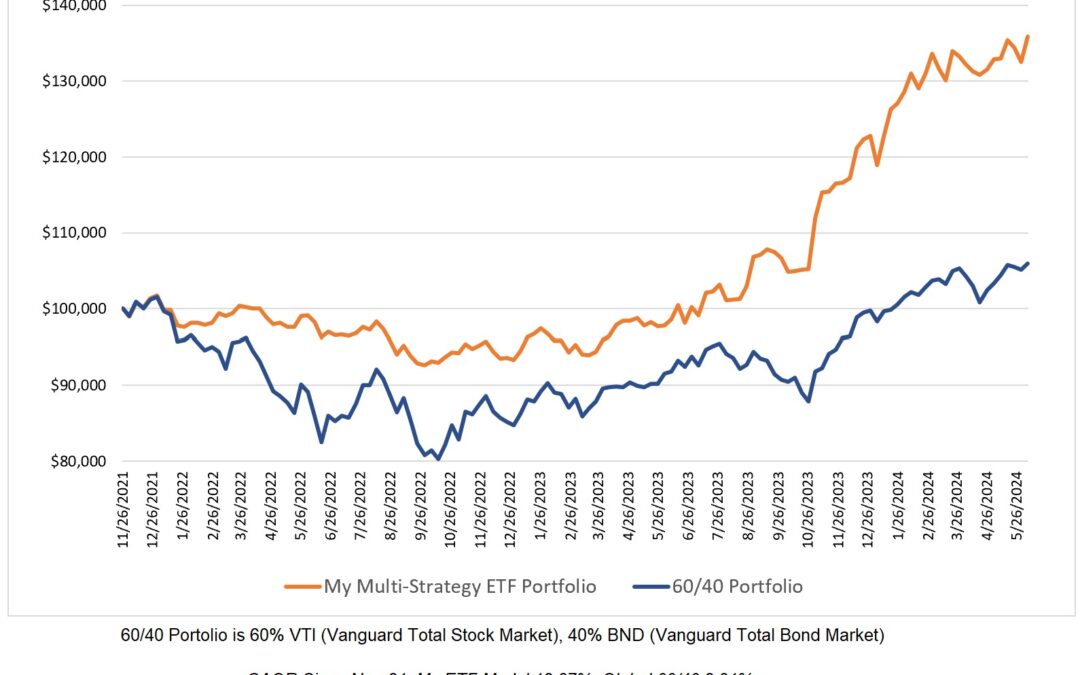

This was a good week performance-wise as my multi-strategy ETF model increased by 2.53% to a new all-time high. There is no change in my model's allocation as it remains 100% invested in QQQ.

This was a good week performance-wise as my multi-strategy ETF model increased by 2.53% to a new all-time high. There is no change in my model's allocation as it remains 100% invested in QQQ.

My global ETF multi-strategy model fell by 1.40% this week and the global 60/40 model fell by 0.34%. There is no change in my model's allocation as it remains 100% invested in QQQ.

