If you haven’t heard of a covered strangle, don’t be alarmed. It is a relatively simple stock and option combination that is rarely discussed in the financial media. Essentially, a covered strangle is a covered call plus a short put. Given that a covered call is a long stock/ETF position and a short call, a covered strangle therefore is a combination of a long stock/ETF position, a short put position and a short call position with both options having the same expiry date. The put and call would typically have the same expiry date and similar deltas when the trade is initiated.

The Options Industry Council has a concise explanation of a covered strangle here including possible profits, losses, influence of volatility and when to use a covered strangle.

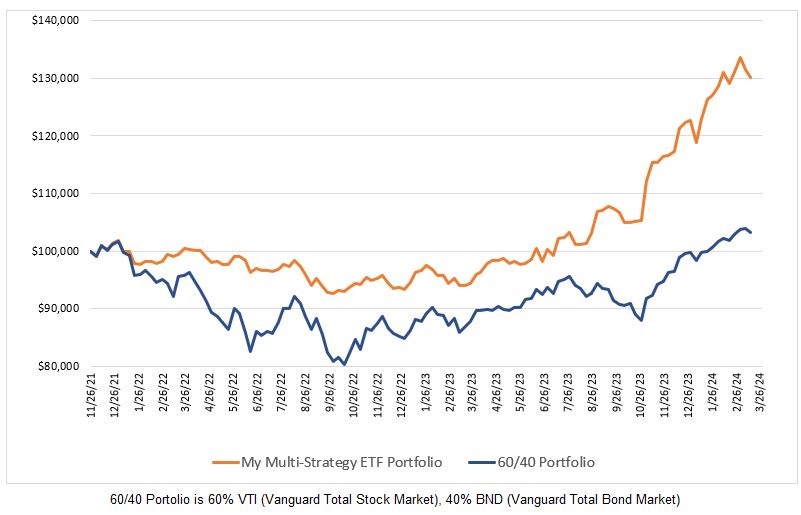

Most of my investment portfolio is constructed based on tactical asset allocation (TAA) models using a basket of liquid US ETF’s. One of the strategies I am considering using to slightly improve the performance of my TAA investments is the use of a covered strangle with SPY.

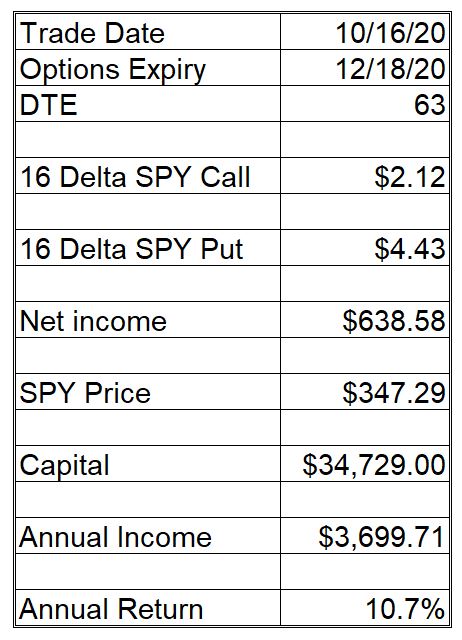

The table below provides an idea of the revenue that would be generated for one covered strangle using SPY.

The annual return is based on the assumption that both the call and the put options expire worthless. This is a scenario that I expect to rarely occur. I will close the option positions before expiry using a profit target, maximum loss and time stop rules.

As always, there are no free lunches especially when options are involved. For me, using a covered strangle adds risk to my TAA investment strategy. There is risk associated with the price of SPY falling below the put strike price. When that happens, I will typically buy back the put at a loss. The income that I received from selling a call at the same time as I originally sold the put will reduce the overall loss but there could still be a loss.

My intent is to open a covered strangle on 100 shares of SPY and post all the trade transactions for the next year here so you can follow along and gain an understanding of intricacies of managing a covered strangle.

0 Comments