February has lived up to its reputation as a difficult month for investors. The grind lower in recent weeks has led to my models becoming very cautious as they now have 61% allocated to cash and very short-term treasuries via the BIL ETF.

February has lived up to its reputation as a difficult month for investors. The grind lower in recent weeks has led to my models becoming very cautious as they now have 61% allocated to cash and very short-term treasuries via the BIL ETF.

February 17 Texas Instruments (TXN) - $160.00 Puts Expired The puts that I sold on January 30 expired worthless thereby generating a 9.6% annualized return on the trade. My Tactical Asset Allocation Model The models I use have an increased allocation to...

As far as FinTwit is concerned, some bull markets may have just started. On January 12, Walter Deemer posted on Twitter "The stock market generated Breakaway Momentum today for the 25th time since 1945" which he later followed with "And as icing on the cake, we also...

January 05 Energy Sector SPDR (XLE) - Sold Covered Calls I sold Jan-20 $91.00 covered calls for $0.43. January 06 My Jan-06 $397.00 SPY calls expired out of the money so I kept my shares. General Motors (GM) - Sold Jan-20 $33.00 Puts My Tactical...

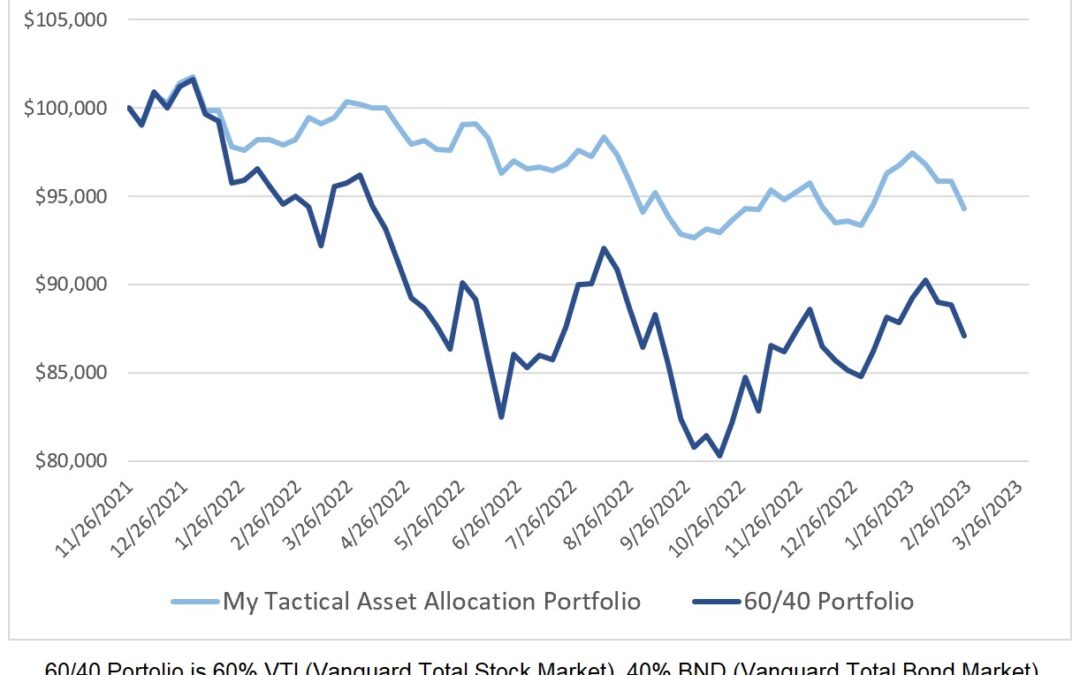

