As June 18 was the monthly option expiration date for June options, I had a lot of trades in the past two days. Many of the stocks that I had sold covered calls on earlier, closed above the strike price on Friday and accordingly were assigned. For those stocks that closed below the call strike price on Friday, I sold some of them today but held others and sold July covered calls to collect even more premium. Fortunately for me, some of the stocks that closed below the strike price on Friday rallied above that strike yesterday.

I would normally wait until the weekend to post as a means of keeping my posts to a minimum but, given the number of trades I had yesterday and today, I thought it would be better to publish this post today.

June 22

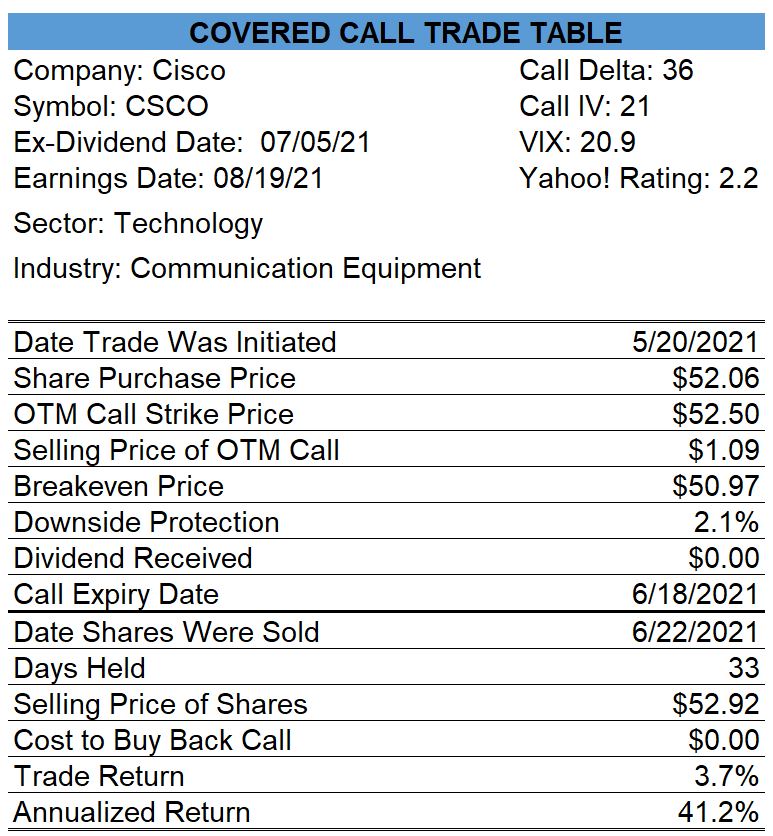

Cisco (CSCO) – Closed Covered Calls

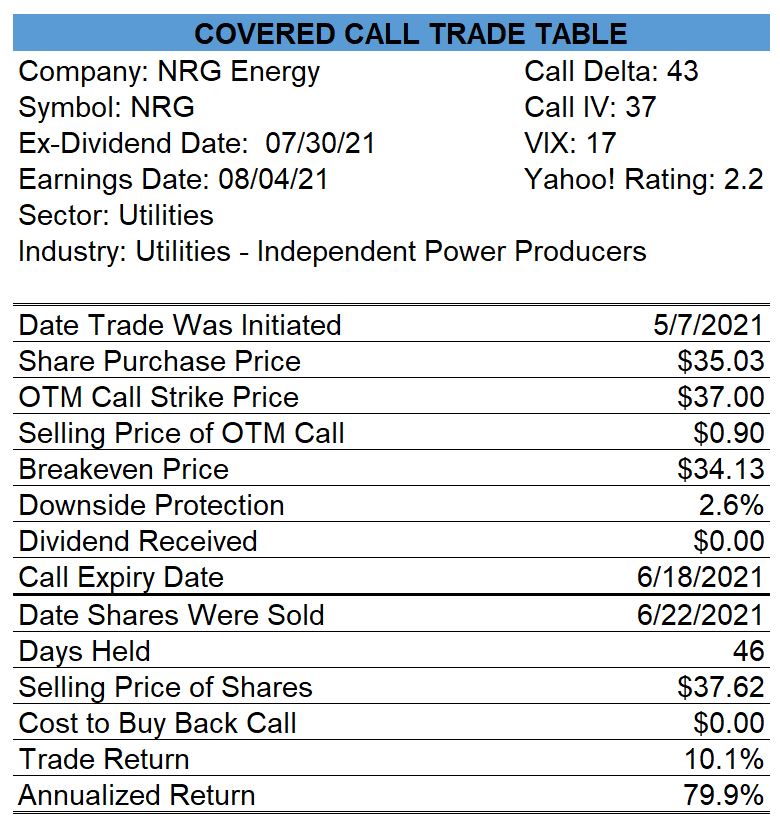

NRG Energy (NRG) – Closed Covered Calls

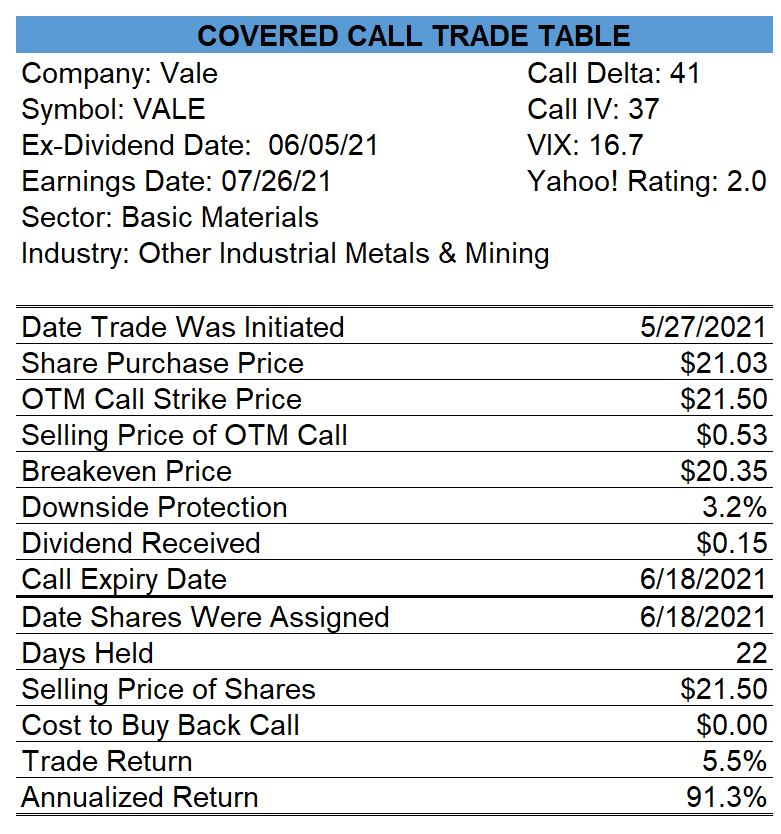

Vale (VALE) – Closed Covered Calls

Most of my VALE calls were assigned on June 18. The table below is for the shares that were assigned.

