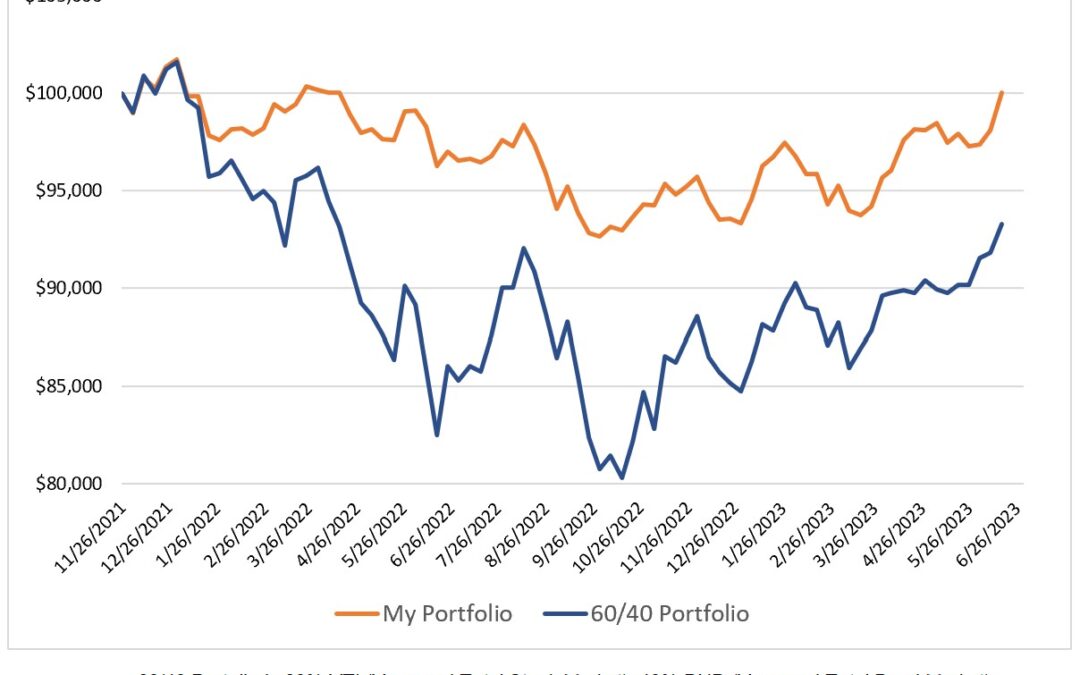

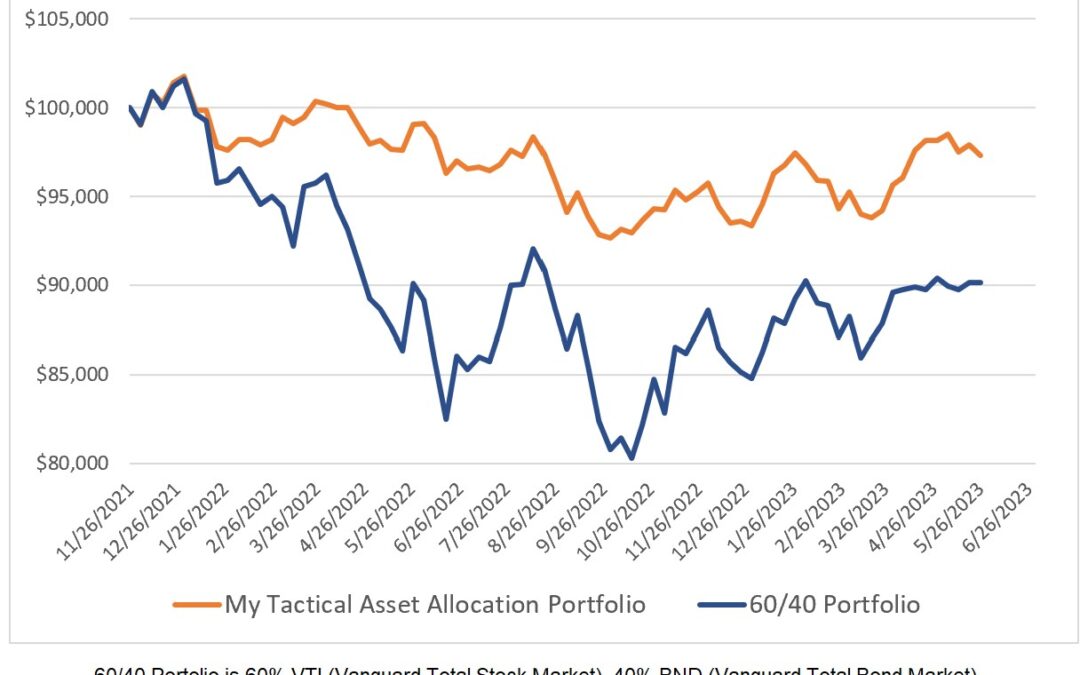

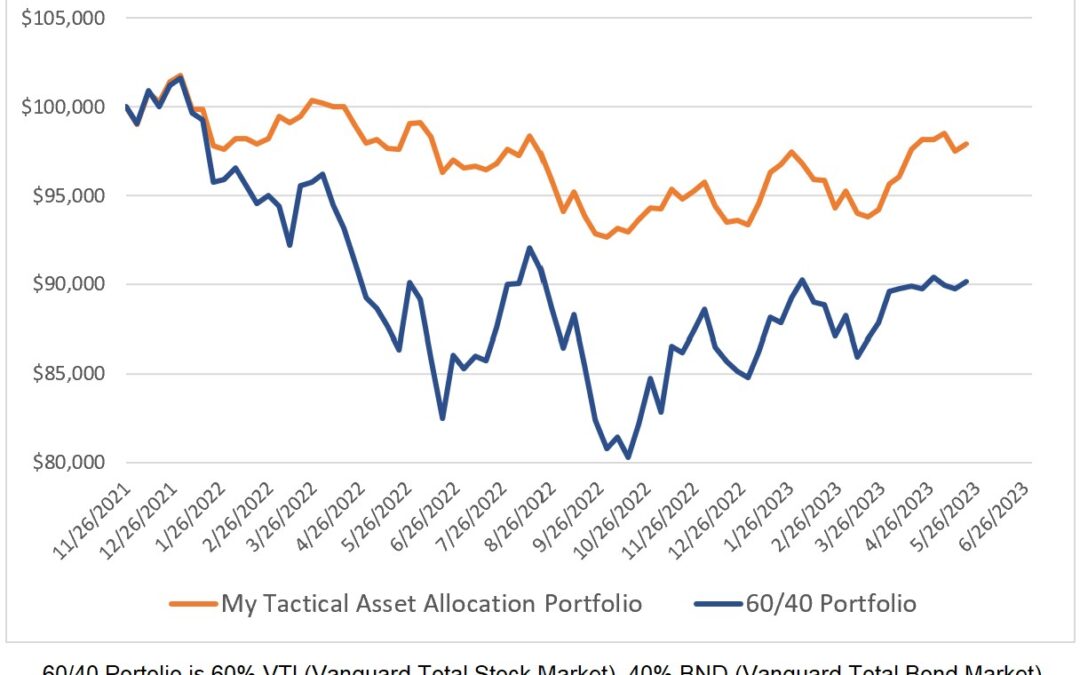