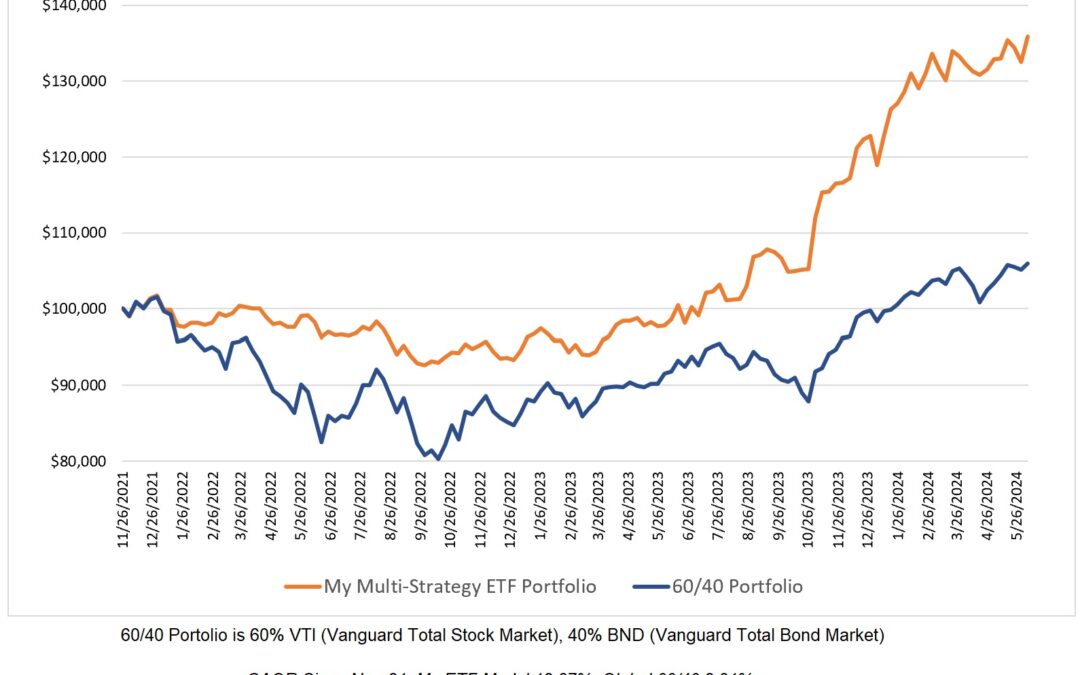

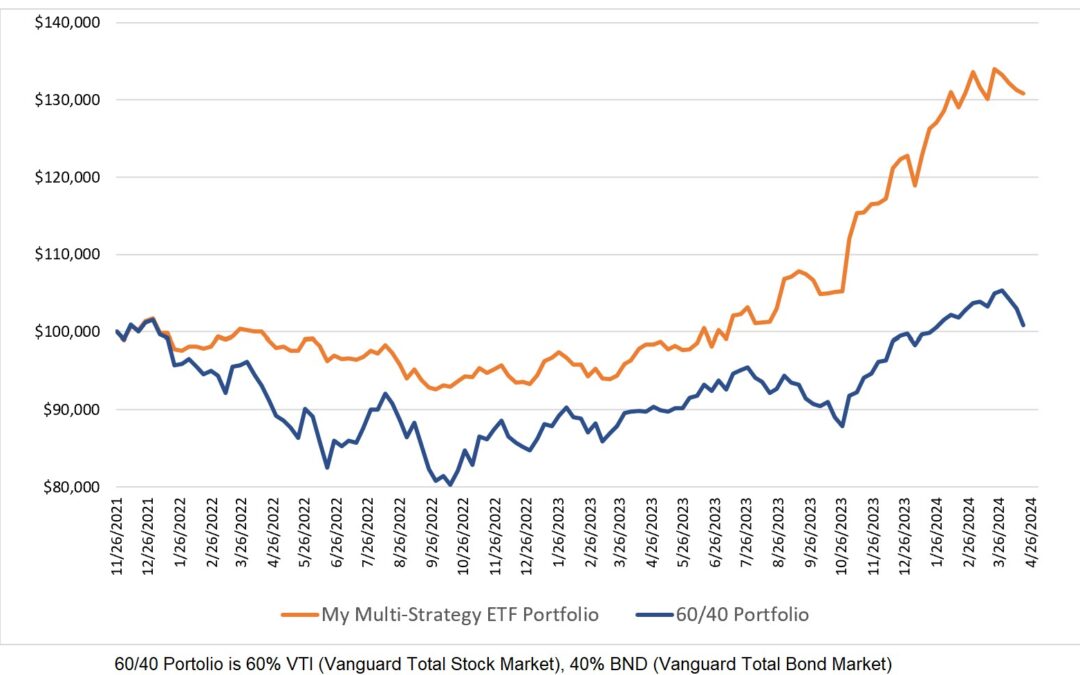

This week, both my ETF multi-strategy model and the 60/40 gave up a portion of the gains from the previous week with my model down 0.77% and the 60/40 down 0.18%. As you can see in the chart above, both models are very close to their all-time highs. Since I began...

