My 2022 Tactical Asset Allocation Performance

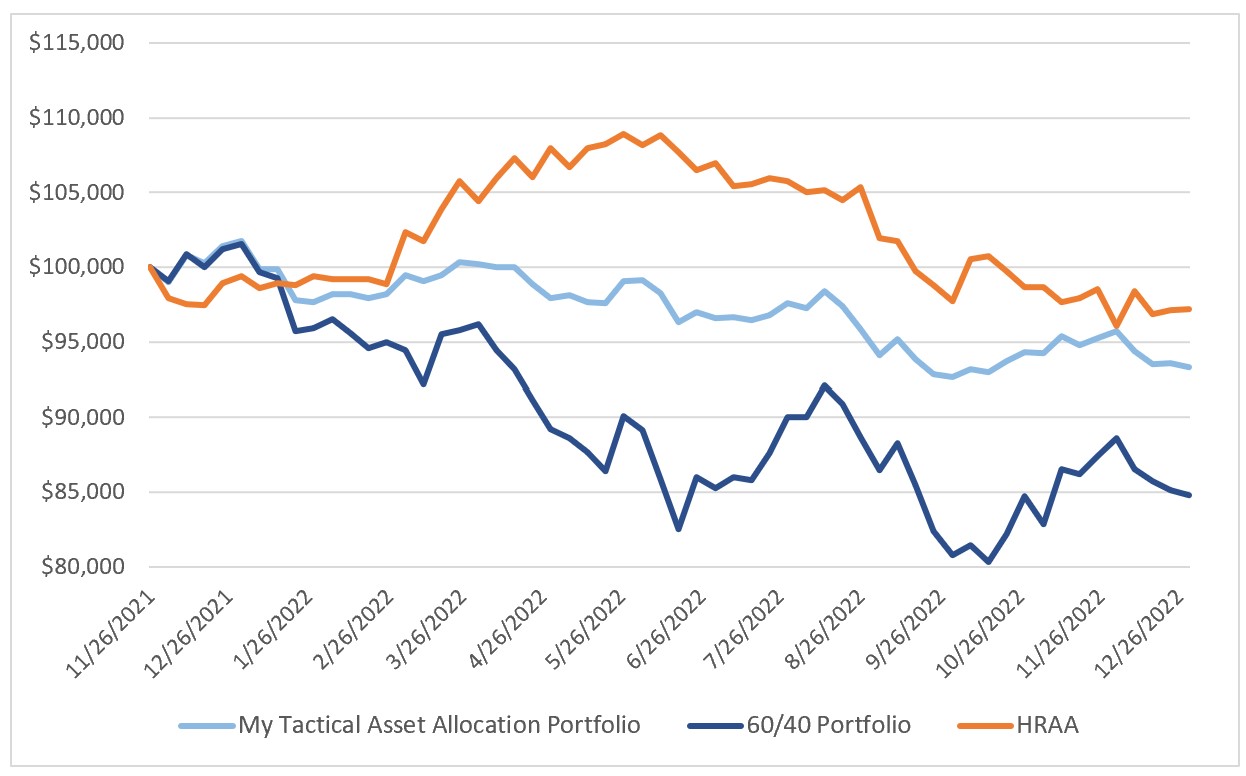

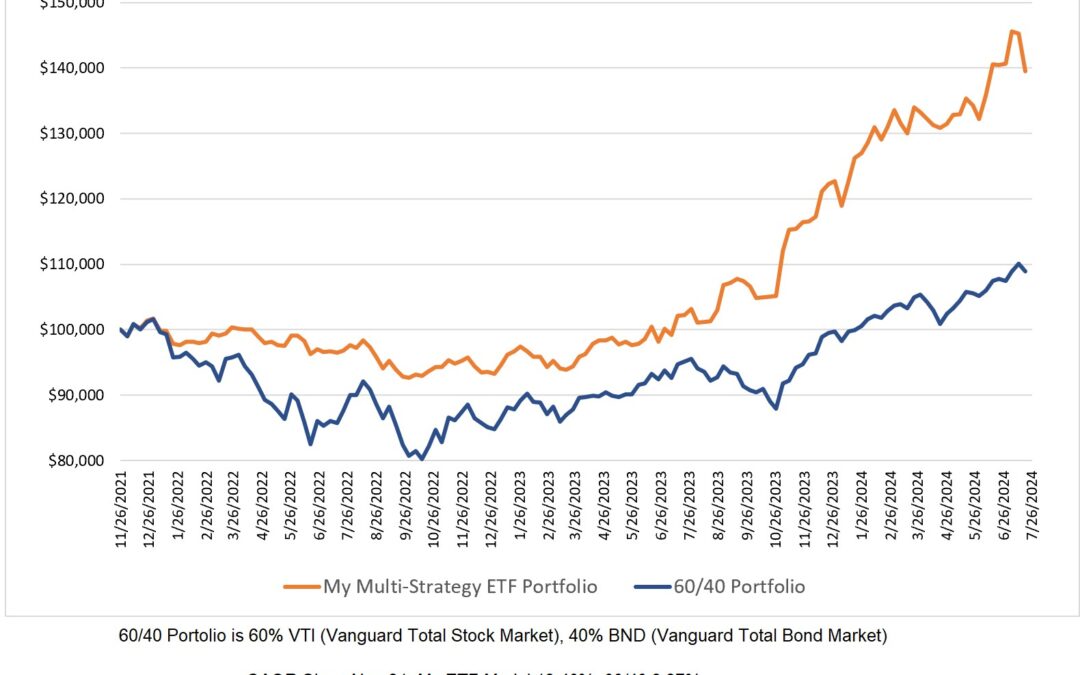