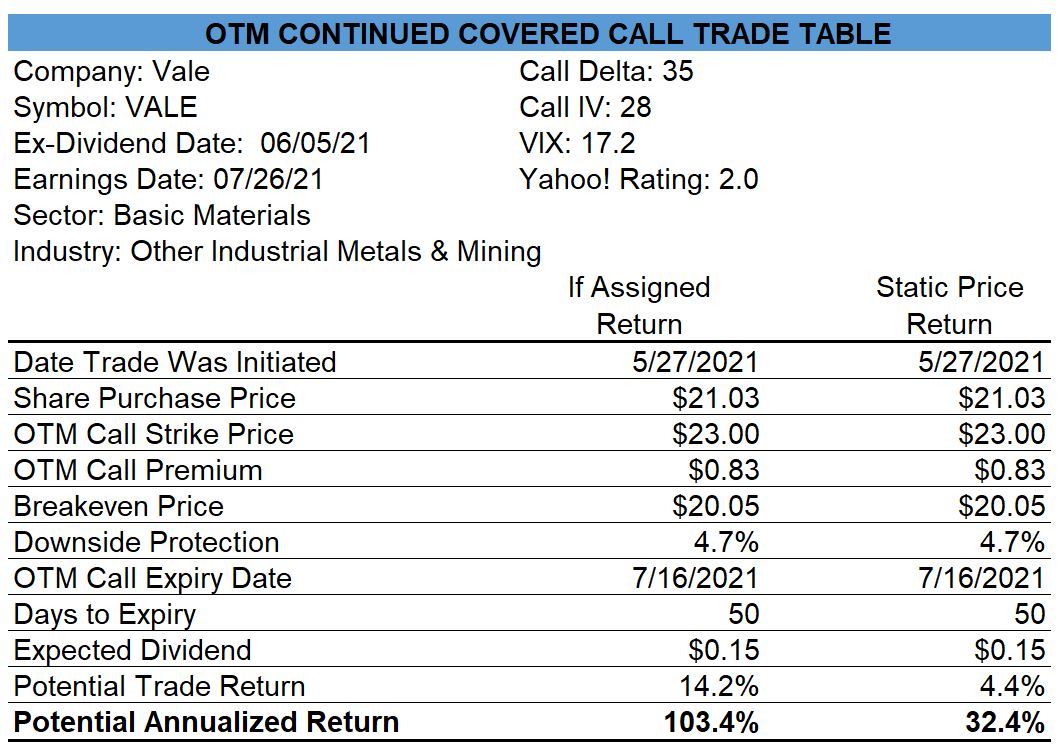

Vale (VALE) – Continuation of Covered Calls

Shares of VALE closed $0.01 above my $25.00 call strike price on June 18 and therefore some shares were assigned. For those that I kept, I sold Jul-16 $23.00 calls for $0.30.

