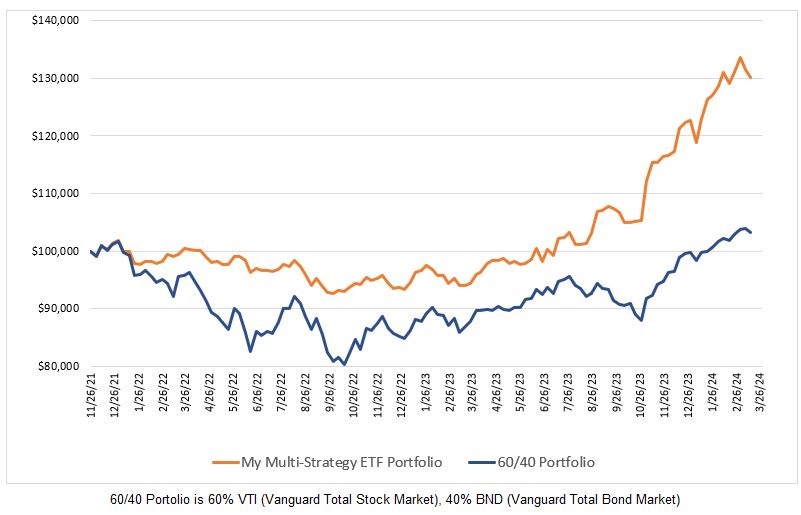

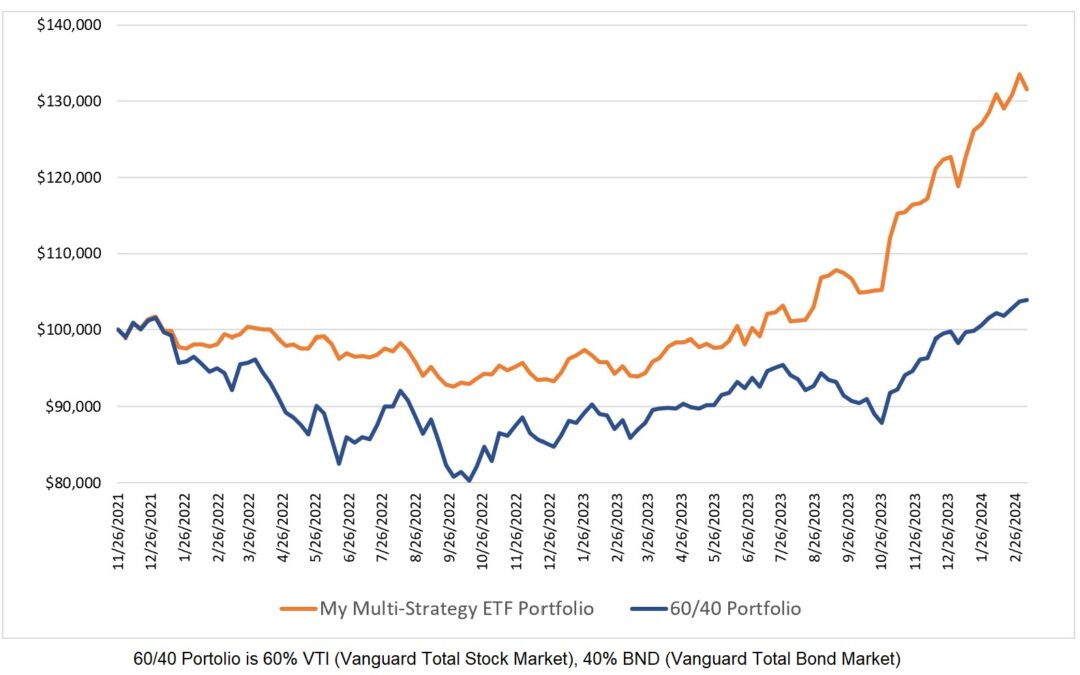

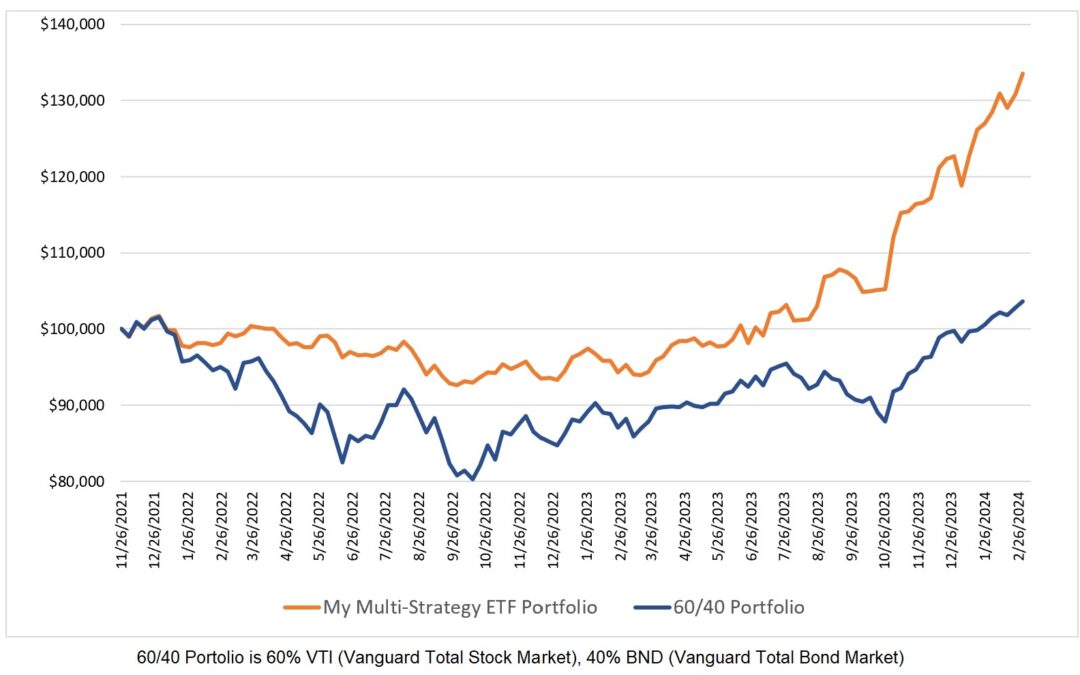

