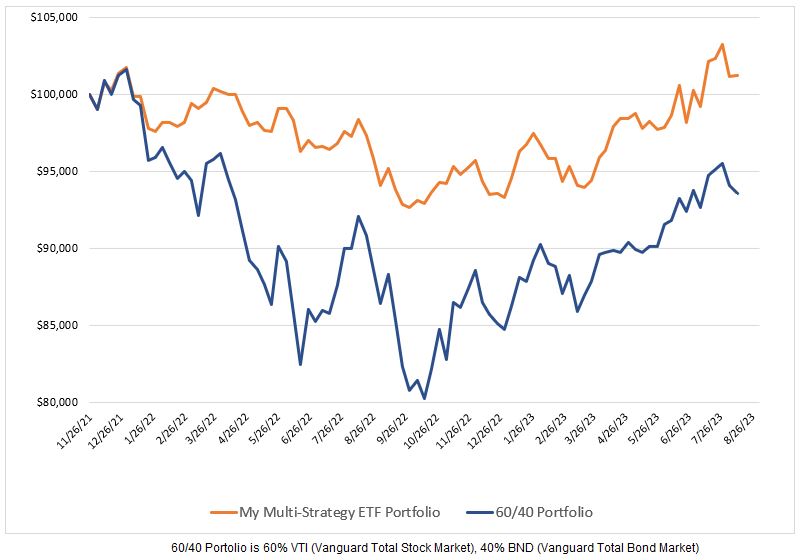

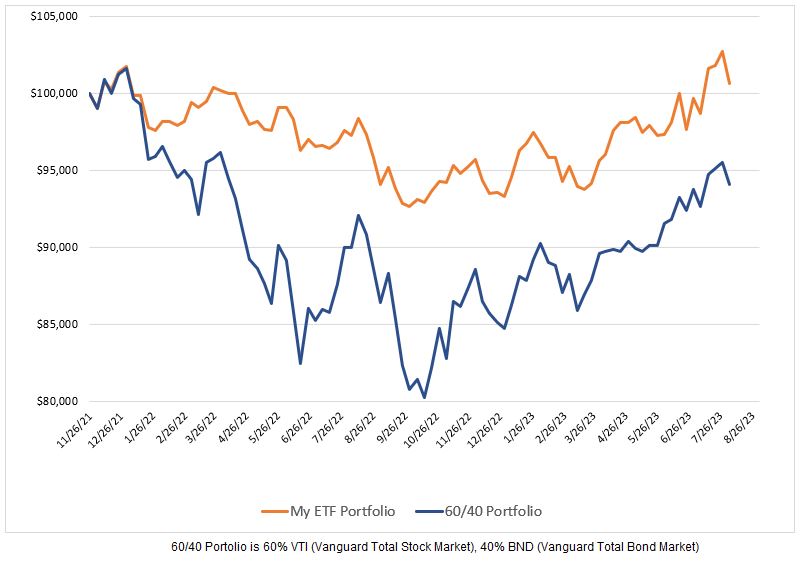

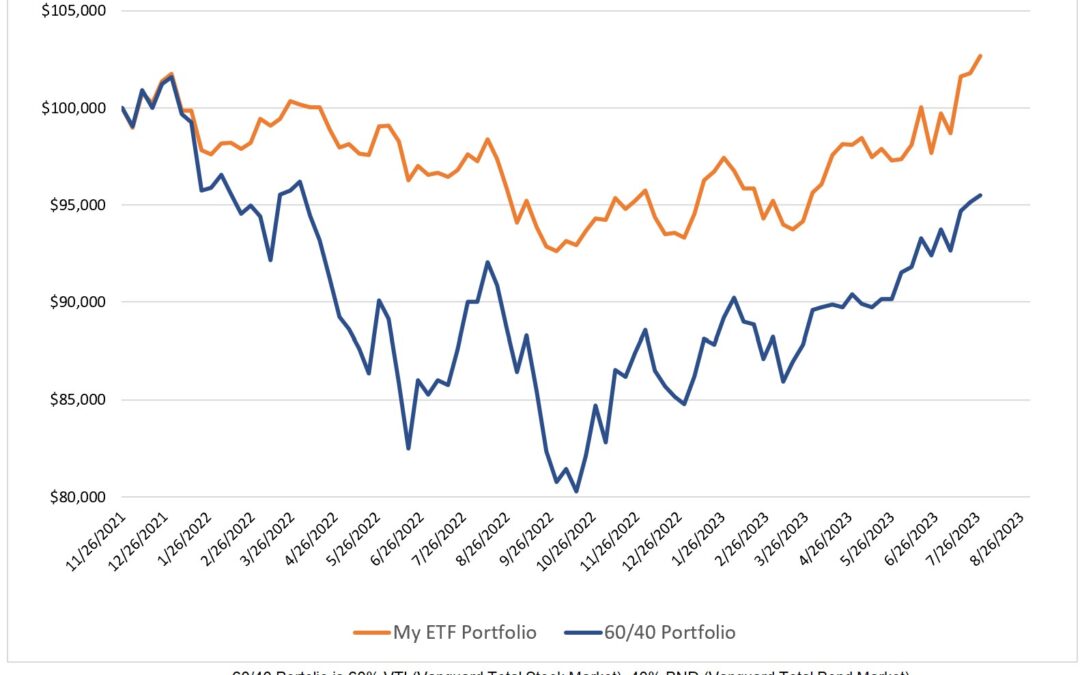

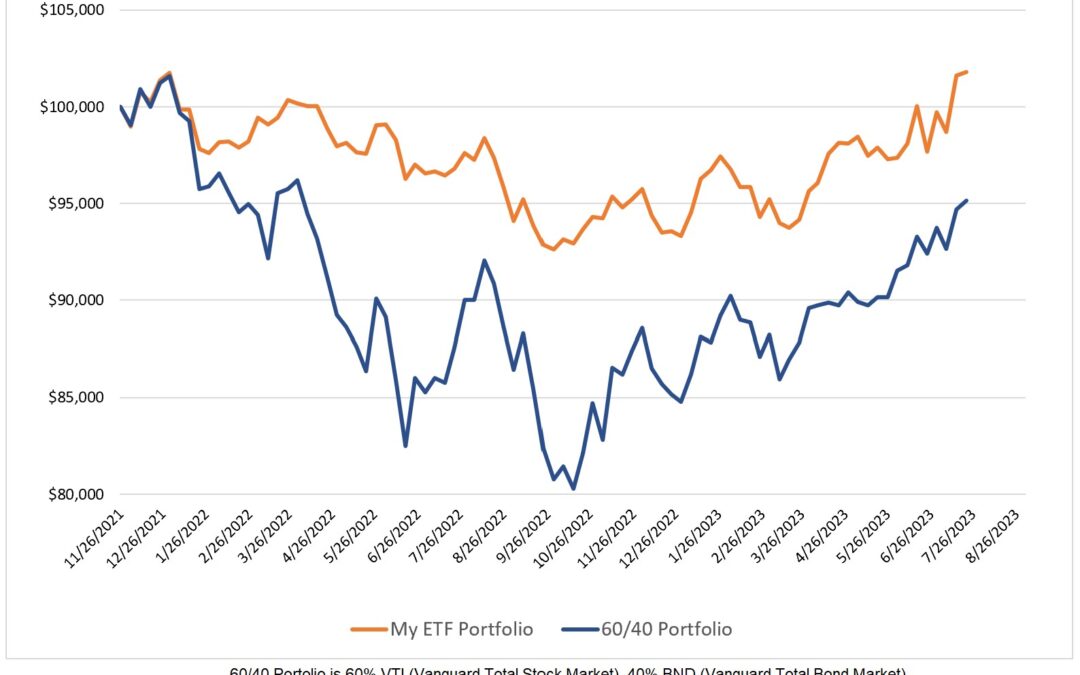

