November 29

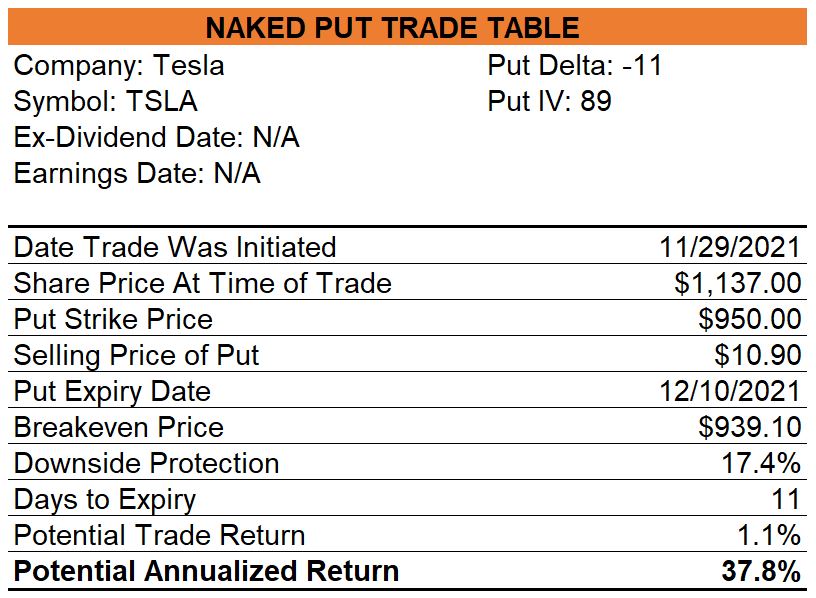

Tesla (TSLA) – Sold Naked Puts

Marathon Petroleum (MPC) – Bought Shares

This is a Tier 1 trade to which I allocated 15.8% of my US equity holdings. I paid $62.24 for my shares of MPC and set up a 5% trailing stop.