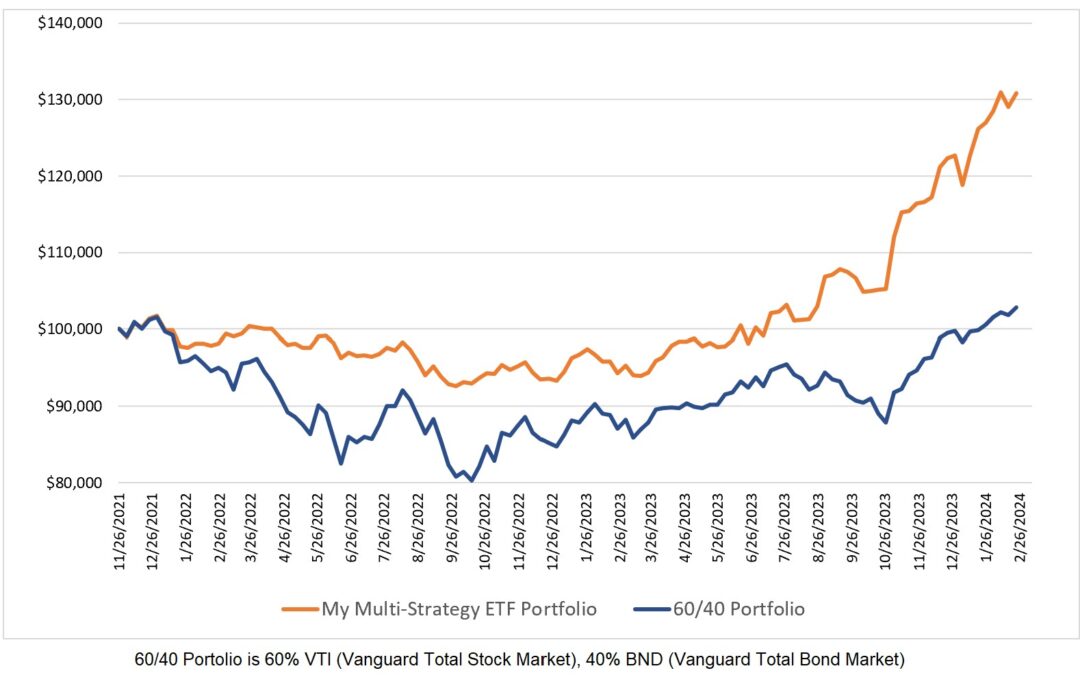

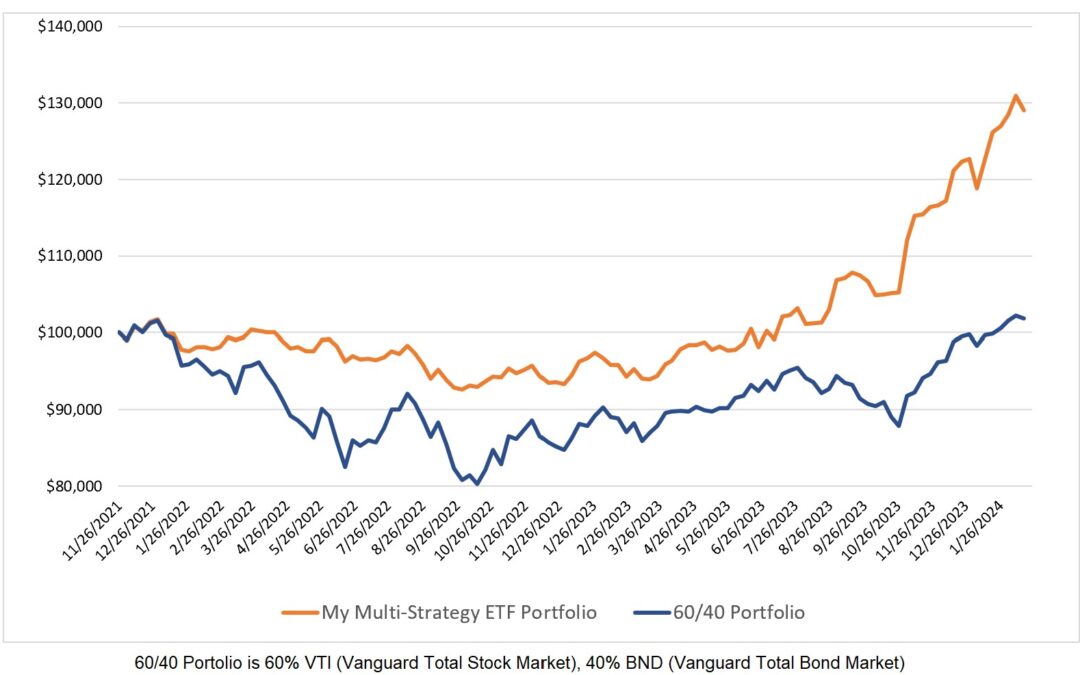

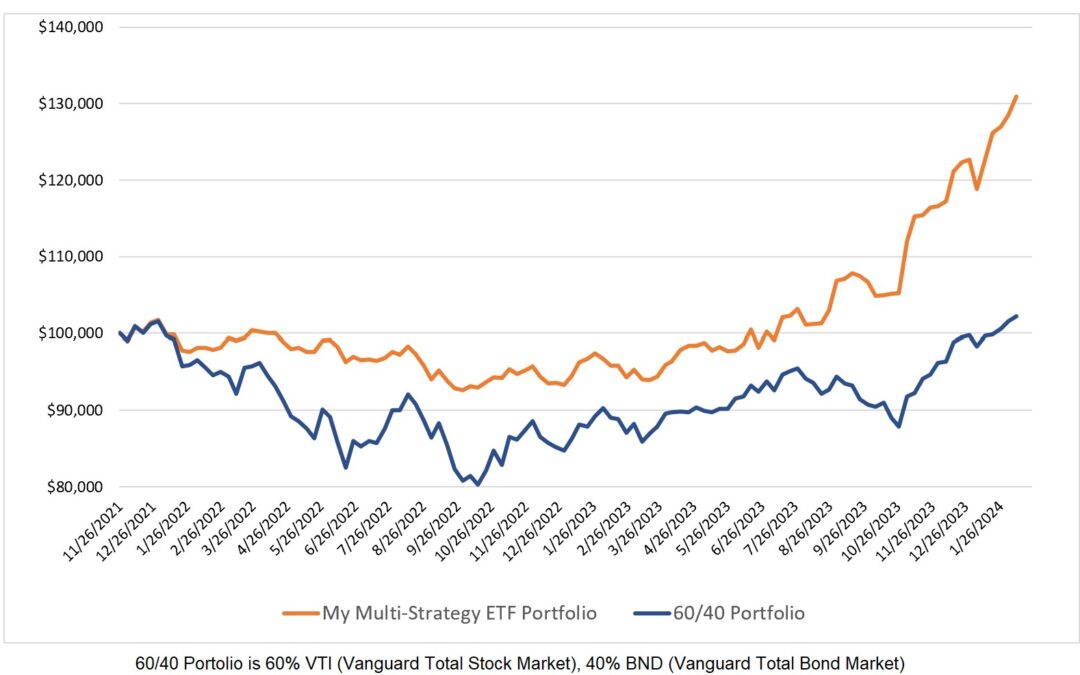

