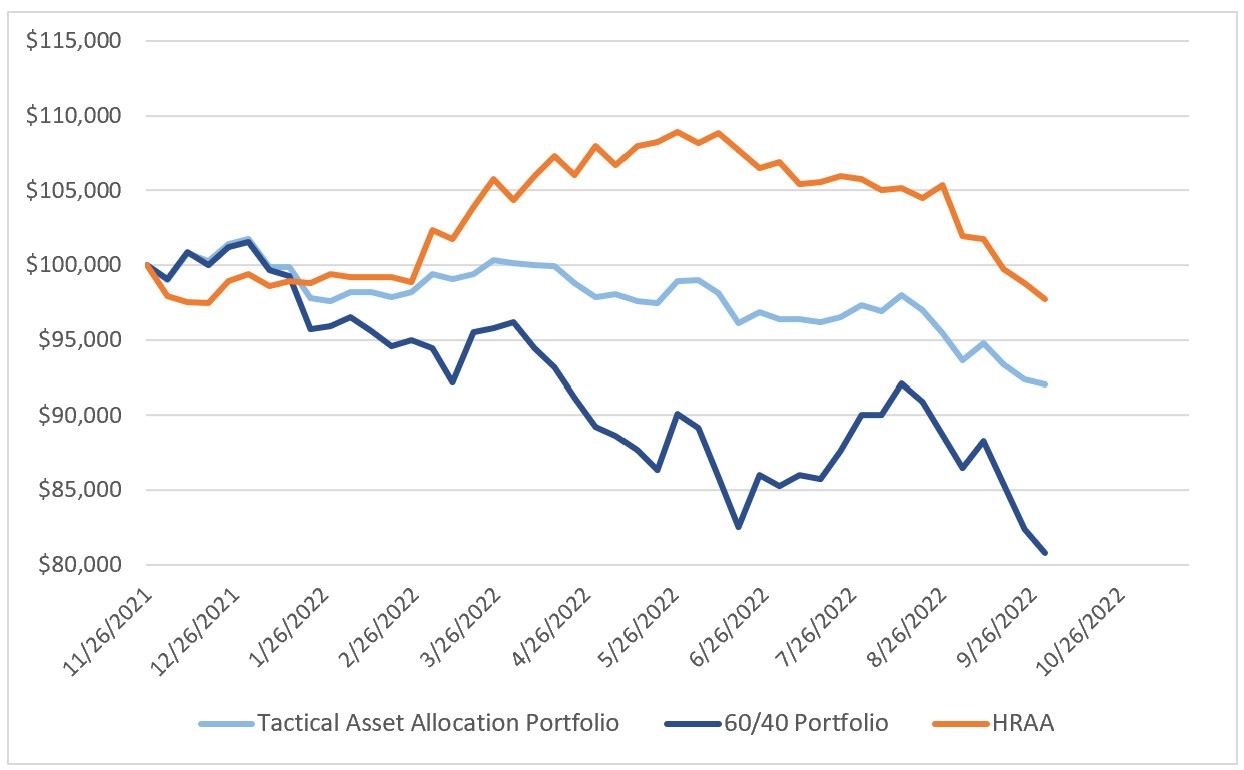

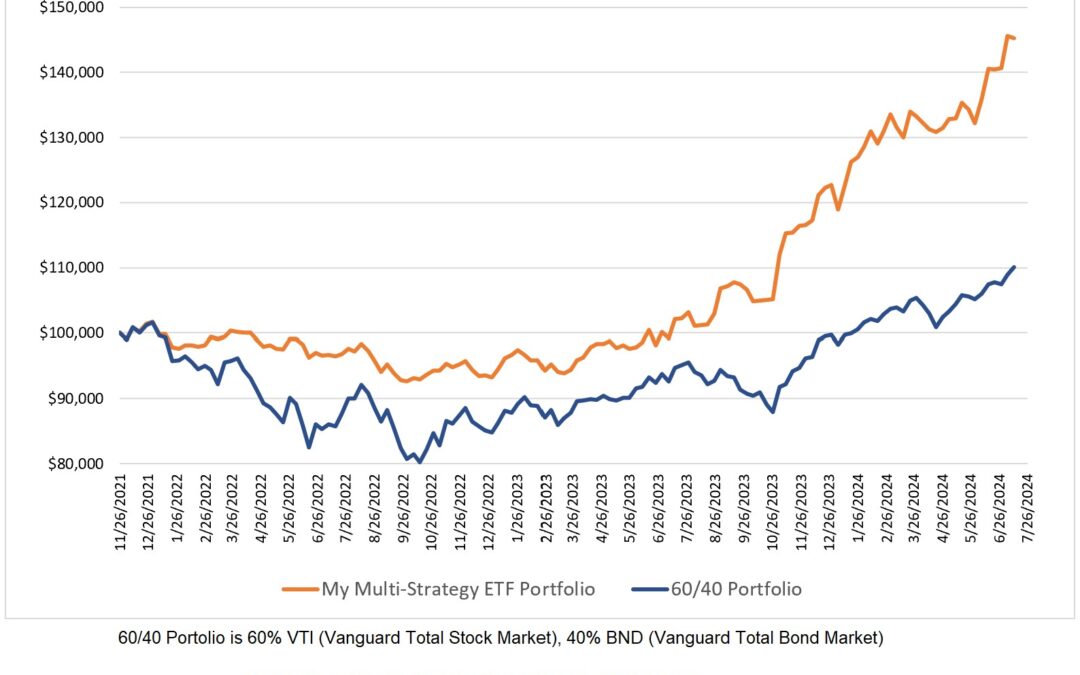

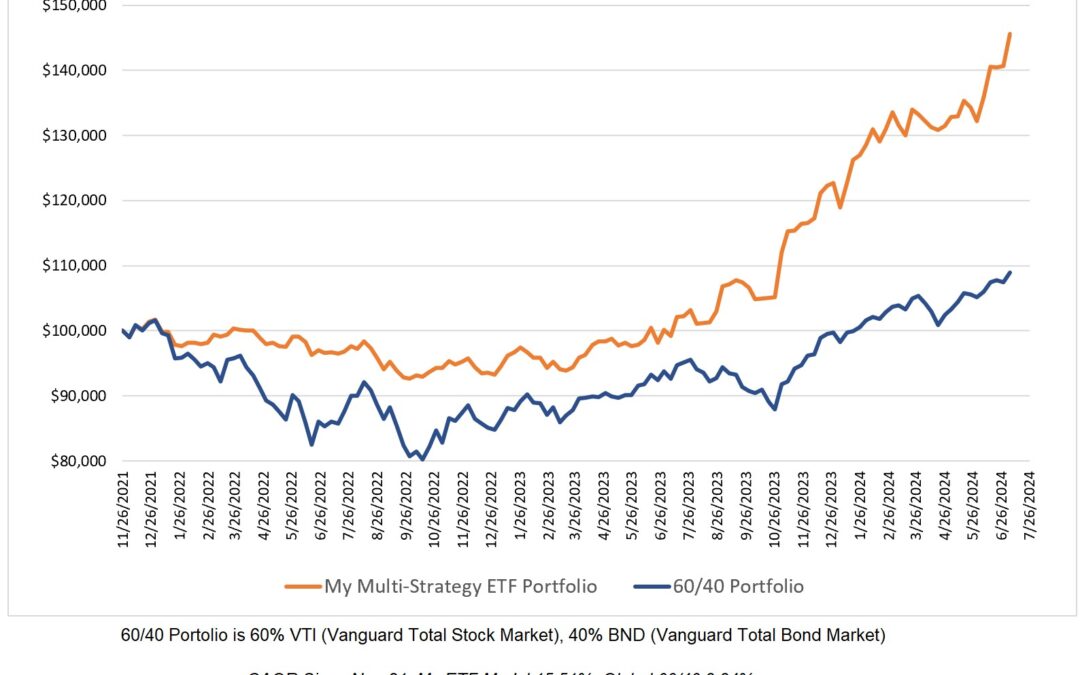

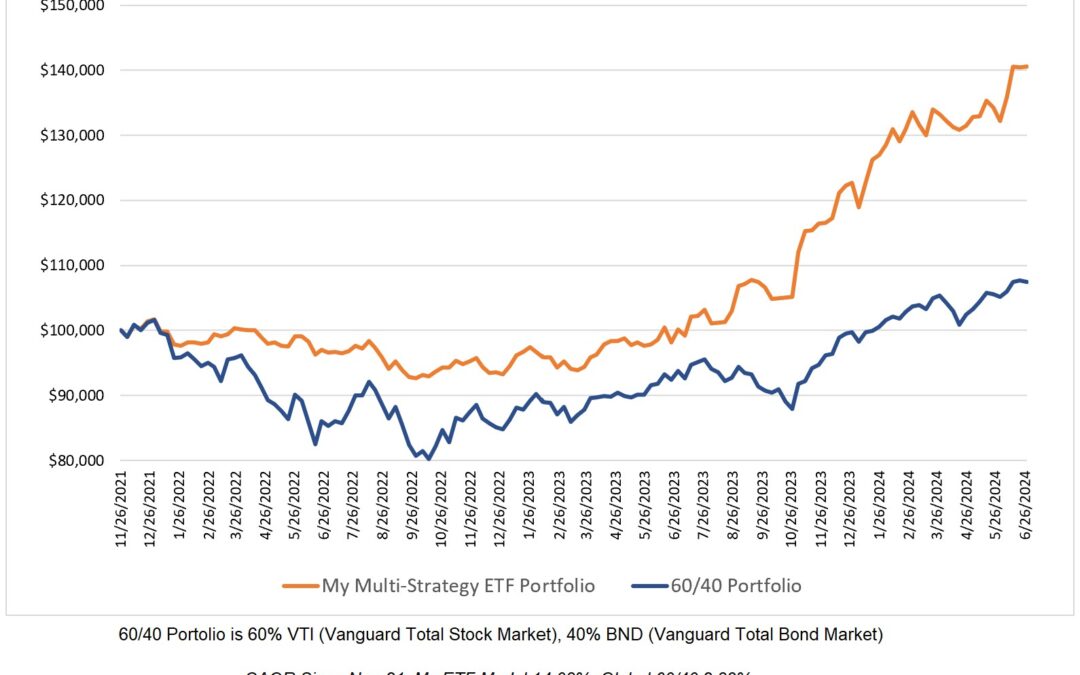

The grind lower in markets this year continues relentlessly. The 60/40 portfolio is now down 20% year-to-date. I’m certain that such a performance is testing the resolve of many investors to stick to a buy-and-hold strategy.

As for my overall portfolio, I have benefitted from the rise in the value of the US dollar versus the Canadian dollar. The majority of my investment holdings are in US dollars and that has partially helped me have a YTD portfolio change of about -2.5%. That’s a heck of a lot better than what a US investor has to show for holding a 60/40 portfolio. I will note that I am talking about a very short timeframe here which must be taken into consideration.