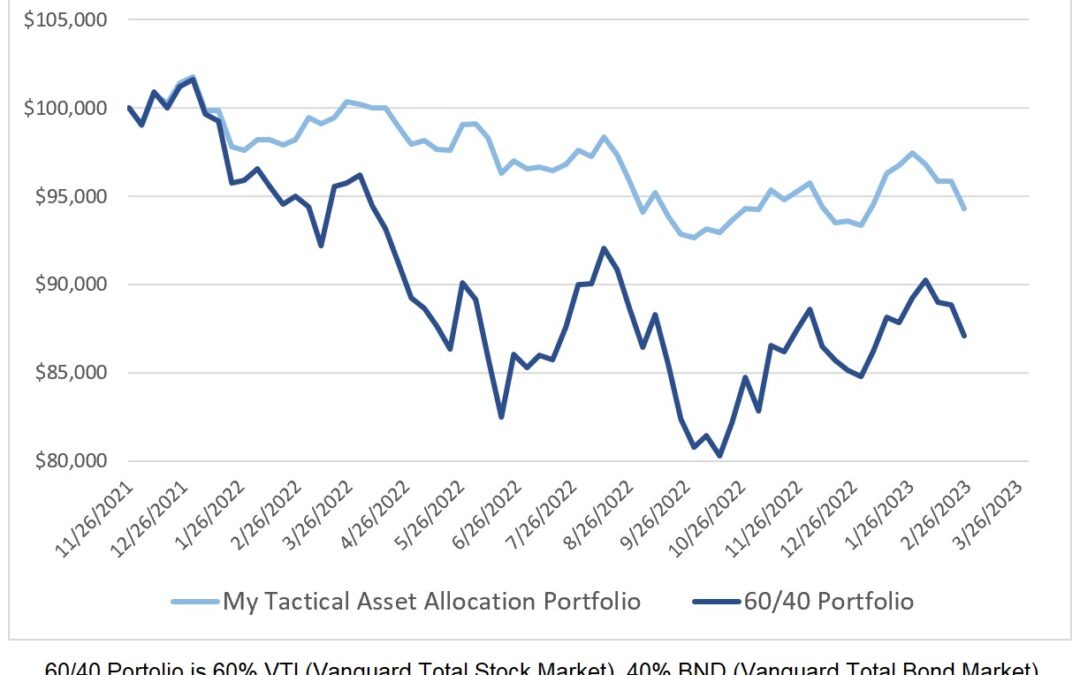

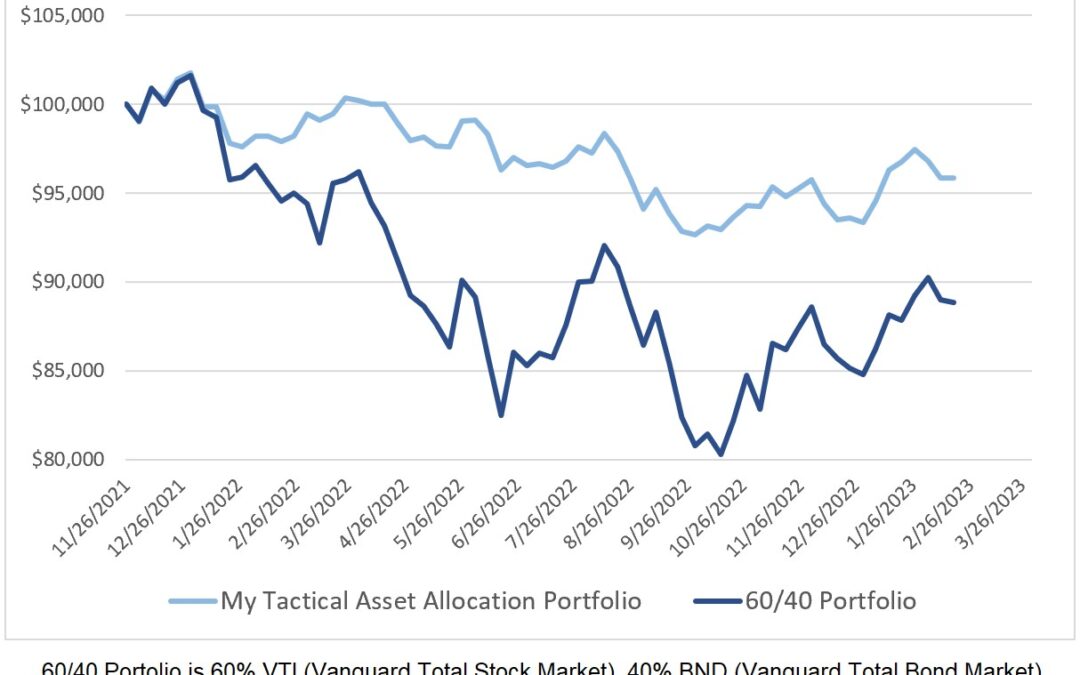

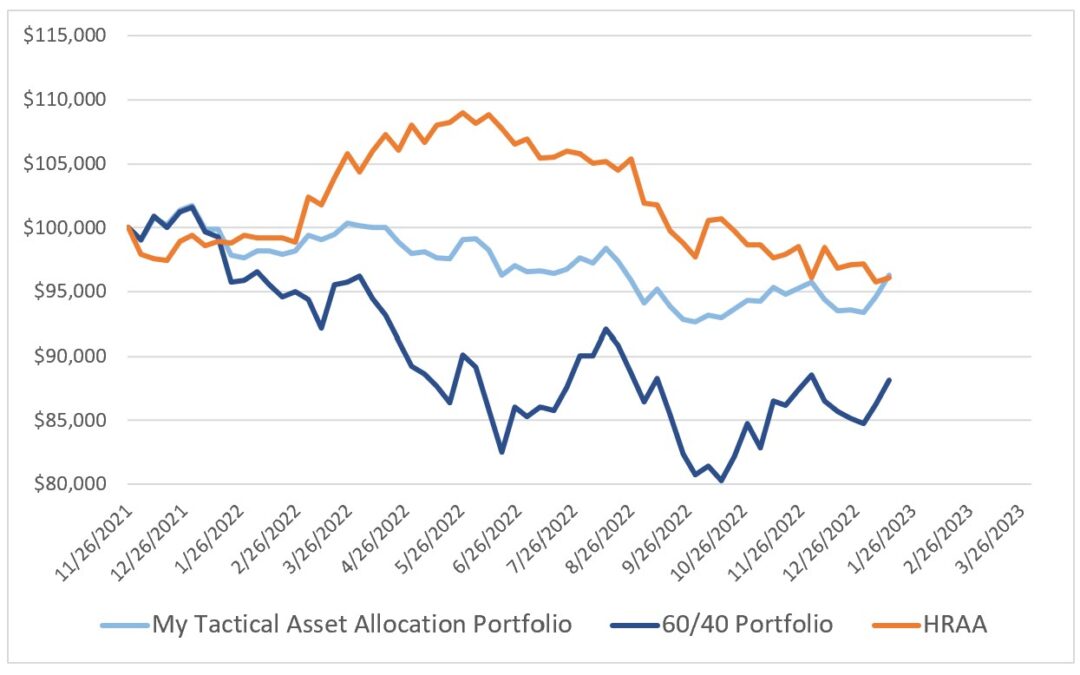

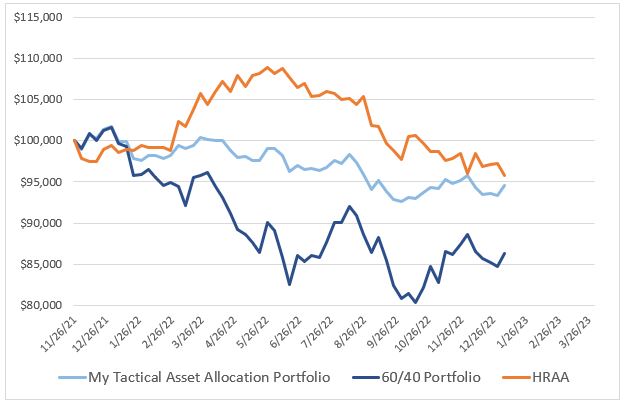

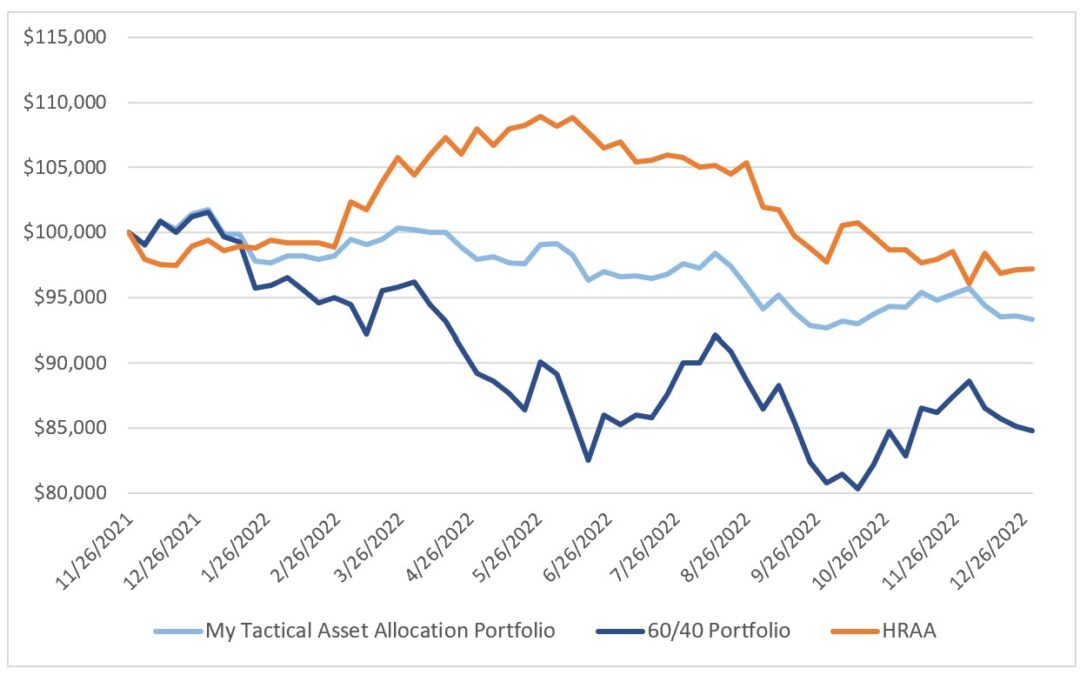

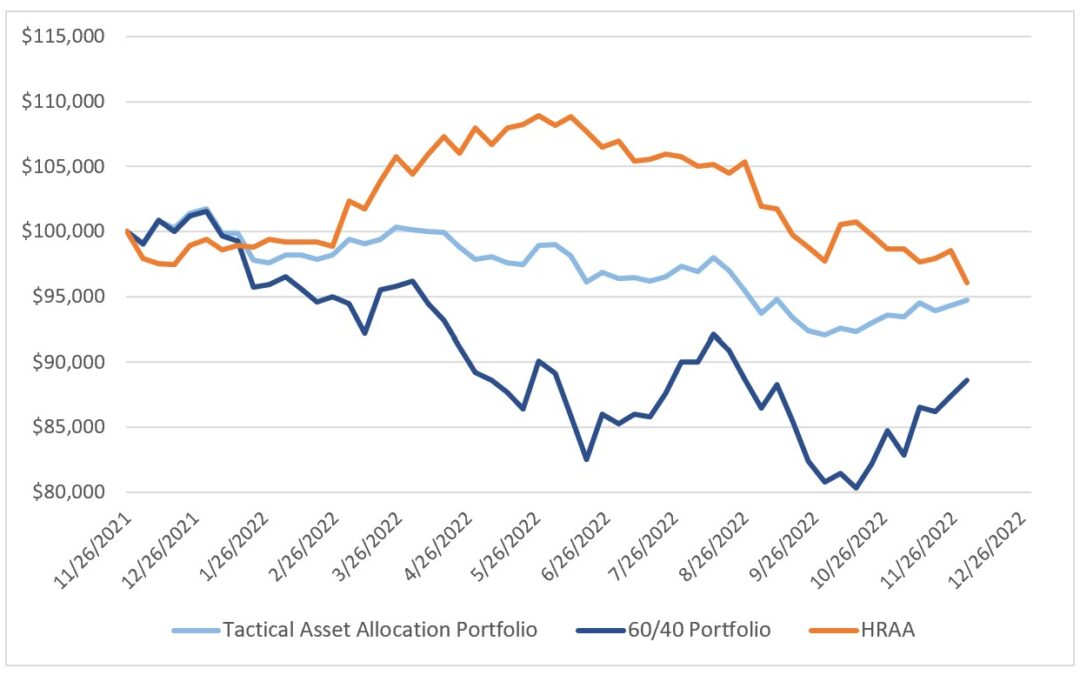

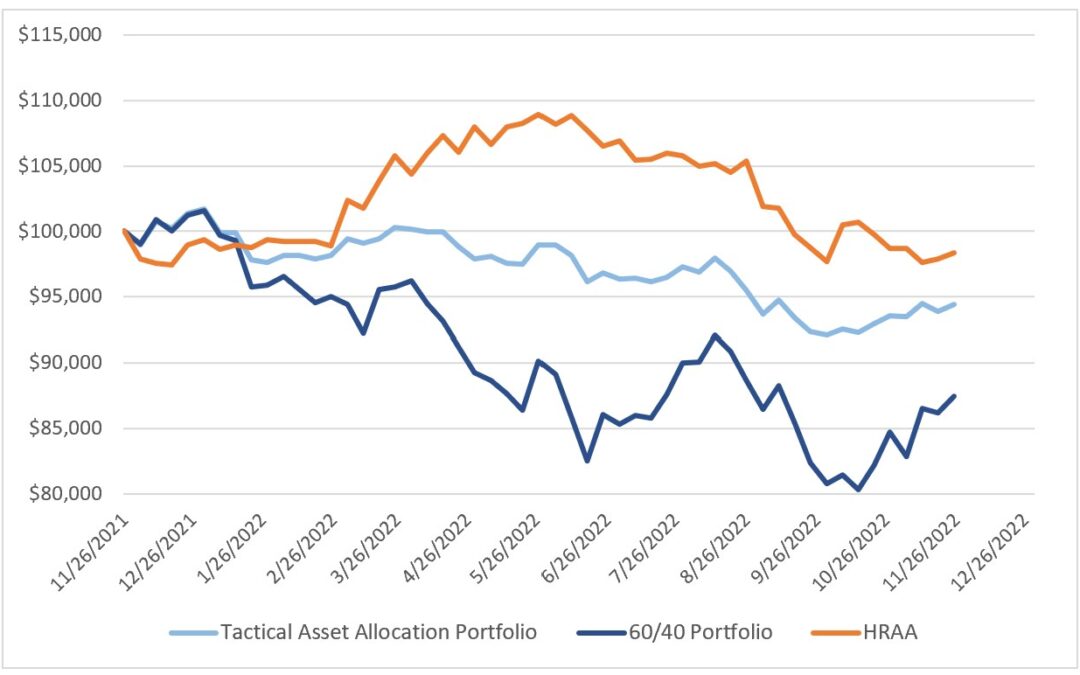

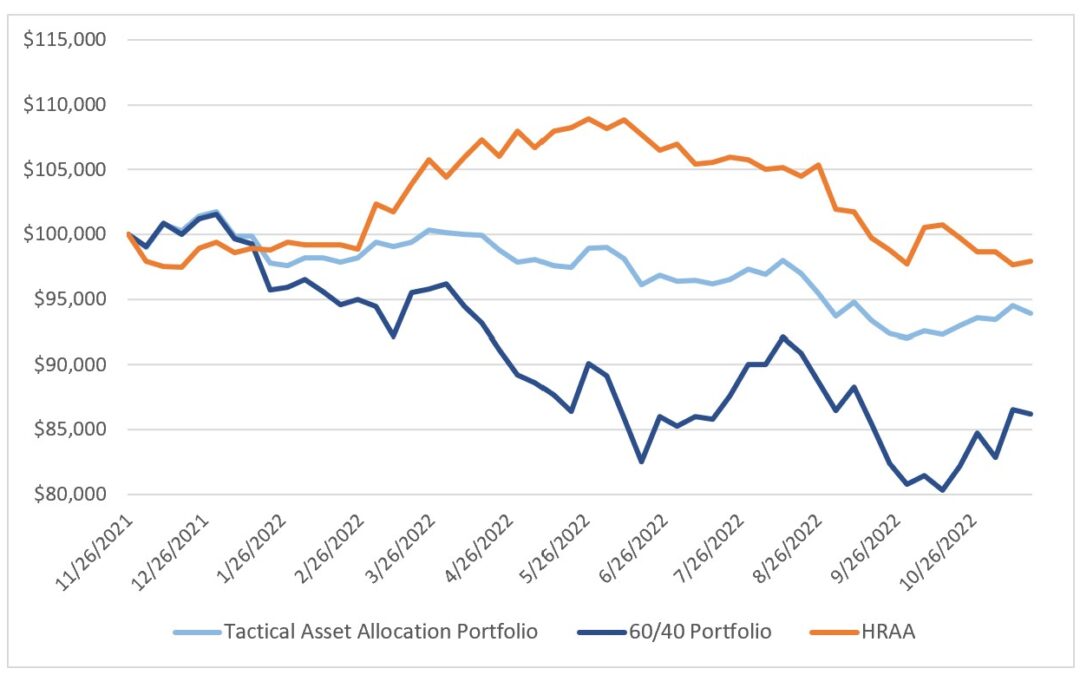

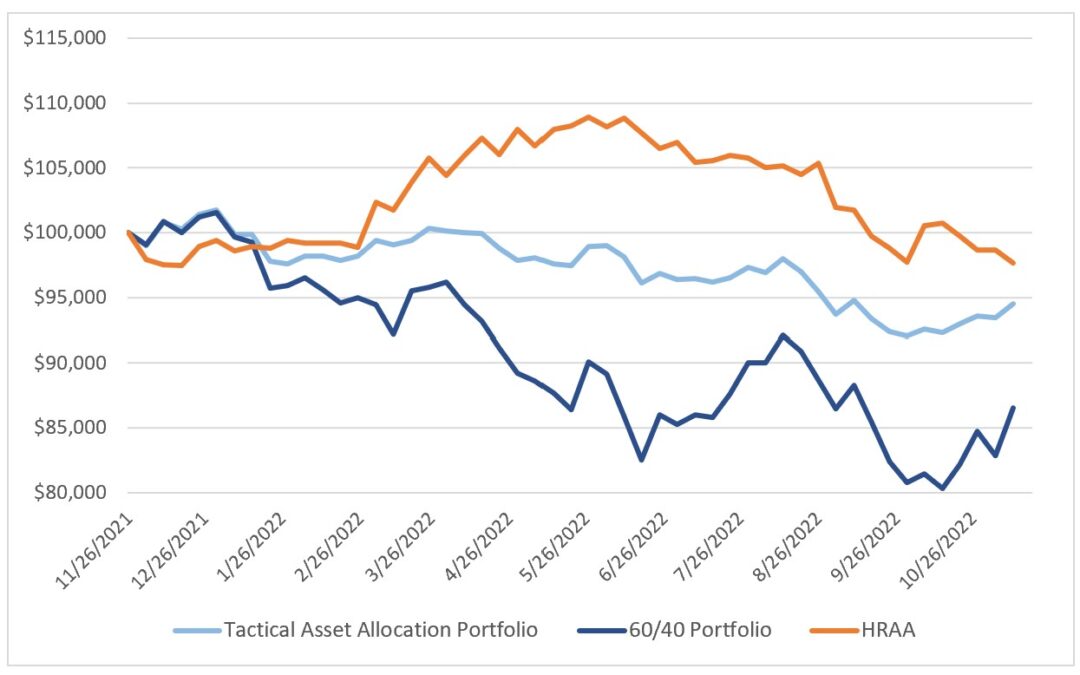

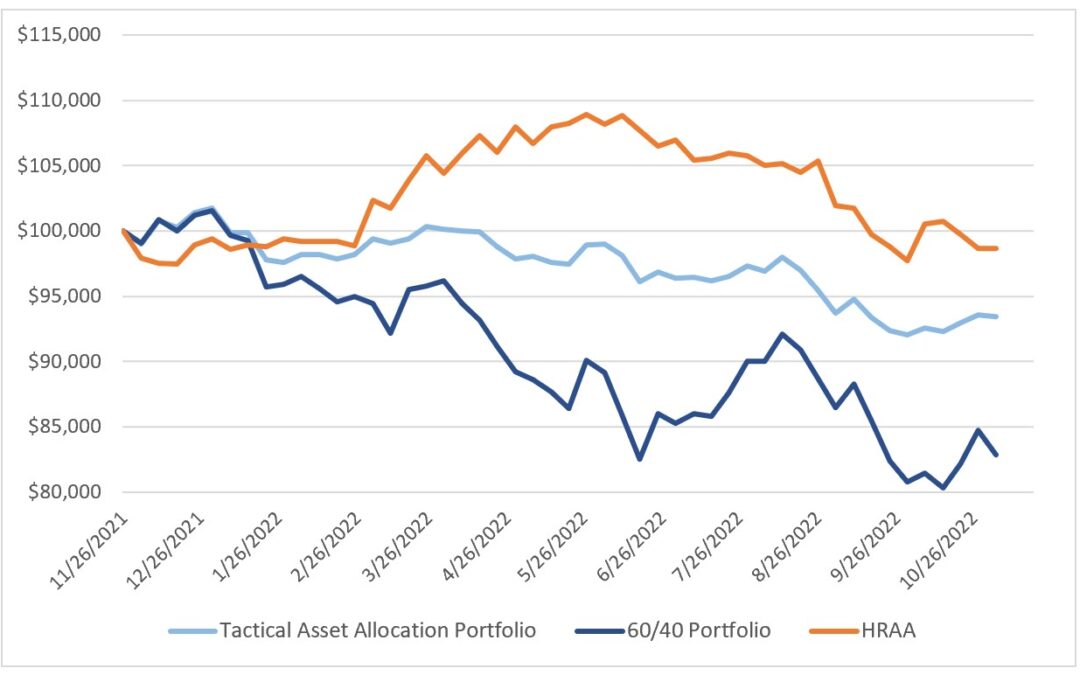

My 2022 Tactical Asset Allocation Performance My TAA model finished the year down 8.3% compared to a loss of 16.6% for the 60/40 portfolio. Compared to the average of seven Tactical Asset Allocation ETFs, my model fared well in 2022. Combined, the seven ETFs have...

When I look at the chart above, I like the much smoother equity curve of my model versus the traditional 60/40 of the professionally managed Horizons Resolve Adaptive Asset Allocation ETF. In the period covering just over one year, my model and HRAA arrived at the...

It has been a year since I began posting the weekly tactical asset allocations of my models. A one-year period is far too short of a timeframe to base a performance comparison on so I have little to say about the chart below which compares my TAA model performance to...

Slowly, ever so slowly, my models are reducing the cash allocation and increasing allocations to equity ETFs. My Model Tactical Asset Allocations

My models are now down 7.1% YTD versus a decline of 14.8% for the 60/40 portfolio. My Tactical Asset Allocations

Increases in ETF prices this past week have led to my models adding allocations to EFA, VGK, IWM, and DBC. Year-to-date, my model portfolio is down 8.2% versus a decline of 18.5% for the 60/40 portfolio. Since I started posting weekly ETF allocations late last year,...