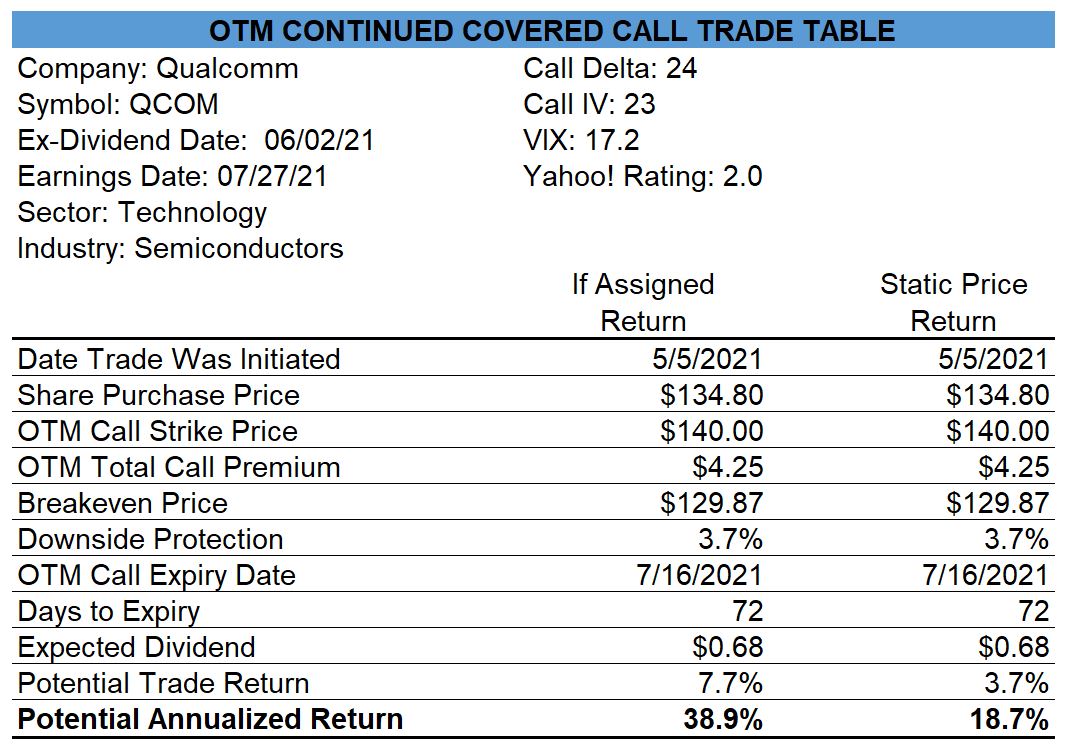

Qualcomm (QCOM) – Continuation of Covered Calls

Shares of QCOM closed below my call strike price of $135.00 on June 18 so I held the shares and sold Jul-16 $140.00 calls for $1.10.

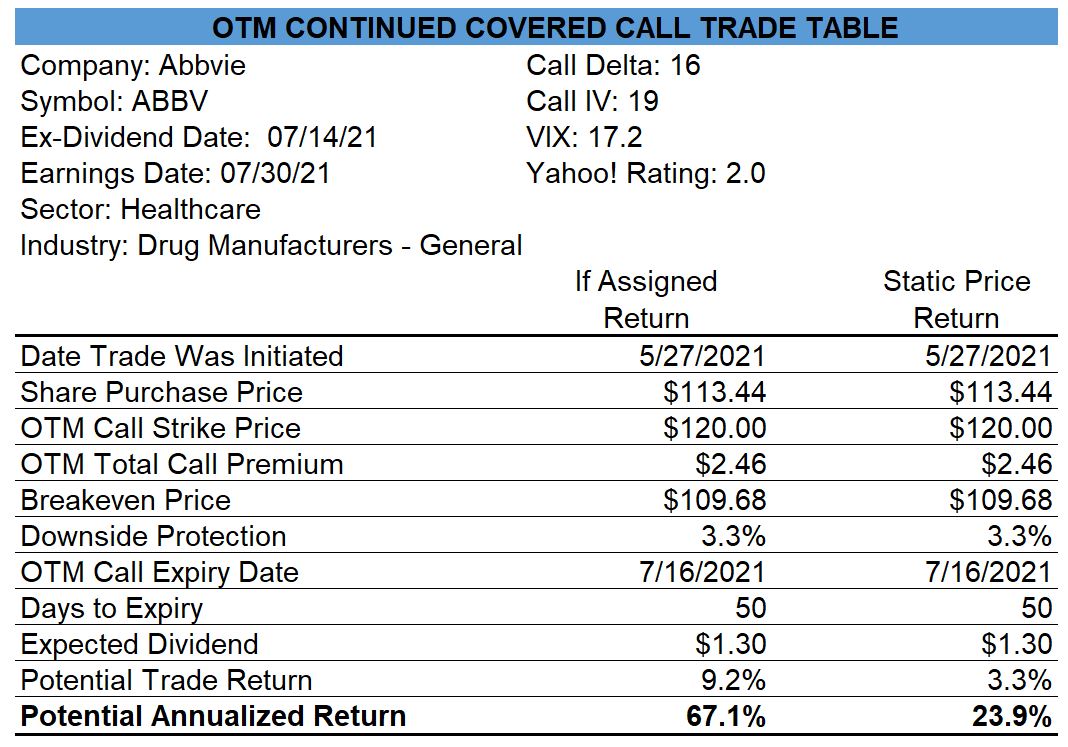

AbbVie (ABBV) – Continuation of Covered Calls

Shares of ABBV closed below my call strike price of $114.00 on June 18 so I held the shares and sold Jul-16 $120.00 calls for $0.51.