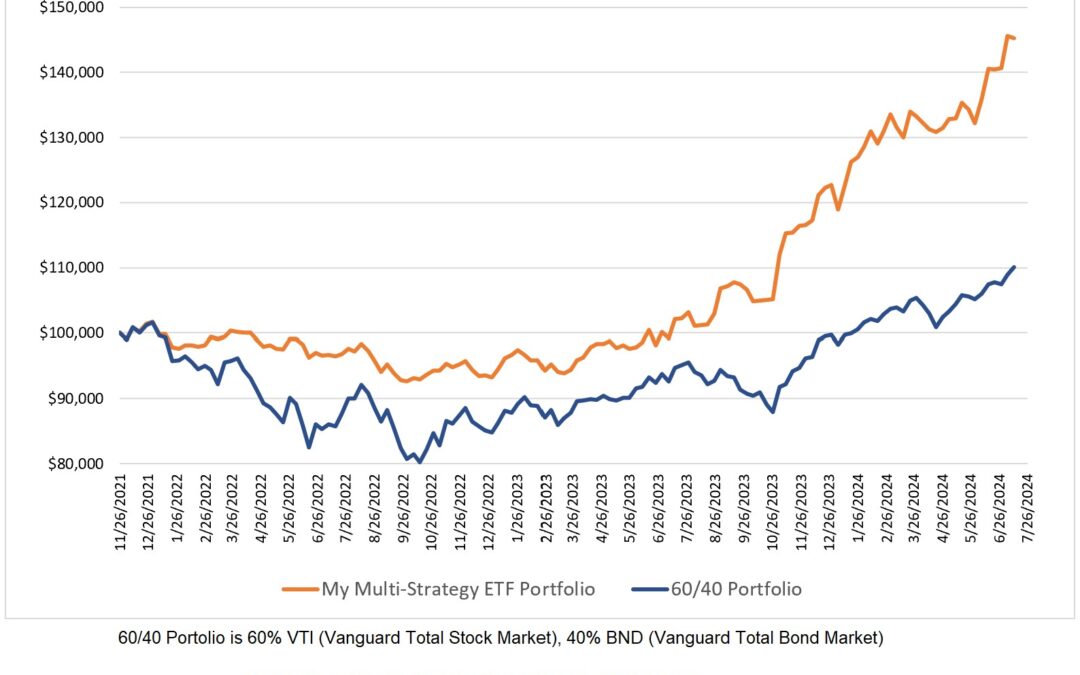

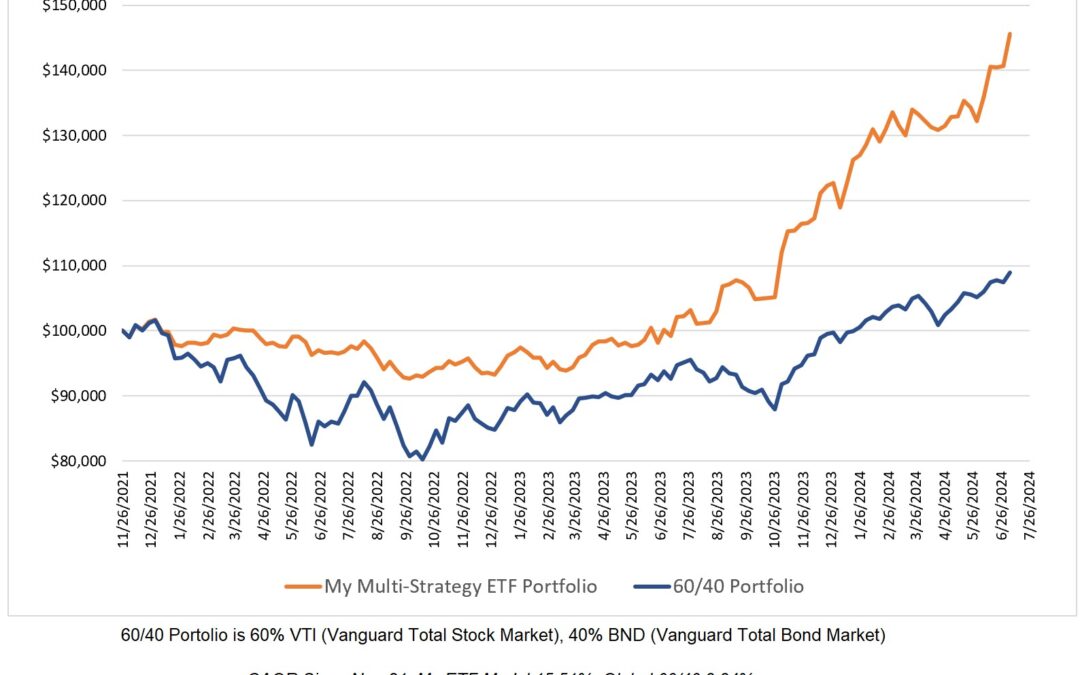

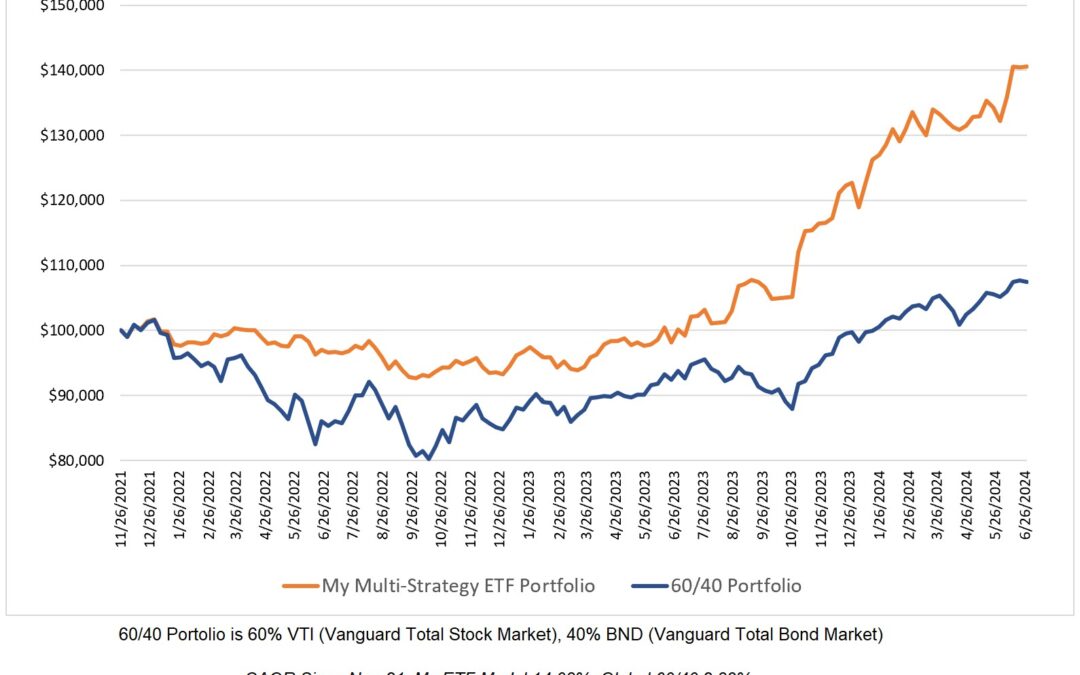