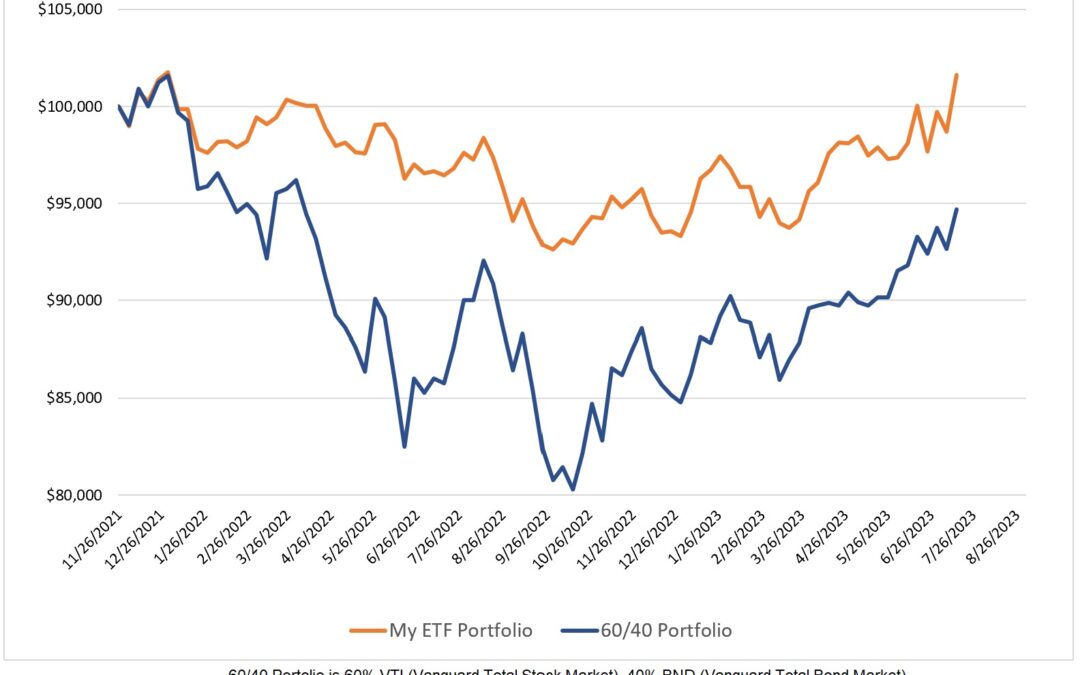

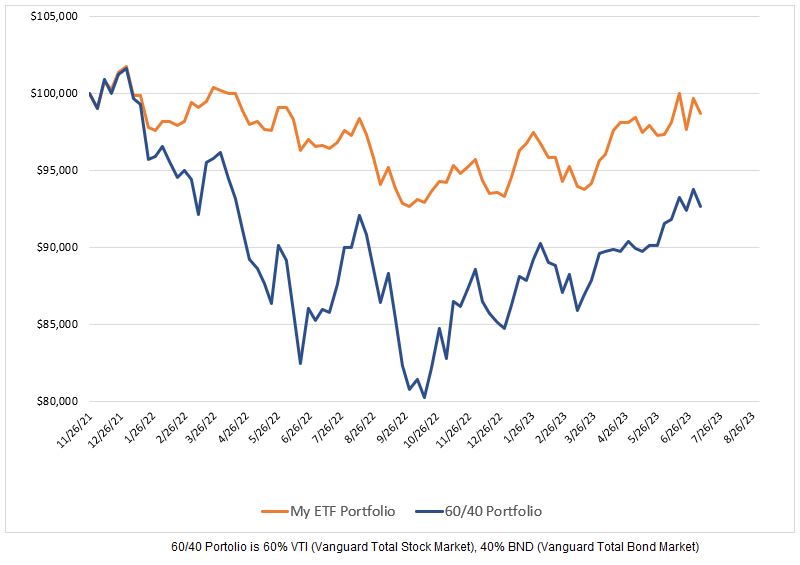

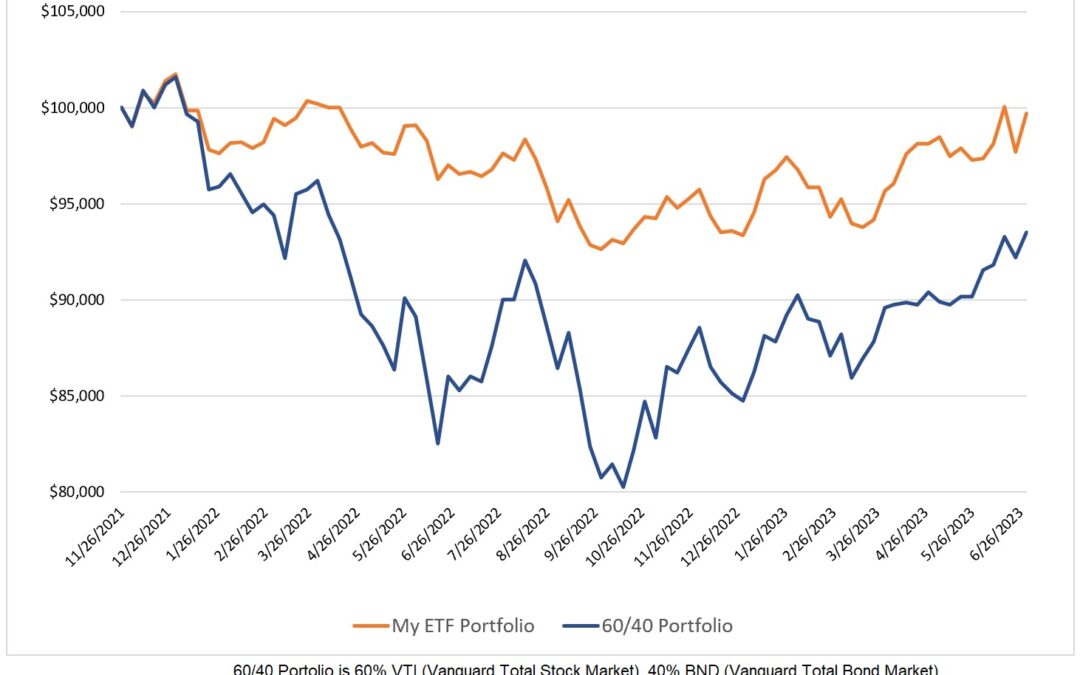

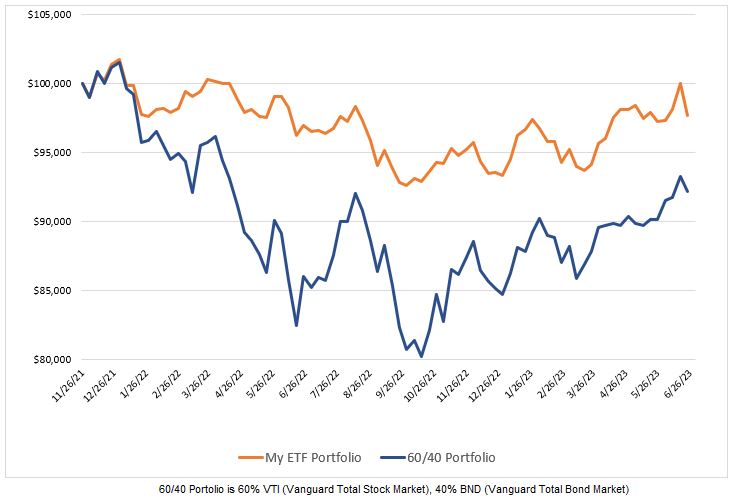

