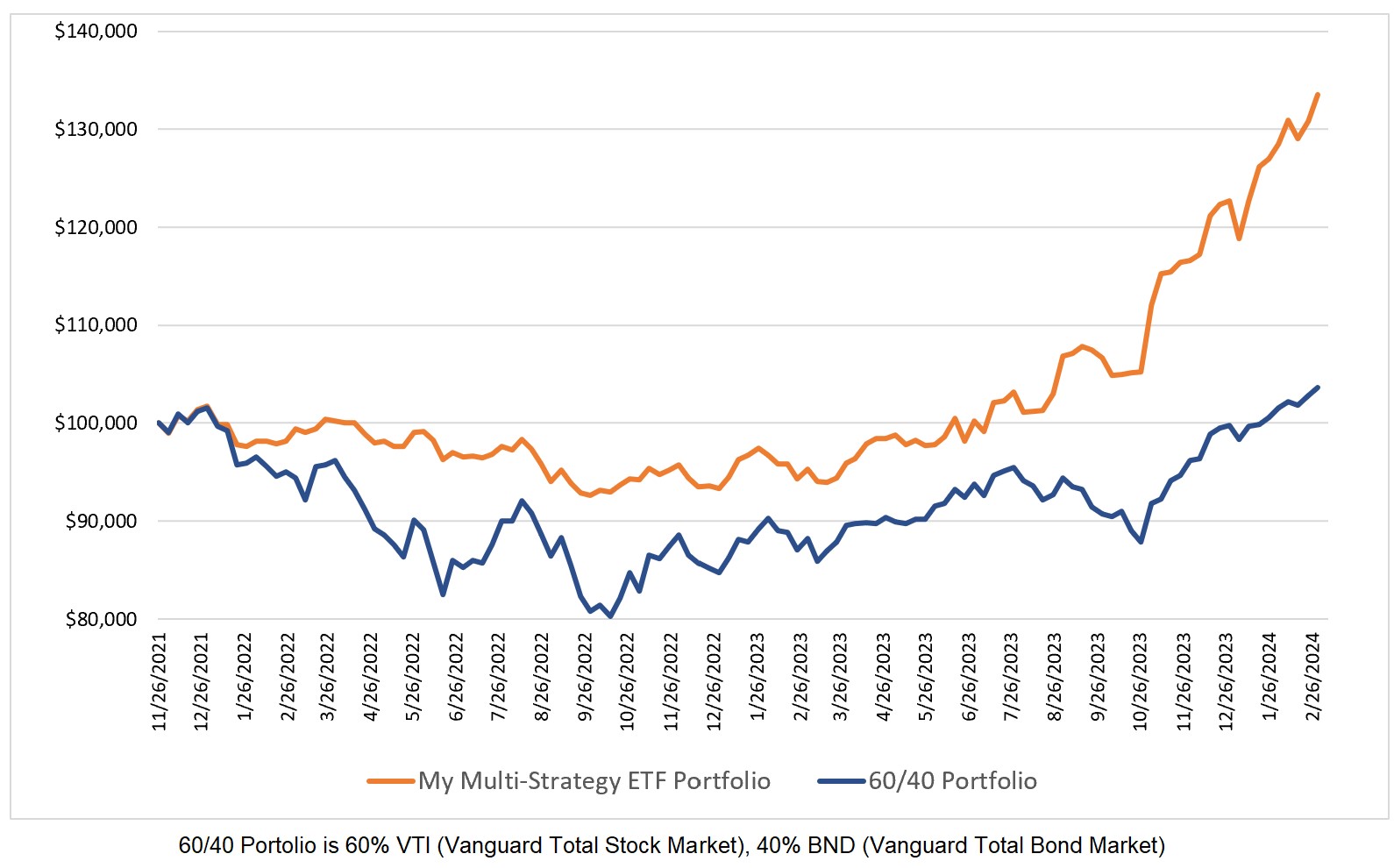

It was another positive week for my global multi-strategy ETF model as it rose by 2.02% compared to an increase of 0.77% for the 60/40 (VTI/BND) model. Since I began posting weekly allocations here in November 2021, my model has generated a CAGR of 13.63% compared to 1.58% for the 60/40 model. Whether such a difference in CAGR’s persists into the future is unknown. I will say that it is a higher spread than I expected based on backtesting. Interestingly, my model has generated a higher return with a lower weekly volatility than the 60/40 model. That’s exactly what I wanted.

There is no change in my model’s allocation as we head into the sixteenth consecutive week of 100% allocation to QQQ.

0 Comments