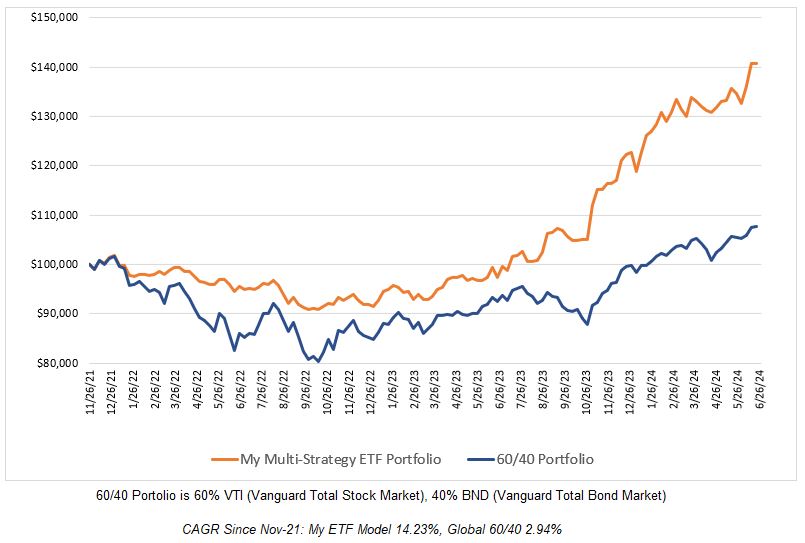

My TAA model finished the year down 8.3% compared to a loss of 16.6% for the 60/40 portfolio.

