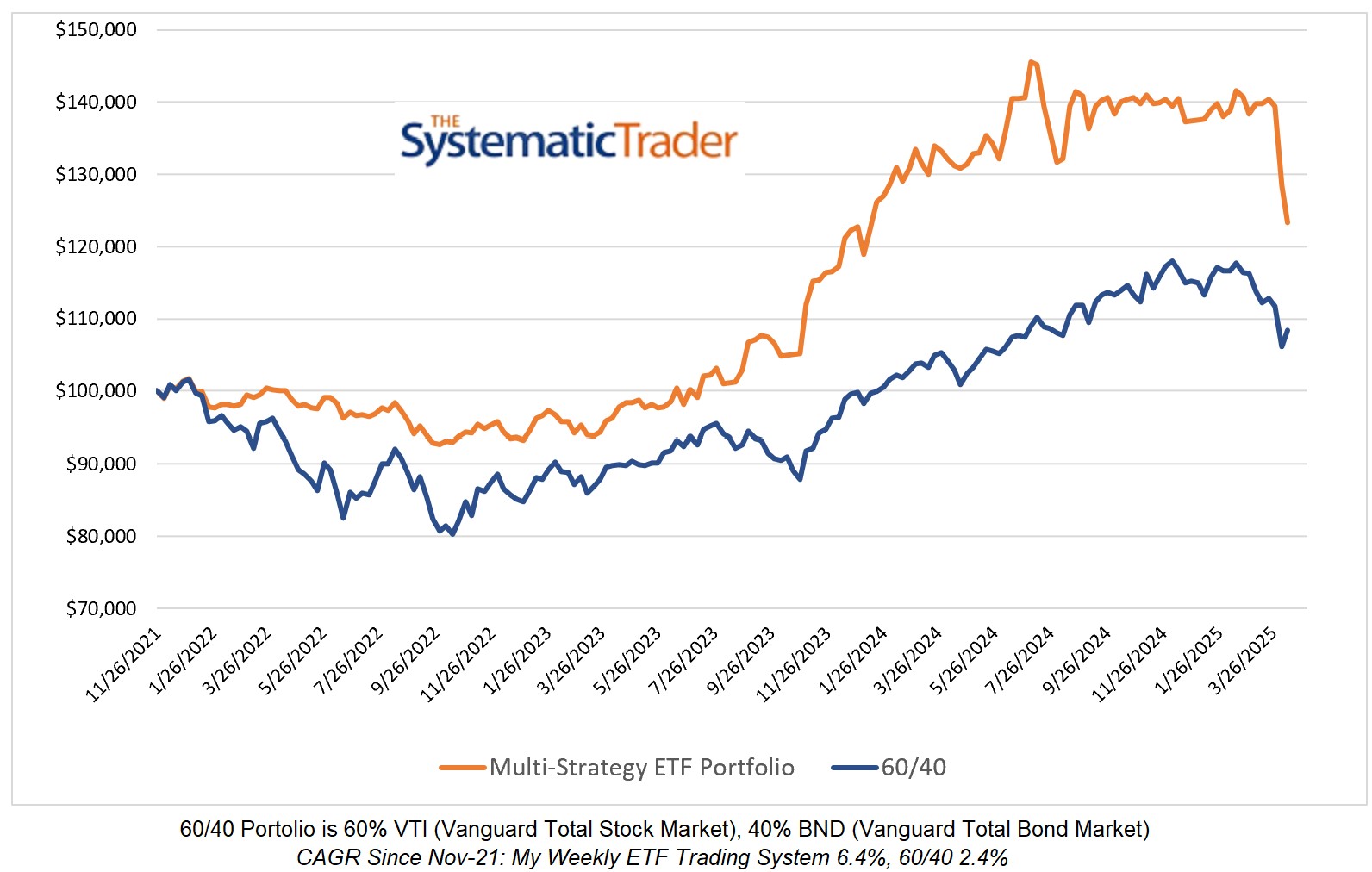

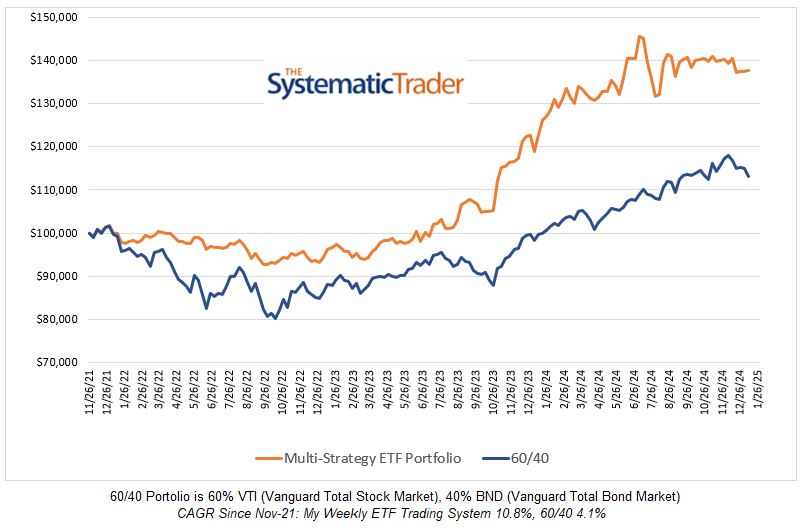

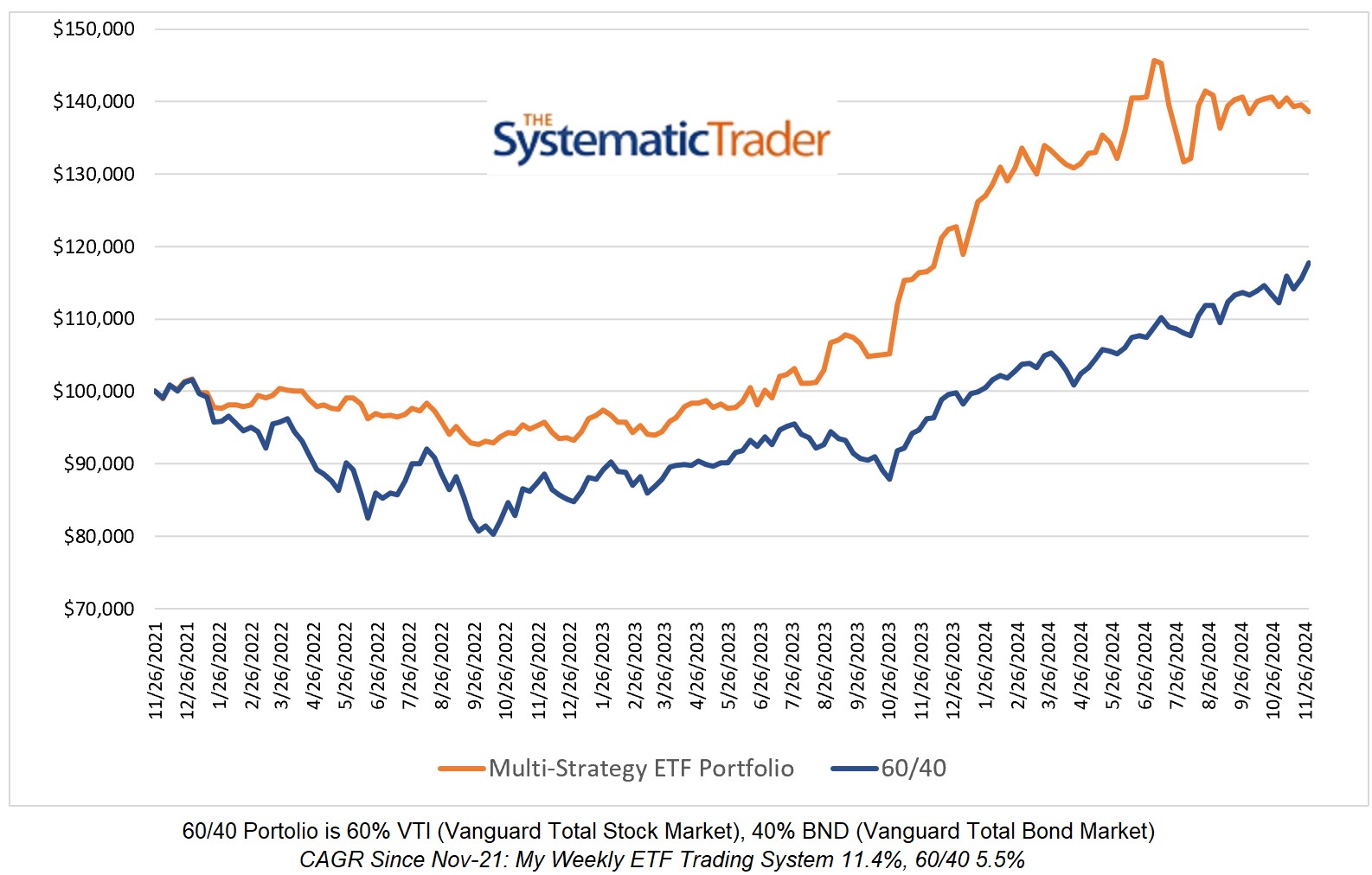

My global multi-strategy ETF model rose by 3.01% this past week compared to a 1.43% increase in the 60/40 model. Since I began posting weekly ETF allocation updates here, my model has achieved a 13.38% CAGR versus a 2.01% CAGR for the 60/40 model. For the 18th...