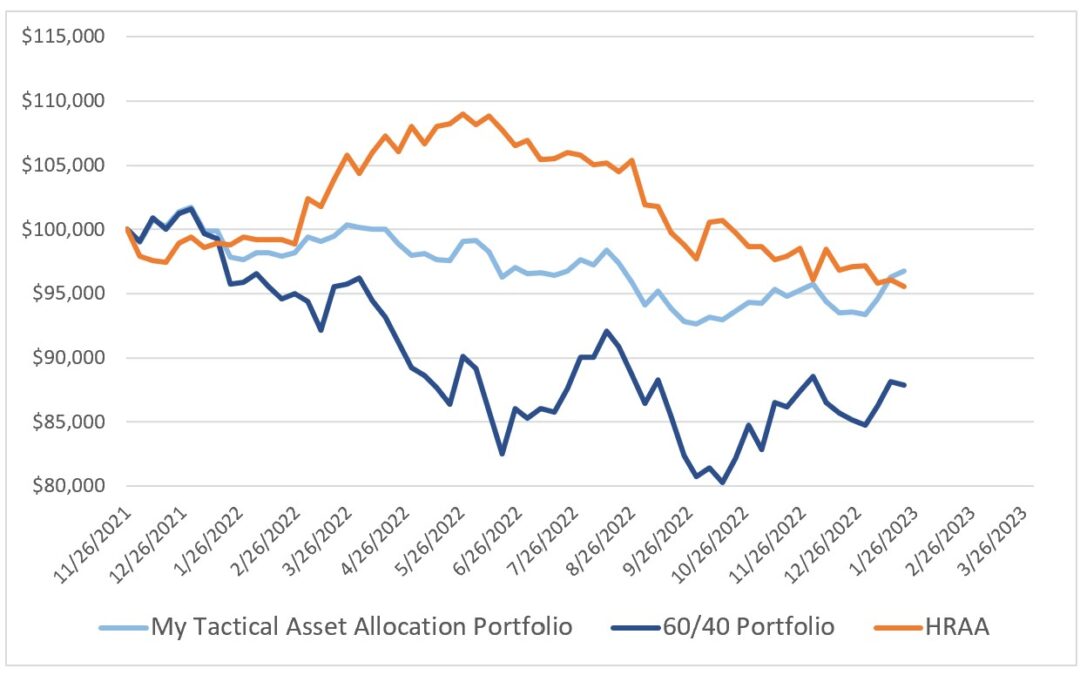

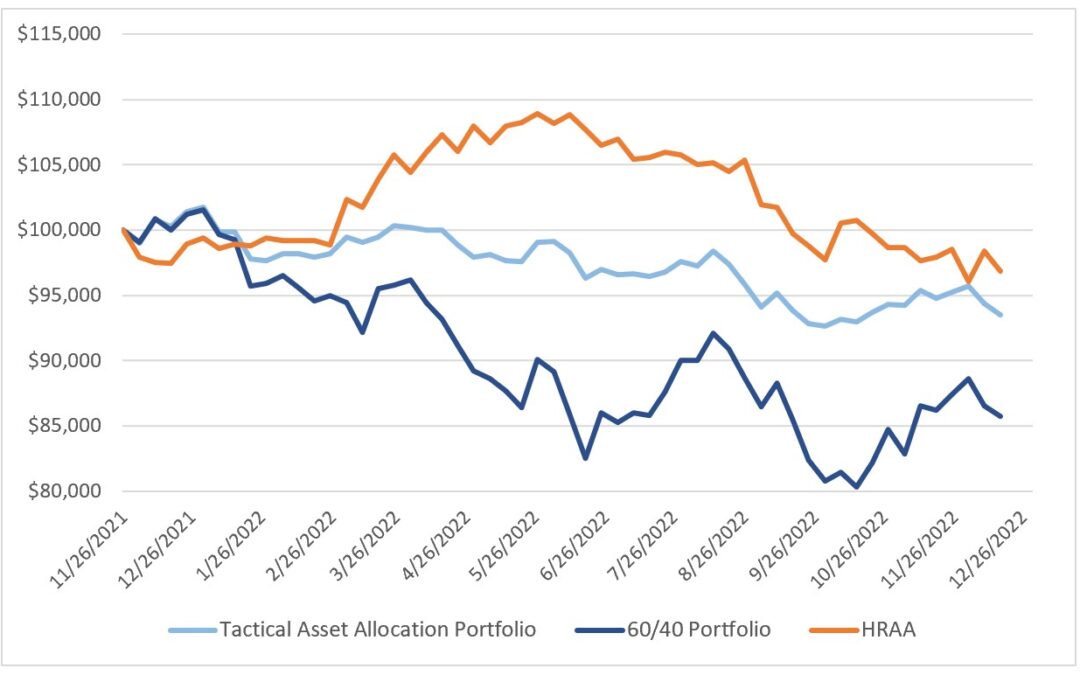

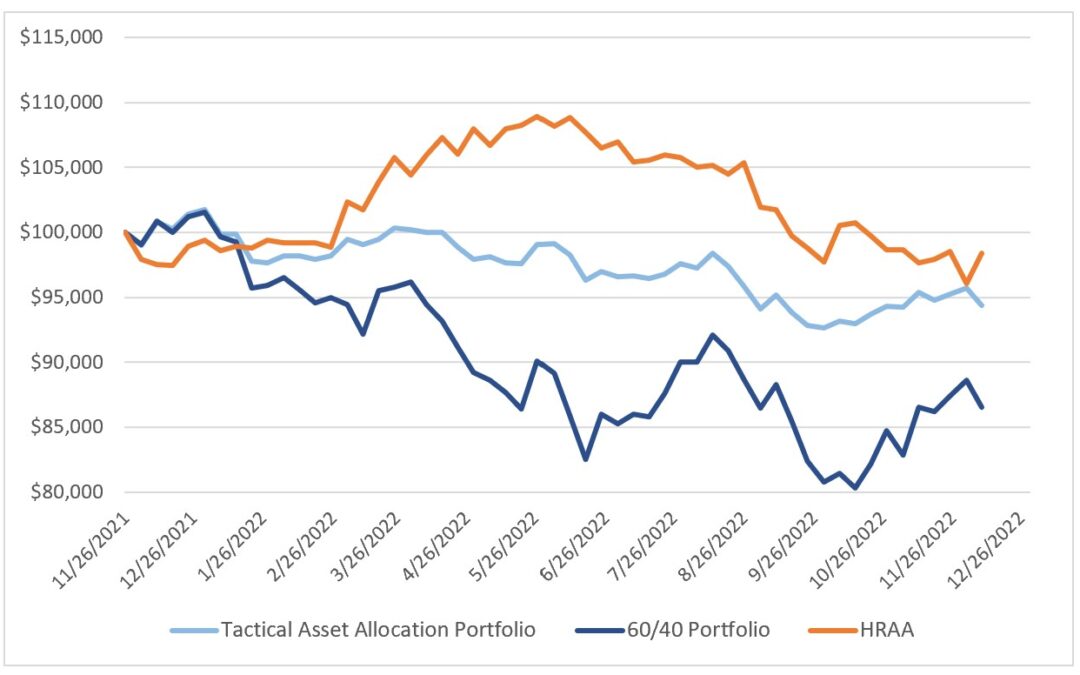

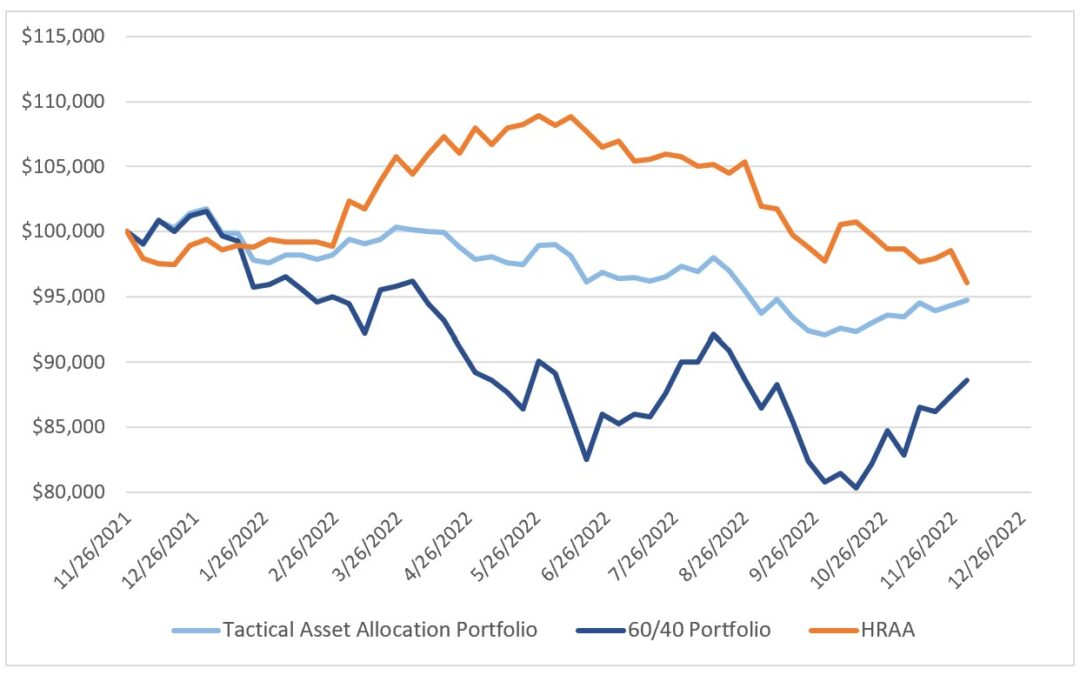