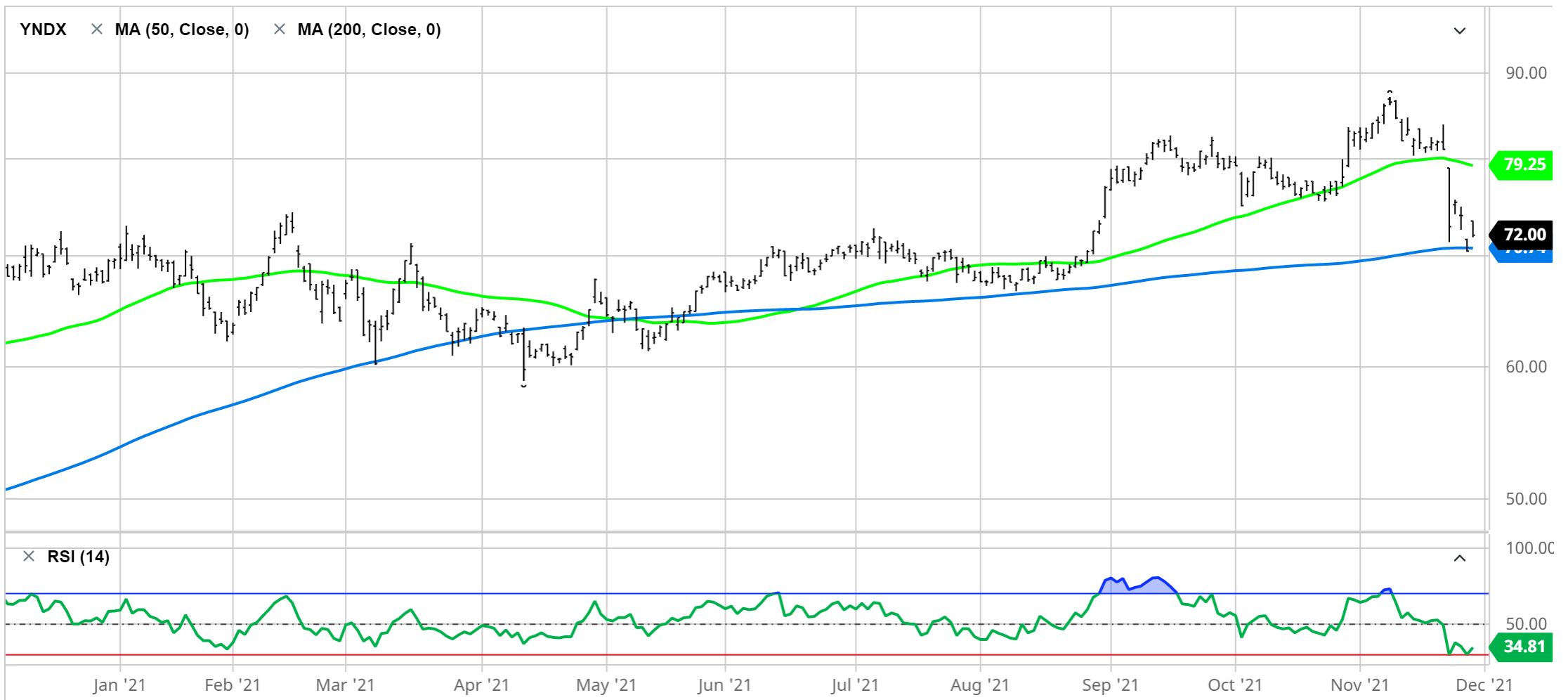

Yandex (YNDX) – Bought Shares

This is a Tier 2 trade to which I allocated 4.5% of US equity holdings. I paid $72.17 for my shares and set up an 8% trailing stop.

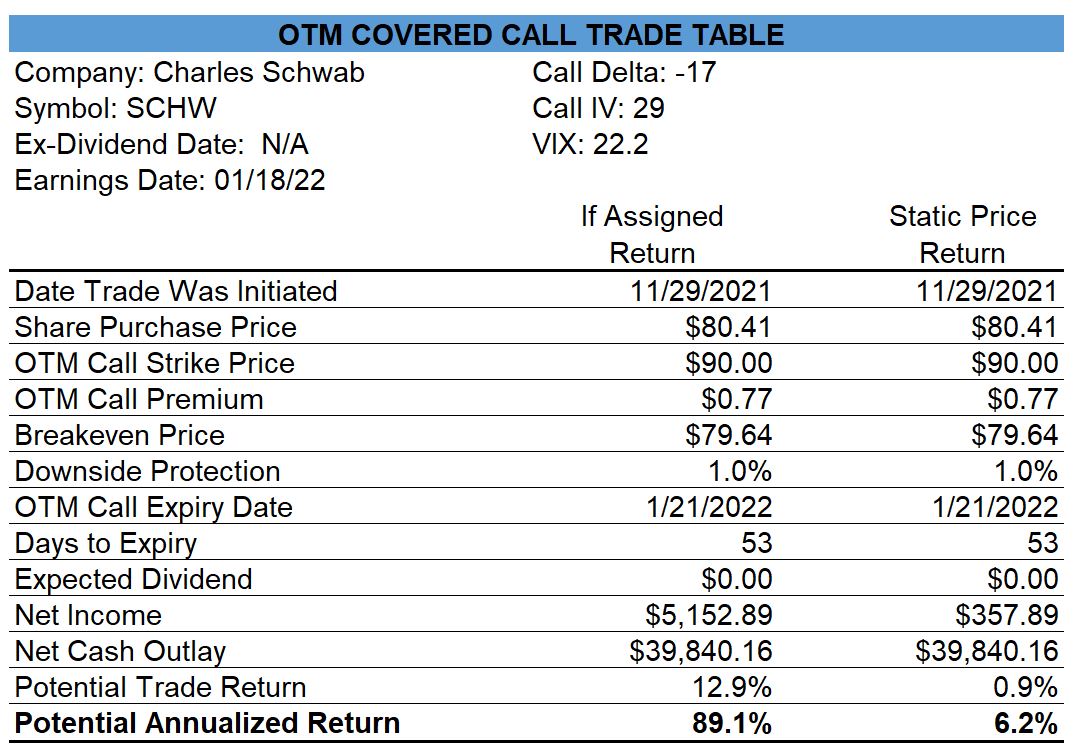

Charles Schwab (SCHW) – Opened Covered Calls

This is a Tier 2 trade to which I allocated 8.8% of my US equity holdings.

