As discussed in an earlier post, I am selling options in a margin account as a means of generating additional income on my investment portfolio. Up to now, I have sold naked puts and today I entered my first covered strangles with SPY and QQQ as the underlying. I am certainly not swinging for home runs but rather small wins to compound over many years.

The tactical asset allocation models that I use currently have allocations to both SPY and QQQ so I chose those two ETF’s for my first covered strangles. My preference is monthly options as they have higher liquidity and entering the trades today gave me 60DTE (days to expiry).

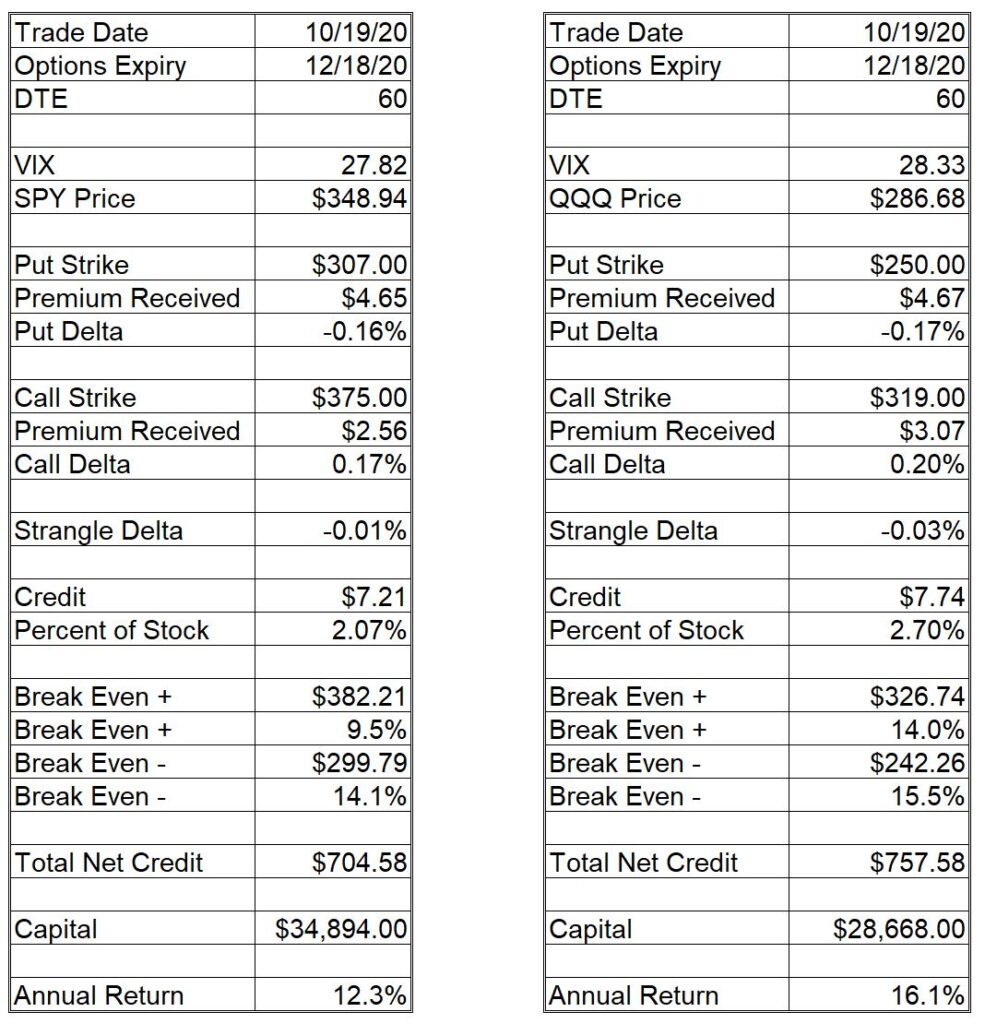

The tables below provide info on the December SPY 307/375 strangle and the December QQQ 250/319 strangle.

Both strangles are very close to delta neutral.

The maximum profit from the sale of the call and put options is the total net credit which would only be realized if the options expire worthless on December 18 with the ETF prices between the Break Even + (call strike + credit) and the Break Even – (put strike – credit). Based on my experience selling naked puts, I expect that I will buy back the options before expiry as per my risk and profit management rules.

All the best in trading and in life.

0 Comments