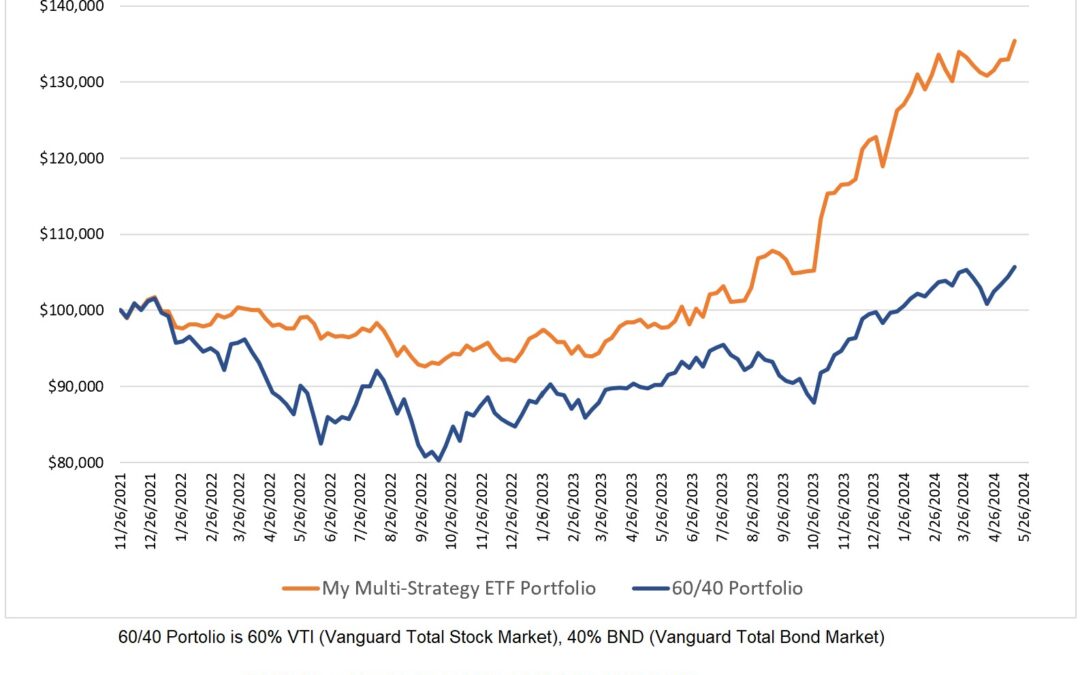

My multi-strategy ETF model hit a new equity high this week and has now produced a CAGR that is 10.76% higher than the 60/40 model since I started posting weekly ETF allocations here in 2021. My model is now equally allocated to EFA (iShares EAFE), IWM (iShares...

It was a positive week for both my global multi-strategy ETF model and the 60/40. My model is now 100% allocated to BIL (SPDR 1 - 3 Month Treasuries).

