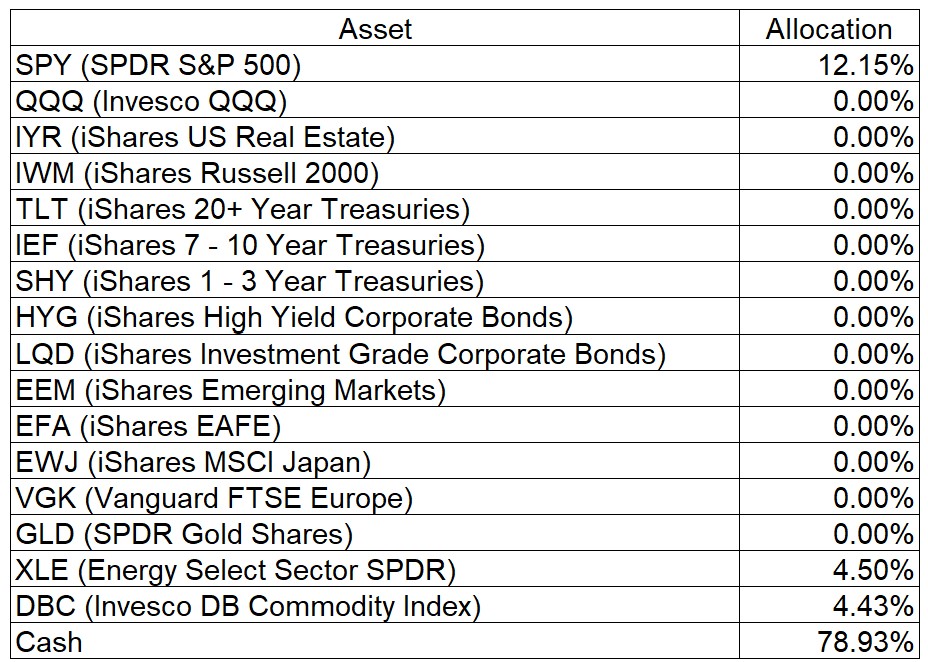

The model that I use to signal when conditions are right to go long individual US stocks was very close to changing to a “Buy” signal this past week and then the inflation report came out which triggered a sell-off in most markets. With many of the ETFs that are components of my models falling in price this week, my allocation to cash has increased to 78.9%.

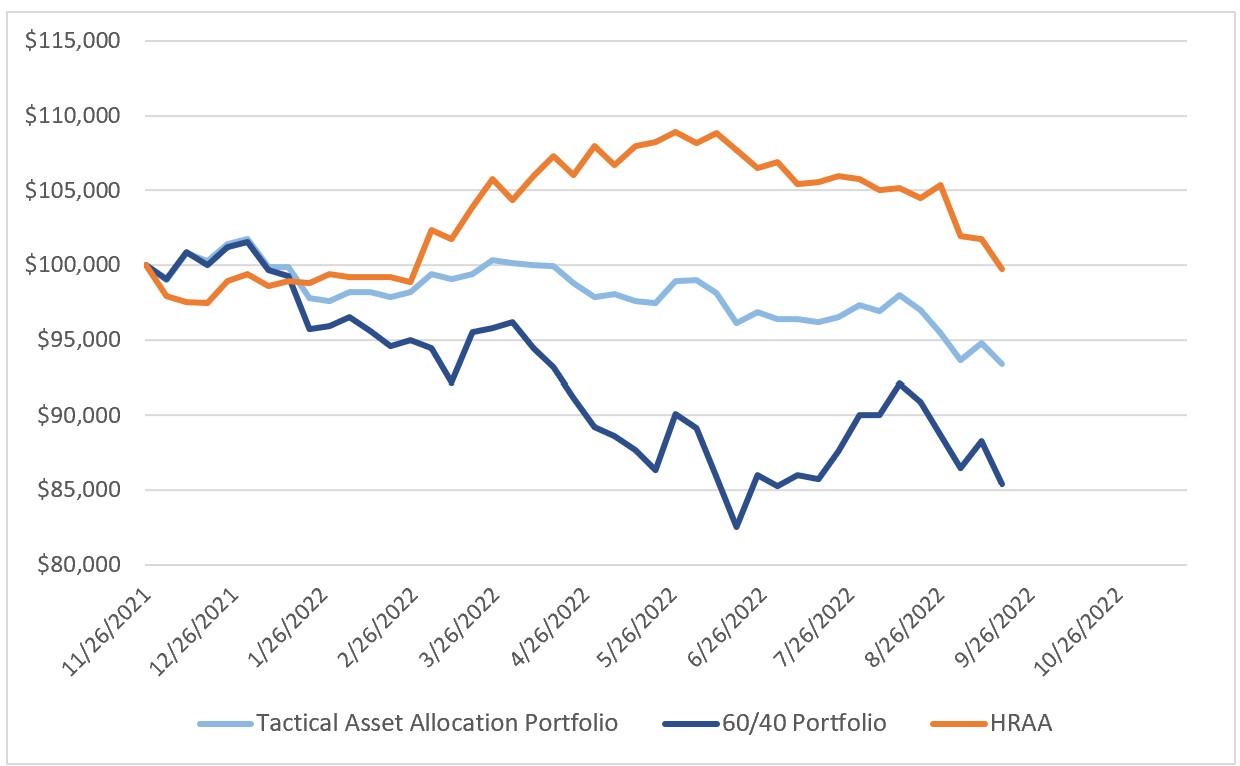

Year-to-date my model is down 8.2% versus 15.9% for the 60/40 portfolio. Seven US-based TAA ETFs that I follow are collectively down 11.3% YTD. For my Canadian readers, VBAL (Vanguard Balanced) is down 12.9%. Relatively speaking, my model is performing satisfactorily. Of course, I would much rather have a positive YTD performance than be down the least.

0 Comments