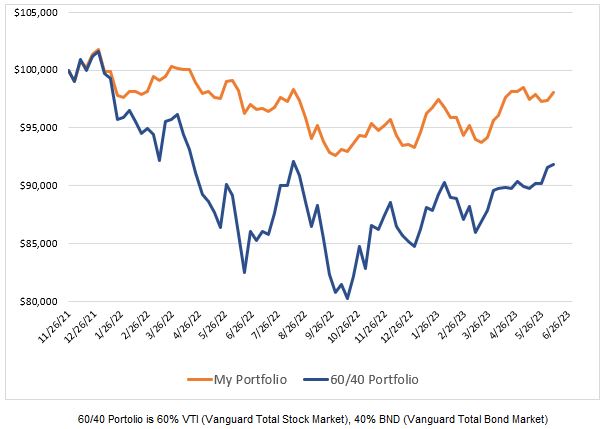

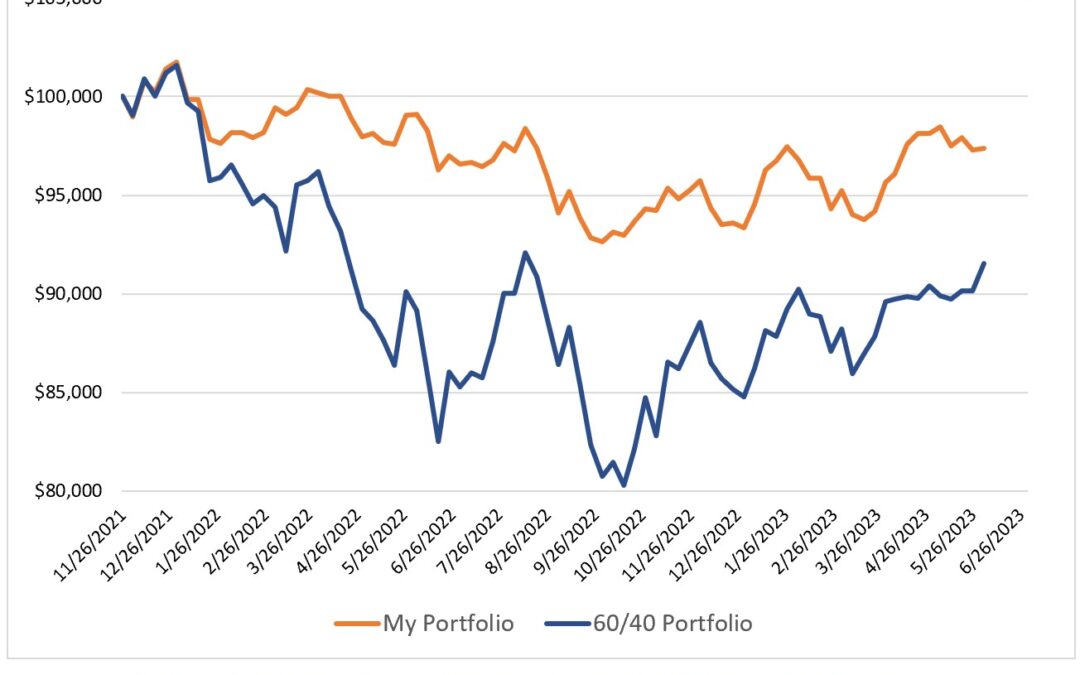

With my ETF portfolio investing solely in BIL, nothing exciting happened this past week. My portfolio rose by 0.10% versus a decline of 0.55% in the 60/40 model. Since I began posting my weekly ETF allocations, my portfolio has a CAGR 4.54% higher than the 60/40 model...