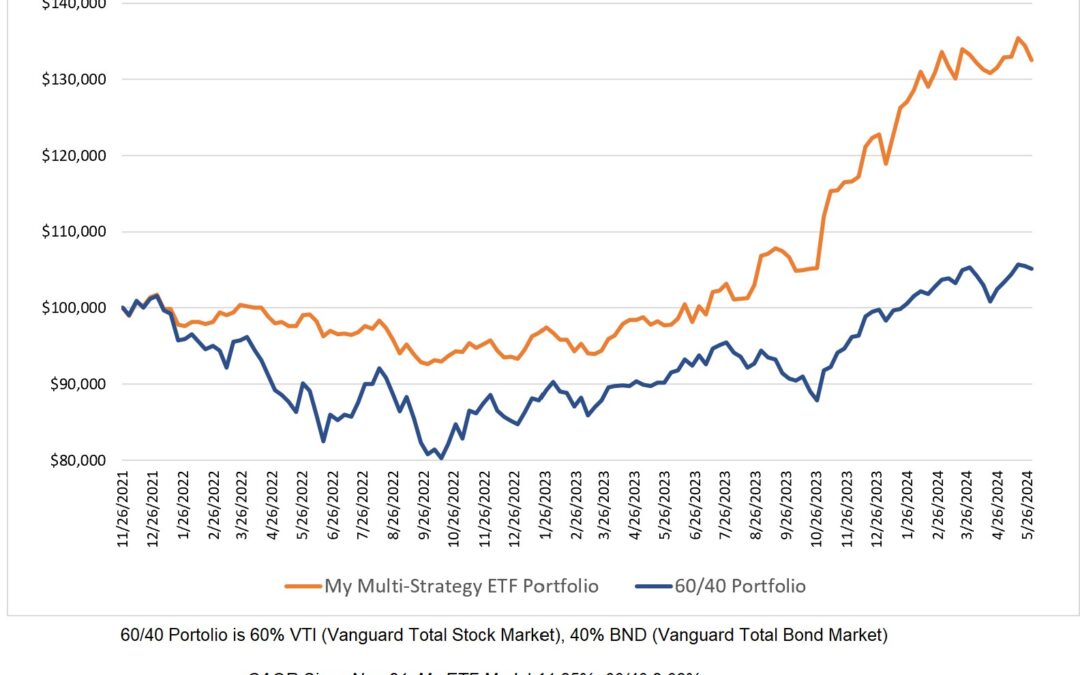

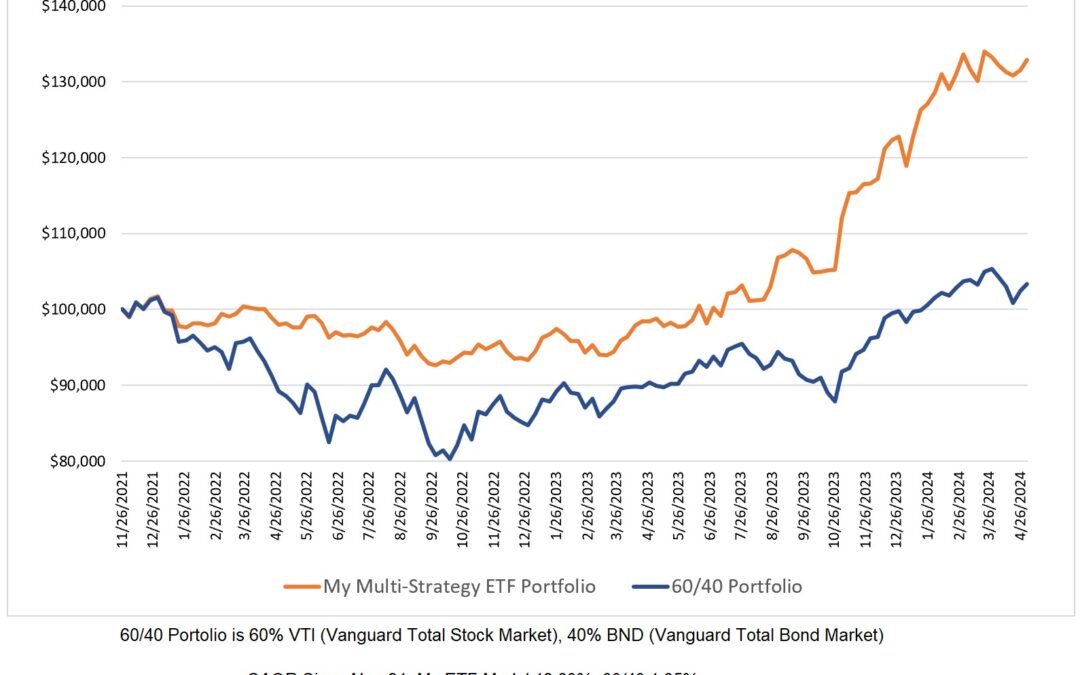

It was a positive week for both my global multi-strategy ETF model and the 60/40 with my model up by 0.50% and the 60/40 up by a healthy 1.57%. Since I began posting weekly ETF allocations in November 2021, my model has produced a CAGR that is 11.0% higher than the...