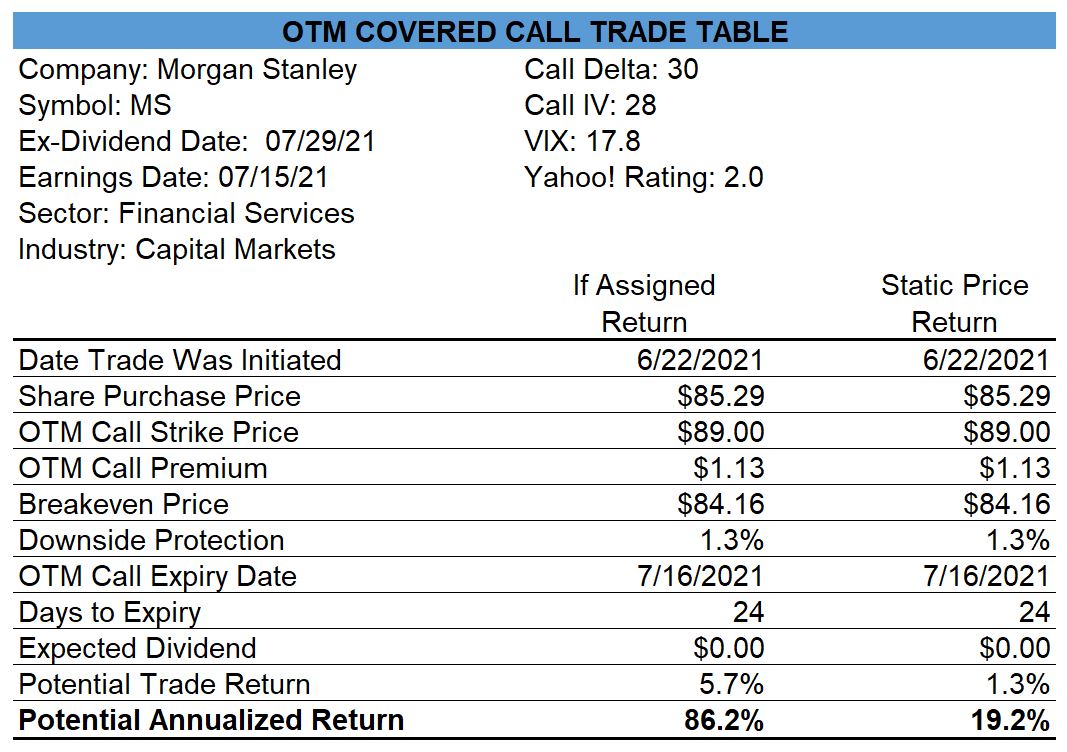

Morgan Stanley (MS) – Opened Covered Calls

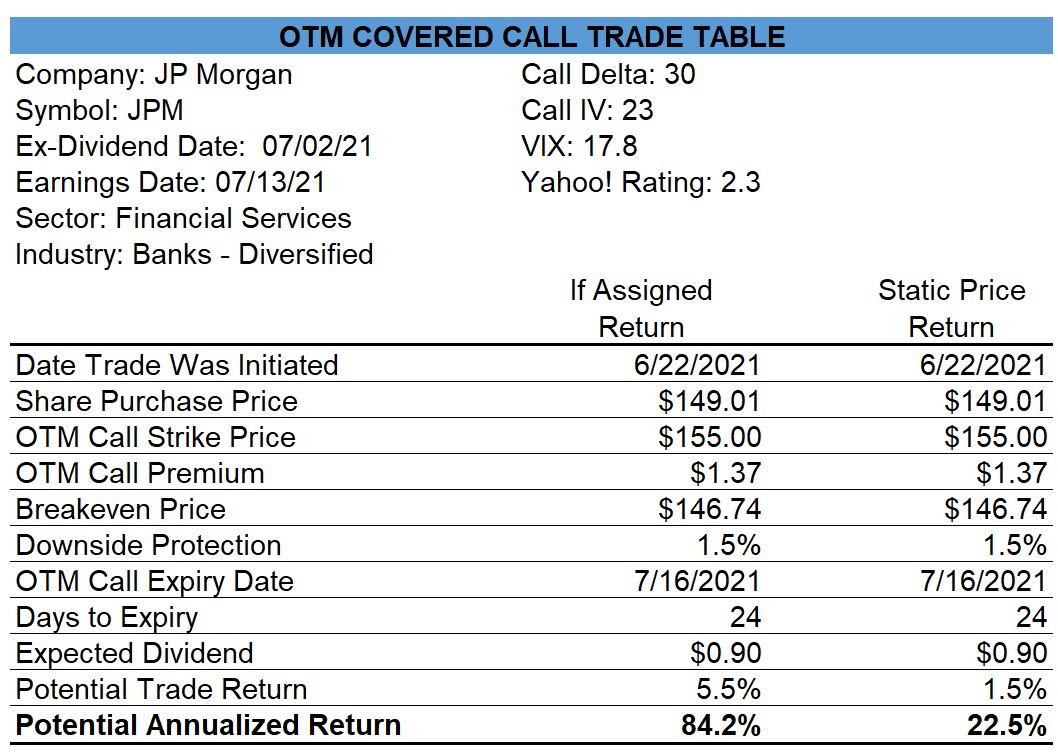

JP Morgan (JPM) – Opened Covered Calls

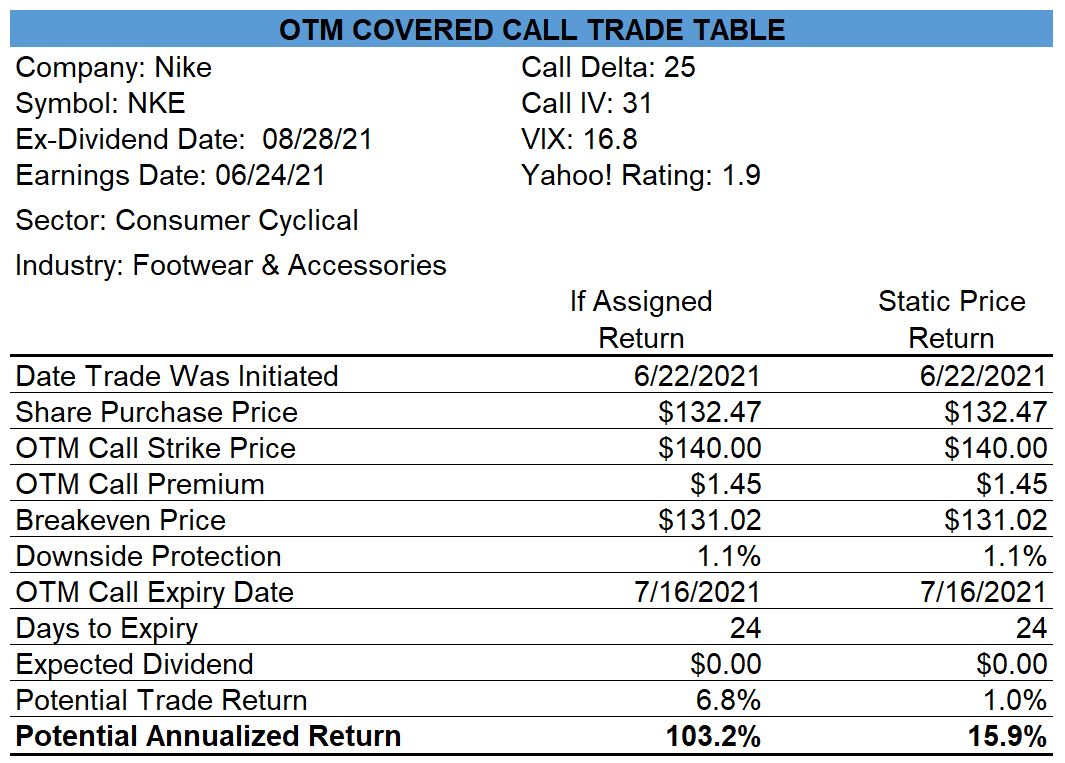

Nike (NKE) – Opened Covered Calls

Late in the trading session today, I decided to open a covered call trade on Nike even though the earnings will be released on Thursday, June 24. Prior to today, I have never opened a covered call trade two days before an earnings release but I have my reasons which are based on a new layer that I have added to my analysis.

0 Comments