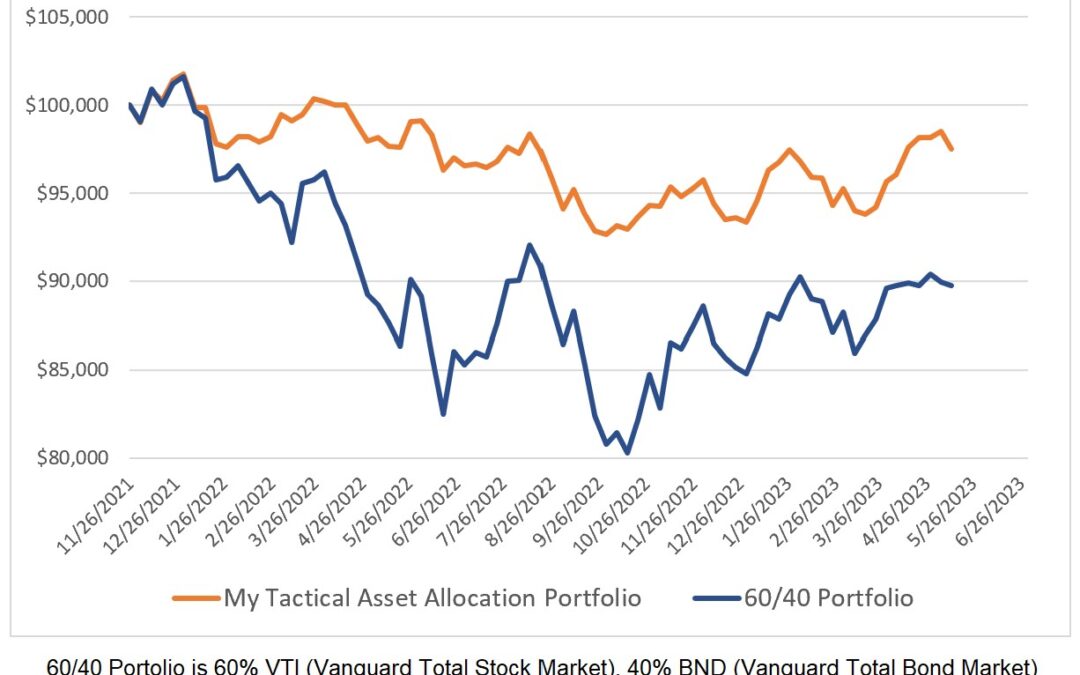

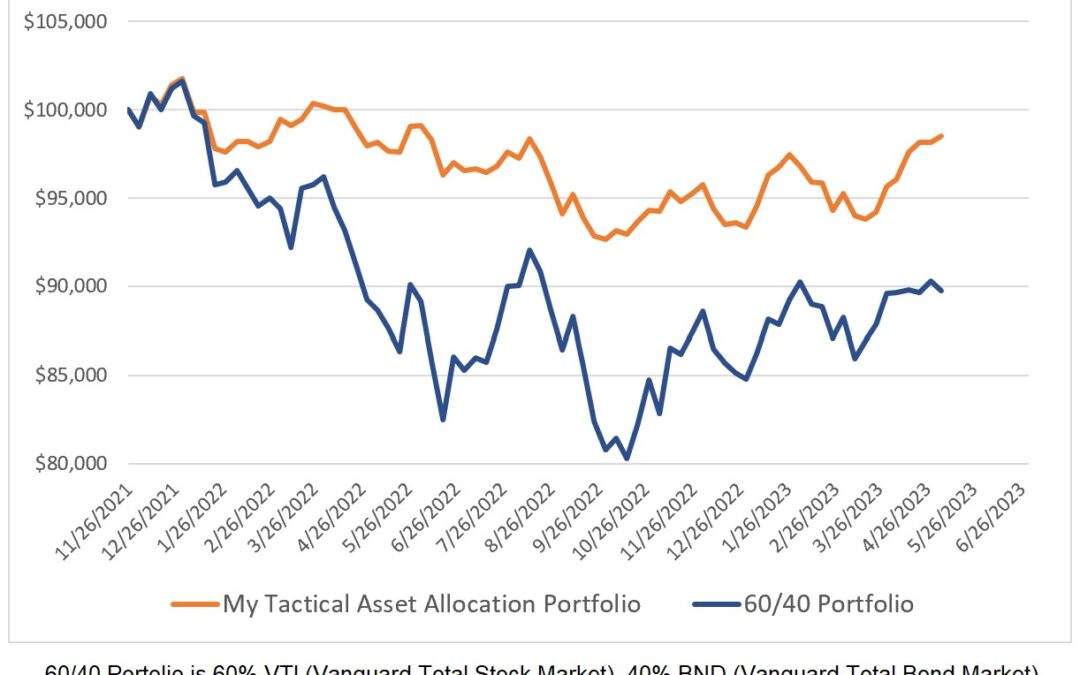

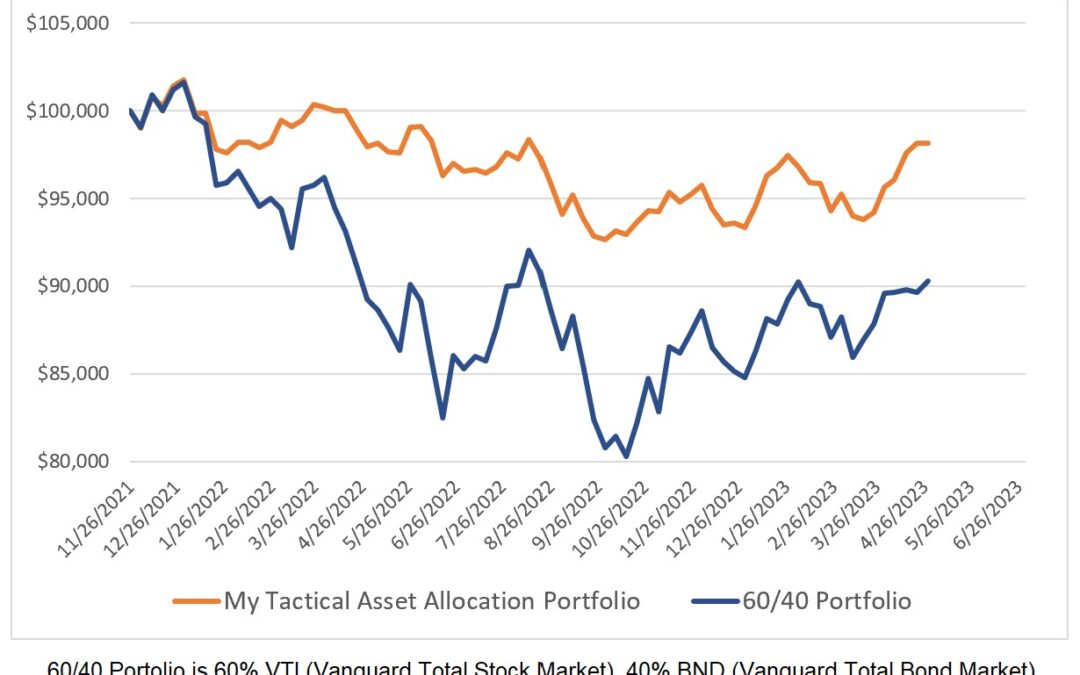