November 30

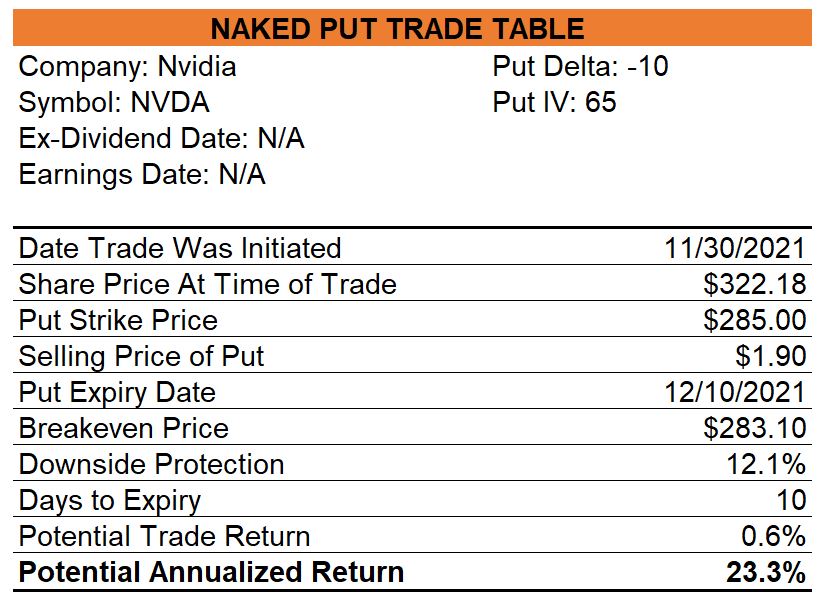

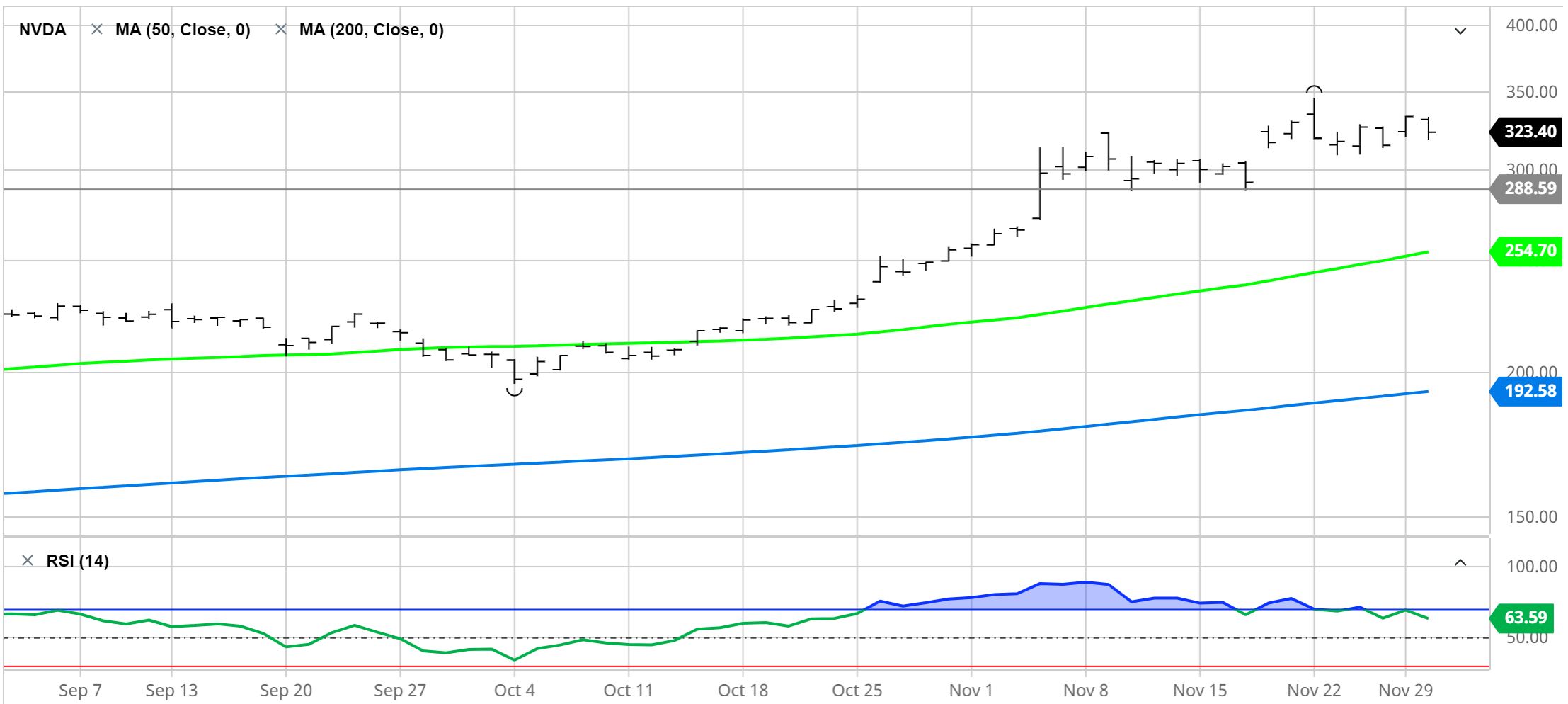

Nvidia (NVDA) – Sold Naked Puts

NVDA Dec-10 $285.00 puts passed my screen today and there appears to be price support at the $288.50 level so I sold the puts for a potential 23.3% annualized return.

December 02

