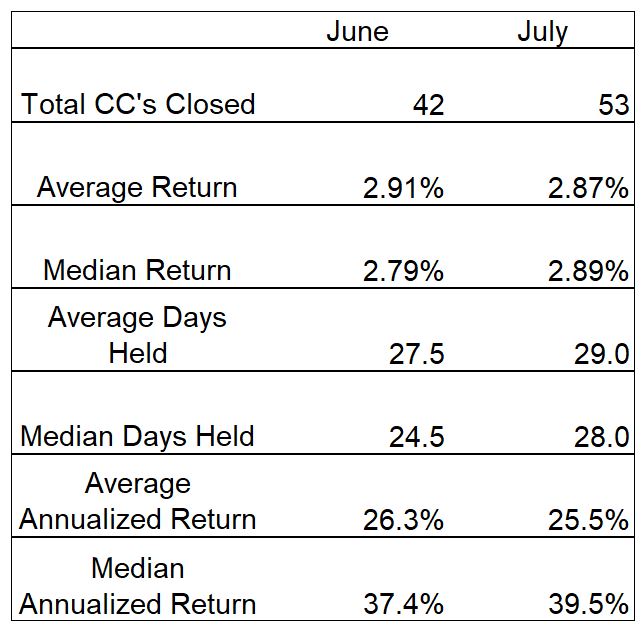

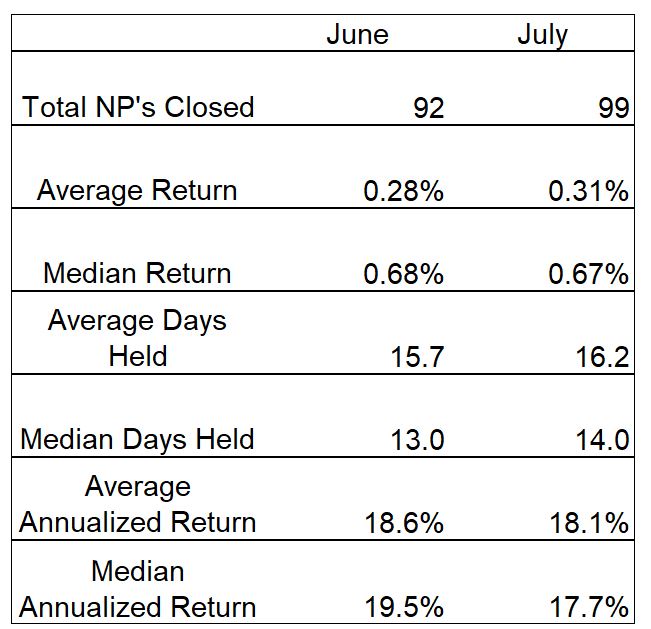

As a somewhat active trader of covered calls and naked puts, I believe it is very important that I record every trade and summarize them monthly to gain an understanding of my trade performance. All is well if the trade performance remains stable but should it begin to falter then it is imperative that I analyze my trades to discover if I should reduce position size.

Covered Calls – Year To Date

Naked Puts – Year To Date

Note: I calculate the annualized returns for my naked put trades as if they were cash secured. This results in much lower calculated annualized returns but that is my preferred method.

In all honesty, posting trade results for everyone to see is easy when the markets favour my strategies and reward me as has been the case so far this year. As the numbers in the above two tables indicate, trading covered calls and naked puts has been rather profitable for me this year and I endeavour to learn how to become better at trading them.

All the best in trading and in life.

0 Comments