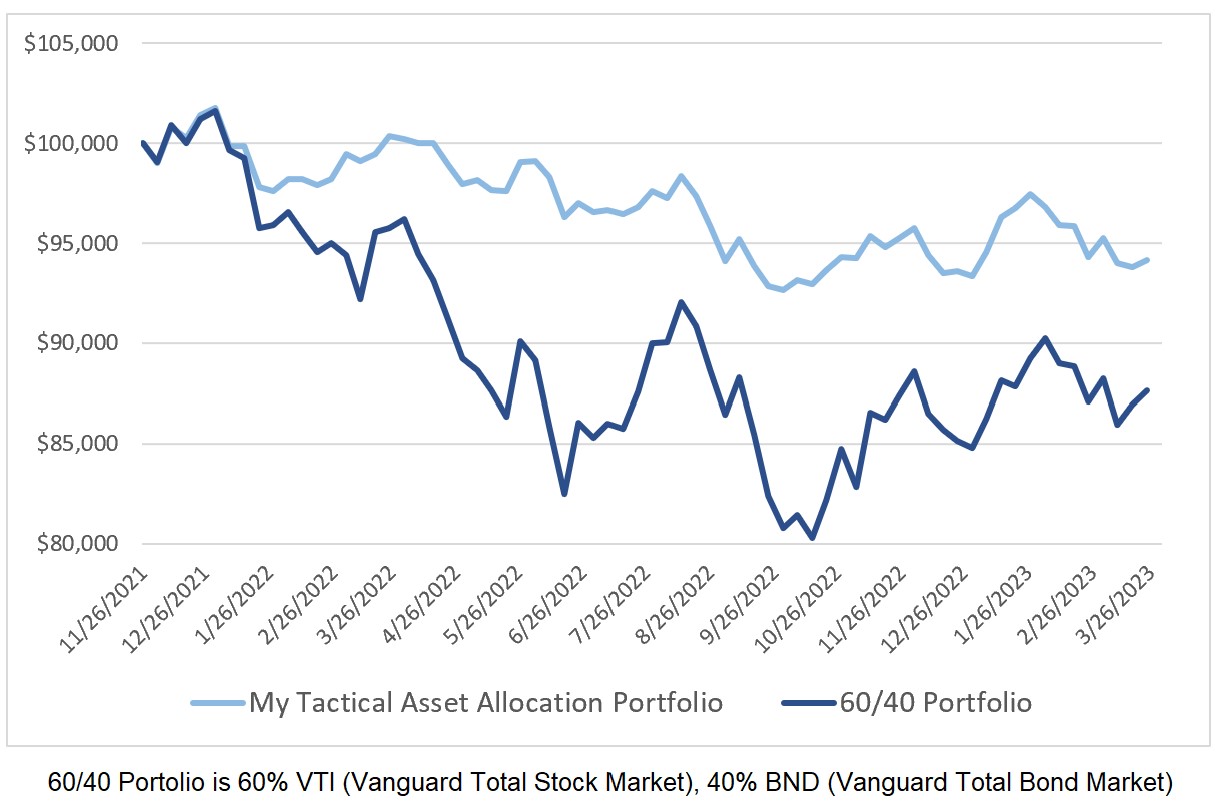

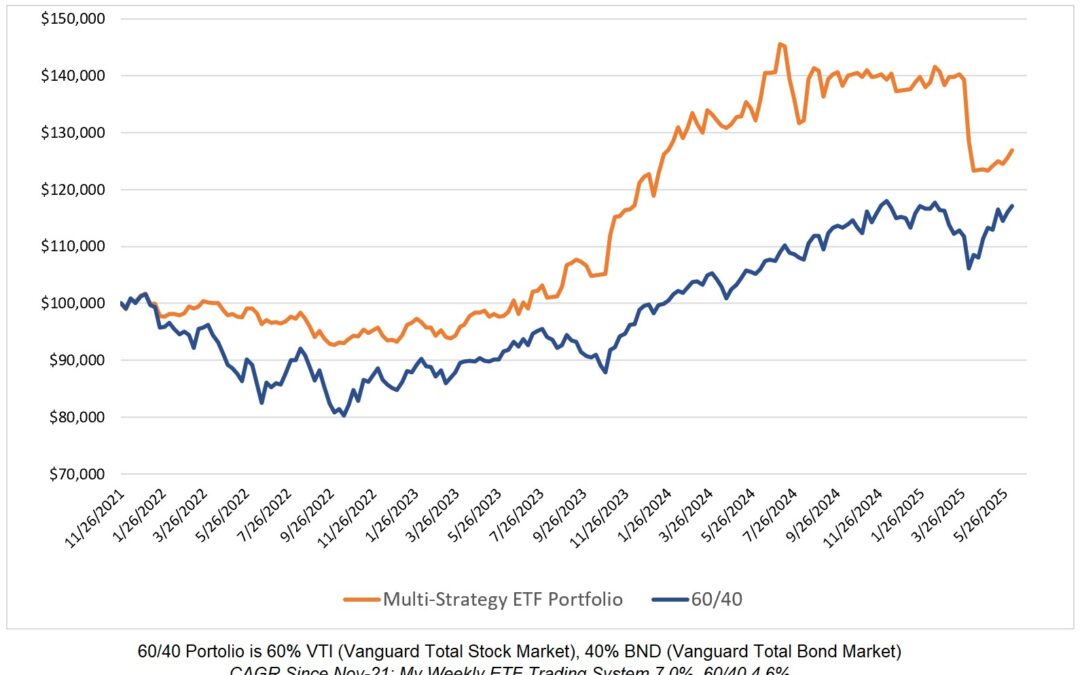

Markets continue to provide minimal returns as witnessed by my TAA model and the global 60/40 portfolio which are both little changed from last October. Seasoned investors realize that portfolio returns are usually lumpy and that makes it challenging for some people to stick with a given strategy. An investing strategy would be remarkably easy to adhere to if it provided a smooth equity curve.