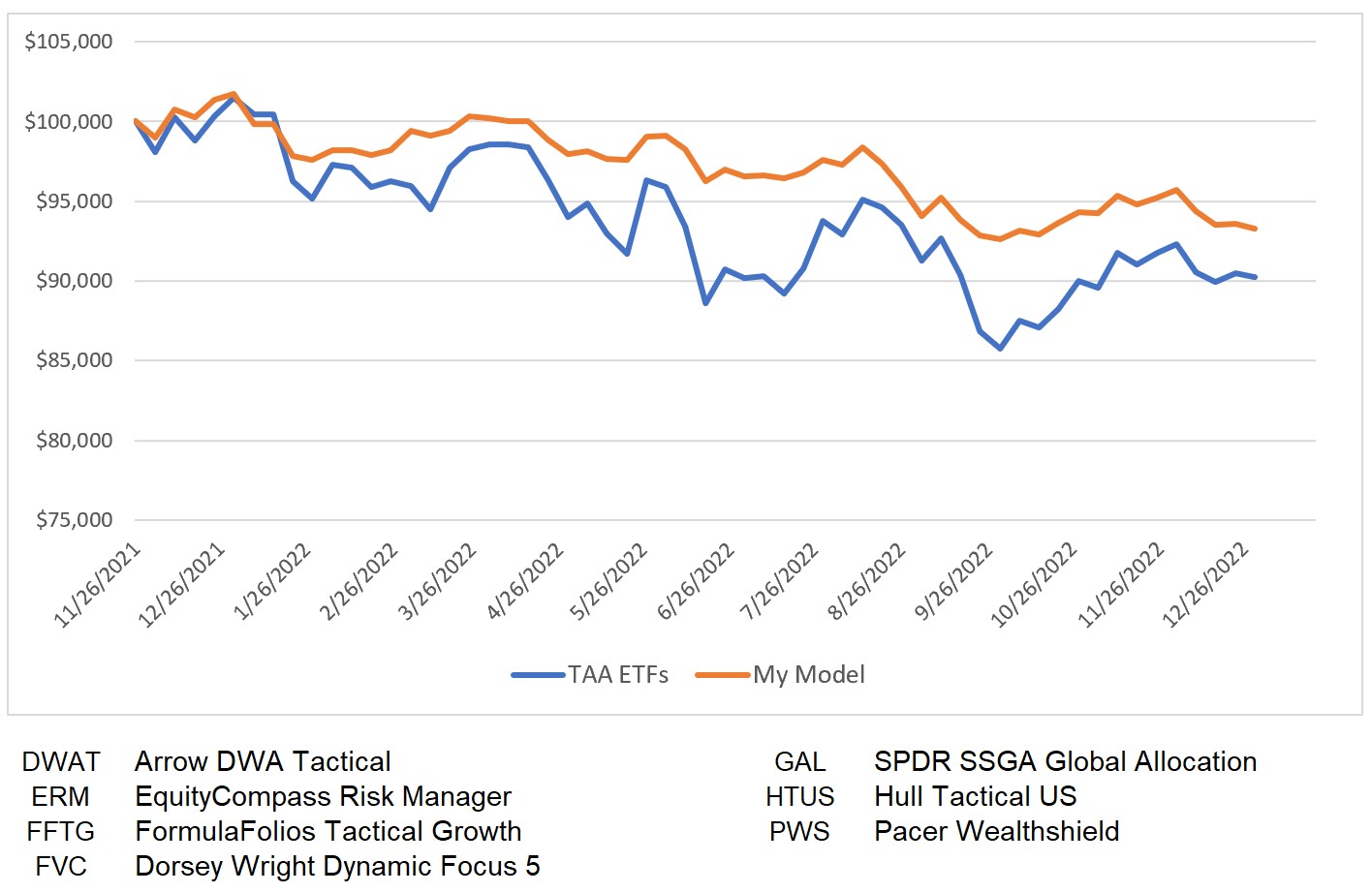

Compared to the average of seven Tactical Asset Allocation ETFs, my model fared well in 2022. Combined, the seven ETFs have roughly $600M in assets under management and my model outperformed those ETFs which is a good indication but I have to bear in mind that it is only a one-year comparison period. What I do like when I look at the equity curves below is that my model had significantly less volatility. There is a saying that each investor has to choose an investing style that they can stick with. The relatively low volatility of my TAA model is a characteristic that I designed my model around. I know that I am more likely to stick with a low-volatility strategy than a high-volatility strategy.

One other characteristic of my model which should become evident over a number of years is that it will likely have a lower drawdown than many other investing strategies. In 2022, my model had a maximum drawdown of 9.0% whereas the 60/40 portfolio had a maximum drawdown of 21.0%. For me, a 21% drawdown would be psychologically painful.

