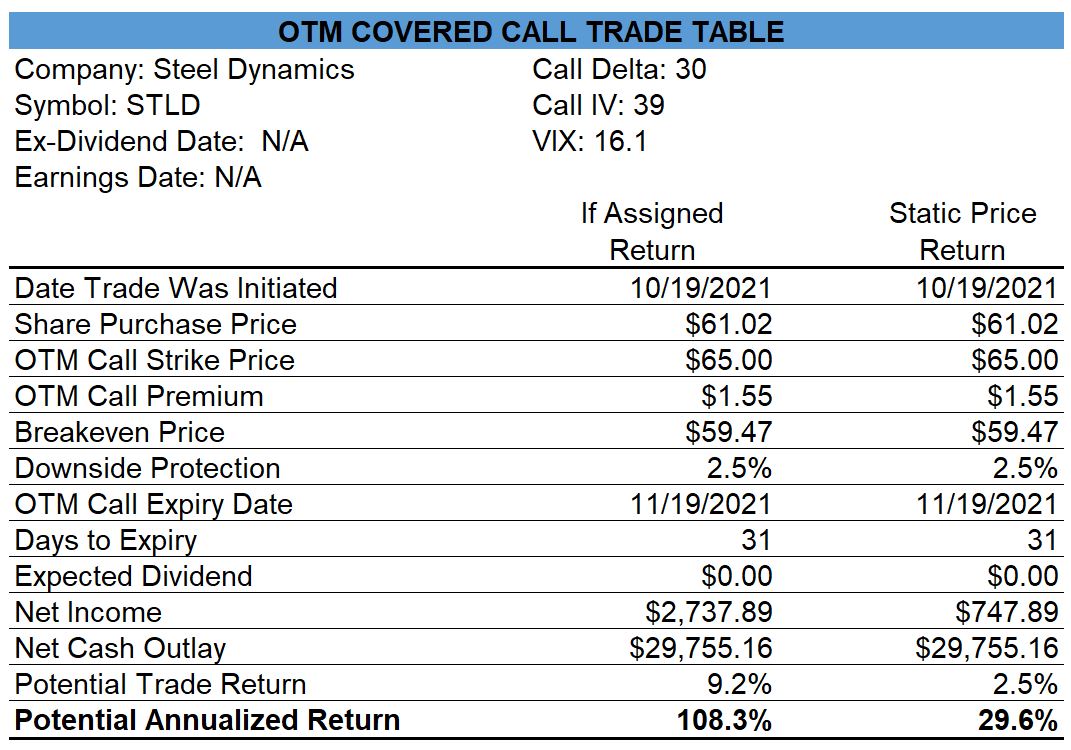

October 19

Steel Dynamics (STLD) – Opened Covered Calls

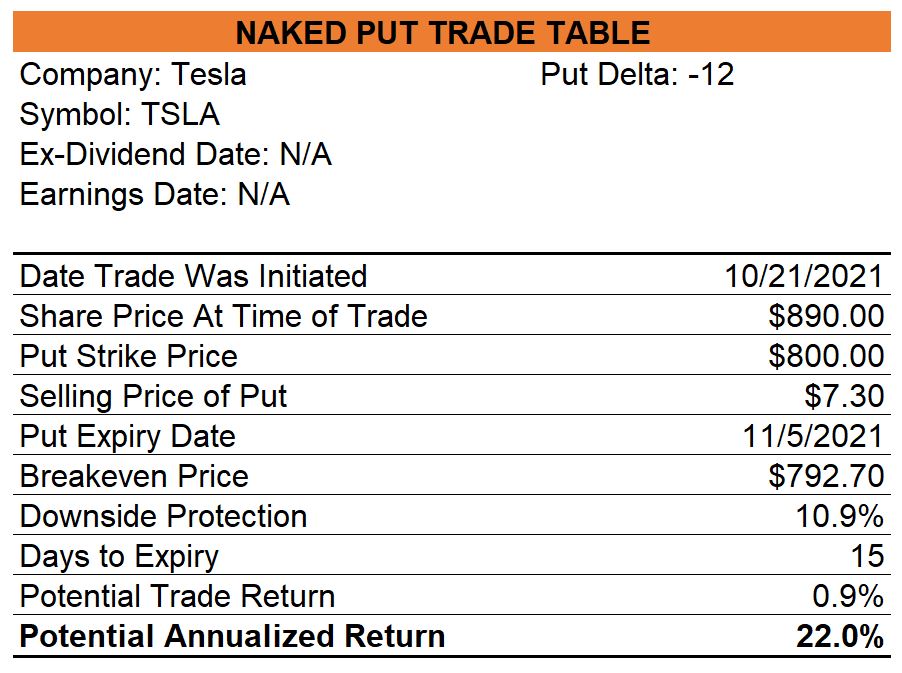

October 21

Tesla (TSLA) – Opened Naked Puts

This is the fifth time that I have sold naked puts on Tesla since late July. All have closed OTM (so far).

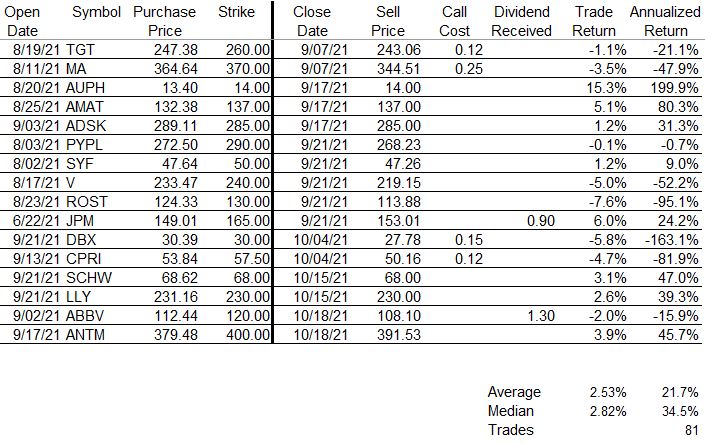

Covered Call Trade Performance

So far in 2021, I have closed 81 covered call trades which have generated an average annualized return of 21.7%. How does my trade performance compare to holding SPY you ask? Well for the trades posted here, the average improvement over buying and holding SPY is 7.9% annualized and the median improvement is 19.2% annualized.

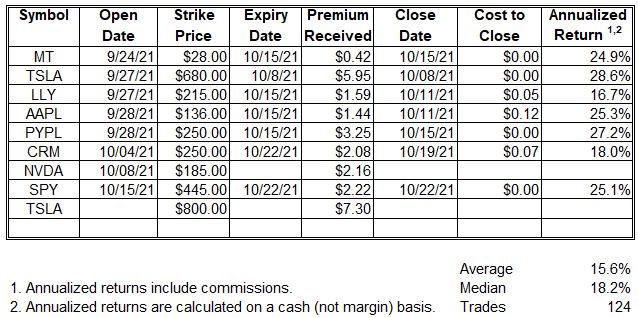

Naked Put Trade Performance

So far in 2021, I have closed 124 naked put trades which have generated an average annualized return of 15.6%. Please note that I calculate returns on a cash basis even though the trades are in a margin account. If, like some of the “expert option traders” on YouTube, I calculated my annualized returns on the basis of a 15% margin requirement then my average annualized return would be 104% (15.6% x (100/15)).

Open Trades

My open naked put and covered call trades can always be viewed here.

0 Comments