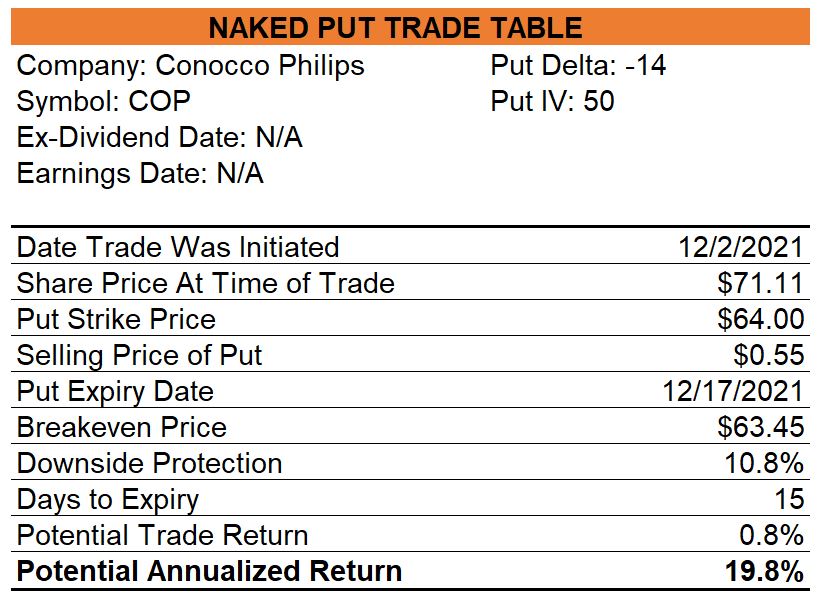

Conocophillips (COP) – Sold Naked Puts

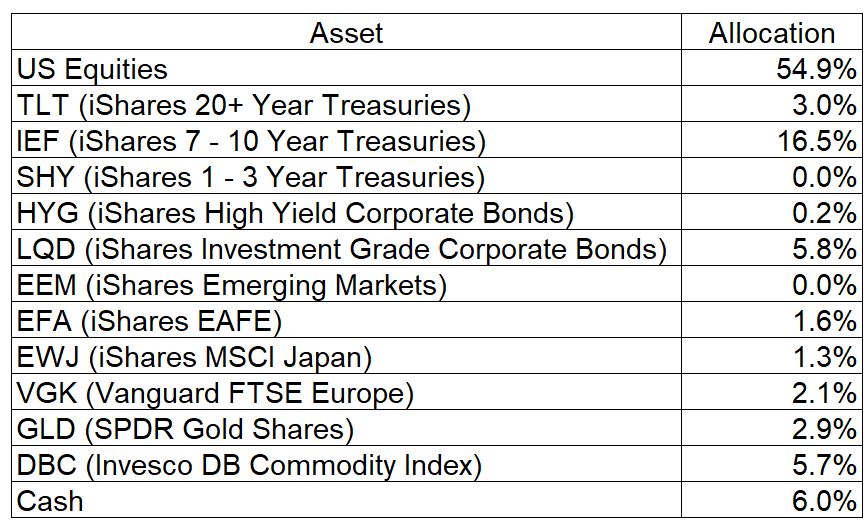

Asset Allocations

My tactical asset allocation model currently has allocations as provided in the table below.

Open Trades

My open trades can always be viewed here.

0 Comments