Investors often struggle to stick to a proven investment strategy during periods of underperformance due to emotional biases such as fear, uncertainty, and doubt. These emotions can be amplified by the constant news cycle and the fear of missing out on potential gains. Additionally, investors may lack the patience and discipline required to remain invested for the long term. They may be tempted to switch to a seemingly more promising strategy or investment that has performed well recently, even though it may not align with their original investment goals and objectives. However, changing strategies frequently can lead to missed opportunities and increased transaction costs, ultimately harming an investor’s long-term performance.

My Tactical Asset Allocation Model

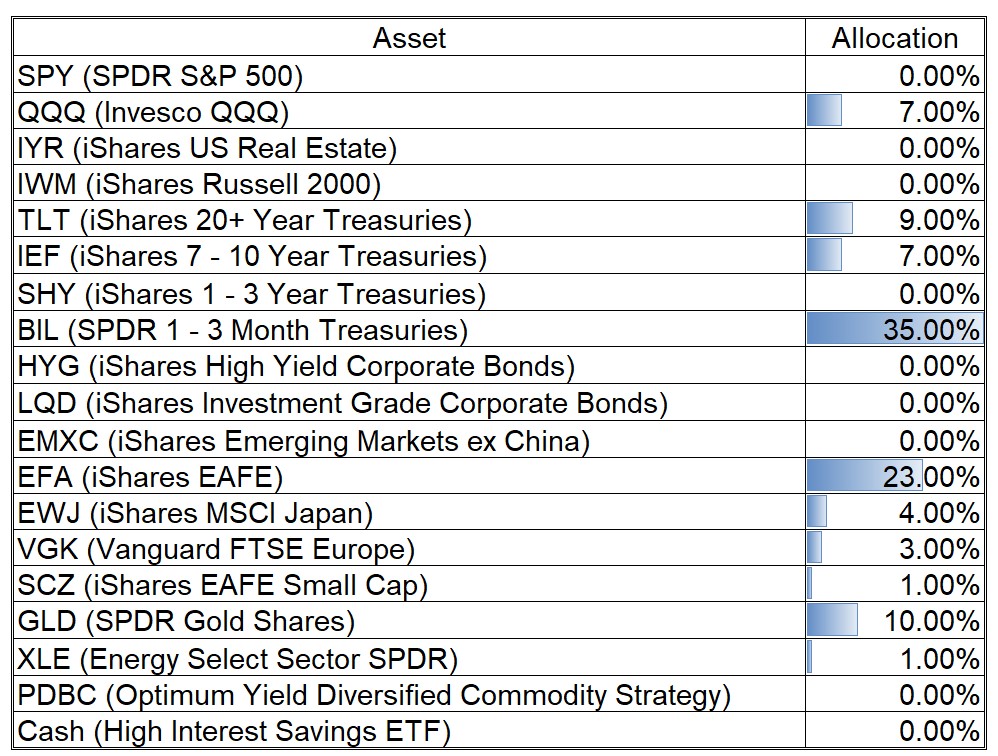

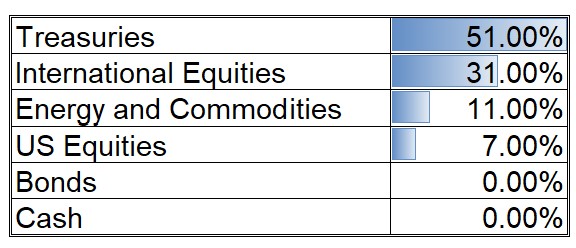

This week, we’re reducing our allocation to Treasuries and increasing our allocation to equities. It’s important to remember that these changes in our TAA models are not predictive but rather reactive to the price changes in ETFs. When we increase our allocation to equities, it doesn’t necessarily mean that a rally in equities is guaranteed. Rather, our TAA models are designed to increase exposure to markets that are starting to move upward in price. We never know or predict how much a price will increase over what period of time. Our strategy is to jump on rising price trends and jump off decreasing price trends. This approach to investing has been proven to outperform buy-and-hold strategies, especially in terms of reducing maximum drawdown.

UPDATE (03/26/23)

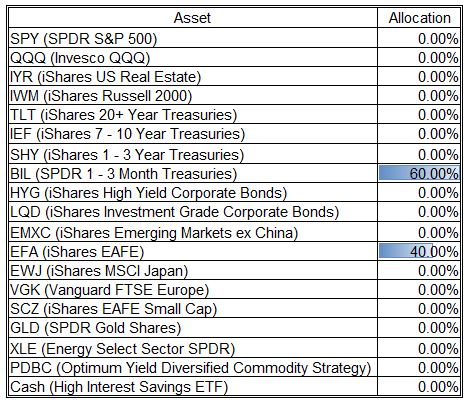

I have determined that my model can generate higher returns if allocations are made each week based on one selected strategy rather than spread out across multiple strategies. This will result in far more concentrated allocations which some of you may not be comfortable with.

0 Comments