May 06 – Closed Two Naked Put Option Trades Profitably. Established a Partial Covered Strangle

On Thursday I bought back the SLB and NEM naked put options that I had sold earlier. I paid $0.07 for the SLB puts resulting in a 90% annualized profit and I paid $0.10 fr the NEM puts resulting in a 27% annualized profit. The average annualized return on my most recent 20 closed naked put trades is 31%.

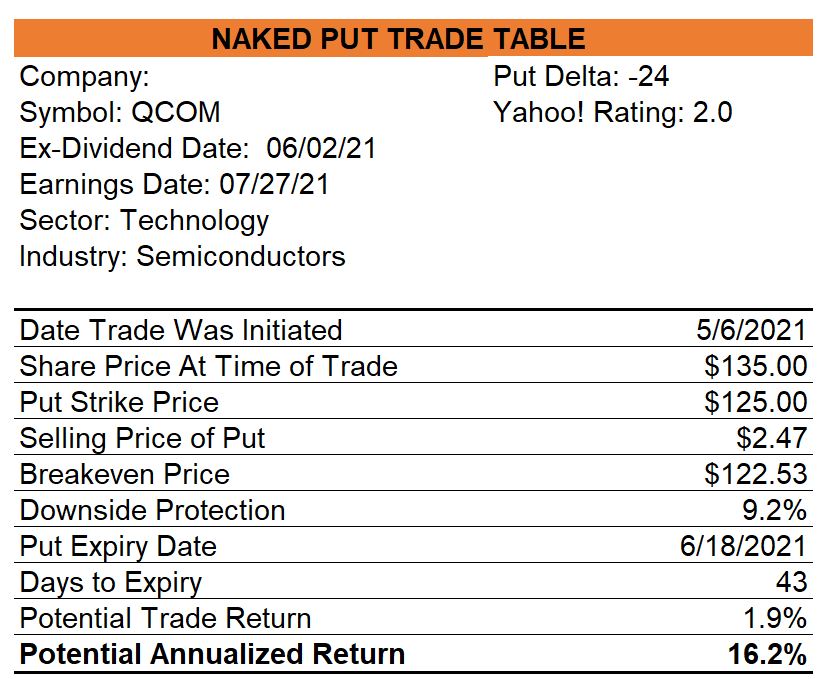

I opened a covered call trade on Qualcomm on May 05 and today I sold some naked puts (fewer than the number of calls I sold) to establish what I refer to as a partial covered strangle. It is my way of generating more income with my capital.