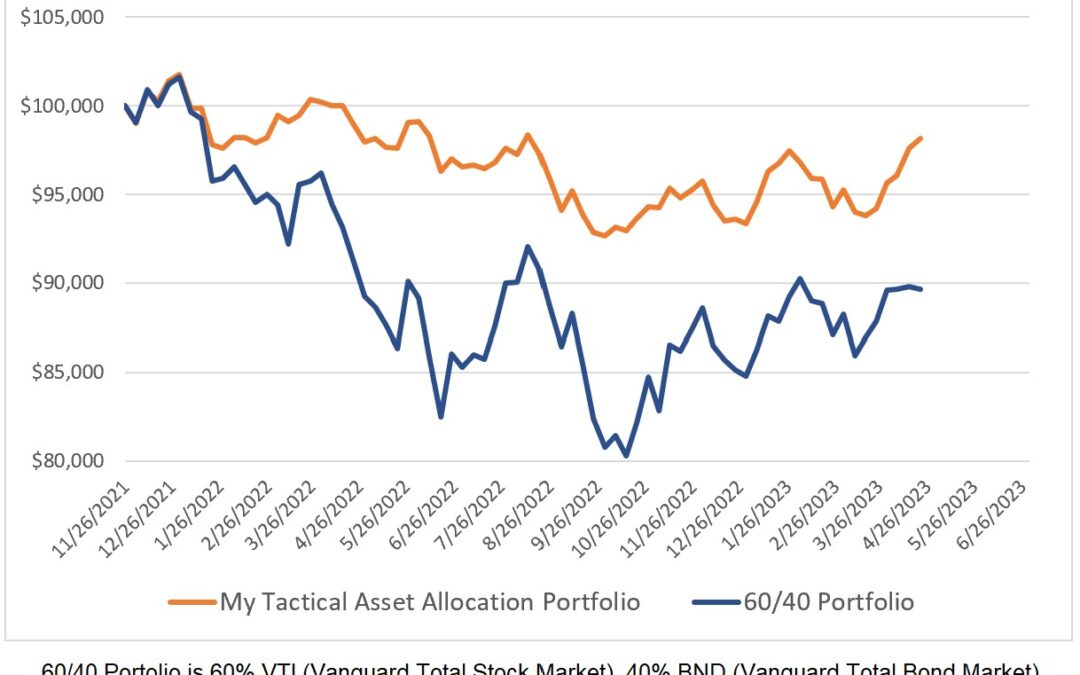

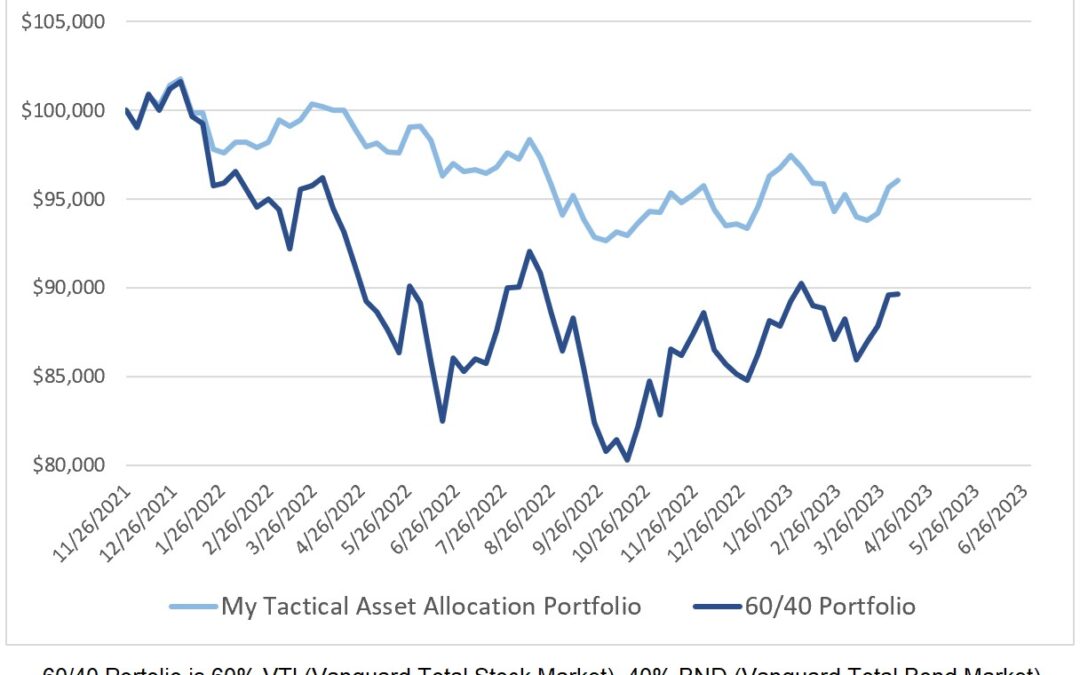

This past week was a very strong one for equity markets as many closed out the week up by 2% to 4%. My portfolio was up by 1.95% and the 60/40 portfolio was up by 1.59%. As of this post, my ETF portfolio has outperformed the 60/40 portfolio by 4.41% annually and has...