Happy Thanksgiving. I hope you have much to be thankful for not only this weekend but every day.

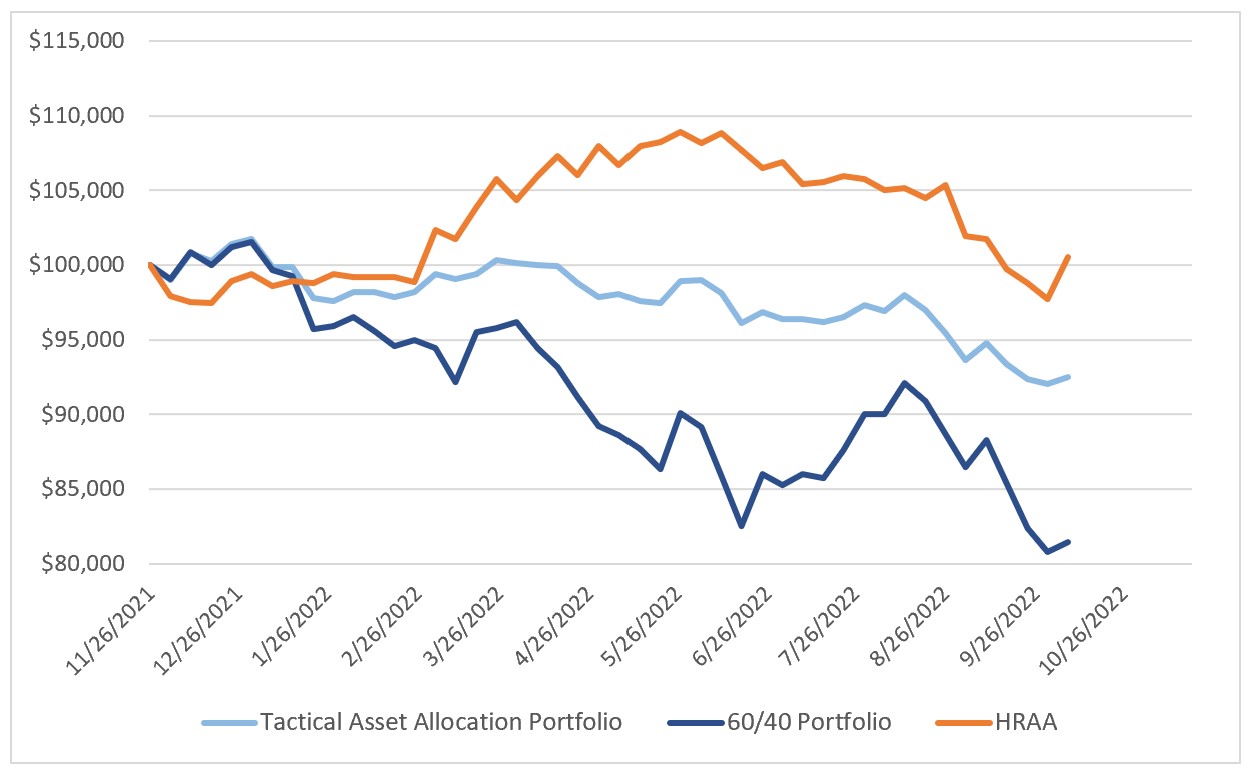

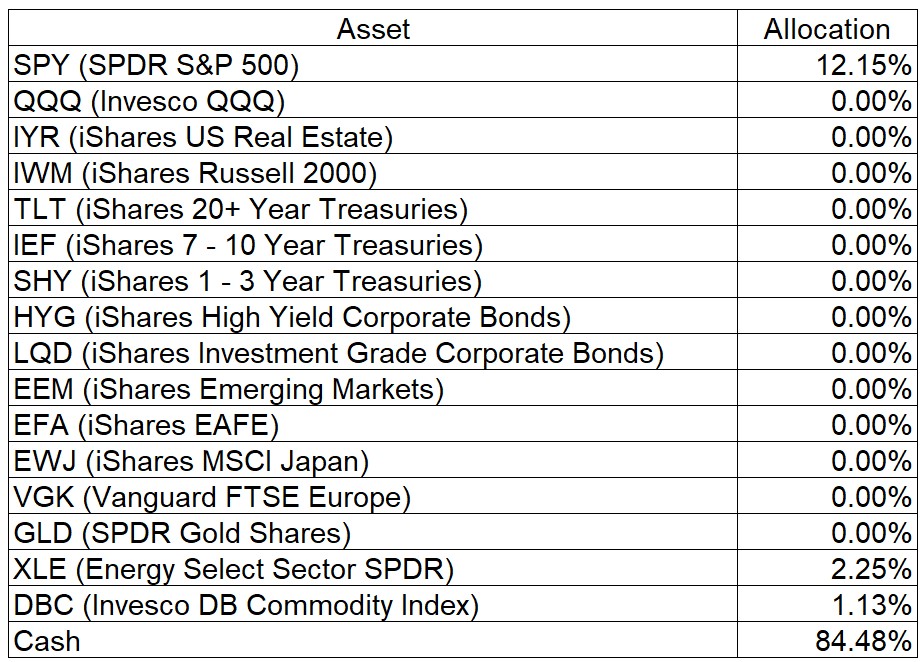

The market continues to be challenging particularly for investors that don’t have a battle-tested strategy that they will adhere to. If you follow a buy-and-hold strategy based on the 60-40 portfolio you are now experiencing a 20% drawdown YTD. That isn’t particularly devastating but at a time when you can get second-by-second updates on your portfolio value, it may be distressing for some. A portfolio based on the tactical asset allocation weights that I post every week is down 9% YTD. Time will tell whether the 60-40 model or my model will provide better returns over the long term. I’m not a fan of large drawdowns regardless of a model’s returns and that, in part, is why I follow a tactical asset allocation strategy.

You will note on the chart that the Horizons ReSolve Adaptive Asset Allocation ETF is performing relatively well so far in 2022. Year-to-date it is actually up 1%. Over the past several months I have increased my allocation to HRAA.

0 Comments