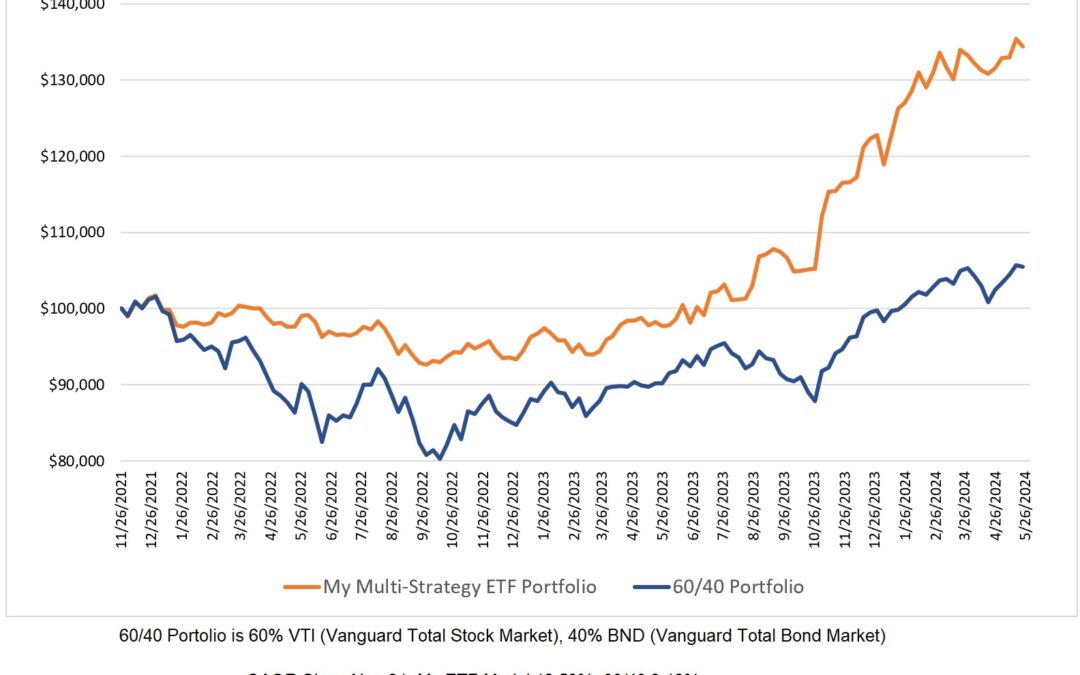

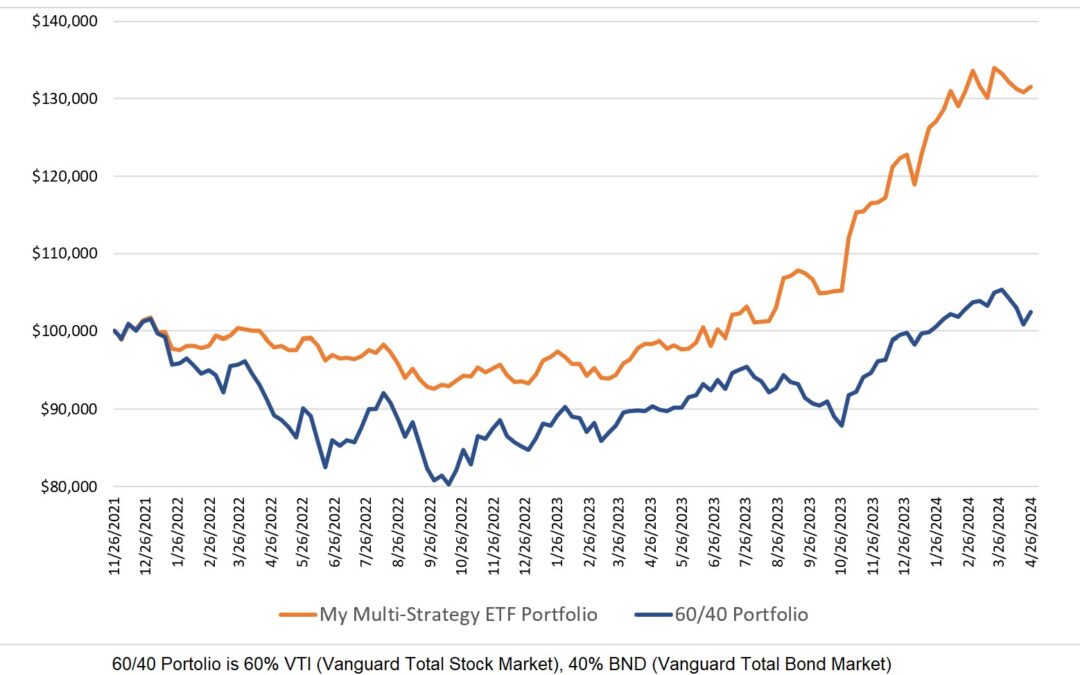

My global multi-strategy ETF model mostly side-stepped an ugly week in the markets as it lost 0.35% compared to a 2.07% loss for the 60/40 model. My model has new allocations as per the table below. This is the first time in months that my model did not have an...

This past week was one in which it was hard to hide from falling prices. Both my Global Multi-Strategy ETF model and the 60/40 fell in price. My model has changed allocations to 66.7% BIL (SPDR 1 - 3 Month Treasuries) and 33.3% PDBC (Optimum Yield Diversified...

My global multi-strategy ETF model is up 8.2% year-to-date compared to 4.7% for the 60/40 model. The allocation to QQQ only has ended as my model now has allocations to five ETF's as noted in the table below.

For the twentieth consecutive week, my global multi-strategy ETF model remains 100% allocated to QQQ. My model has increased by 38.8% over the past year compared to a 17.3% increase in the 60/40 model. To be honest, this much outperformance in one year is a lot higher...