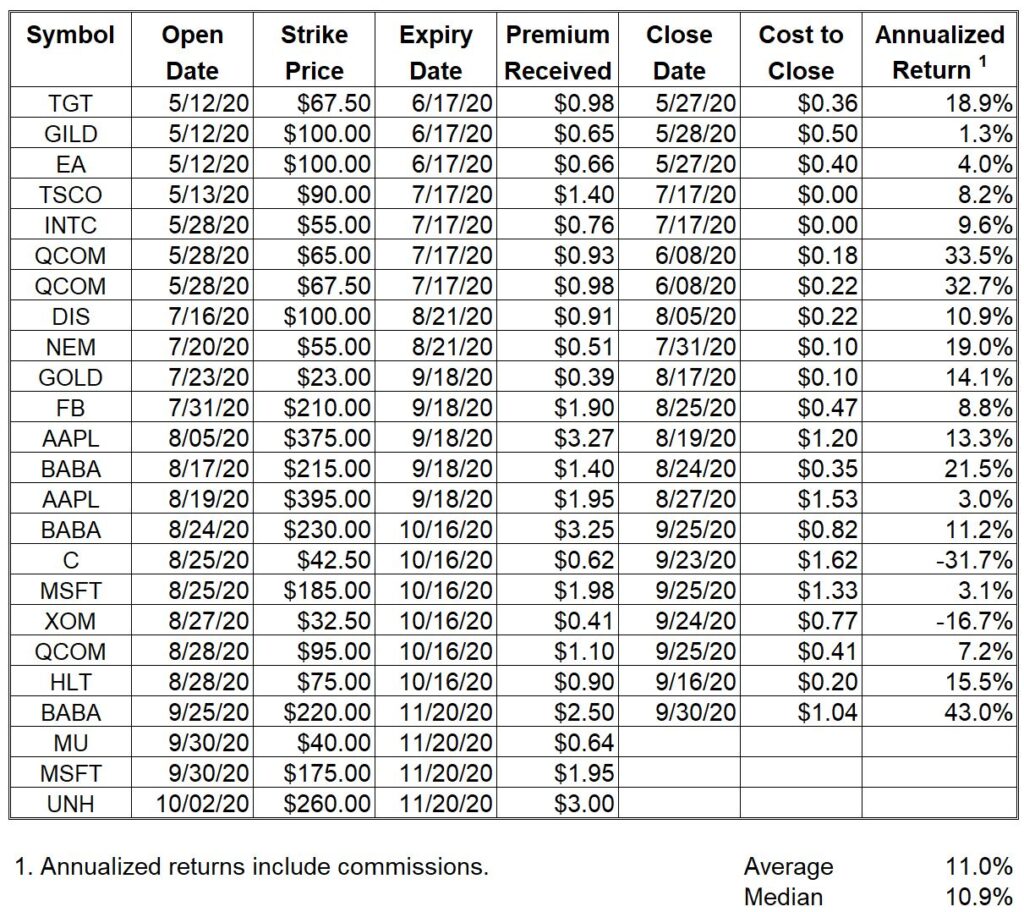

This past week I sold puts on MU, MSFT and UNH. Also, I closed the BABA trade for my highest annualized return so far this year.

If you perform a Google search on “selling put options for income” you will likely see on the first page of results a number of YouTube videos. Virtually all of them are terrible and the creators use a slight of hand to calculate phenomenal returns on their put trades. The issue is almost always the same in that the creators calculate the returns based on margin requirements. For example, if you sell a put on a $100 stock in a margin account and the margin requirement for the put (it varies by stock and strike price) is 20%, the YouTube video creator will likely calculate the return on the trade based on $20 rather than $100. Obviously, this has the effect of increasing the calculated return five-fold.

Below is a link to a Canadian trader’s site which has a very outdated design but the content is fine. One caveat – do not click the link at the bottom of the article to Troy’s Money Tree as the site now appears to be malicious. I have advised the site owner Teddi.

As Teddi notes in her post, selecting a stock to sell a put on is a paramount consideration. She looks for stocks in a sideways range which is a little different from what I do in that I consider stocks with positive momentum.

If you are considering selling stock put options as a means of generating income but are new to trading options, I strongly suggest you paper trade for six to twelve months first. After that, you could continue to paper trade but also commit a small amount of your portfolio to selling puts until you are confident in your put selection strategy as well as your ability to manage open trades.

All the best.

0 Comments