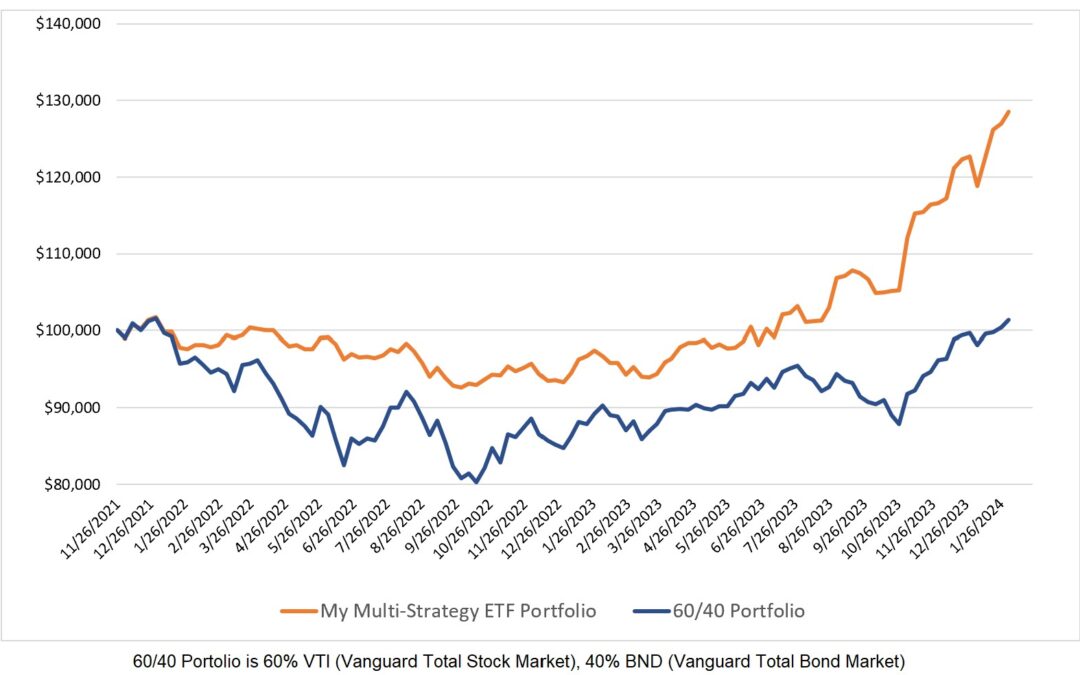

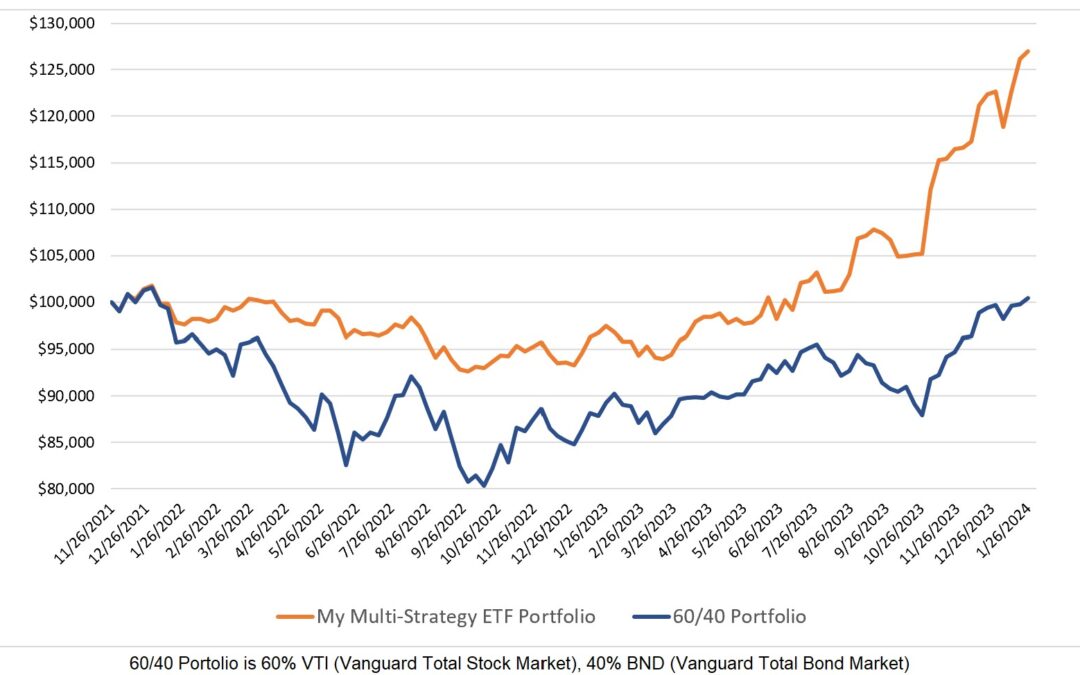

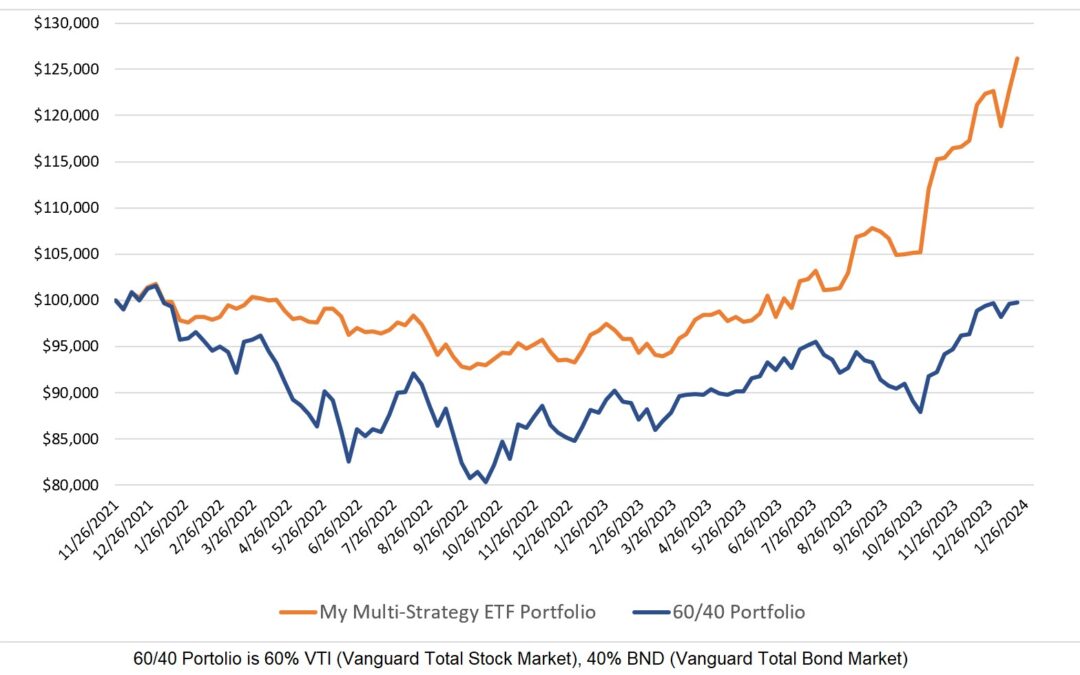

My global multi-strategy ETF model rose by 3.01% this past week compared to a 1.43% increase in the 60/40 model. Since I began posting weekly ETF allocation updates here, my model has achieved a 13.38% CAGR versus a 2.01% CAGR for the 60/40 model. For the 18th...