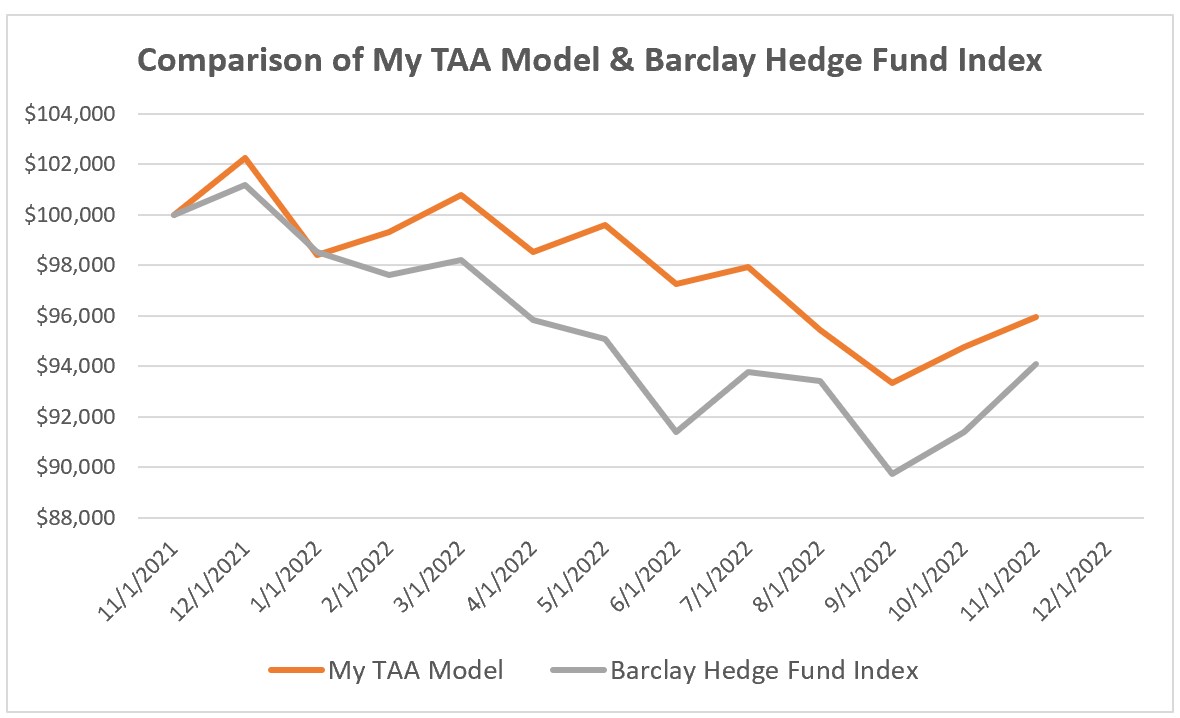

Out of curiosity, I compare the performance of my TAA model to the Barclay Hedge Fund Index which includes over 3,300 funds and as of November 30, my model was ahead of the index for 2022.

My Current Tactical Asset Model Allocations

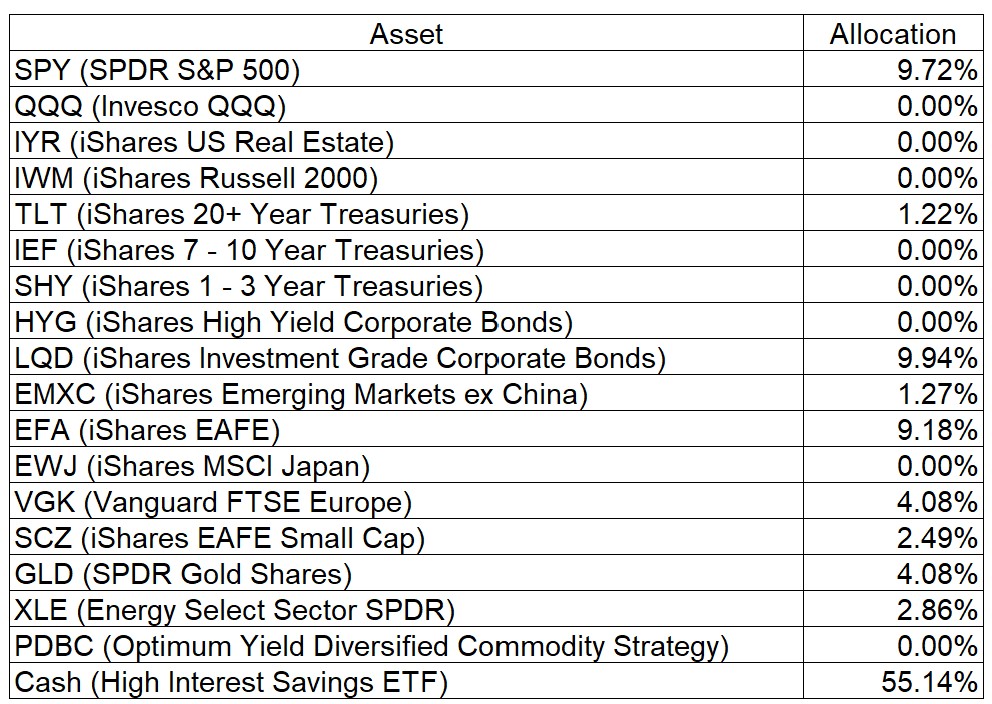

Going forward, I will use EMXC (iShares Emerging Markets ex China) rather than EEM (iShares Emerging Markets) as the emerging markets ETF.

The cash allocation increased again this week as there are lower allocations to equities and bonds.

Open Stock Trades

I currently hold VLO and FANG which have an open profit of 5.3% and an open loss of 0.6% respectively. My open stock trades can always be viewed here.

Predictions for 2023

I hope you didn’t really expect me to make any stock market predictions! Those are futile with the exception that they force you to think about what could happen, how you would react, and possibly if your portfolio is correctly positioned. I let my model select the asset allocations each week and I follow along. Financial media can be somewhat interesting to consume but there are pundits predicting market crashes and market bottoms every day. Some of those pundits are highly educated and have decades of investing experience which can lead one to believe that those predictions are worth listening to. They aren’t.

0 Comments