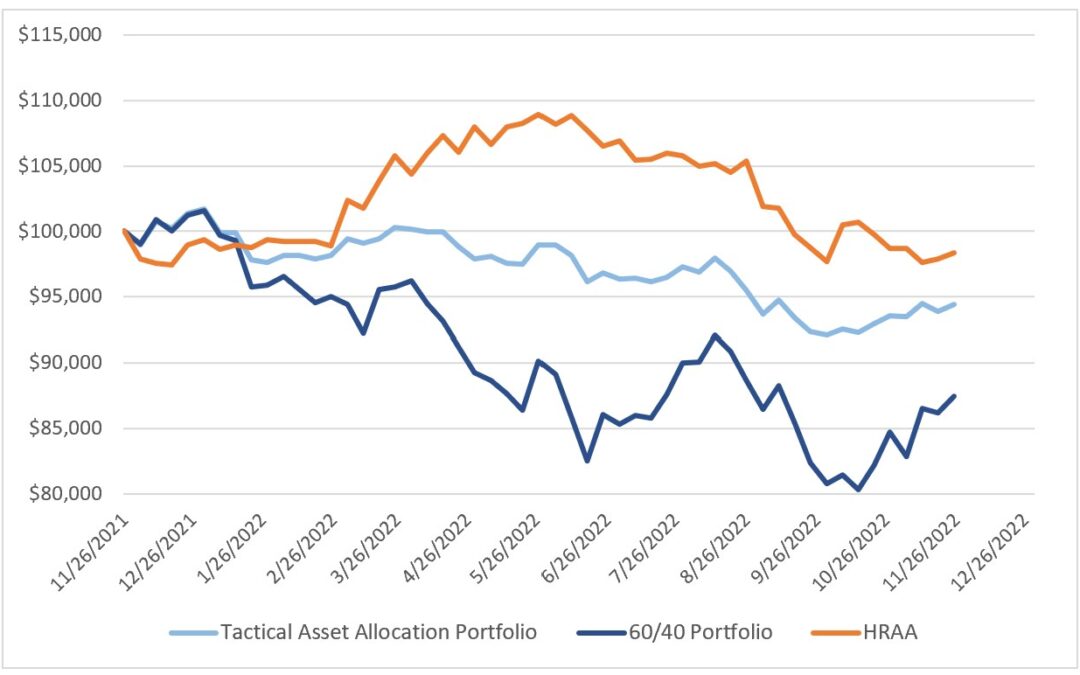

January 19 SSR Mining (SSRM) - Shares Purchased January 20 The covered calls I sold earlier on SPY and XLE expired OTM so none of my shares were called away. Similarly, the puts I sold on GM expired OTM so no shares were assigned to me. My Tactical Asset...