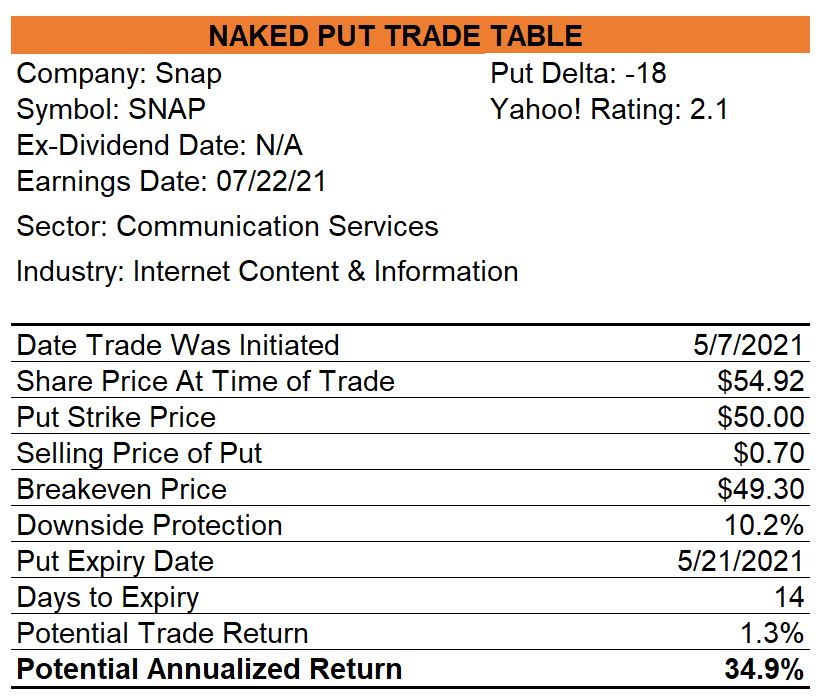

May 07 – Sold Naked Puts on Snap

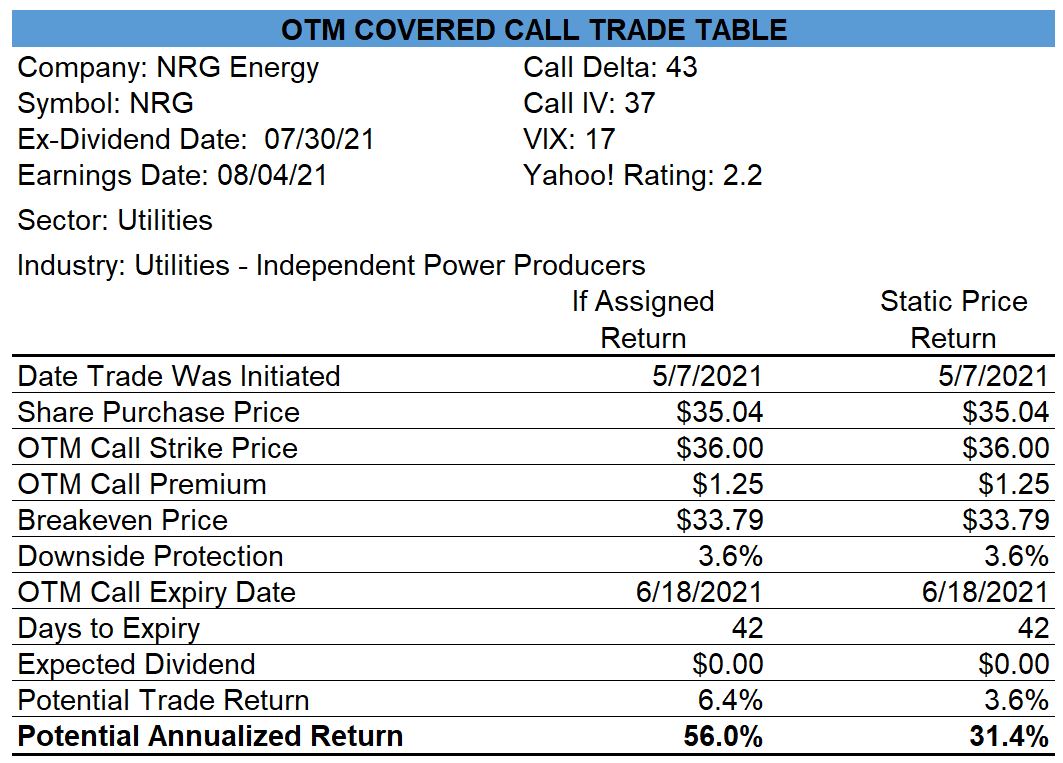

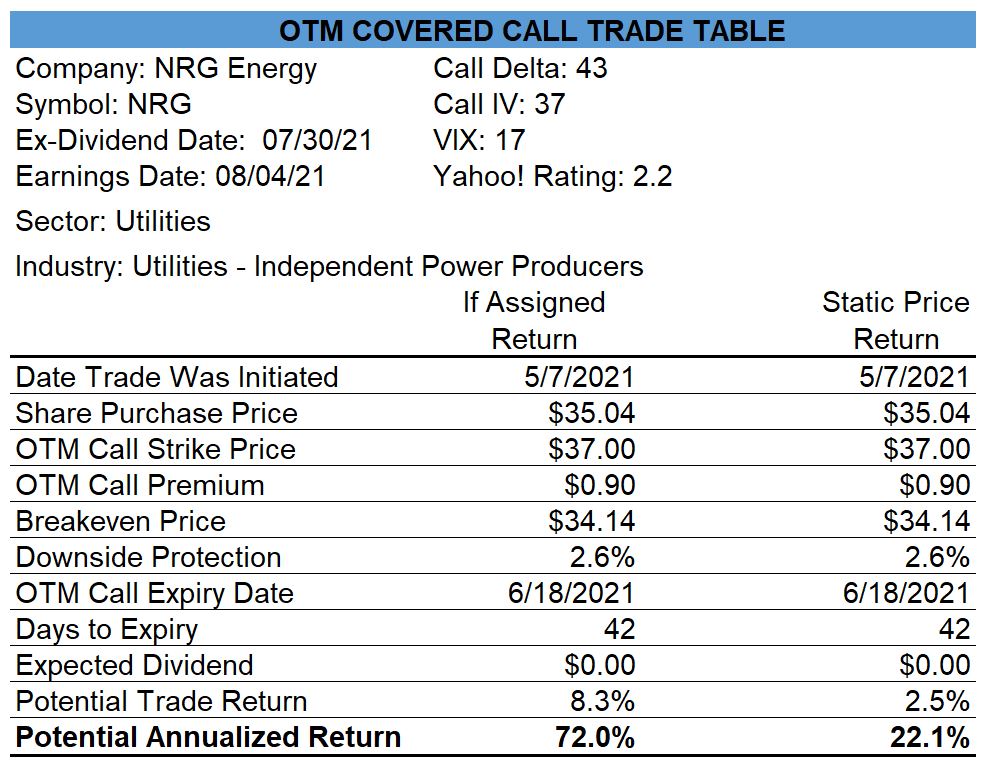

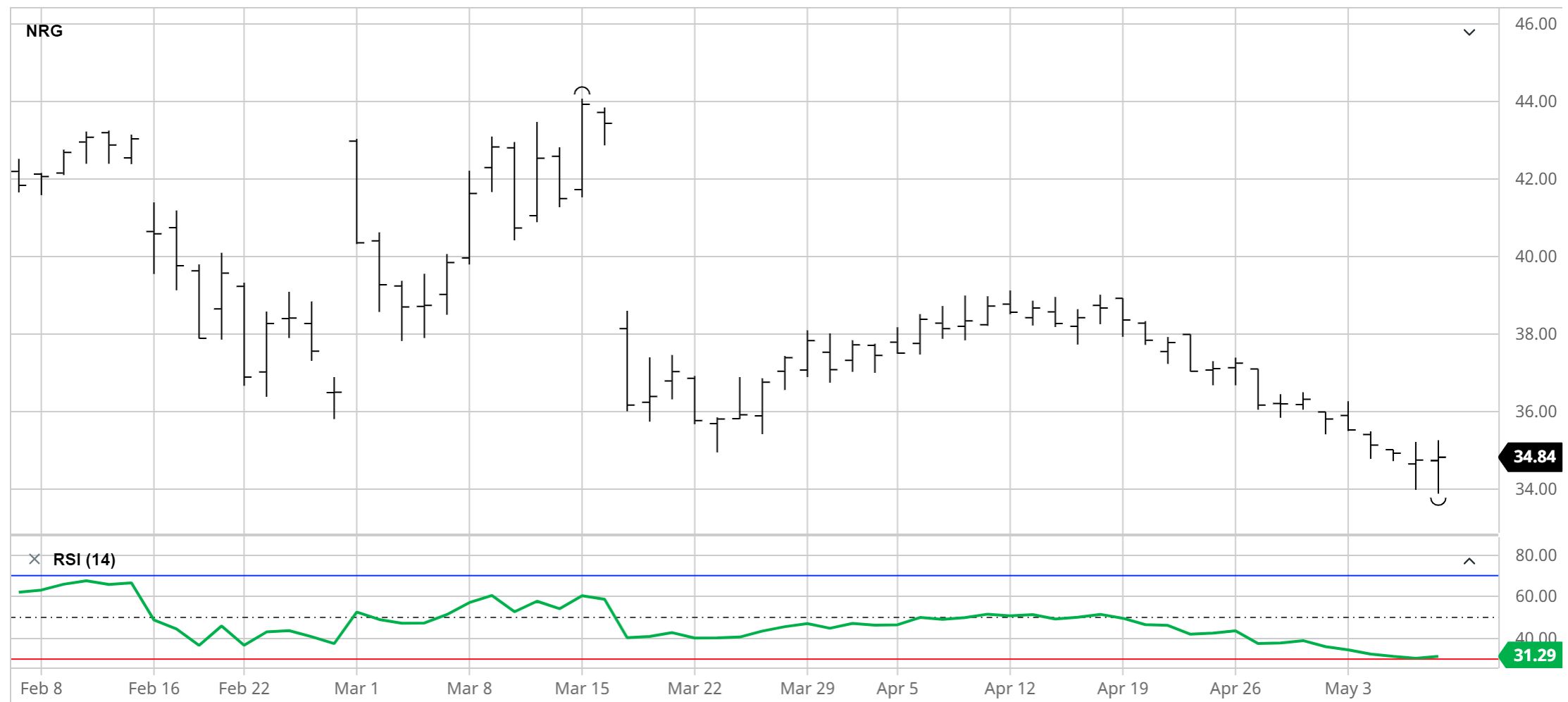

May 07 – Initiated Covered Calls with NRG Energy

On Friday afternoon, shares of NRG passed one of my covered call screens so I purchased shares and then sold an equal number of Jun-18 $36.00 calls and Jun-18 $37.00 calls. The premium I received was $1.25 and $0.90 respectively.

All the best in trading and in life.

0 Comments