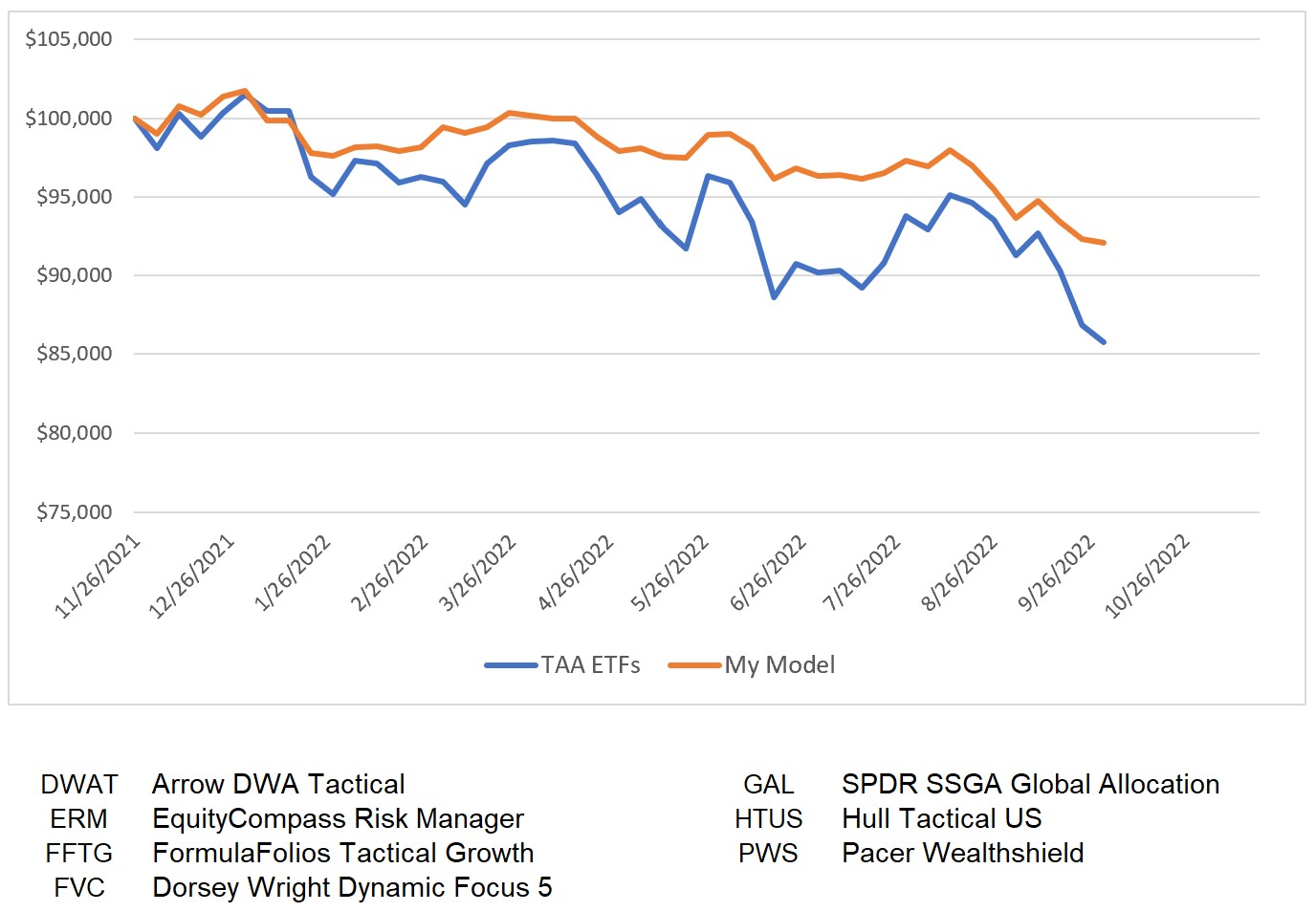

In addition to comparing the performance of a portfolio based on the ETF allocations that I publish here each week, I also compare my model’s performance to a basket of Tactical Asset Allocation ETFs. The period of time covered is too small to be of value but I present it here for your interest.

Tactical Asset Allocations

The move into higher cash holdings permeates most of the TAA models I use. Collectively, my models now have a very high allocation to cash of 85.6%. You may ask “What does such a high allocation to cash mean in terms of a forecast for the near term?” In my opinion, it means little with regard to what happens next. Tactical asset allocation models aren’t predictive; the models I use simply move into the strongest performing ETFs with a positive past performance over the previous one to twelve months.

0 Comments